assalve/E+ via Getty Images

Introduction

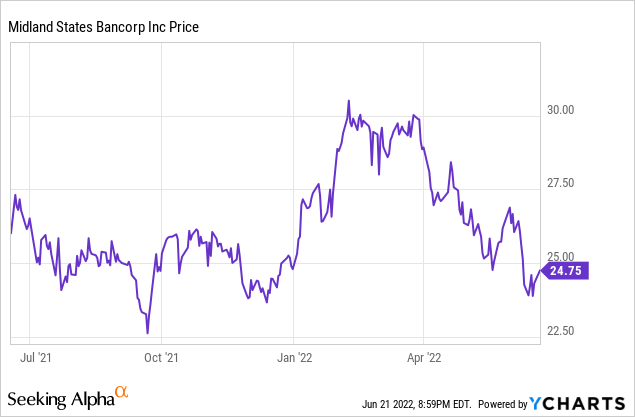

It has been almost a year since I last discussed Midland States Bancorp (NASDAQ:MSBI) and I was pretty neutral in my previous assessment of the regional bank. Fast forward to June 2022, almost 11 months later and the share price is trading at exactly the same level (although it was trading over 20% higher in the first quarter of this year).

A decent result in the first quarter but higher interest rates erode the book value

The bank reported an EPS of $0.92 in the first quarter of this year which makes the current share price in the mid-$20s quite attractive. But there’s more than meets the eye here.

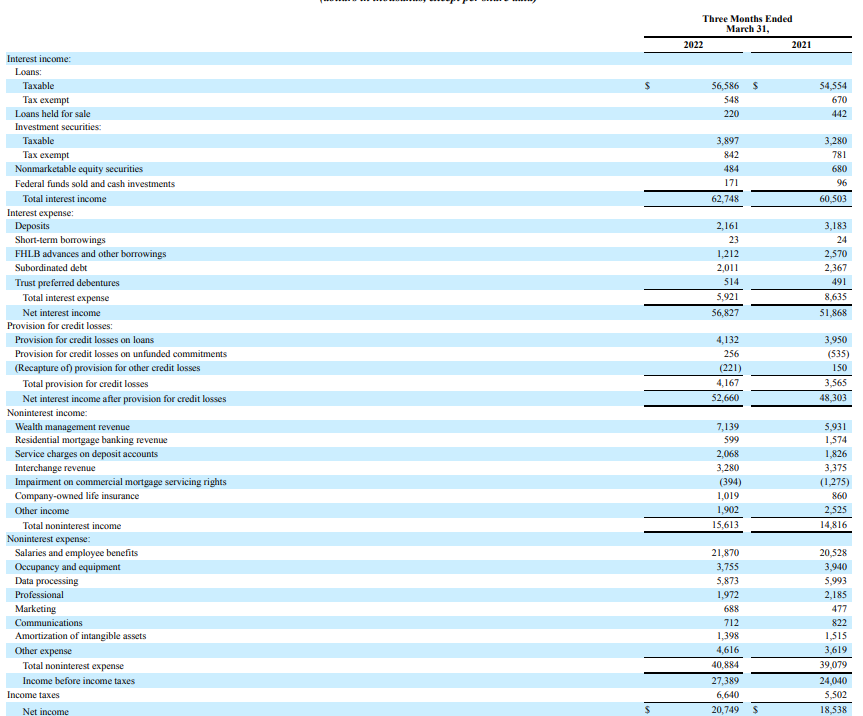

Midland States Bancorp saw its interest income increase by just over 3% to $62.7M while the interest expenses continued to decrease. In Q1 2022, the bank paid just $5.9M in interest expenses compared to $8.65M in Q1 2021. The combination of higher interest income and lower interest expenses is obviously excellent as it allowed the net interest income to increase by almost 10% to $56.8M.

MSBI Investor Relations

The net non-interest expenses remained pretty stable at $25.2M (a small increase) and despite the higher amount earmarked for loan loss provisions ($4.2M compared to $3.6M), the pre-tax income of MSBI came in at $27.4M, resulting in a net income of $20.7M for an EPS of $0.92.

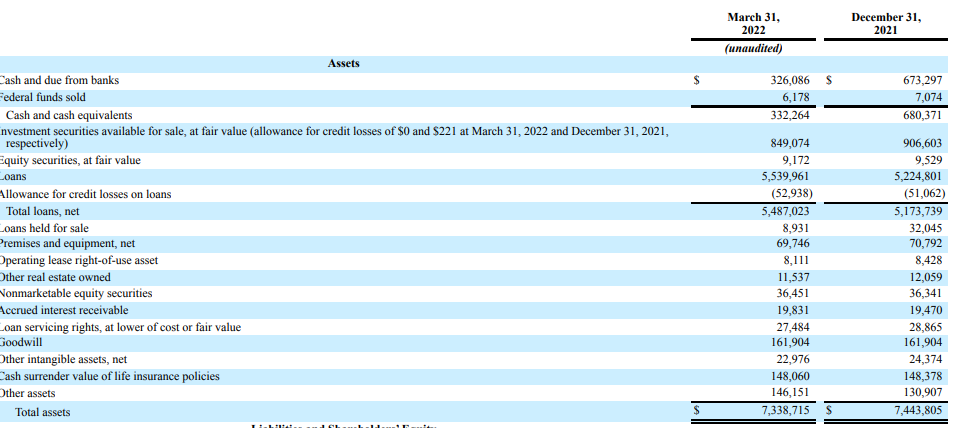

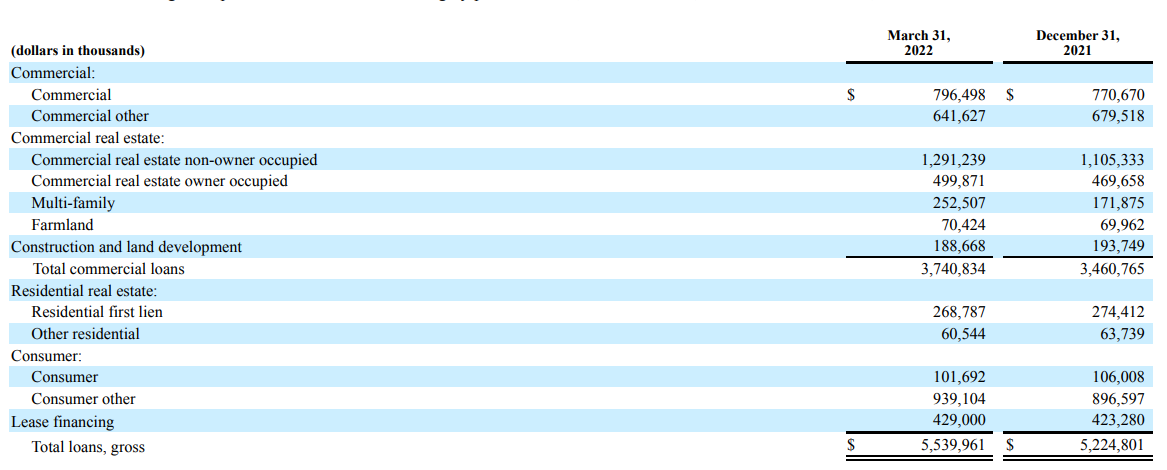

That sounds great, but there’s a small caveat I’d like to highlight. Let’s have a look at the balance sheet first. The total amount of assets decreased to $7.34B while the bank deployed some of its cash in the loan portfolio which actually increased by 6% to almost $5.5B.

MSBI Investor Relations

I like it when banks have a decent buffer of liquid assets (cash and securities) but the recent volatility in the interest rates also means the bank has experienced increased unrealized losses on the securities portfolio.

That’s important because it erodes the book value. Although the bank reported a net income north of $20M despite recording higher loan loss provisions, the net equity on the balance sheet decreased from $664M to $645M. This sounds counter-intuitive as the bank spent just $6.5M on paying a dividend and $1.1M on buying back stock. So you would reasonably expect the equity portion of the balance sheet to have increased by approximately $13M rather than reporting a decrease of $19M.

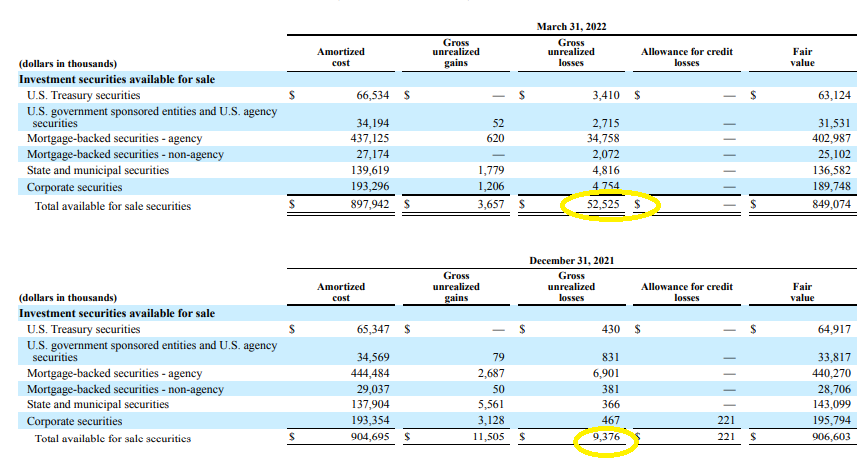

MSBI Investor Relations

The image above indeed shows that compared to year-end 2021 the total amount of unrealized losses has increased while the total amount of unrealized gains on the investment securities portfolio has decreased.

The quality of the loan book

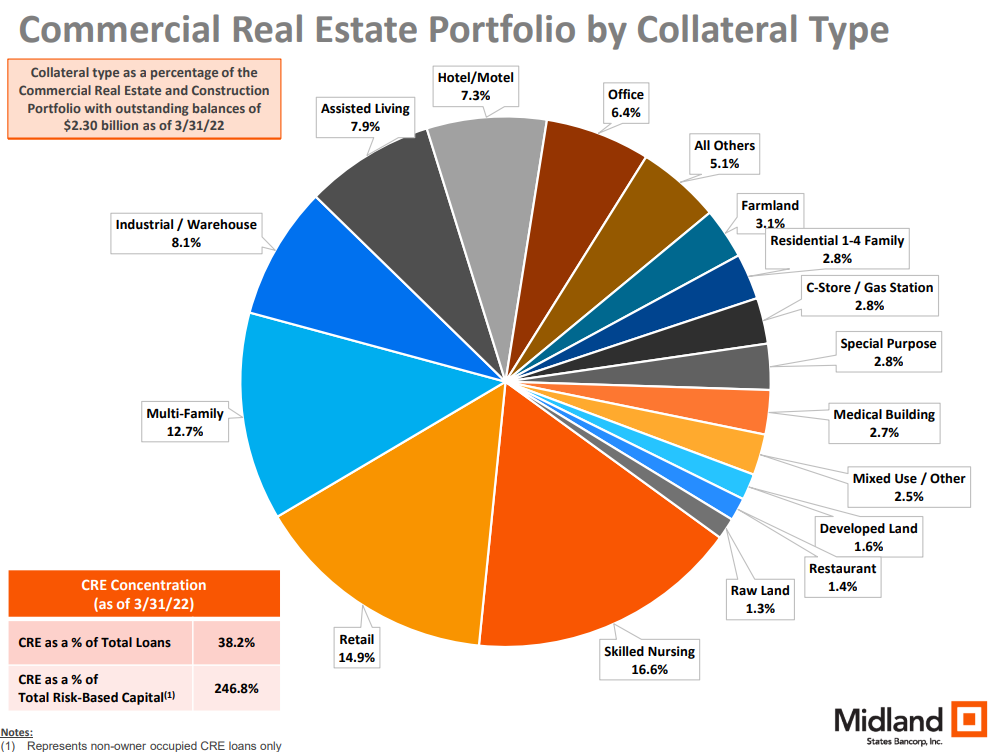

The increasing interest rates will unfortunately continue to have a negative impact on the book value of the bank, and it will be important to continue to report strong earnings to mitigate the impact of this erosion. This means it is important to keep an eye on the (higher yielding) loan book to see what MSBI is investing its assets in.

MSBI Investor Relations

As you can see, the vast majority of the loan book consists of commercial loans and commercial real estate and it will be very important to keep an eye on defaults and the loan quality.

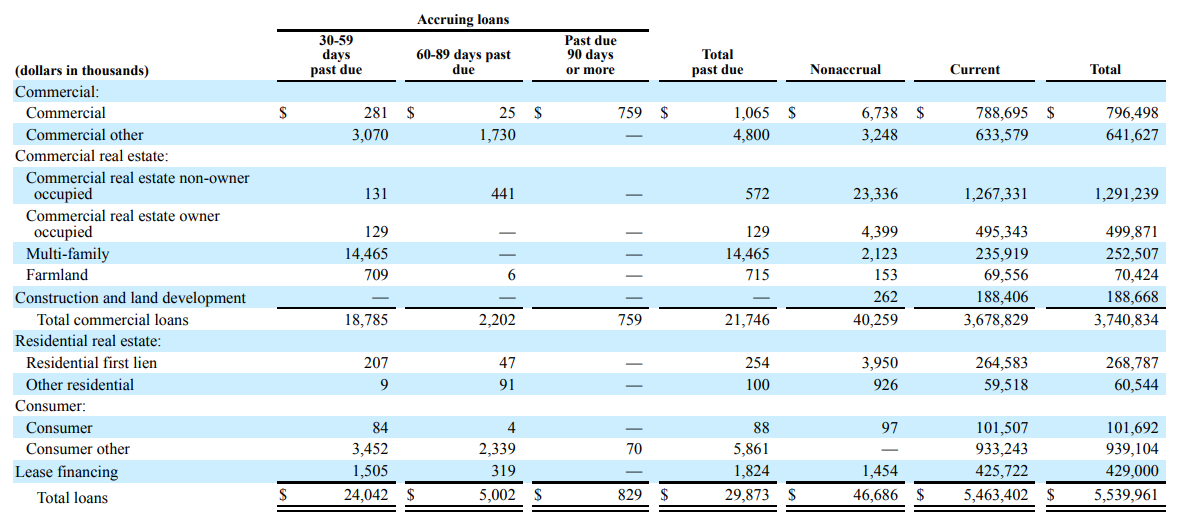

MSBI Investor Relations

As of the end of Q1, the total amount of non-accruing loans was approximately $47M while an additional $30M in loans were classified as ‘past due’ (although the vast majority of those loans past due were only slightly past the due date), so it will be interesting to see how this evolves over the next few quarters.

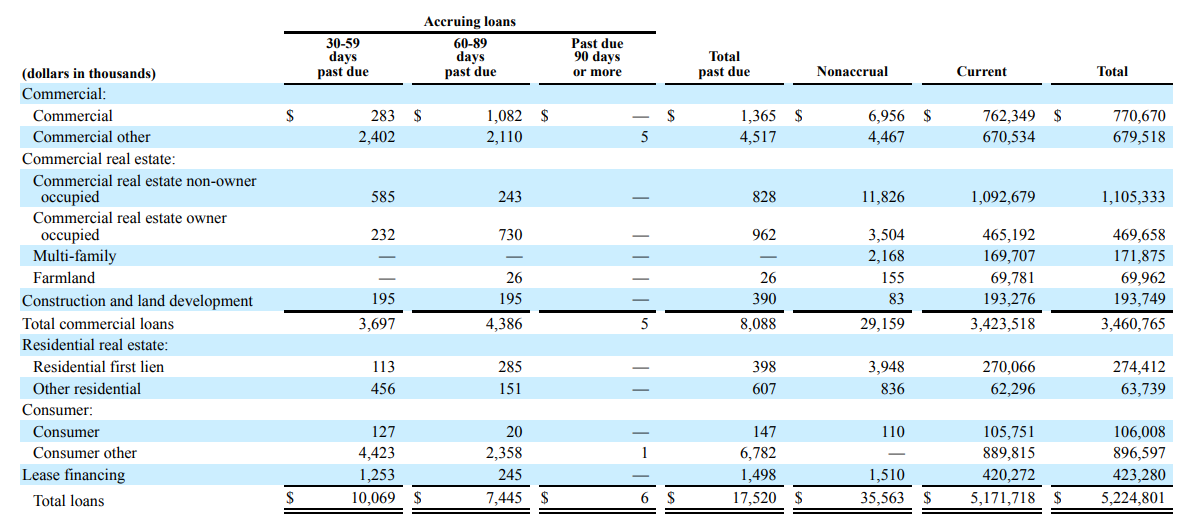

MSBI Investor Relations

That is substantially higher than the just $35.6M in non-accruing loans and $17.5M in loans past due the balance sheet contained at the end of last year. So in just one quarter, the total amount of non-accruing loans increased by over $10M while the total amount of loans past due increased by over $12M. This explains why MSBI continues to record loan loss provisions as it needs to stay ahead of the curve here.

MSBI Investor Relations

Investment thesis

Midland’s net interest margin of in excess of 4% is great and the very strong net interest income is fueling the bank’s financial results. Based on a P/E perspective, the stock is cheap as it is trading at just around 7 times earnings. The main reason why the market isn’t applying a higher multiple on Midland States Bancorp likely is because it wants to see how the quality of the loan book evolves while we also should not underestimate the impact of the higher interest rates on the tangible book value which stood at approximately $20.90 per share, down from $21.67 as of the end of last year.

Midland States is an interesting smallcap bank but despite its strong earnings profile and reported net income, I’m still on the sidelines. I will keep an eye on MSBI to see how everything plays out. The 4.8% dividend yield is attractive but yield by itself is not a good enough reason for me to go long right now.

Be the first to comment