anita2020/iStock via Getty Images

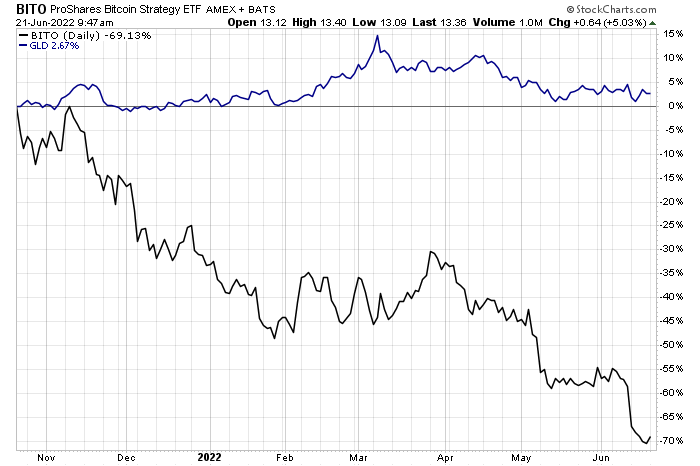

I have never been a fan of Bitcoin or the cryptocurrency space. I made my views known in late October of last year when I asserted that ProShares was introducing an ETF that would bring the digital coin to the mainstream investor after its historic run, which was a clear sign of the top. Indeed, it came within days of Bitcoin’s peak at $69,000. The price of the ProShares Short Bitcoin Strategy ETF (BITO) has since fallen 70%.

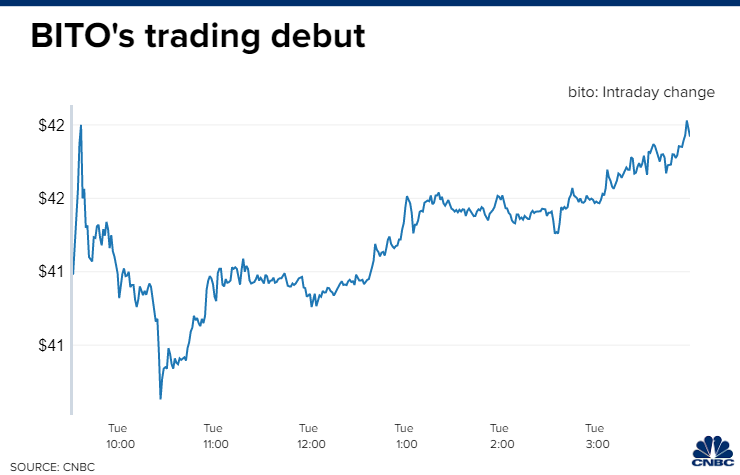

CNBC

Today, ProShares introduces the first ETF that enables investors to short Bitcoin. I think the timing for the ProShares Short Bitcoin Strategy ETF is just as bad as its prior offering for BITO, as can be seen above. The share price of BITO peaked at $44.29, just days after its debut.

You can read the details about this new offering from ProShares website here. The strategy is simple whereby the fund seeks to produce a return that is one-time the inverse of the daily performance of bitcoin. It is important to remember that the performance of this fund, despite not using leverage, will vary with the inverse performance of bitcoin over longer periods of time because it produces the daily inverse. The compounding of the daily returns is what leads to the deviation of the point-to-point return over longer periods.

In my view, the money management industry has the uncanny ability of calling tops and bottoms in different strategies by creating products that capitalize on what is ultimately their peak in popularity. This time is no different, as sentiment for the cryptocurrency space has collapsed in the same way the value of bitcoin has over the past seven months. For this reason alone, it leads me to believe there is a tradeable bottom in the shares of BITO. That said, this is a trading vehicle in my opinion and not a long-term investment.

With bitcoin hovering around $20,000, the cryptocurrency looks oversold and washed out with an upside of 50% to the $30,000 level using nothing more than technical analysis. We are left with no other tools to analyze price in this situation, because bitcoin has no fundamental metrics other than there being a limited amount of it.

Bloomberg

As I stated last October, I see bitcoin and the thousands of other digital coins that followed as solutions to a problem that never existed, born out of years of speculation that was fueled by unprecedented amounts of free money and near-zero-percent interest rates. If one is to survive, it will probably be bitcoin because it was the first to market and is still the largest. Otherwise, it has fallen short on all of its other purported merits.

It is hard to consider it a store of value, much less a currency, when it can lose half its value in a matter of months. It also earns nothing and yields nothing. It is clearly not an inflation hedge, which is why I recommended gold over bitcoin last October to defend against what I expected to be an increase in the inflation rate. The return for gold (GLD) has been somewhat underwhelming, given the rise in inflation, but it has a positive return, while bitcoin has collapsed.

StockCharts

Regardless, cryptocurrency is still an industry worth approximately $1 trillion, which can’t be ignored. Bitcoin is the safest trading vehicle within the cryptocurrency space, because it has amassed a huge following and absorbed such a large amount of capital. Therefore, I would avoid the ProShares Short Bitcoin Strategy ETF, as it is likely to have as poor a performance in the coming months as its counterpart that launched last October.

Be the first to comment