PM Images/DigitalVision via Getty Images

The collapse of the crypto exchange platform FTX (FTT-USD) came unexpectedly, unfolded in a few days, and has rocked the crypto industry to its core. FTX was the third-largest exchange in the world and one of the most visible crypto companies on the back of a rapid rise to prominence during the pandemic as the company splurged on celebrity sponsorships and a Super Bowl commercial.

Fundamentally, the FTX bankruptcy will come to become a watershed moment for the beleaguered industry still reeling from a year that saw the collapse of the Terra/Luna currency (LUNC-USD), the bankruptcy of Voyager Digital Ltd. (OTCPK:VYGVQ) and BlockFi, the liquidation of crypto hedge fund Three Arrows, and the implosion of market maker Alameda Research. 2022 was when crypto dreams died. There is likely more pain to come. Indeed, Core Scientific (CORZ), the largest Bitcoin miner in North America, has indicated that it might file for chapter 11 bankruptcy after running into financial difficulties.

The core risk for Tyson, Virginia-based MicroStrategy (NASDAQ:MSTR) will come from the global regulatory response to the 2022 crypto crisis. The company is split in two between a conventional enterprise analytics business providing business intelligence, mobile software, and cloud-based services to its customers. The other part functions as a direct Bitcoin holding company.

This dual business model has seen MicroStrategy garner a significant retail investor base as the options for stock market exposure to Bitcoin as an asset class remain quite limited. Whilst there are a number of Bitcoin futures ETFs, the SEC has for years rebuffed spot Bitcoin ETF applications. The most recent attempt is the spot ARK 21Shares Bitcoin ETF, which the SEC is still seeking market feedback on.

Critically, the collapse of FTX makes any such approval and the subsequent flood of capital into Bitcoin even more unlikely. Hence, retail stock market investors have a limited pool of options. This has historically driven MicroStrategy to trade at a substantial premium to its net asset value.

A New Regulatory Landscape And Stunted Bitcoin Adoption

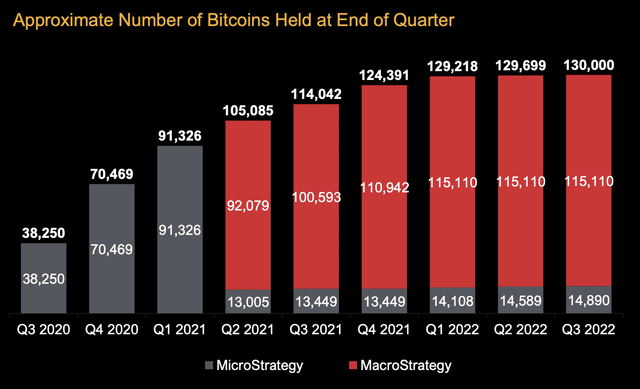

Saylor’s MicroStrategy is a Bitcoin maximalist. This describes a stance that believes Bitcoin is the only true digital asset and that all other cryptocurrencies are not useful. Hence, the company only invests in Bitcoin and recently purchased an additional 301 Bitcoins for $6 million at an average price of $19,851 per Bitcoin to increase its total Bitcoin holding to 130,000 bitcoins. This total was acquired for $3.98 billion at an average price of $30,639 per Bitcoin.

The company recently reported earnings for its fiscal 2022 third quarter, which saw the business pull in revenue of $125.4 million, a 2.1% decrease over the year-ago quarter and a miss of $445,000 on consensus estimates. This decline was set against cash burn from operations of $1.5 million, a significant deterioration from a positive cash flow of $14 million in the year-ago quarter. Management flagged their hybrid approach of running a mature yet cash-generative enterprise analytics business together with acquiring and holding Bitcoin as a treasury reserve for the long term. But the underlying analytics business has now had two quarters of negative operational cash flows, with rising interest expenses being a core factor in this.

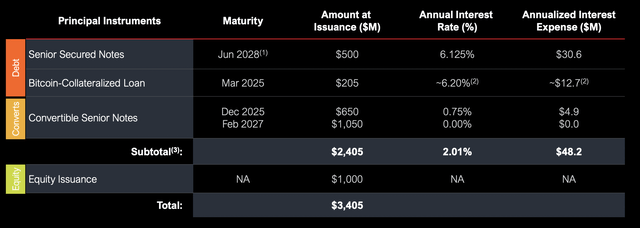

MicroStrategy has historically been dependent on debt and aggressive share dilution to purchase Bitcoin rather than only using positive cash flow from its operations. The company has a total debt balance of $2.4 billion but at an extremely low blended annual interest rate of 2.01%. This is positive as it’s essentially half the current Federal funds rate of 4%. The bulk of the balance is in the form of convertible senior notes, and the option to convert them to equity will likely be chosen when the first note comes due in December 2025. The most near-term debt coming due is a $205 million Bitcoin-collateralized loan in March 2025. This provides material leeway.

FTX Failure Caps A Bleak Year For Cryptos

MicroStrategy has recorded a cumulative impairment loss of $1.99 billion since it commenced its Bitcoin purchases and the company will have to record even higher impairment charges with Bitcoin currently trading at $16,260, down significantly from just two weeks ago when the earnings report was released.

Saylor has gone on the defensive post-FTX collapse. He believes Bitcoin to be in a dysfunctional relationship with other cryptocurrencies that he wants out of. He also appealed to regulators to set out a clear roadmap for legitimate cryptos to register to become digital securities or digital commodities. The future of the industry post-FTX should be one of registered digital assets trading on regulated exchanges, where everyone has the type of investor protection they’d be accustomed to on the NASDAQ or NYSE.

The company also recently filed to sell up to $500 million of its common shares, a move that should see them raise more cash to potentially take advantage of any further pullback in Bitcoin prices. Overall, there are likely going to be substantial chances to acquire Bitcoin in the weeks ahead as the full impact of the FTX implosion continues to reverberate across the industry and the crypto winter enters a new year. MicroStrategy should be fine with its leverage being extremely cheap and unlikely to pose a problem even with Bitcoin collapsing below $10,000. Longs are more likely to be worried about the company’s total equity slipping further into the negative. This was at negative $200 million as at the end of its third quarter and renders the stock as an avoid.

Be the first to comment