Maxxa_Satori/iStock via Getty Images

Being challenged in life is inevitable, being defeated is optional.”― Roger Crawford

Today, we take a look at a fairly well-known company fighting identity theft. The stock has taken hit lately as a strategic merger has hit a bit of a snag. This is likely to be resolved favorably, and the purchase will create considerable synergies when completed. An analysis follows below.

Company Overview:

NortonLifeLock Inc. (NASDAQ:NLOK) is a Tempe, Arizona-based identity theft protection company tasked with preventing, detecting, and restoring potential damages caused by cyber criminals to retail consumers. The company boasts a consumer cyber safety platform with ~80 million users and 23.5 million direct accounts in more than 150 countries. Peter Norton Computing was formed in 1982 and acquired by cybersecurity firm Symantec in 1990. LifeLock was founded in 2005 and purchased by Symantec in 2017. The combination was rechristened to its current moniker after Symantec spun out its enterprise division in 2019. Shares of NLOK trade just under $25.00 a share, translating to a market cap of $12.7 billion.

The company operates on a fiscal year (FY) ending on the closest Friday to March 31. As such, April 1, 2022, marked the end of FY22.

Business Model & The Cyber Security Market

According to The Harris Poll, over 415 million people across 10 countries were victims of cybercrime in 2021, with 81 million victims of identity theft. These victims spent ~4.4 billion hours trying to restore their identities or resolve other cybercrime-related issues. Norton’s charge is to prevent these offenses with its product offerings to the retail consumer.

Norton generates revenue through a subscription model, whereby individuals and companies pay a monthly fee to receive three types of products that include security, identity protection, and online privacy. LifeLock provides protection against identity theft for an individual or family with a guarantee – contingent upon the package type – of up to $1 million for property confiscated as a result of online theft occurring on its watch, as well as another $1 million to cover attorney and expert fees in the recovery process. The company also offers Norton 360, which provides protection against malware and other online attacks. Norton also provides an encrypted data tunnel for secure transmission of sensitive data, reputation management services, and anonymous browsing capabilities.

For this business, Norton competes against security providers such as Czech concern Avast (AVST) – more on it shortly – Romanian cybersecurity firm Bitdefender, McAfee, Kaspersky, Trend Micro (OTCPK:TMICF), Apple (AAPL), and Microsoft (MSFT). In identity, the company contends with products from credit bureaus such as Equifax (EFX), Experian (OTCQX:EXPGF), and TransUnion (TRU), as well as theft protection offerings from Allstate (ALL) and Credit Karma (KARMA). For the online privacy customer, Norton competes with Life360, Kape’s (OTC:CSSDF) ExpressVPN (virtual private network), and NordVPN, among others.

Proposed Avast Merger

This competitive landscape was potentially altered when Norton announced its intentions to acquire Avast in August 2021. Still subject to UK regulatory approval, the combination will significantly raise its product users by ~435 million to ~515 million, while expanding its portfolio of consumer offerings that leverages Norton’s strength in identity with Avast’s bailiwick in privacy. It also broadens an already diverse geographic reach – about half its revenues are currently from international sales – and facilitates expansion into home office and very small business security. Further down the income statement, Norton expects to realize $280 million in annual cost savings, which should help drive double-digit EPS growth within one year of consummation.

In what could be termed a risk arbitrageur’s dream, Avast shareholders can elect to receive either: (i) $7.61 a share in cash and 0.0302 shares of NLOK; or (ii) $2.37 a share in cash and 0.1937 shares of NLOK. Although the combination unlocks significant synergies and the market bid up its stock when the deal was first announced, given the recent pullback in Norton’s share price, it appears that most rational shareholders – assuming deal approval – will choose option (i).

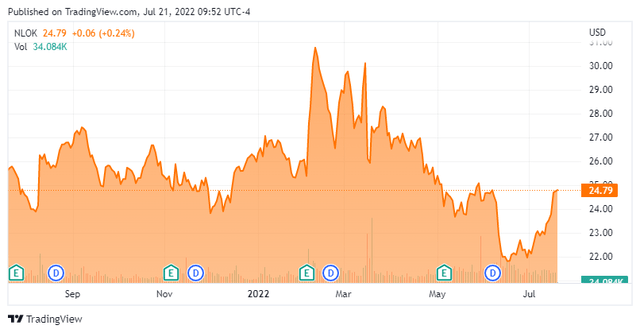

Share Price Performance

Unlike the seemingly countless 2021 IPOs and other high-growth, cash-bleed companies whose share prices have been decimated by higher cost of capital concerns, Norton’s approximate 20% slide since setting an all-time high of $30.92 in February 2022 is a function of Avast merger uncertainty. The combination was initially slated to close on February 24th, which was later revised to April 4th. Although it had received regulatory clearance from the requisite authorities in countries within the EU and the U.S., the Competition and Markets Authority [CMA] in the UK elected to refer the merger to Phase 2 investigation, concerned that the combination will garner between 40% and 50% market share (by revenue), in effect rendering the UK market a duopoly (with McAfee). When Norton announced the CMA’s intention to delay approval of the deal pending its Phase 2 investigation on March 16, 2022, its stock sold off 13% in the subsequent trading session, commencing a three-month tailspin. That said, management is still confident the acquisition will close sometime in 2H22.

4QFY22 Results:

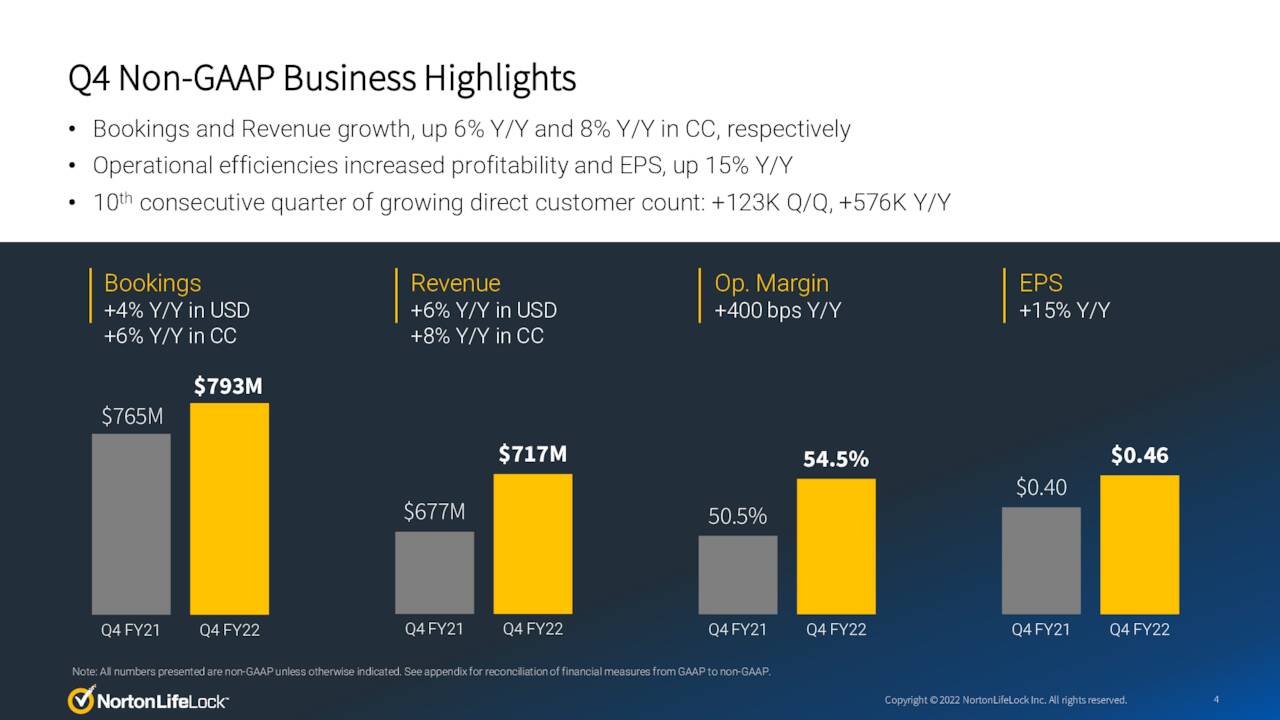

With the deal’s closing up in the air, Norton announced 4QFY22 and FY22 results on May 5th, posting $0.46 a share (non-GAAP) on revenue of $716 million in its final fiscal stanza versus $0.40 a share (non-GAAP) on revenue of $672 million in 4QFY21, registering 15% and 7% improvements, respectively. These results were $0.01 and $7 million better than Street expectations, marking its tenth consecutive quarter of year-over-year growth at the top line. GAAP gross margin was 85.9% versus 85.3% in 4QFY21 and non-GAAP operating margin was 54.5% versus 50.5%. Norton added 123,000 new customers quarter-over-quarter and 576,000 year-over-year while exiting its fiscal year with a direct monthly ARPU of $8.89, down from $9.01 in the prior year.

May Company Presentation

The company did not provide projections for FY23, only 1QFY23, which was $0.43 a share (non-GAAP) on revenue of $710 million (based on range midpoints). Although this guide was $0.03 shy of Street expectations, it should be noted that the earnings estimate includes headwinds from currency of $0.03 a share and from new accounting standards of $0.02 a share. The market did not react meaningfully to this report.

Balance Sheet & Analyst Commentary:

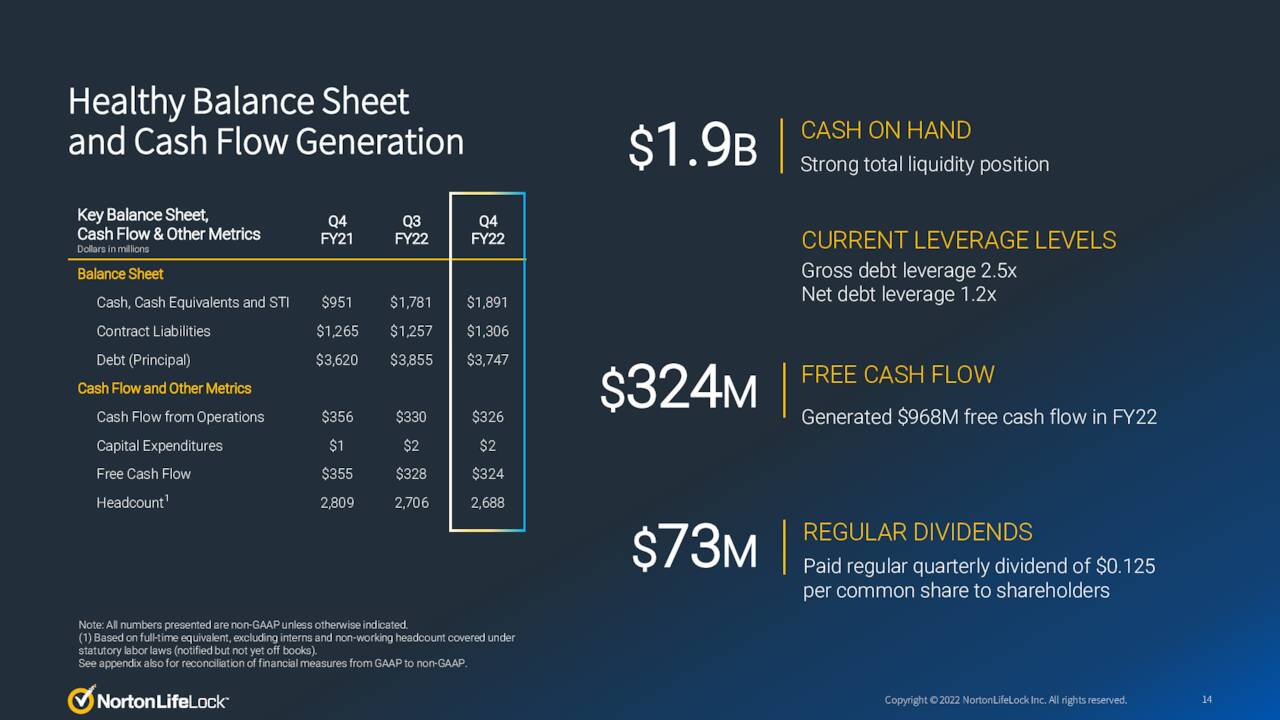

Assuming the deal is eventually consummated, and Avast shareholders elect the cash-heavy option, it will cost Norton ~$8.3 billion, of which the cash portion will be ~$7.9 billion. It will be financed by $1.9 billion of balance sheet cash and debt, the latter of which the company is already carrying $2.7 billion while inheriting an additional ~$350 million [NET] from Avast. Leverage post-acquisition will be a little north of 4.0. That said, Norton generated cash from operations of $974 million in FY22 and the combination should kick off cash of ~$1.5 billion before synergies are factored into the algebra, permitting a quick paydown.

May Company Presentation

Before the Avast deal was announced, Norton engaged in an aggressive share repurchase program as a means of returning capital to shareholders. It was initially suspended during the Avast acquisition process but resumed in April 2022, with the company buying back approximately four million shares in the first six weeks of FY23. The company also pays a quarterly dividend of $0.125 a share, translating to a current yield of just north of two percent.

With an uncertain path to merger consummation against the backdrop of the worst inflation in 40 years, it isn’t surprising to see the Street tepid on Norton’s prospects. Currently, analysts rendering commentary over the past year feature three buy ratings and two holds. Their median twelve-month price target is just under $28 a share within a tight price target range ($26 to $29). They expect the company to earn $1.81 on revenue of $2.92 billion in FY23, followed by $1.96 a share on revenue of $3.08 billion in FY24. These projections do not include the potential impact of Avast.

Board member Peter Feld, representing the interests of funds run by Starboard, is very bullish on Norton. On behalf of those funds, he purchased 2.5 million shares under $22.50 a share between June 13th and June 15th.

Verdict:

The selloff in the overall market combined with hand wringing concerning the Avast combination have shares of NLOK trading at just over 13x FY23E EPS. It can be argued that its high debt load (assuming acquisition) and macroeconomic headwinds (such as fewer PC shipments) are not deserving of a higher multiple. That said, Norton kicks off a ton of cash and will kick off even more if Avast is eventually approved. Either way, the arb short pressure will be removed and shares of NLOK should be more buoyant. In the meantime, with deal uncertainty already factored in, the company’s stock will likely remain in a narrow range until a regulatory decision out of the UK is known, making a covered call strategy a solid play to improve on its just over two percent yield.

A challenge only becomes an obstacle when you bow to it.”― Ray A. Davis

Be the first to comment