The Good Brigade

As fears mount over the state of the economy and as rising interest rates threaten to put a damper on housing and general building construction, remodeling, and other related activities, any company tied to the construction space seems to be taboo for the market. Even firms that are trading at fundamentally cheap levels and that are growing nicely have experienced a pullback, many of them experiencing declines that are larger even than the broader market’s decline. A great example of this can be seen when looking at TopBuild (NYSE:BLD), a player in the insulation installation space that also focuses on the distribution of insulation and related accessories and building products. Although it is possible that the company could experience some pain moving forward and it is true that shares of the enterprise are trading at rather lofty levels compared to similar firms, the stock is cheap on an absolute basis and its long-term outlook is likely positive. Because of this, I have decided to retain my ‘buy’ rating on the firm for now.

BLD shares have fallen too far

Back in February of this year, I wrote my first article covering TopBuild and its prospects as an investment opportunity. In that article, I said that the company continues to grow at a nice rate, thanks in part to acquisitions but also because of organic means. I claimed that this performance would likely continue for the foreseeable future but I also recognize that shares of the business were not exactly cheap. Even so, I ended up rating the company a ‘buy’, because I felt that the positive outweighed the negative and that shares would likely outperform the broader market moving forward. Since the publication of that article, things have not gone exactly as planned. While the S&P 500 is down by 15.5%, shares of TopBuild have generated a loss for investors of 23.7%.

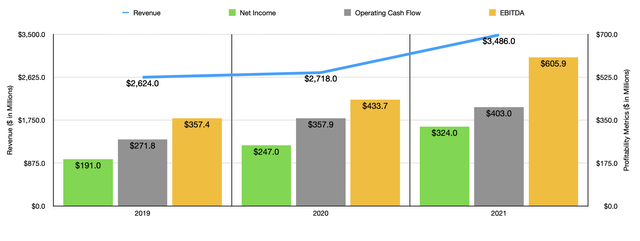

This decline in price seems to me to be largely unwarranted. Fundamentally speaking, the company remains robust. To see what I mean, we need only look at how the business ended its 2021 fiscal year and how it has performed since. For 2021 as a whole, the company generated revenue of $3.49 billion. That represents an increase of 28.3% over the $2.72 billion generated one year earlier. This increase in sales was driven by three key factors. The most significant were the acquisitions the company made during the year, which contributed to a 15.6% rise in revenue. Higher selling prices added 8.5% to sales, while rises in sales volume added 4.1%. This increase in revenue brought with it a rise in profitability. Net income in 2021 totaled $324 million. That compares favorably to the $247 million generated one year earlier. Operating cash flow jumped from $357.9 million to $403 million and EBITDA grew from $433.7 million to $605.9 million.

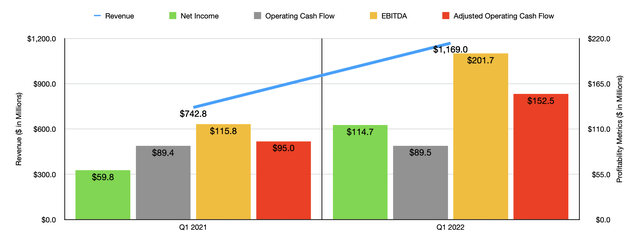

Despite broader economic concerns, performance for the company has remained strong in the 2022 fiscal year. Revenue in the latest quarter came in at $1.17 billion. That’s 57.4% higher than the $742.8 million generated one year earlier. Acquisitions alone added 38.6% to the company’s top line. However, price increases added an impressive 16.5%. Despite this rise in pricing, the company still benefited to the tune of 2.2% from rising volume. This shows that even though inflation has hit this space, demand has not been entirely blunted.

For any sort of capital-intensive company, you should expect small improvements in pricing and volume, particularly the former, to have a significant impact on the firm’s bottom line. Even a small rise in margin can have a huge impact for the company. Consider net income in the latest quarter. The net profit margin for the business came in at 9.8%. That compares to the 8.1% seen just one year earlier. Although this may not seem like much, that 1.7% difference (combined with higher sales) caused net income to skyrocket by 91.8% from $59.8 million to $114.7 million. Other profitability metrics also came in strong. For instance, EBITDA came in at $201.7 million. That compares to the $115.8 million generated just one year earlier. Operating cash flow inched up only barely from $89.4 million to $89.5 million. But if we adjust for changes in working capital, it would have risen from $95 million to $152.5 million. Management is already using this excess cash flow to reward shareholders. During the latest quarter, for instance, the company initiated a $100 million accelerated share buyback plan.

Although the market seems to be concerned about the near-term outlook for this business, management is not. They currently anticipate revenue for the current fiscal year of between $4.65 billion and $4.80 billion. At the midpoint, that would translate to a year-over-year increase of 35.5%. Meanwhile, EBITDA should come in at between $810 million and $860 million. At the midpoint, that would translate to a year-over-year increase of 37.8%. No guidance was given when it came to other profitability metrics. But if they increase at the same rate that EBITDA should, then we should anticipate net income of $446.5 million and operating cash flow of $555.4 million.

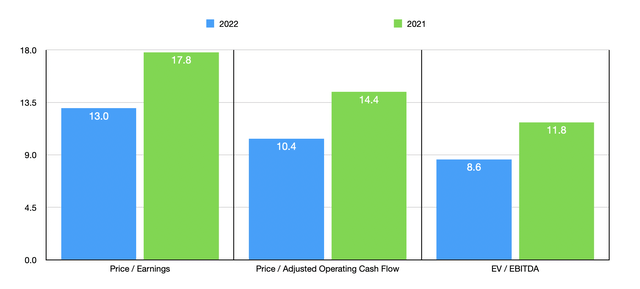

Using this data, it’s quite easy to value the company. On a forward basis, the firm is trading at a price-to-earnings multiple of 13. This compares to the 17.8 reading that we get if we rely on 2021 results. The price to operating cash flow multiple should be 8.4, down from the 14.4 we get if we use 2021 figures. And the EV to EBITDA multiple should decline from 11.8 last year to 8.6 this year. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies range from a low of 2.5 to a high of 10.2. And when it comes to the EV to EBITDA approach, the range was from 3.4 to 6.4. In both cases, TopBuild was the most expensive of the group. Meanwhile, using the price to operating cash flow approach, the range was from 5.5 to 29.7. In this case, our prospect was cheaper than all but one of the companies.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| TopBuild | 17.8 | 14.4 | 11.8 |

| Legacy Housing Corporation (LEGH) | 10.2 | 5.5 | 5.3 |

| Meritage Homes Corporation (MTH) | 3.8 | 25.6 | 3.4 |

| Century Communities (CCS) | 3.2 | 25.7 | 3.6 |

| KB Home (KBH) | 4.2 | 29.7 | 5.2 |

| Beazer Homes USA (BZH) | 2.5 | 16.9 | 6.4 |

Takeaway

Relative to other companies related to this industry, TopBuild looks to be rather pricey. But growth has been robust and the forward multiples on the company are definitely attractive. It is entirely possible that the company could experience a bit of a soft patch at some point in time. But that is unlikely to be this year. And given the strong mix of growth and affordable share price, I do think the company warrants upside potential from here. Because of that, I have decided to retain my ‘buy’ rating on the firm.

Be the first to comment