alexsl/E+ via Getty Images

Investment Thesis

Microsoft (NASDAQ:MSFT) is down more than 30% from its recent highs. In fact, Microsoft’s sell-off has picked up momentum and is down more than 20% in about 6 weeks. This is the momentum that future textbooks will write about!

I explain where I see an echo of the dotcom bust. While pressing ahead and arguing that analysts are incapable or unwilling to read the room. That Microsoft’s EPS consensus numbers need to come down.

At the same time driving home the point that the time to be bullish on Microsoft is now.

Finally, I offer practical tips to think about the present investment environment.

Reminiscence of a Previous Bust

When I started investing, I read about the dot-com bust. I thought to myself, how would have felt? What would I have done during those moments?

I read how all my value investing idols had different coping strategies. As I plowed through countless graphs that reflected the carnage that tech was left in. And from that experience, I drew up my own versions of what I would have done.

And what I observed time and time again, was that the most painful aspect of the whole sell-off was the bear market rallies. The bear rallies would have killed me off. And that’s exactly what I believe kills off the investor.

It’s not necessarily the bear market but the sharp rallies off the bottom that draw you back in, only to grind lower. It’s that consistent tearing and mowing of investors’ capital, and alongside that lack of enthusiasm to throw good money after bad money is what I remember about the dot-com bust.

What’s Happening Right Now?

When a bear market starts, it starts slow. There’s just some air let out as too many people price anchor to the price they witnessed just a few weeks ago. There’s not a widely enough accepted recognition that the fundamental dynamics have changed. And slowly but surely, more and more people wake up out of a trance.

At first, there’s inaction. Then, a few people buy a few dips along the way. Then, as things progressed the buy-and-hold crew is unwilling to do anything. Indeed, the whole definition of buy and hold is that the group sticks to their guns.

But as Microsoft starts dropping more than 25% from its previous highs, there’s a sudden mass awaking. And people start asking difficult questions about their stock investment. And it’s at that point, that investors start to sell out.

It’s that mass awakening, that mass selling, that typifies the final stretch of the bear market. The indiscriminate selling.

However, I believe that if there was a time to sell out of Microsoft, that time has now gone. This is not the time to be selling! And here’s what one should instead be thinking about.

Thinking Ahead, What’s Next?

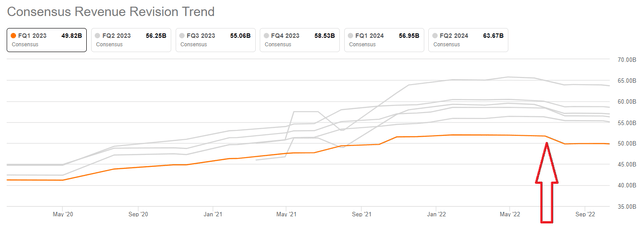

MSFT revenue consensus estimates

Here’s what we see above. The red arrow points to the summer when indications that the inflation was more persistent than investors originally believed. And you can see that fiscal Q1 2023 (upcoming earnings) has been downwards revised, and that makes sense.

What I do believe that analysts are missing, is that the next twelve months need to be downwards revised more. Why?

Because everywhere we look, from FedEx (FDX), ServiceNow (NOW), AMD (AMD), and Micron (MU), all these broad global companies have offered recent guidance and they unanimously describe the challenging backdrop in supplies, from inflation, or in cloud enterprise spending. The writing is on the wall.

Embracing Reality

The reason why analysts have failed to adjust later quarterly revenue estimates is that there’s an unplaced belief that the impact of a potential recession will not significantly affect enterprise companies. After all, particularly large enterprises are the companies that are best capitalized to withstand turbulence.

However, I believe that even if they are able to withstand turbulence, they are not recession-proof.

Consequently, I argue that analysts are going to be forced to downwards revise fiscal Q2 2023 (ends December 2022) and fiscal Q3 2023 (ends March 2023) revenue estimates.

And at this stage, you’ll take a pause and think, “I thought you were bullish” on Microsoft. And this is my thesis, that Street needs to start downwards revising its revenue consensus more aggressively in order to regain credibility.

Presently, there’s an unwillingness to be too ahead of the curve, to acknowledge reality. There’s no point in taking career risk. But we know from those large global companies mentioned above that things are coming to a standstill outside, it’s not difficult to read the room.

MSFT Stock Valuation – 25x This Year’s EPS

Here’s what I believe is a likely scenario. Microsoft’s fiscal 2023 (ends June 2023) EPS will end up lower around 5% to 10%, than current estimates.

Let’s say 10% for the purposes of our discussion. That implies that Microsoft’s EPS would come in at $9.14 rather than $10.16 which is the current estimate.

That would put Microsoft at 25x this year’s EPS. Now, I won’t pretend to argue that I find this multiple particularly cheap, I don’t!

Yet, here are two reasons why I think this is an attractive time to get in.

Firstly, I’ve downwards revised Microsoft’s EPS estimates to adjust for the new reality that’s underway.

Secondly, I recognize that Microsoft customers, enterprises, from around the world, will be the first areas to bounce back after a recessionary period.

And herein is the appeal of investing in Microsoft, it’s a toll bridge on the digitalization of the world.

Key Takeaway: How to Invest, Back to Basics

When it comes to investing in bear markets, there are 4 things that are important to acknowledge.

- The final part of the bear market, that moment of final capitulation is a necessity for ending the bear market.

- That final rinsing out of all investor enthusiasm is the most painful part.

- The absolute bottom doesn’t stay there for too long.

- Nobody rings a bell to inform you that now is the time to get in.

As we look at Microsoft today, it feels like throwing money down the sink. However, after considering these 4 elements, what you are left with is a period that lasts around 3 or 6 months of throwing good money after bad money.

But each time one sticks to the process of dollar cost averaging, one can be sure that the average price will work out favorably when we come out at the other end onto the next bull market.

Be the first to comment