yocamon/iStock Editorial via Getty Images

Introduction

Japanese car brands are known for their reliability and quality. Subaru (OTCPK:FUJHY) (OTCPK:FUJHF) is one of these car brands and the Impreza is one of the greatest Subaru cars of all time. Subaru has its reputation for toughness, reliability, and the fact that every Subaru car has four-wheel drive (a sought-after feature for car enthusiasts).

Today, other car manufacturers have also developed strongly on their reputation and captured a large share of the market. Subaru’s popularity has therefore declined somewhat, resulting in declining sales. However, analysts expect sales and earnings growth for the coming years to be strong. This makes the stock worth investigating further.

The stock on the Tokyo Stock Exchange peaked in late 2015, after which it entered a bear market. From 2020, the price level has stabilized. As a result, the valuation has become attractive.

Subaru’s Share Price Chart (Yahoo Finance)

The stock is a strong buy as Subaru has a strong cash position and many analysts expect strong growth and a high dividend.

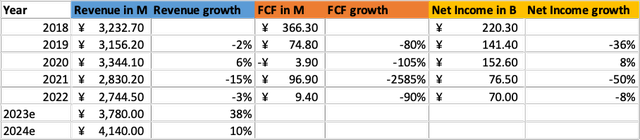

Financial Results

The first quarter of fiscal 2023 was strong with sales growing 31.3% compared to the same period last year. Profit before tax also grew strongly by 12.1%. I quote from their quarterly report:

While production constraints continued due to the global shortage of semiconductors, global production increased 11.7% to 205,000 units. Production in Japan rose 15.3% to 135,000 units, while production in the U.S. grew 5.4% to 70,000 units. Global vehicle sales increased 11.7% to 196,000 units, led by sales growth in Subaru’s key U.S. market.

As positive factors such as the effects of foreign exchange rates and the growth in unit sales more than offset a steep rise in raw material prices and an increase in SG&A expenses, operating profit rose 7.4 billion yen to 37 billion yen, profit before tax grew 4.2 billion yen to 38.4 billion yen, and profit for the period attributable to owners of parent increased 8.7 billion yen to 27.2 billion yen.

Despite sales gradually declining since 2018, Subaru has built a strong cash position of ¥1,250 billion. Short-term debt is ¥51 billion and long-term debt is ¥280 billion. This makes their net cash position a strong ¥919 billion. This is significant considering their market cap of ¥1749 billion; their net cash position is over 50% of market cap.

Car manufacturers generally have low profit margins and free cash flow margins. Therefore, both earnings and free cash flow decreased more than sales during the same period.

The outlook for Subaru is favorable. Analysts expect strong revenue growth for fiscal year 2023 and 2024. The projected revenue growth for fiscal year 2023 is a strong 38% and for fiscal year 2024 they expect a revenue growth of 10%.

Subaru had a strong quarter and despite a semiconductor shortfall, the company expects revenue of ¥3,500B and pre-tax profit of ¥200B for fiscal 2023 due to the positive impact of the increase in auto sales and favorable exchange rates.

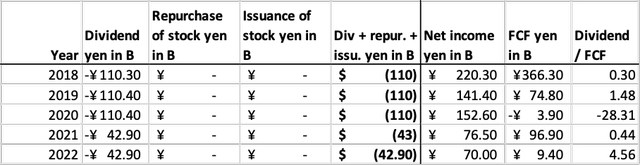

Subaru’s Financials (SEC and Author’s Own Calculation)

Compared to US car manufacturers such as Ford (F) and General Motors (GM), Subaru’s revenue growth forecast is high. The sales growth estimate of these automakers is 16% and 21%, respectively, according to the SA ticker pages.

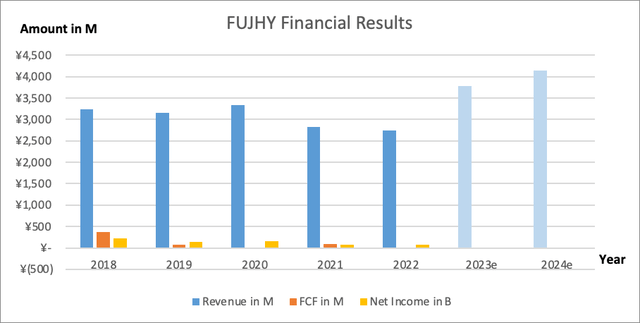

Below is a graphical representation of the table of Subaru’s growth figures.

Graphical Representation Of Subaru’s Financial Results (SEC And Author’s Own Visualization)

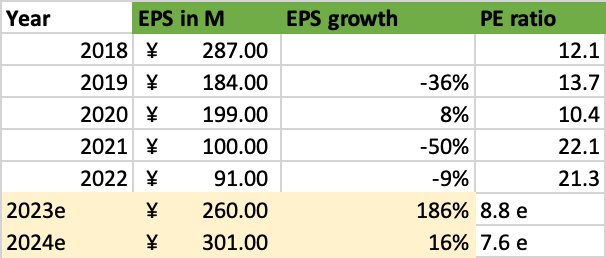

In addition to strong revenue growth, analysts expect EPS growth of 186% for fiscal year 2023 and 16% growth for fiscal year 2024.

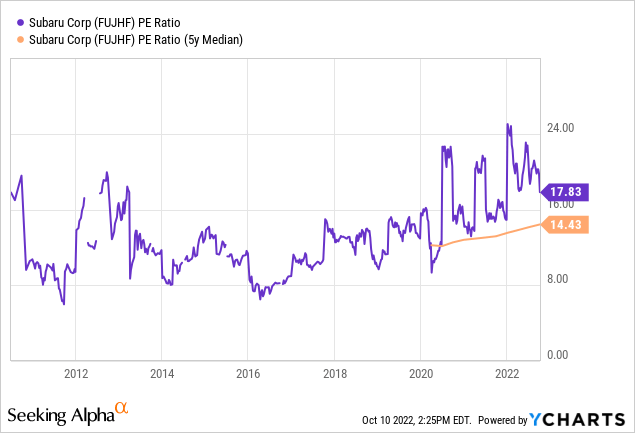

The forward PE ratio for 2024 will then be 7.6, very attractive compared to their historical PE ratio of 14.4. If we take the historical PE ratio of 14 for the 2024 valuation, the stock price will be ¥4214, a growth of a whopping 85%.

Subaru’s EPS and PE Ratio (SEC and Author’s Own Calculation)

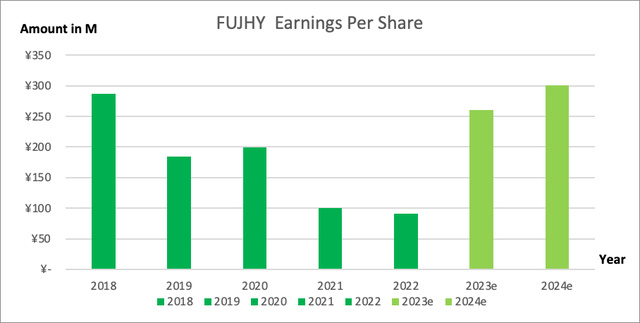

I have also graphically displayed the table below for the earnings per share.

Subaru’s EPS (SEC and Author’s Own Visualization)

High Dividends Can Be Expected

Subaru pays a dividend of ¥56 per share, which is about 2.46% of the current share price. Earnings per share have fallen in recent years, which has led to a fall in dividends. The outlook is strong, and a solid dividend can be expected for the coming years.

Subaru’s Cash Flow Highlights (SEC and Author’s Own Calculation)

Subaru’s dividend has been cut as their net income fell. Auto manufacturing profit margins are generally low, and Subaru’s net income margin for fiscal year 2022 is just under 2.6%. A small decrease in sales leads to a larger decrease in profit.

Since Subaru expects strong earnings growth, I expect the dividend to grow along with it. Assuming a 50% dividend payout ratio, Subaru is expected to pay ¥130 in dividends for 2023 and ¥151 for 2024. This makes the current price level of the stock very attractive as it yields a dividend yield of 5.7% and 6.6%, respectively.

Valuation Metrics Are Favorable

Earlier in the article, I mentioned the strong growing expected earnings per share for 2023 and 2024 with forward PE ratios of 8.8 and 7.6, respectively. I have shown this graphically in the diagram below. In the past 10 years, the PE ratio of 8 was historically low, this was visible in 2012, 2014 and 2016.

In 2012, the stock rose from ¥518 in 2012 to its all-time high of ¥5088 at the end of 2015. This is a huge return of up to 882% over 3 years, driven by low valuations and strong earnings growth.

Strong earnings growth is again expected in the coming years and I expect a strong share price appreciation. Subaru is a reliable Japanese car brand with a liquid balance sheet, strong growth prospects and a favorable valuation. I think the stock is a strong buy.

Risks

I prefer to buy foreign stocks on the local stock market because the liquidity is higher, and it is easy to see how much currency profit or loss is being made from the investment.

Investing in foreign stocks involves currency risk, and Subaru is no different. Subaru is listed in the yen currency on the Tokyo Stock Exchange. The inflation of Japan is not as high as in the United States. This will make Japan less inclined to raise interest rates, possibly causing the currency to lag behind the dollar. I expect the value of the dollar to continue to appreciate against the value of the yen as inflation remains high. This could be disadvantageous for US investors who want to invest in foreign stocks.

This is an advantage for Subaru because their sales market mainly concerns the United States. If the dollar rises, it will benefit Subaru’s sales and profits. The opposite is also possible.

Conclusion

Subaru is a Japanese car brand known for their reliability and quality. In recent years, their prominence has declined, resulting in a decline in sales and profits, and a declining share price. Analysts expect strong growth in the coming years. Despite declining sales and profits, Subaru has well replenished its net cash position and its net cash position now comprises approximately 50% of the market capitalization. Analysts expect earnings per share to rise by an average of 186% and 16% in 2023 and 2024. This corresponds to a forward PE ratio of 8.8 and 7.6 respectively, a historically low equity valuation. At the average PE ratio, the stock could rise as much as 85% through 2024. The dividend yield is now 2.5%, but at 50% dividend payout ratio, the dividend yield will be 6.6% if investors buy the stock now. The trustworthy Japanese car brand, the improved outlook, the low stock valuation, and the high dividend growth expectations make the stock a strong buy.

Be the first to comment