jetcityimage

I track the Top 10 stocks by market cap weight that dominate the S&P 500 closely, even though I don’t hold positions in any of them. That’s because of the outsized role they play in the performance of the broad market indexes that I do hold: the Vanguard S&P 500 ETF (VOO) and The Vanguard Total Stock Market ETF (VTI). Those top 10 stocks have made up anywhere from 20 -30% of the value of these ETFs over the past decade. They have made up almost 50% of the total value of the Invesco QQQ Trust (QQQ) over the same period.

Thus it was that back on February 15 of this year I published a long article that laid out a case for why Microsoft (NASDAQ:MSFT) was the very best of the mega-cap stocks that dominate both the S&P 500 and the ETFs that track it, like the SPDR S&P 500 ETF Trust (SPY), and the Invesco QQQ Trust. The most compelling reason I laid out in that article for choosing Microsoft was the resilience of its business model, which has enabled it to be one of the very few Top 10 stocks in the S&P 500 that maintained that Top 10 ranking for over 20 years.

I cited MSFT’s excellent management, debt positioning, and ability to expand its business into different niches as the world changed as being what had enabled it to maintain its double digit earnings growth despite being an enormous, fully mature company.

Valuation Was What Kept Me From Recommending Microsoft Last February

Though I cited those very positive factors in that February article, I determined that its valuation at the time was still extreme. This was true, even after the market and tech stocks in particular had already suffered a significant market decline. In that article I laid out several unrelated different ways of coming up with a fair price for MSFT but its price back in February was way above all of them. The most moderate target price I came up with was based on its historical average P/E ratio and analysts’ forecasts of future earnings. It was 30% above where Microsoft was priced in mid-February.

With the renewal of the bear market in the NASDAQ index that we have just seen, and the continuing impact of inflation and the interest rate increases that have been adopted, worldwide, to attempt to tame it, I wondered whether after seeing its share price drop by more than 26% Microsoft would now be a good buy.

How The Metrics Examined in February Have Changed

Note: All metrics in the analysis that follow are those compiled by Factset as reported by Fastgraphs.com.

Earnings Expectations

In February analysts forecast that Microsoft’s earnings for the fiscal year ending in June 2022 would be $9.19/share. In fact they came in at $9.21/share, a very small positive difference of only .2%.

In February those same analysts projected that earnings for fiscal 2023 would be $10.52/share. The current earnings amount analysts expect to see for fiscal 2023 has now declined to $10.05/share, which represents a significant drop of 4.45%.

Earnings Growth Rate Expectations

This reduction in analysts’ earnings forecasts have made a very significant difference in the earnings growth rate now being forecast for fiscal 2023. It has dropped from 14%, which was the consensus forecast in February, to 9% now. If that current forecast holds, at the end of June 2023 Microsoft will register its first year without double digit earnings growth since 2016. We will get back to the importance of this decline further on in this article.

Long-Term Debt To Capital

In February Microsoft’s Long-term Debt was reported to be 31.51% of its capital. That number has improved. It is now 29.54%. This represents a decline of roughly 6%. Given how long term interest rates have surged, this is a sign of prudent management.

Credit Rating

Microsoft’s credit rating has not changed. It continues to be one of the very few companies in the S&P 500 that have achieved AAA credit ratings. It is the only stock in the list of the Top 10 stocks in the S&P 500 by market cap that has achieved that premium credit rating. Ratings for the others, except for Tesla, range from UnitedHealth Group’s (UNH) A+ to Apple (AAPL) and Alphabet’s (GOOG)(GOOGL) AA+. Tesla, in contrast sports a BB+ credit rating, which falls into the “speculative” range, to use Standard & Poor’s euphemism, a range whose members’ bonds are usually known as Junk bonds.

Dividend Yield

Back in February I pointed out that Microsoft was also the highest yielding of the Top 10 stocks in the S&P 500, though its yield was a puny .084% at the time. It now has the second highest highest yield of the S&P 500’s Top 10 stocks, with its current yield having risen to 1.21%. That yield is exceeded only UnitedHealth Group’s 1.32% yield. Its sharp price decline since February had pushed its current yield up to 1.21%. That is far higher than Apple’s current yield of .66%. None of the other mega cap Top 10 stocks in the S&P 500 pay any dividend at all.

Dividend Growth

In February I was also impressed with Microsoft’s forecast dividend growth rate for fiscal 2022, which was almost 9% in February. This is high for what is still a growth stock, one that was still seeing its earnings growing at a double digit rate.

I now note that the final annual Microsoft dividend for 2021 as reported by Factset has been revised downward. This increased its dividend growth rate for fiscal 2022 to 10.5%. Microsoft is now predicted to have a slightly lower rate of dividend growth by the end of fiscal 2023, one around 7%.

The table below displays the change in the metrics we have just discussed and in Microsoft’s P/E ratio between February 2022 and October 2022.

| Metric | 02/15/22 | 10/12/22 |

| Forcast Earnings Fiscal 2022 | $9.19 | $9.21 |

| Forcast Earnings Fiscal 2023 | $10.52 | $10.05 |

| Earnings growth rate Fiscal 2023 | 14.00% | 9.12% |

| Long-term Debt to Capital | 31.51% | 29.54% |

| Credit Rating | AAA | AAA |

| Dividend Yield | 0.08% | 1.21% |

| Dividend Growth | 10.5%(2022) | 9% (2023) |

| Price/Earnings Ratio | 33.81 | 23.86 |

Price/Earnings Ratio

Microsoft’s very high P/E ratio was a main reason I did not recommend buying it in February. It has come down significantly, to be sure, but the question is, has it come down enough.

Microsoft’s price has dropped from $295.04 on February 11, 2022 to $225.41 on October 11, 2022. This represents a decline of 23.6%. Even though its earnings forecast has also declined, that decline has not been nearly as steep. So Microsoft’s Price/Earnings ratio has dropped dramatically. It was 33.81 in February. It now stands at 23.86.

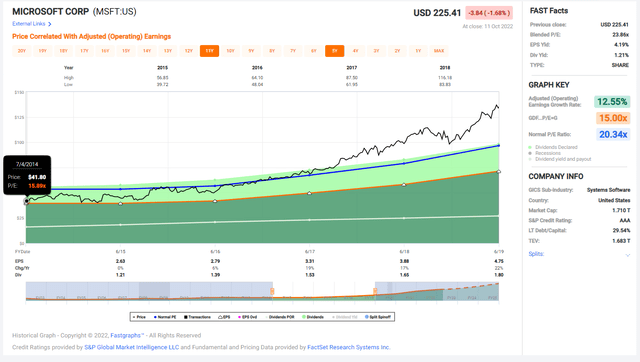

This represents a very significant decline. The last time that Microsoft’s P/E ratio had dropped below this level was in December of 2018 after the Federal Reserve had raised its base rate to 2.25%–which investors will recall was followed by a market swoon that convinced the Federal Reserve to pull rates down sharply almost immediately. It could do this, of course, because inflation was still running under its 2% target in early 2019.

Between the time when Satya Nadella took over as CEO in 2014 and the June of 2019–the period before the beginning of the COVID-19 Tech frenzy, Microsoft’s P/E ratio rose from 15.89 to 28.23. But investors should note that during much of this period Microsoft’s P/E ratio remained relatively low. It rose no higher than 21.46 until it achieved 19% annual earnings growth in 2017. That was when it began its dramatic price increase. That double digit earnings growth rate is what propelled it higher before the COVID-19 induced surge in Tech earnings. Which is why it matters now that its earnings growth rate is forecast to be below 10%.

Microsoft Price, Earnings and Dividends 2014-2019

Fastgraphs.com

How Does Microsoft’s P/E Based Valuation Now Stack Up?

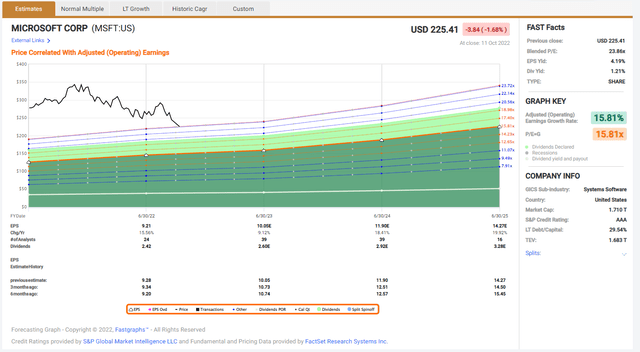

Below you see the Fastgraph forecast graph showing you how classic valuation technique based on a Graham-Dodd model would evaluate Microsoft. The orange line depicts a P/E ratio that would represent a fair value based on its expected future earnings growth rate.

Microsoft Fastgraphs Forecast Graph

Fastgraphs.com

As you can see, analysts are still expecting Microsoft to continue to grow its earnings at a rate in the mid-teens after suffering only a very brief decline in its earnings growth rate in fiscal 2023.

But notice how the analysts’ estimates of future earnings growth for the next two and a half years have declined every three months. It is very possible they may decline further now that inflation is showing every sign of persisting no matter what interest rate manipulations the world’s central banks indulge in.

So while Microsoft is indeed far better valued than it was 8 months ago, it is far from being a screaming buy when evaluated using strict valuation methods. And given that its P/E ratio only rose up to the level where it currently stands after its annual earnings growth hit double digits, a persistent decline in annual earnings growth could lead to a continuing decline in its stock price.

Investors Should Pay Close Attention to Forward Guidance When MSFT Reports Earnings

That’s why management’s next quarterly report is likely to have an outsized impact on Microsoft’s price going forward. Investors are still expecting that its current decline in its earnings growth rate is temporary. Should that turn out not to be true, or, even worse, should earnings actually decline, investors may take their remaining profits and exit.

Microsoft is expected to report earnings on October 25, 2022, which is slightly less than 2 weeks away. Even if you are only invested in Microsoft via a broad based market ETF like SPY, VOO, or QQQ, you should pay close attention to the forward guidance issued–or more ominously, omitted–when Microsoft reports.

Market Momentum Is Still Heading Downward And Microsoft Tracks The S&P 500 Closely

Microsoft’s $1.17 trillion market cap makes it the second largest company in the world, trailing only Apple with its $2.26 Trillion market cap. This is what makes it the second largest holding in the broad market indexes tracked by the world’s most popular ETFs, making up anywhere from 5% to more than 10% of the value of these indexes. But while its success has done a lot to push up the price of these indexes, it is chained so closely to those indexes that when other mega cap stocks in these indexes have run into trouble, Microsoft’s price has gone down with theirs.

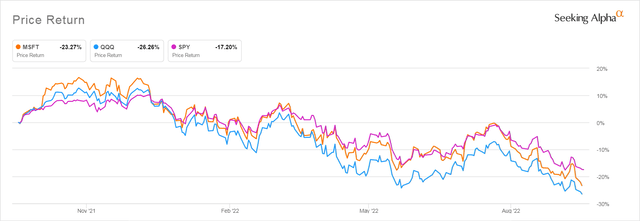

Below you can see how tightly Microsoft’s price movements track those of the S&P 500 ETF, SPY, and of QQQ.

MSFT, QQQ, and SPY 1-Year Price Performance

Seeking Alpha

As you can see, there are no significant periods when SPY or QQQ’s prices drop and Microsoft’s price rises. You can also see how closely Microsoft’s price decline has tracked that of SPY. Its performance is much more linked to that index than it is to the index QQQ follows, which holds the top 100 largest stocks listed on the NASDAQ exchange. Though Microsoft itself has not fallen as far as Tech-heavy QQQ, it has fluctuated in a way very similar to the fluctuations of the S&P 500 quite closely during the 9-month period during which both the stock and the index have been slowly declining into a bear market.

There is no reason to believe that this close coupling will vanish anytime soon. Even if Microsoft performs better than expected, poor performance of the other 499+ stocks in the S&P 500 may pull MSFT’s price down with theirs.

Inflation Is Not Showing Signs Of Abating

And there is very good reason to expect that those other 499+ stocks will perform worse than analysts currently expect. The September Producer Price Index data released today should be a slap in the face for investors who thought that inflation was ebbing. It showed an unexpected increase of +0.4% vs. +0.2% consensus and -0.2% prior. Producers have been dealing with increased prices by raising the prices they charge consumers–often far more than the prices they have been paying. But you can only raise prices by so much before you lose your customer. This means profit margins are likely to shrink while operating expenses increase. On top of which consumers faced with increasing costs for food, fuel and rent cut back on their consumption.

The Fed And Other Central Banks Have No Choice But To Raise Rates

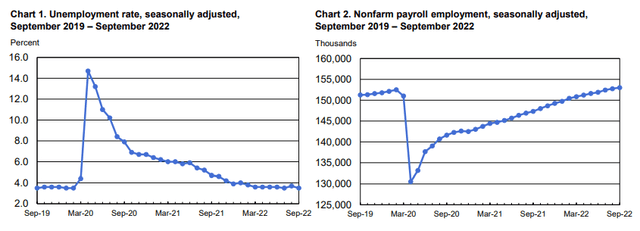

The demand for labor continues to be strong, as you can see in the charts below. So it is likely that the CPI figures for September released tomorrow, October 12, 2022, will also dash any hopes that the wage-price spiral is being tamed. This guarantees that the Federal Reserve, along with the rest of the world’s central banks, will be compelled to continue to raise interest rates.

BLS September Employment Figures

Bureau of Labor Statistics

Rising interest rates might not actually harm Microsoft directly, given their prudent debt management. But it will harm the businesses of many of its corporate and retail customers, at least for the next year or two.

Ex-US Economies Are Suffering Far More Than The US Economy

Investors should also remember that though its stock is listed on a U.S. stock exchange, Microsoft is an international company that earns 50% of its profits from sales outside of the United States. Those sales are facing headwinds not seen since the bull market began to take off in 2013.

The Russian invasion of Ukraine has created havoc in the UK and EU because of the outsize role that Russia plays in supplying the gas that runs the utilities in those regions. In the face of the Western powers’ pushback against its invasion, Russia has cut off energy to the UK and EU and their energy costs have skyrocketed. How much can be gauged by the fact that the French government is turning off hot water in public office buildings. Some restaurants in the UK faced with extreme rises in their electricity costs are serving customers by candle light. Liz Truss’s latest attempts to address these surging energy costs in the UK has precipitated a crisis that has forced the Bank of England to resume purchasing bonds to keep the pension system from collapsing.

Even excluding the impact of the Russian invasion of Ukraine, there are major problems within the countries whose wealthier citizens contribute so much to the bottom lines of Microsoft and its peers. China is facing major economic issues of its own, with its stubborn pursuit of a Zero COVID policy that results in sporadic shutdowns of manufacturing, which is hitting an economy already dealing with a huge property bubble.

The Strong Dollar Decreases Ex-US Buying Power

Customers outside of the United States are also contending with yet another major stress factor that limits their ability to buy new goods and services: the decline of their native currency’s buying power. As I write the Euro’s value has dropped to $.97 after decades when it traded at a premium to the dollar. The Pound’s value has dropped almost 20% over the last few months, too.

All these factors will mean that customers, both corporate and retail, will have less money to spend on the goods and services offered by the American companies dominating the S&P 500, including Microsoft.

So it is very likely we will continue to see earnings estimates drop, momentum continuing to press downwards, though investors, as usual, will continue to be distracted by the usual weekly bobbing up and down and the repeated claims that the bottom is in. If you are a wise investor you will ignore them.

Bottom Line: Nibble If You Must But Hold Off Making Large Investments In Microsoft Now

The conclusion seems inescapable. Though Microsoft is definitely a far better buy than it was 8 months ago, the same factors that have driven its price down over this period are still operating.

Earnings estimates are dropping, inflation is raising prices for corporate customers, threatening margins and making executives far more choosy about what new goods and services they buy. Retail customers are seeing their portfolios decline with no relief in sight thanks to persistent inflation. Increasing interest rates are also hitting hard the many other members of the S&P 500 who don’t have the stellar credit and prudent debt management Microsoft has put in place. International customers are facing unprecedented attacks on their ability to buy any but the most essential goods and services. All this suggests that the market as a whole has further to fall, and that it will take Microsoft with it.

I continue to believe that investors who stay in short-term cash instruments like money market funds or year-long Treasury ladders will be finding even better entry points to buy Microsoft in the next eight months.

I have been accused of being a perma-bear over the last two years during which I have bought very little stock, convinced that the valuations I saw everywhere in the market were dangerously elevated. Now, with the market priced at the level it was at in November of 2020 I’m glad I did not give into the temptation to go with the crowd.

There will be future buying opportunities. But I am more convinced than ever that valuation does matter and that those who come up with excuses about why this time is permanently different will always pay a price. I’ll keep watching Microsoft as well as the other bellwethers of the major broad based indexes and when they finally reach a level which makes them truly good buys I’ll buy loading up the truck, buying hand and fist, and indulging in all the other greedy cliches investors love to employ. But for now, I’m sitting on my hands and enjoying those 4% and higher yields I’m able to get from the cash I have on the sidelines.

Be the first to comment