piranka

DXC Technology (NYSE:DXC) is a $6.6bn market cap IT services and technology company. In early Sep’22, media reports appeared that DXC has hired an advisor and is in talks with at least one PE firm, with KKR being singled out as a potential suitor. Last week, DXC finally confirmed the rumors, announcing that the company has been approached by a financial sponsor. Bloomberg subsequently reported that Baring Private Equity Asia might be the potential acquirer. The rumored acquisition price is $45/share – 55% upside from the current prices. Interestingly, the market took these developments rather coldly with shares trading at only 15%-20% premium to pre-rumor levels.

The buyout rumors come amid DXC’s multi-year strategic review and previous buyout interests. After the arrival of a new CEO in 2019, DXC disposed of multiple business units, including State & Local HHS ($5bn, Mar’20), healthcare provider business ($525m, Jul’20) and, more recently, Microsoft Dynamics business (Aug’22) while also pursuing several strategic acquisitions. This has allowed the company to significantly reduce net debt (from $6.3bn in Mar’20 versus the current $2.6bn) as well as reach profitability with net income of $736m in FY2022 compared to losses for the previous years. With improving financial performance, the company became an acquisition target last year – in Jan’21, DXC received a non-binding offer (price wasn’t disclosed, but rumored to be at $10bn enterprise value) from French-listed peer Atos. The management rejected the offer, noting it as ‘inadequate and lacking certainty’. I estimate Atos’ bid at $30/share – slightly above current market prices.

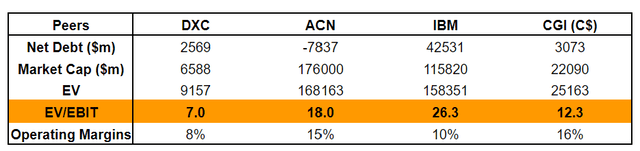

At current prices, DXC trades at only 7.0x TTM adjusted EBIT. A $45/share offer would value the company at a 10x multiple. Much larger but still somewhat comparable peers trade at much higher multiples – ACN ($176bn market cap) is at 18x, IBM ($116bn) at 26.3x and GIB (C$22bn) at 12.3x. Likewise, DXC management seems to think the stock is cheap – $701m worth of DXC’s stock (over 11% of the current market cap) has been repurchased since Mar’21 at around today’s levels.

Business and Financials

DXC emerged in 2017 as a combination of two companies – CSC and EDS (formerly HP Enterprise). DXC provides Fortune 500 companies with enterprise software services, including data analytics, business process services, outsourcing and cloud solutions, among others. The company segments its operations into Global Business Services (GBS, including analytics, applications and business process services) and Global Infrastructure Services (GIS, cloud/security and IT outsourcing).

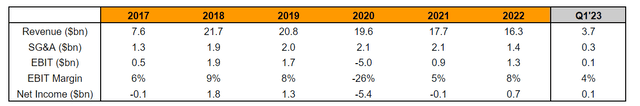

Financially, the company’s revenues peaked in 2018 (ending March) before starting to decline each year. This, however, has been driven by divestitures of above mentioned segments. Going forward, the company expects the new strategy to lead to higher margins – this is already reflected in 2022 results where the EBIT margin came at pre-pandemic levels of 8-9%. Importantly, management has noted that the revenue has been moving towards “higher value business” of GBS (as opposed to GIS). GBS made 47% of revenues in FY2022 compared to 42% in FY2019. From a cost perspective, the company has managed to significantly cut SG&A – $1.4bn in FY2022 compared to historical average of ~$2bn. These facts suggest that while macroeconomic tailwinds are likely to suppress the company’s operating performance in the near-term, DXC is well-positioned to benefit from strategic transformation efforts given sticky customer relationships.

Note: 2020 EBIT has been negatively impacted by $6.8m in goodwill impairment losses.

Baring Private Equity Asia

Baring Private Equity Asia (BPEA) – one of the rumored buyers – is a private equity firm with investments across Asia. BPEA seems to be a credible firm with a portfolio of 45 companies (10 holdings in technology, enterprise software and related industries) and fee paying AUM of $21bn. BPEA has completed several international acquisitions recently, including IGT Solutions (May’22, bought from an affiliate of Apollo), PI Advanced Materials (Jun’22) and Virtusa (Feb’21). The company is regarded as a top-3 private markets investment manager in Asia by AUM. It is worth noting here that in Mar’22 BPEA agreed to be bought out by the Sweden-based investment company EQT Partners for $7.5bn. The merger is currently ongoing and is expected to close by year-end.

Conclusion

At current prices, DXC presents an interesting investment opportunity with a large 55% upside. Given the company’s undervaluation relative to peers, a financial buyer might acquire DXC at a significant premium to current prices. Despite the ongoing technology stock and broader market sell-off, in my view risk/reward is favorable here, suggesting that investors should consider DXC as a position in their portfolios.

Be the first to comment