NoDerog

Thesis

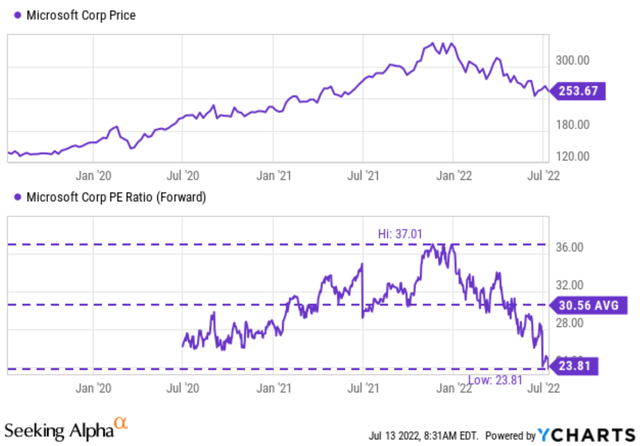

Microsoft (NASDAQ:MSFT) investors are anxiously waiting for its next earnings report for 2022 Q4 scheduled on July 26, 2022. The stock has lost almost 25% of its stock price YTD and about 30% from its all-time peak of $350 as you can see from the top panel of the following chart. Combined with earnings growth, such price correction has indeed brought the valuation to an attractive level unseen in several years. As shown in the bottom panel of the chart, its FW PE now hovers around 23.8x. It is the lowest level since July 2020 and more than 1/3 lower than its peak level of 37x.

However, if you are tempted to do some bottom fishing here, this article will show a few reasons that you should not pull the trigger just yet. First, the valuation is attractive, but not THAT attractive. Second, we expect extreme volatilities ahead, especially during the earnings report, both because of the overall market sentiment and also issues specific to its business fundamentals. These issues include the unfolding signals for a recession, global PC shipment decline, global supply chain disruptions, and the uncertainties associated with its Activision Blizzard acquisition, et al.

And the remainder of the article will elaborate on these issues.

Valuation is not that attractive

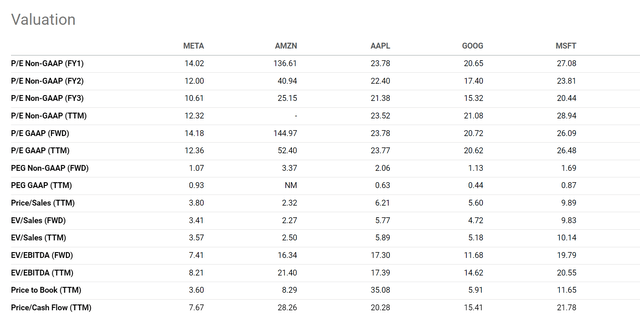

As mentioned above, its current valuation is certainly attractive compared to its own historical record. However, once we broaden the view, it is not that attractive. The next chart compares its valuation against the rest of the FAAMG group. As you can see, its FY1 PE is actually the most expensive one among this pack with the exception of Amazon (AMZN). And in terms of topline metrics, its price-to-sales ratio is not only also the most expensive one but also at a substantial premium relative to the others.

To get a closer view, we will single out the comparison against Apple (AAPL) here. MSFT’s 27.1x FY1 PE is about 14% higher than AAPL, and its price-to-sales multiple of 9.9x is about 60% higher than AAPL. Yet, as we have argued in our earlier writings, AAPL’s profitability is actually far superior to MSFT. A Fama-French analysis shows that MSFT profitability factor is around (slightly above) the 25% percentile of all the companies, but AAPL is far above the top 10% percentile.

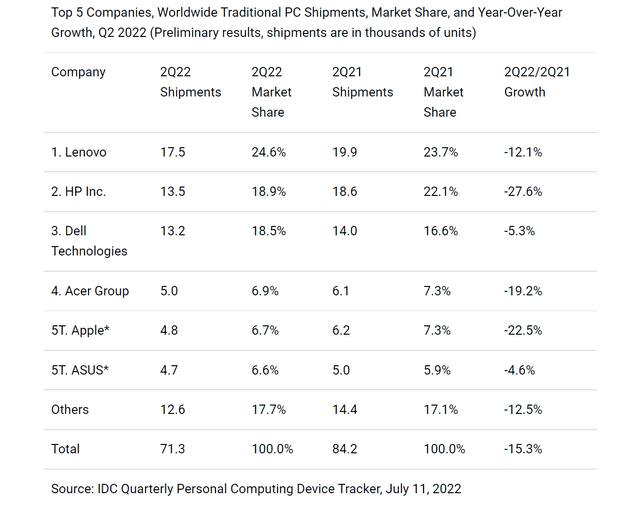

PC shipment decline and logistic digestion

Another issue to pay attention to during the Q4 earnings is the PC shipment, which directly impacts several of MSFT products such as its Windows and Office software installations. According to the International Data Corporation’s latest report:

Worldwide PC shipments have declined 15.3% year-over-year to 71.3M units in Q2 2022. The decline is recorded worse than expected as supply and logistics further deteriorated due to the lockdowns in China and persistent macroeconomic headwinds.

As you can see from the following chart provided in the report, all the top 6 companies reported double-digit decline except Dell and ASUS.

International Data Corporation

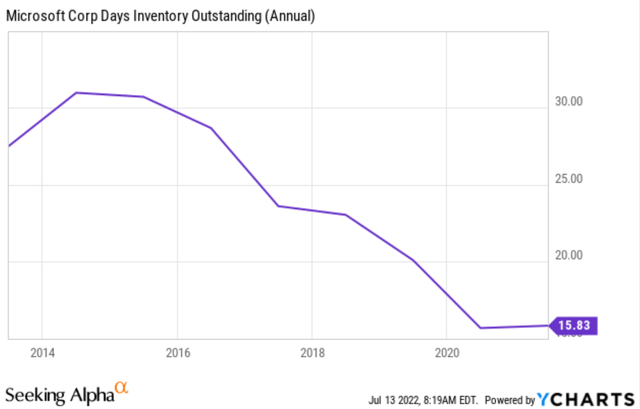

At the same time, global supply chain disruptions may persist longer and impact MSFT’s own shipment. It is true that MSFT is largely a software company and is better shielded from many of the supply chain issues. Its Home and Office Software sales account for about 37% of the total sales and Web-Based Data and Services another 11%. But it does have a considerable hardware segment too. Its Electronic Gaming and Entertainment Electronics accounted for about 9.1% of last year’s sales. And as you can see from the following chart, the inventory is at a record low of 15.8 days of inventory outstanding. A lower inventory can be a good sign of efficiency. However, too low of an inventory can mean lost sales – something I have experienced personally with MSFT and Dell in the past a few months more than once. I would pay special attention to management’s update on the impact of PC shipment and logistics chain issues during the earnings report.

Final thoughts and other risks

You have good reasons to be allured to MSFT shares here. It’s undoubtedly a superb business in the long term, and its valuation bubble has largely deflated already. However, its valuation is not that attractive when compared to other good stocks, especially when adjusted for profitability.

Furthermore, besides the PC shipment and logistic chain issues mentioned above, I would also pay special attention to management’s update on the following issues:

The Activision Blizzard acquisition. The pending acquisition of Activision Blizzard for $68.7 billion is the largest acquisition in MSFT’s history. If it is approved, it will definitely be a positive addition for MSFT. It provides excellent synergies with its existing gaming segment and will augment its growing metaverse strategy. However, there are considerable uncertainties to its approval. The U.S. federal trade commission will have to review it very carefully given the magnitude and the potential impact on competition. Outside of the U.S., the U.K.’s Competition and Markets Authority had also opened an inquiry into the acquisition to evaluate its impacts on competition.

Foreign exchange rate impact. As a global business, MSFT’s earnings are also sensitive to foreign exchange rates. According to a Piper Sandler analysis, 57% of incremental growth came from outside the U.S. last year. As the U.S. Dollar strengthens against the Euro and Yen to a 20-year peak, MSFT had to cut its revenue and earnings outlook for the FY Q4 quarter and part of the reason is the foreign exchange rate.

Be the first to comment