lcva2

Thesis

Going into FY 2023 Q1 reporting, I was cautious on Microsoft (NASDAQ:MSFT). And apparently, my prudence was justified – given that MSFT stock lost as much as 8% in after hours trading, pricing in a cautious outlook on cloud computing.

Although Microsoft managed to beat analyst consensus with regards to both revenue and earnings, investors were disappointed to learn about a worse than expected outlook for Azure cloud computing. Moreover, Microsoft is negatively impacted by slowing ad demand (LinkedIn, Bing Search / News), as well as a rapidly deteriorating environment for PC sales. It is as if the bull thesis for Microsoft is increasingly standing on shaky legs.

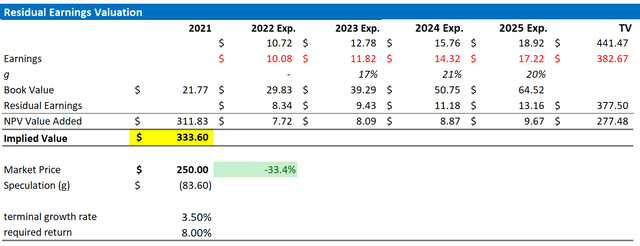

As a function of a depressed short/-medium term outlook, I continue to believe that Microsoft stock is a ‘Hold’, although the long-term outlook remains positive. Adjusting my residual earnings model for MSFT, I lower the target price to $333.60/share, versus $368.64/share prior.

Microsoft’s FY 2023 Q1 Results

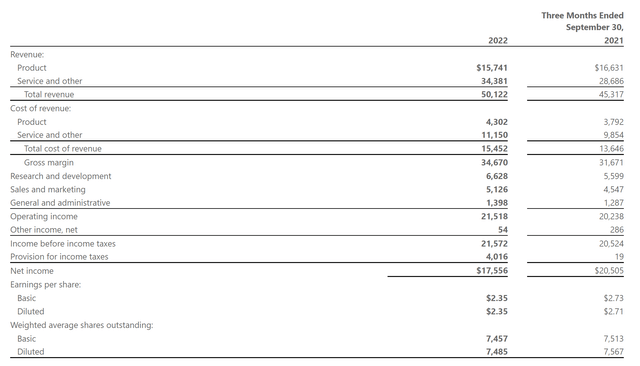

During the September quarter, Microsoft generated total consolidated revenues of about $50.1 billion, which implies a year over year growth of 11%. Analysts have estimated sales to be about $500 million lower, at $49.6 billion. Operating income increased at only half the pace of sales expansion: growing 5% year over year to $21.5 billion. Net income for the period came in at $17.6 billion, which translates to $2.35 a share (analyst consensus expected $2.29/share, according to data compiled by Bloomberg)

Microsoft CEO Satya Nadella commented:

In a world facing increasing headwinds, digital technology is the ultimate tailwind …

… In this environment, we’re focused on helping our customers do more with less, while investing in secular growth areas and managing our cost structure in a disciplined way.

And CFO Amy Hood added:

… We continue to see healthy demand across our commercial businesses including another quarter of solid bookings as we deliver compelling value for customers.

Simply looking at Microsoft’s Q1 FY 2023, an analyst might fail to see the negativity – the quarter delivered a solid consensus beat with regards to both revenue and EPS. But the key insight that I am focusing on is an unexpected weakness in Microsoft’s cloud computing business.

Outlook Disappoints

Although Azure sales increased by 42% year over year in the September quarter, Amy Hood commented that the growth will slow to about 37% yoy in the December quarter. At the same time, profit margins are compressing due to two key arguments. First, Microsoft suffers from a strong dollar – as the company is selling globally (weakening currencies) but paying most of the expenses in US dollar (strengthening currency). Second, rising energy prices will likely add $800 million of incremental higher costs – energy to power data centers, etc.

At the same time, Microsoft is fighting against a sharply slowing demand in personal computing products/services. Notably, according to research by Gartner, PC shipments fell 19.5% in the September quarter 2022 versus the September quarter 2021. Microsoft management said:

In our consumer business, materially weaker PC demand from September will continue, and impact both Windows OEM and Surface device results even as the Windows installed base and usage grows

Moreover, Microsoft is also challenged by a weakening advertising market, given exposure to LinkedIn and Bing Search/News. This is in line with what we have heard from both Snap’s and Alphabet’s Q3 results.

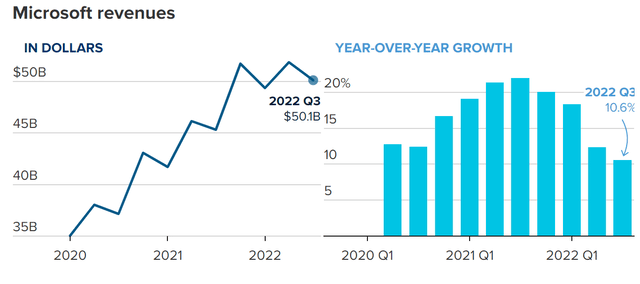

To sum up the outlook, Microsoft now expected sales for the December quarter to be between $52.35 billion and $53.36 billion, which is approximately $3.2 billion below analyst consensus estimates (mid-point reference). The graph below should highlight clearly that Microsoft’s growth is slowing sharply.

Adjusting Target Price – Down

Following a weaker outlook for Microsoft, I adjust my residual earnings model for MSFT to account for preliminary consensus EPS downgrades. Moreover, I also increase the cost of equity to 8% (versus 7.5% prior), while the terminal growth rate remains unchanged at 3.5%.

Given the EPS downgrade as highlighted below, I now calculate a fair implied share price of $333.6/share, $368.64/share prior.

Analyst Consensus Estimates; Author’s Calculation

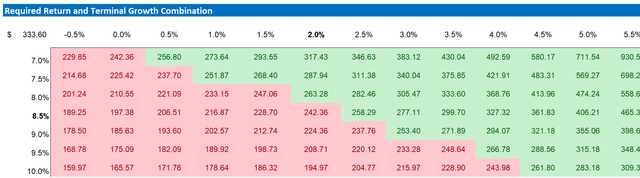

Below is also the updated sensitivity table.

Analyst Consensus Estimates; Author’s Calculation

Conclusion

I agree with Satya Nadella’s comment, that ‘in a world facing increasing headwinds, digital technology is the ultimate tailwind’. And accordingly, my long term outlook on Microsoft remains positive. Bit short-/mid- term I don’t believe we will see lots of upside surprise from MSFT, especially now that also Azure cloud computing is stumbling. And of course, investors should also note the slowing digital advertising demand, as well as a fragile PC market.

I reiterate my ‘Hold’ rating on Microsoft stock, and I downgrade my base-case target price down to $333.6/share, $368.64/share prior.

Be the first to comment