knowlesgallery

Investment Thesis

Micron (NASDAQ:MU) came out and laid out that things are not looking healthy. Customers are pulling back on spending, hence Micron is reducing its spending by 50%.

For their part investors have been quick to cling to the fact that Micron is priced at 17x trailing free cash flows. However, I declare that this is not a constructive way to think about this investment thesis.

There are just too many moving parts for me to get bullish on this name.

How Did We Get Here?

Going into what’s widely viewed as one of the leading indicators of the economy, investors were not holding much hope for this earnings result.

That being said, let’s be honest, it’s not only Micron that’s done 50% from its recent highs, but across the board.

The negativity in the air is palpable. Across many surveys, as investors, we’ve rarely been this bearish on the outlook for the market. We have all moved to one side of the boat. Nothing positive can be seen on the horizon until the Fed says it’s going to slow down its rate hikes.

Until that time, it’s a blood bath.

Guidance, What Guidance?

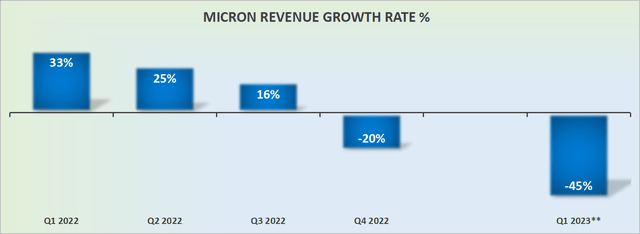

Micron guided for approximately $4.25 billion of revenue growth rates for fiscal Q1 2023. Needless to say, that’s far from satisfactory.

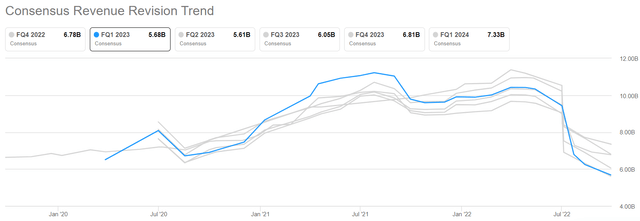

That being said, consider analysts’ revenue estimates in the graphic that follows.

MU analyst’s revenue estimates

Since last quarter, fiscal Q1 2023 estimates have been downwards revised by nearly 50%. What?

How is it possible, that one of the biggest chip companies in the world is able to see its revenue growth rates contract so significantly in just 90 days? This is not some small-cap company.

And even then, the guidance for Q4 was too conservative! Accordingly, the revenue estimate going into the earnings results was $5.7 billion, and the guidance ultimately came out at $4.3 billion at the midpoint.

At this point, why even bother to guide at all? In the past two long years, we have consistently said, every day, nearly as a daily ritual, that these are unprecedented times. Given that it’s just so difficult to forecast, particularly its Micron’s cost structure, I believe Micron is doing themselves a disservice. Why?

Because in the coming weeks, with supply chains, currency, inflation, or countless other current macro events somehow getting worse, the Street will downwards revise Micron’s guidance in any case, as they did for this quarter.

What’s Next for Micron?

For all my trepidation, let’s be honest. The after-hours reaction was been astonishingly muted. Given all the bad news, how could the stock have remained unchanged?

Obviously, that’s a silver lining. And investors have moved quickly to cling to that as a ray of good news. Investors are just dying to buy this dip.

And that’s the problem with bear markets. Stocks don’t go down in a straight line. There are corrections along the way, that trap bulls into believing that the bottom is in and that everyone can celebrate.

MU Stock Valuation – 17x Trailing Free Cash Flow

Micron is telling you, things are rough for them. They are coming out and telling investors that they need to cut back on spending on their capex by 30%. This is what they said on the call:

Our fiscal Q4 financial results were impacted by rapidly weakening consumer demand and significant customer inventory adjustments across all end markets. We are responding decisively to this weak environment, by decreasing supply growth through significant cuts to fiscal 2023 CapEx and by reducing utilization in our fabs.

There’s no ambiguity, Micron believes that now is the time to be defensive. Customers are pulling back from the market. That’s all the indication you need to know that things are just getting started.

There’s absolutely no point in looking at trailing free cash flow and saying that Micron is priced at 17x trailing free cash flows. Investors need to think ahead. And the near-term is opaque.

The Bottom Line

With everything that’s still percolating through the market right now, one part of me hopes that sooner rather than later, the market will fully capitulate so we can start to get a serious base in this market.

Because before we know it, there’s tax loss season coming for institutions in October, which will force the selling pressure to exacerbate this situation further.

The other part of me observes how just days ago, Micron announced that it was going to spend $15 billion on its new US-based Fab facility. Consequently, on the back of that announcement, Micron is inspiring investors to take a long-term view of Micron. To think further ahead than just the next quarter.

And with that in mind, investors are being asked to think that if this is the top of this memory cycle, the next memory cycle could be even stronger, driven by data and auto. Along these lines, since stocks move higher before the bottom of the cycle, investors are being made to believe that now is a really good time to start building a position here.

And as a value investor myself, I buy into that argument, with vigor. On yet the other hand, I only don’t believe that out of all the stocks that are down in 2022, Micron is where I see the most attractive risk-reward opportunity. Whatever you decide, good luck and happy investing. This will get better.

Be the first to comment