vzphotos/iStock Editorial via Getty Images

Introduction:

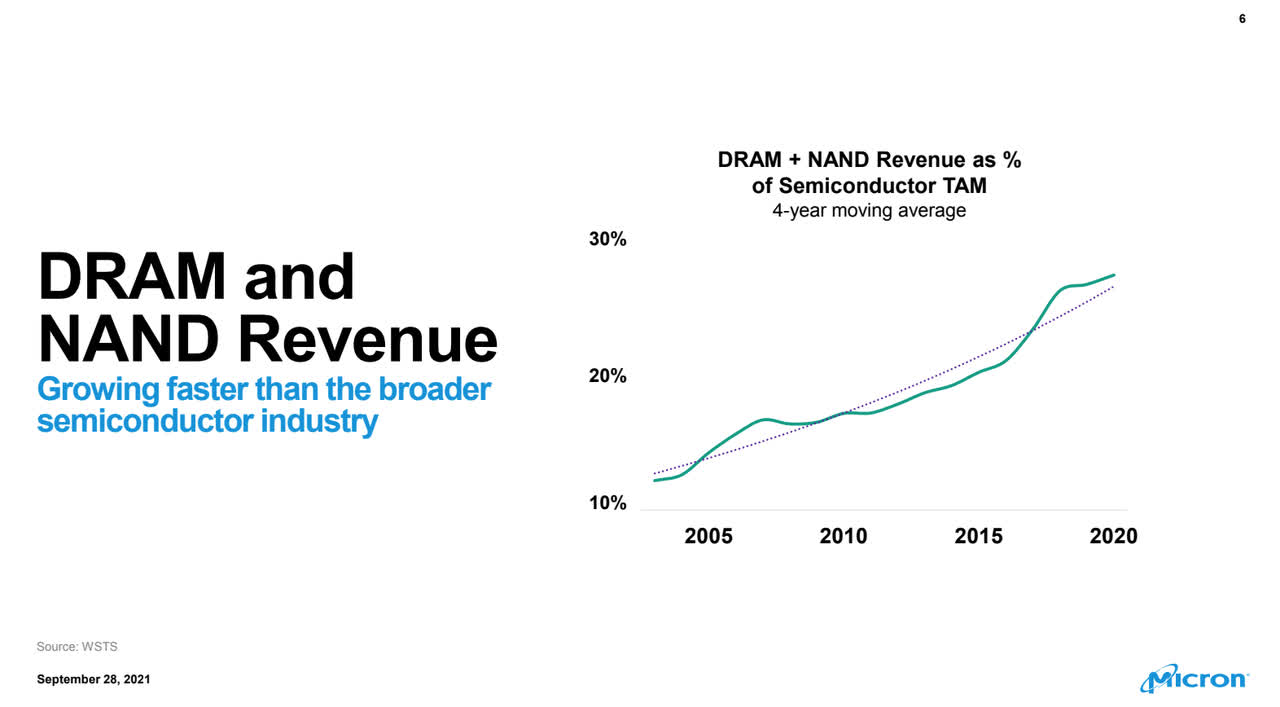

With the current market downturn, we see a golden opportunity to buy into the semiconductor industry through memory giant: Micron Technology (NASDAQ:MU). The advocacy around the strong buy on Micron is twofold and straightforward. First, Micron works on memory during an era when the memory market’s growth is a reality and necessity. The pandemic was the cure to Micron’s stagnation. It increased memory infrastructural demands to support work from home environments, and these demands are still on the rise. Global memory chip markets are forecasted to grow at a 16% CAGR by 2024. Micron will be an essential part of that growth. The second layer driving the strong buy is price. Micron is cheap for what it’s offering. The company has outpaced revenue and gross margin consensus for the last six quarters.

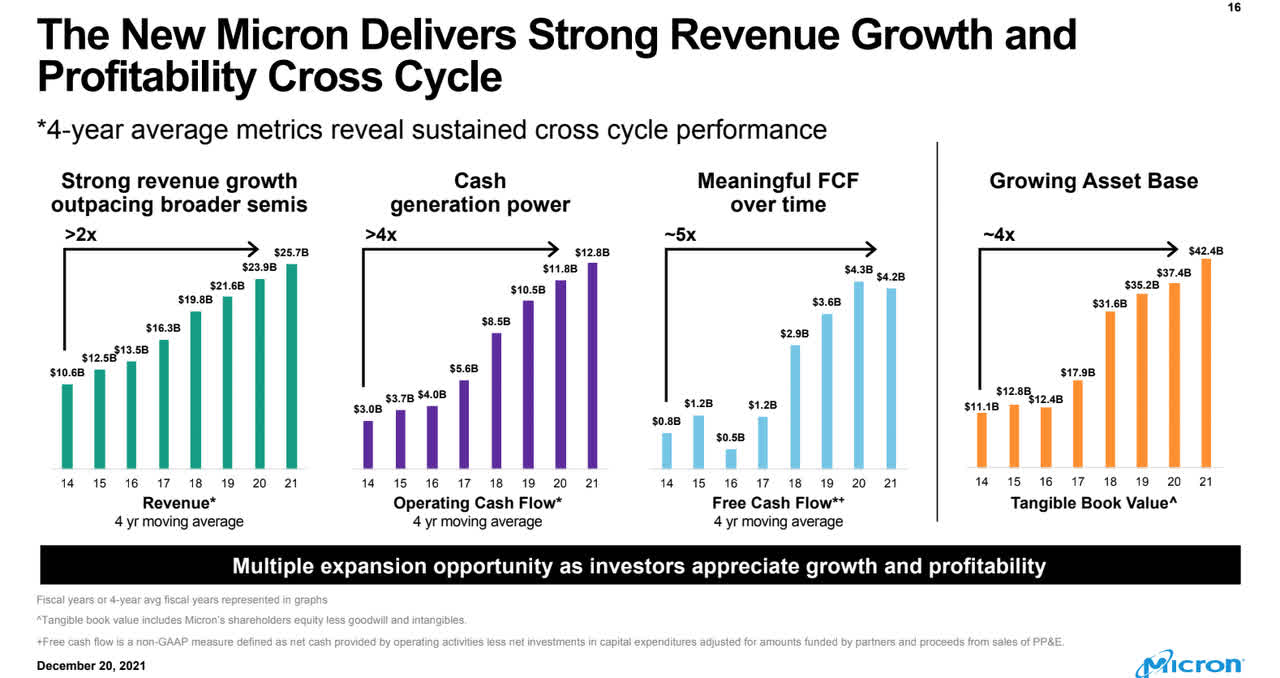

Essentially, Micron’s revenue increased from $5.8b in Q1 ’21 to $8.3b in Q2 ’21. Micron’s FY21 earnings show growth of 29% YoY. MU’s competitive edge in the industry market is not its numbers but its focus on memory that fuels its value growth and quarterly change.

Micron’s steady growth occurs within the memory market industry that splits into two major productions: volatile (usually, DRAM) and non-volatile (NAND). The former manages your data while the latter stores it. Following the same pattern, Micron’s production is divided between DRAM, making up roughly 72% of its revenue and NAND filling in the remaining 23% with seasonal fluctuations. The primary markets Micron supplies are PCs, Mobiles, Servers, and the largest on-demand Data Centers. Micron has executed a product transition to the latest technology: 1-alpha nodes in DRAM and 176 layer 3D NAND. We believe Micron’s cost reduction will outpace the industry decline driven by the transition to 1-alpha and 176-layer 3D. Micron’s product transition will make it exceedingly profitable. Now is the time to buy-in.

Micron

Micron is not the first but among the largest DRAM and NAND producers globally after Samsung (OTC:SSNLF) and SK Hynix. The catch is that Micron is a pure memory company while its competitors are not. Memory is only 25% of Samsung’s revenues, and SK Hynix focuses on memory alongside foundry businesses. Micron is committed to the memory league– it’s a major supplier, so its stock cannot dip too low without going back up, specifically with increased demand for DRAM and the expansion of Data Center end markets.

Stock Performance:

Micron’s stock has dropped 22.76% since last year. The Year-to-Date (YTD) affirms more of the same, with a drop of 24.11%. Nevertheless, the company maintained their stock price between a $65.67 low and a $98.45 high.

Micron has grown dramatically on its five-year metric by 154.77%, more than its competitors, with SK Hynix at 127.9% and Samsung Electronics at 61.83%. Micron is a pandemic-favorite stock. We saw it boost gross margin ratings over the past eight quarters. We still did witness the stock decline at the start of 2022, but it is slowly recovering.

Micron

Valuation:

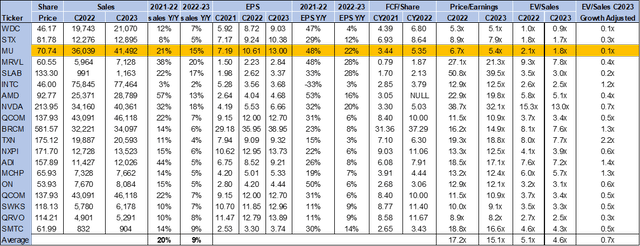

Micron is a value pick and a long-term growth pick in the semiconductor memory market. MU’s stock is currently gaining momentum at $72.66, back up from its 52-week low of $65.67. EPS estimates for 2022 stand at $10.61 and $13.00 for 2023, which are among the highest in the industry. We believe these numbers all point to Micron’s potential growth stock. MU came out of FY2021 sales with 21% and outperformed the average Y/Y sales of 20%. While MU’s FY2023 expectations are lower at 15%, they still outweigh the group average for the same period, at 9%. Despite all this, the stock is still trading exceptionally cheaply.

On the EV/Sales metric, MU is trading at 2.2x compared to its larger-cap group average of 5.5x and is forecasted to trade at a lower rate of 1.9x in C2023 with the group average of 5.0x. We believe it’s undeniable that Micron is undervalued, trading at 7.6 times forward earnings estimates. The company already outperformed Wall Street consensus on revenue and EPS. If MU continues expanding beyond what analysts have pegged for, it will surpass 2022 estimates.

Word on Wall Street:

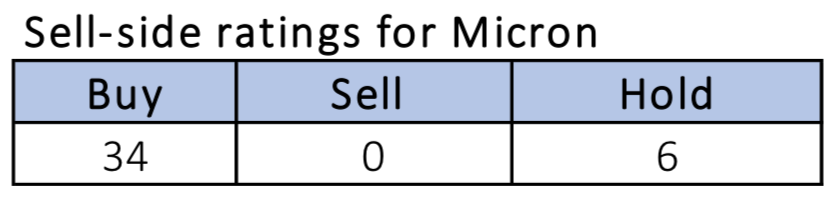

Market consensus for Micron is an obvious buy, with the buy vote making up 90% of the sell-side ratings and a 10% opting for a hold. The market is optimistic about Micron’s upside as 0 of the 40 votes pushed for a sell despite ongoing supply chain pressures.

Refinitiv Refinitiv

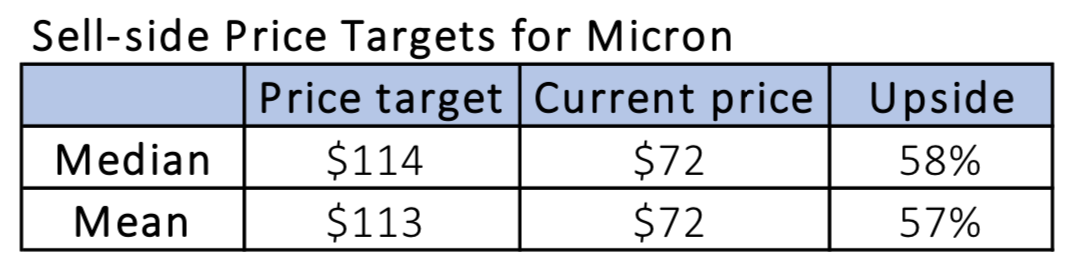

Micron’s upside is further affirmed in its sell-side price targets, with the median price target standing at $114 and the current price at $72, leaving room for a 58% upside. The mean price target stands at a similar $113 and foretells a potential 57% upside. Micron’s price targets illustrate how undervalued the stock is now, which becomes even more apparent, seeing how high the stock prices of other semi players are in comparison.

What to do with the stock:

We view Micron as a definite buy. Even though the market looks less than ideal, it has opened the cookie-cutter entry point into an expanding industry. Micron underperformed both the PHLX Semiconductor and S&P 500 indexes as the following chart shows.

YCharts

There remain concerns about the recent sell-off, but they are reassured by the fact that semiconductor stock trading occurs in the sector as a whole rather than individual stocks. The sell-off is uniform to the industry and not particular to Micron. The price drop actually works in investors’ favor. Micron’s stock is cheap due to market volatility and simultaneously incredibly undervalued in contrast to its potential. Therefore, given the risk/reward, we would be buying shares here.

Be the first to comment