SusanneB

Introduction

When last discussing Kimbell Royalty Partners (NYSE:KRP) earlier in the year, their outlook was business-as-usual during 2022 with their capital allocation strategy set to remain unchanged, as my previous article highlighted. Although, it would nevertheless be very profitable as oil and gas prices surged to heights not seen in years, which unsurprisingly, saw their unitholders benefit as their distributions followed in tandem. Interestingly, they are poised to end the year with a sizeable Permian acquisition but after digging into its terms, they are merely growing bigger, but not better for their unitholders as the benefits are counteracted by the costs, as discussed within this refreshed analysis.

Coverage Summary & Ratings

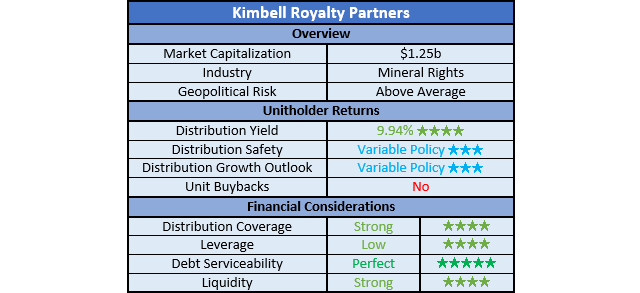

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

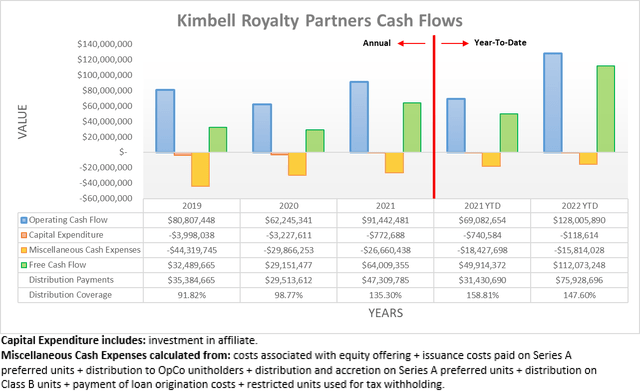

Following oil and gas prices surging during 2022 on the back of the Russia-Ukraine war, it was no surprise to see very strong cash flow performance following in tandem with their operating cash flow hitting $128m during the first nine months. Apart from easily beating any previous results during their recent history, thanks to their almost non-existent capital expenditure, they were able to translate the majority of this into free cash flow of $112.1m.

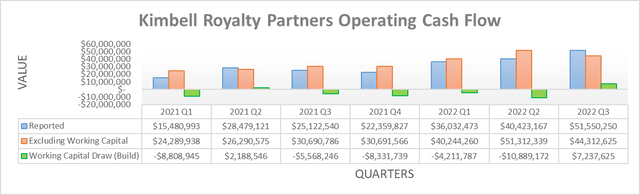

If viewed on a quarterly basis and excluding their working capital movements, their underlying operating cash flow peaked during the second quarter with a result of $51.3m, which is not surprising as the second quarter saw oil and gas prices ease over heightened recession fears. When looking ahead, no one can necessarily predict where their financial performance is heading given the inherent volatility. Although the gloomy economic outlook as central banks rapidly tighten monetary policy creates a very strong headwind, which if nothing else, at least suppresses the upside potential and thus in my eyes, sees the risks skewed towards the downside as we head towards 2023.

The bigger and far more tangible topic right now is rather their latest acquisition of more Permian assets, thereby expanding their existing exposure to this basin. When examining the terms of this acquisition and accompanying details, they are forecasting to see $48.6m of operating cash flow during 2023 at the strip prices on November 1st 2022, which should be almost entirely converted to free cash flow given their almost non-existent capital expenditure. If compared against their operating cash flow during the first nine months, which at $128m annualizes to circa $171m, this acquisition brings about an increase of around 28%.

The extent this higher cash flow performance translates into higher distributions on a per unit basis depends upon the subsequently discussed implications for their capital structure, especially because elsewhere, they are still maintaining their variable 75% payout ratio, as per the commentary from management included below. Despite not providing any per unit boost heading forwards, thankfully it ensures strong distribution coverage as they scale their distributions accordingly with the prevailing operating conditions.

“This represents a cash distribution payment to common unitholders of 75% of cash available for distribution, and the remaining 25% will be used to pay down a portion of the outstanding borrowings under Kimbell’s secured revolving credit facility.”

– Kimbell Royalty Partners Q3 2022 Conference Call.

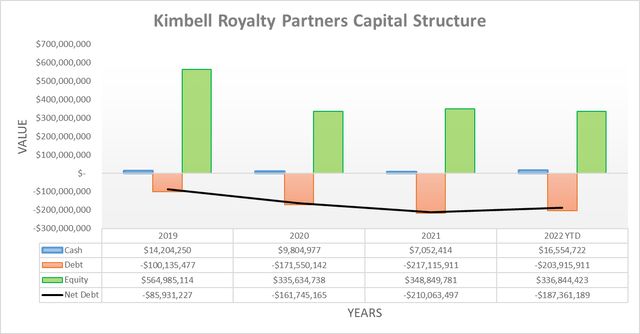

Thanks to their distributions ramping up accordingly with their free cash flow, the first nine months of 2022 only saw their net debt drop modestly to $187.4m versus its previous level of $210.1m at the end of 2021. When looking ahead, their latest acquisition will naturally not only have implications for their cash flow performance but also their capital structure. When reviewing the previously linked terms, they state that $140m is funded via directly issuing 7.3m new common units to the previous owner, Hatch Royalty. As a result, this leaves $150m to be funded via cash, although given their cash balance ended the third quarter of 2022 at only $16.6m, they are forced to fund $106.5m from a public equity issuance of 6m new common units, thereby leaving the residual $43.5m to be funded via debt through their credit facility.

If wrapped together, their outstanding unit count will increase by 13,300,000, which represents a very large increase of 23.19% compared to their latest outstanding unit count of 57,331,833 and thus disappointingly, it is only slightly less than the circa 28% boost to their operating cash flow. This means that on a per unit basis, the benefit to unitholders is minimal and possibly non-existent depending on future oil and gas prices, as this small difference may be netted out. Not to mention, the interest cost of funding the additional debt will also slightly eat away at their operating cash flow, thereby further narrowing this gap. As a result, this acquisition does not materially enhance the outlook for their unitholders because they are only growing bigger in absolute terms, not necessarily on a per-unit basis.

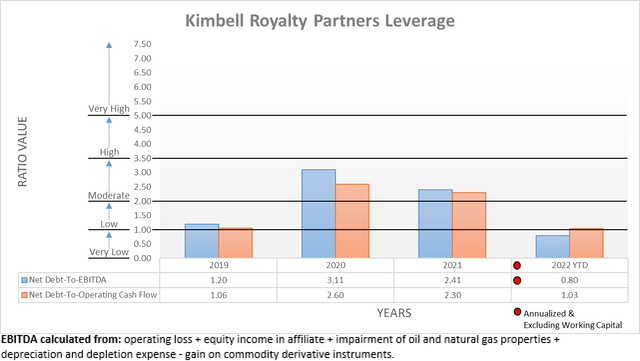

Since their leverage combines their very strong financial performance along with their modestly lower net debt, it was no surprise to see their leverage decrease during the first nine months of 2022. As a result, their net debt-to-EBITDA and net debt-to-operating cash flow are down to 0.80 and 1.03 respectively, which sees the former beneath the threshold of 1.00 for the very low territory and the latter only slightly above this point. Once carrying the additional debt for their latest acquisition, it will likely see both of these above 1.00 and thus into the low territory of between 1.01 and 2.00. If looking back at the end of 2021, these would still be less than their previous results of 2.41 and 2.30 respectively and thus, far from a concern. When looking ahead, their ability to consistently generate free cash flow and accompanying variable distribution policy will see their net debt trend lower across time, excluding any further acquisitions, which in turn helps keep their leverage under control, even as operating conditions vary.

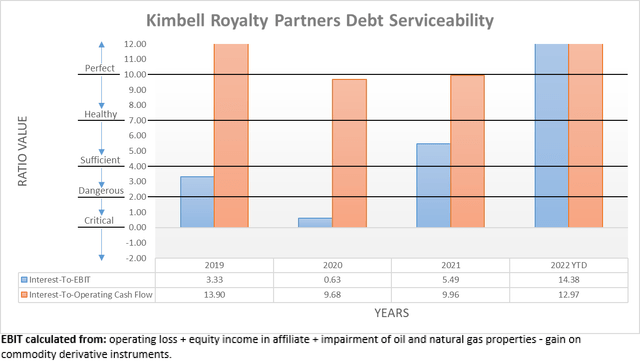

Apart from suppressing their leverage, these same driving forces also helped enhance their debt serviceability, which is becoming increasingly important to consider as interest rates climb rapidly. If comparing their interest expense against their accrual-based EBIT, their coverage is 14.38, whereas a cash-based comparison against their operating cash flow sees coverage of 12.97. Both of these are very similar and easily considered perfect, thereby meaning they can shoulder higher interest expenses without it placing too great of a burden.

Since the entirety of their debt relates to their credit facility, this aspect is particularly important because it carries a variable interest rate of SOFR plus a margin of 3.50%. Put simply, the higher the Federal Reserve lifts interest rates, the more expensive their debt becomes to service and as everyone knows, interest rates appear to only be heading higher in the foreseeable future.

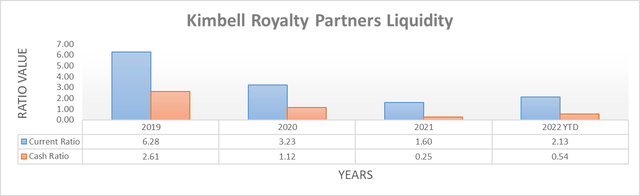

When turning to their liquidity, unsurprisingly, it too faired very well during the first nine months of 2022 with their respective current and cash ratios increasing to 2.13 and 0.54 versus their previous respective results of 1.60 and 0.25 at the end of 2021. Similar to their leverage, their consistent free cash flow and variable distributions should keep their liquidity strong going forwards, which will be particularly important as they draw upon their credit facility to fund the debt portion of their latest acquisition.

As it stood when the third quarter of 2022 ended, they had already drawn $203.9m from their credit facility, thereby leaving only $96.1m available given its $300m limit. Upon funding the $43.5m of their latest acquisition, this will drop to only $52.6m, unless their lenders increase the borrowing base to reflect their larger asset base. Even without this path, they still have ample capital to continue operating uninhibited, albeit to a narrower extent that limits their ability to safely fund further acquisitions within the coming year, until their retained 25% of free cash flow pays down their credit facility.

Conclusion

Whilst acquisitions can be a great way to pursue growth and enhance value for unitholders, in this situation, it is only growing the partnership larger in absolute terms, as the additional operating cash flow is offset by the accompanying higher outstanding unit count. This is not necessarily negative but at the same time, it does not necessarily provide any material benefits to their unitholders. Seeing as their unit price is now not too far away from their all-time highs during 2018, I now believe that downgrading to a hold rating is appropriate in light of the gloomy economic outlook that sees risks skewed to the downside.

Notes: Unless specified otherwise, all figures in this article were taken from Kimbell Royalty Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment