Sundry Photography/iStock Editorial via Getty Images

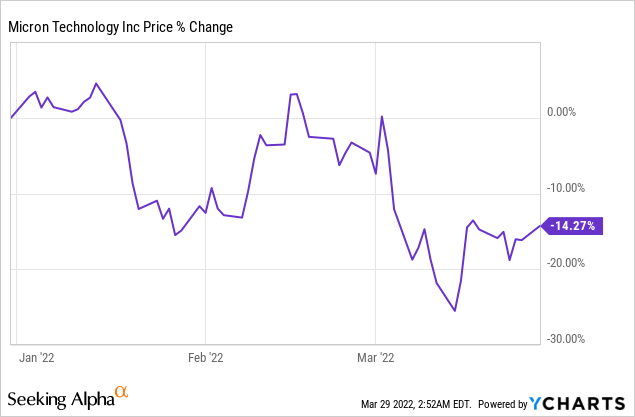

Shares of Micron Technology (NASDAQ:MU) are too cheap to ignore. With Micron dropping back to the $80 level lately, the memory chip maker has once again become massively undervalued relative to its earnings potential. FY 2022 is set to be another year of strong revenue growth and high gross margins for the firm although there are pricing risks in the DRAM market. Micron’s valuation, based off of earnings, is unreasonably low despite the risks and the stock has considerable recovery potential!

Strong business momentum in the DRAM business

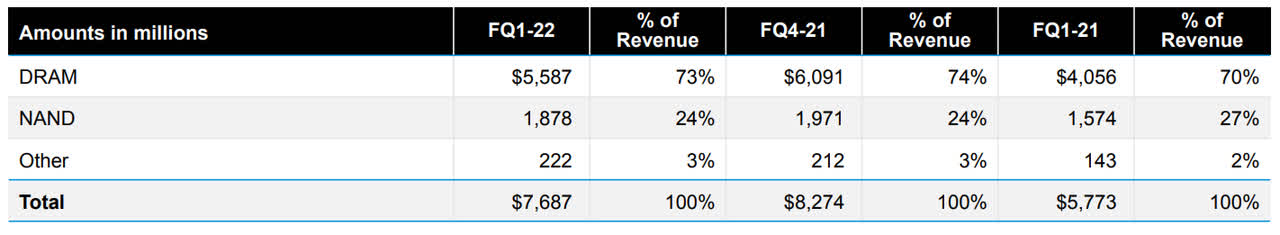

FY 2021 was a fantastic year for Micron. The memory maker saw a surge in revenues due to strong demand for the firm’s memory and storage products, especially in its DRAM segment. Micron’s revenues from DRAM products surged 37% year over year to $5.6B in the firm’s FQ1’22, in part because the DRAM market was heavily undersupplied. DRAM revenues have been supported by strengthening customer demand for Micron’s 1-alpha and 1z DRAM nodes and growing average selling prices throughout the last year. In total, DRAM revenues generated about 73% of revenues for Micron in the last quarter while NAND products generated about 24% of revenues in FQ1-22. NAND revenues are also seeing momentum, especially regarding Micron’s new 176-layer NAND which represents the majority of the firm’s NAND bit production now. NAND-related revenues surged 19% year over year to $1.9B in FQ1-22.

Micron

Strong outlook in place

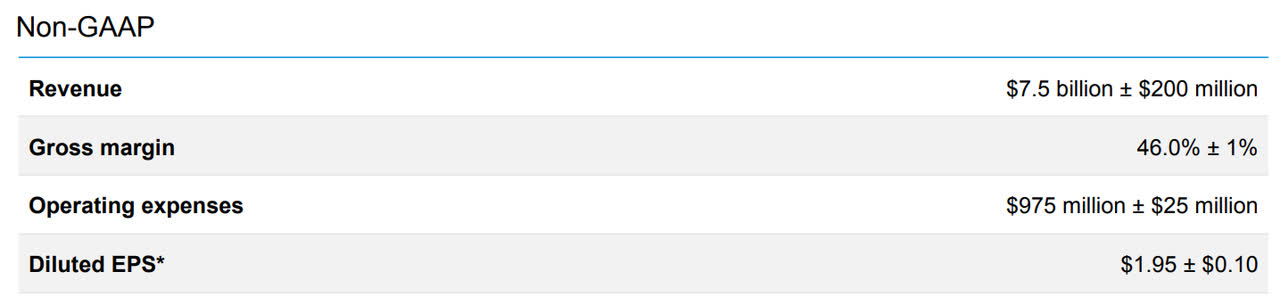

Micron has submitted a strong outlook for FQ2-22: The memory chip maker expects to generate $7.5B in revenues +/- $200M in FQ2-22. The forecast implies a 3% quarter over quarter drop in revenues, but revenues are still going to be materially above last year’s level. The company also guided for strong gross margins of at least 45% in the firm’s second fiscal quarter, indicating that Micron expects to be able to defend elevated gross margin levels at least in the first half of the new fiscal year.

Micron

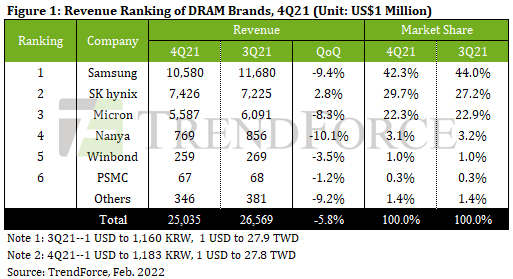

Micron is the third-largest DRAM brand in the world, after Samsung and SK Hynix, and has a large market share. Micron has a market share of approximately 23%, based on projections made by Trendforce, a research service with a focus on the chip industry. Growing demand and higher prices for DRAM products immediately benefit Micron.

Trendforce

Risks with Micron

Micron may face headwinds in the DRAM business regarding pricing. Strong demand for storage and memory products have led to an upswing in average selling prices in FY 2021, especially in the DRAM market which has been chronically undersupplied in FY 2021. But DRAM prices have started to drop towards the end of last year and more pricing pressure could build going forward. Lower average selling prices for DRAM products obviously indicate top line and gross margin risks for Micron, although the memory chip maker still expects to generate record revenues in FY 2022. Micron’s DRAM average selling prices decreased in the lower-single digit range in the last quarter while NAND average selling prices decreased in the mid-single digit range. Micron does not make forecasts about expected average selling prices, but forecasts for FQ1-22, made by Trendforce again, indicate additional pricing pressures in the DRAM market due to a seasonal demand downturn.

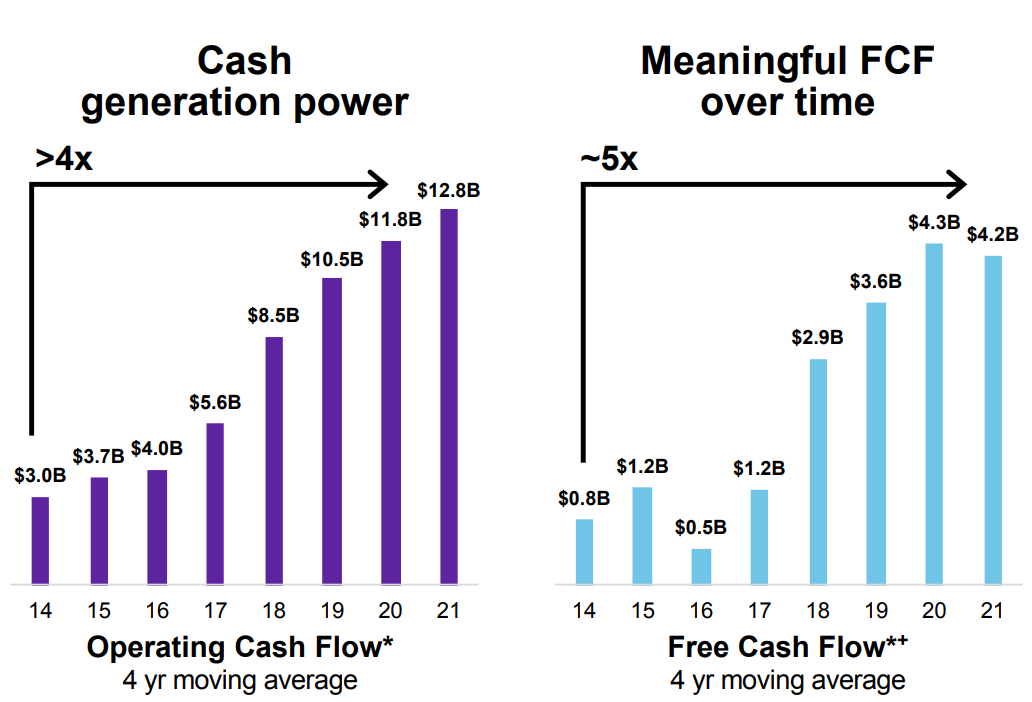

Strong free cash flow ramp

In the period from FY 2017 to FQ1-22, Micron earned approximately $21B in free cash flow and free cash flow conversion has greatly improved. The biggest contributing factor for Micron’s strong commercial performance was strengthening demand for the firm’s products during the current bull market in the chip industry. Micron generated $4.2B in free cash flow in FY 2021 and, I believe, could earn about $4.0B in free cash flow in FY 2022.

Micron

Extreme undervaluation

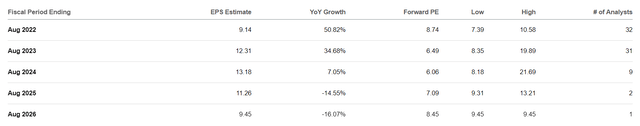

Micron’s shares remain deeply undervalued based on earnings. Micron is expected to see 51% EPS growth in FY 2022 and another 35% on top of that in FY 2023. Based off of $12.3 in FY 2023 EPS, shares of Micron trade for only 6.5 X earnings. I believe the P-E ratio really is unreasonably low at this point and the risk profile for shares of Micron are heavily skewed to the upside.

Final thoughts

Although pricing pressures in the DRAM market may persist, Micron is extremely attractive as an investment. The biggest reason to consider Micron right now is that the company’s earnings potential is widely undervalued. Shares of Micron have a P-E ratio of just 6.5 X although the company is generating a ton of free cash flow and earnings each quarter. While Micron does have risks relating to lower average selling prices, especially in the dominant DRAM business, I believe the risk/reward still heavily favors an investment in the memory chip maker at this time!

Be the first to comment