Eric Bascol

Ahead of the Q2 presentation, we provided an update on the Michelin investment case. Our buy case recap was based on the following:

- Despite the ongoing challenges, we did not believe in a downward outlook revision.

- Having analyzed the company’s track record, we were confident that Michelin was able to pass through raw material inflationary pressure. This was also supported by statistical evidence.

- We deep-dived into Nokian’s Russian exit and following the fact that “the European Union has announced further sanctions against Putin’s country, which currently include a restriction on tire imports to EU countries from Russia“. We were forecasting that Michelin was able to “take advantage of the fact that Nokian won’t export anymore. This could translate into a new slice of the European tire market“.

- Michelin was trading at a compelling valuation supported also by a juicy dividend yield (4% at that time).

So, what happened?

Before analyzing Michelin’s (OTCPK:MGDDD) results that last week presented its half-year report to the investor community, let’s check our above points.

- Michelin’s forecast was maintained (Fig 1)

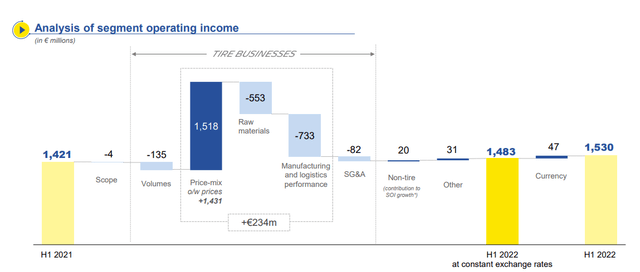

- Looking at Fig 2, it is evident that the company had a positive pricing delta

- Regarding point 3, it is more complicated to show pieces of evidence (due to the country’s sales mix), however, volumes were down by 2.1% in comparison to the first half of 2021, while new car and commercial vehicle registrations are down -14% and -20.3% respectively. This is supportive of the fact that Michelin is gaining market share in Europe (Fig 3).

Fig 1 (Michelin’s guidance)

Fig 2 (Michelin’s EBIT)

Fig 3 (Volume evolution)

Q2 Results

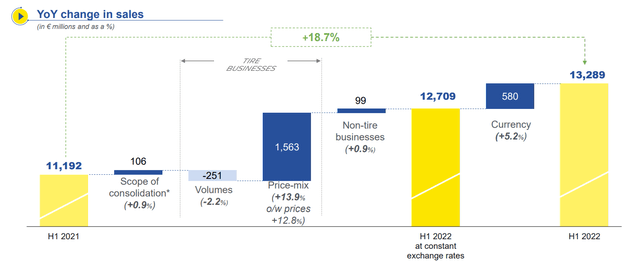

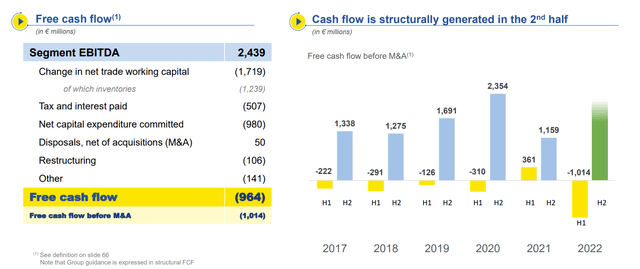

Compared to the first half of 2021, Michelin recorded 18.7% in top-line sales growth for a total amount of €13.2 billion. As we already mentioned, this result was driven by a price increase since tire volumes fell by 2.2%. Looking at the sector level, Michelin grew in all three tire sectors: automotive, truck and specialty tires up by 11.9%, 9.1% and 13.5%, respectively. Non-tire turnover also delivered good results, however, the segment contributed to just a single-digit percentage of the company’s total sales. Going down to the P&L, the Group’s operating profit reached €1.5 billion delivering a plus 7.7% compared to the past year’s semester. However, the operating margin was slightly affected and fell from 12.7% to 11.5%. Michelin’s net income stood at €843 million, down by 18.4%. This negative outcome was due to the Russia write-off for a total amount of €202 million. This was below our internal estimate. In our previous publication, we were forecasting an asset exposure at “around €250 million”. For our readers not familiar with the company, do not worry about the negative cash flow. This is the usual seasonality (that the company knew before COVID-19) and the annual cash flow is usually restored in the second half of the year.

Michelin cash flow

Conclusion and Valuation

In a challenging period and despite the fact that Michelin has revised its market forecast downward on tire volumes, the company is reaffirming its earnings for the full year. During the analyst call, the CEO is aiming to further reduce tire dependency and we believe this is going to be a key upside in the future.

We have not forgotten our point 4, i.e. the valuation. Thanks to the strong half-year result and a minor impact from the Russia write-off, we continue to value Michelin at a multiple of 5.5 EV/EBITDA in line with its historical average (it’s currently trading at an EV/EBITDA of 4.36x). Thus, we reaffirm our valuation at a price target of €34 per share. The next catalyst is scheduled for the 25th of October.

Be the first to comment