ffooter

MGM Resorts (NYSE:MGM) is going through a rapid business recovery after casinos had to close during the pandemic. Las Vegas is thriving of excitement, fueling MGM’s EBITDAR. Two upcoming catalysts are not priced in, as the stock is extremely cheap compared to competitors. More so, the company has been buying back 8% of the shares outstanding in Q2. Ultimately, free cash flow has exceeded 2019 highs to support shareholder returns and reinvestments.

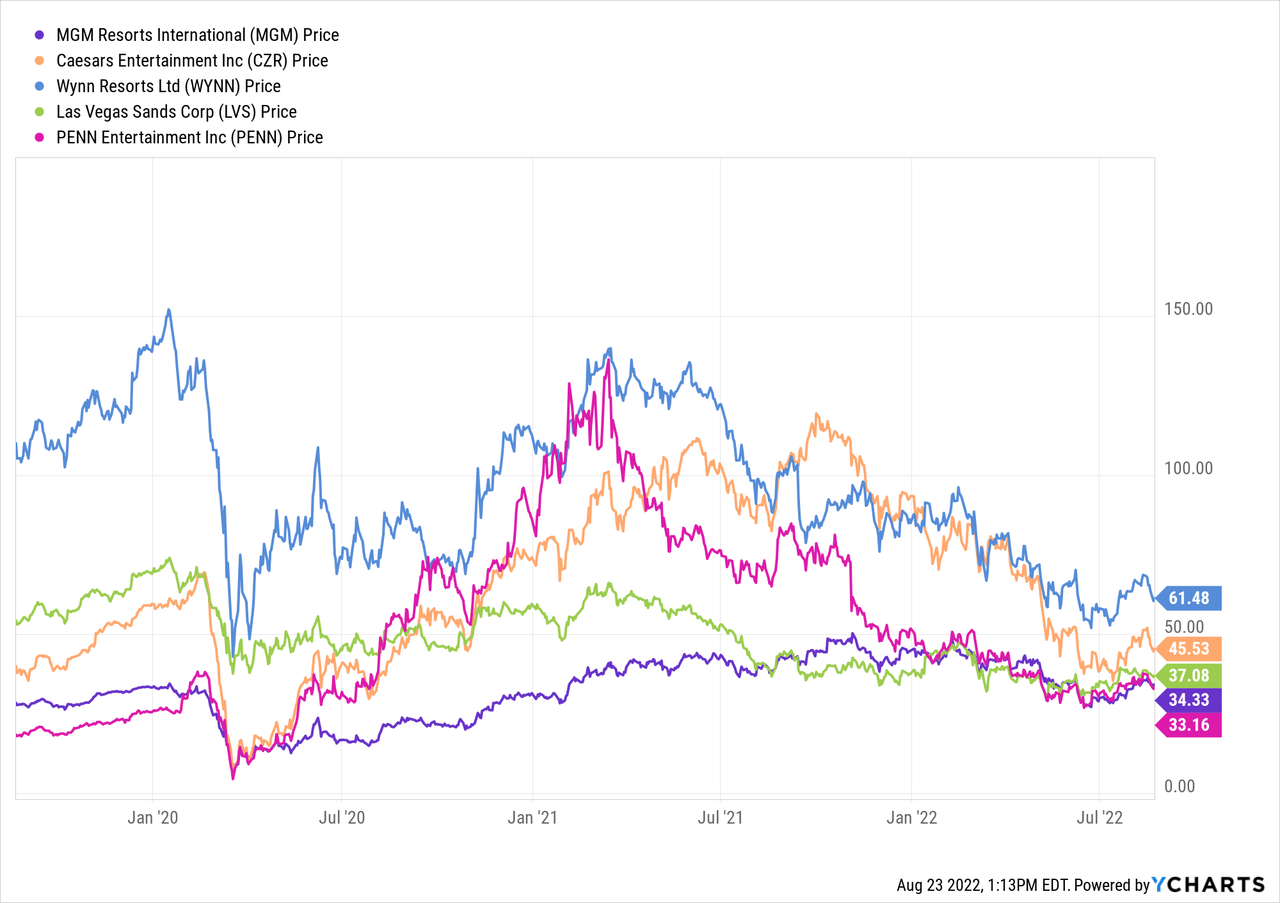

Price action since COVID-19 pandemic

By now, we all know the kind of havoc that the COVID-19 pandemic caused. The whole hospitality industry got condemned; however, one escaped almost unscathed. Although MGM Resorts is still down more than 30% compared to the 52-week high, the stock held up better than its peers. Now is the time to research the stock and figure out what you want to do.

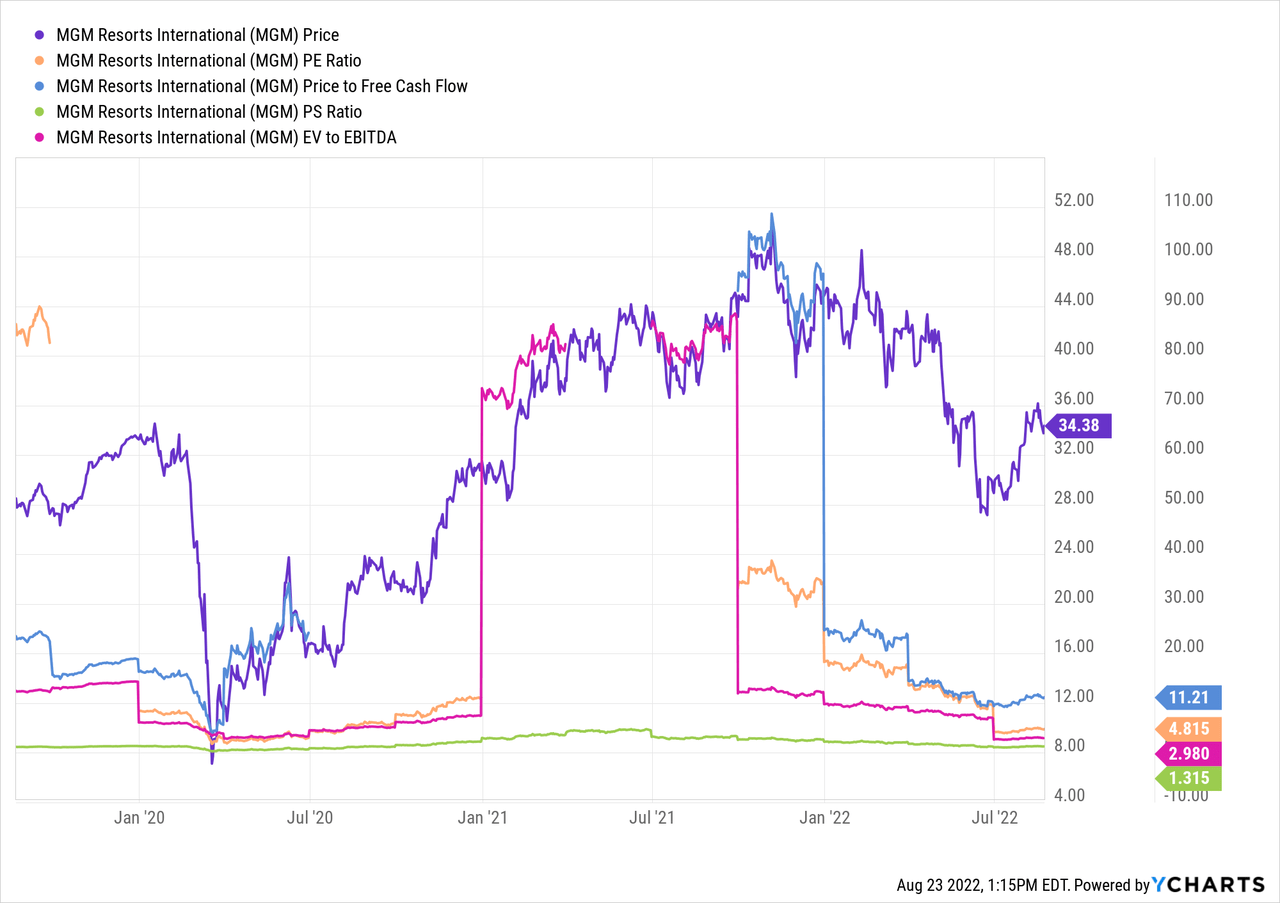

At first sight, it is clear that the company had a hard time on the profitability side of the business as casinos had to close all over the world. Nonetheless, the business recovered and the hospitality industry is now flooded with people that want some excitement in life. Based on the price-to-earnings, price-to-free cash flow and EV-to-EBITDA metrics, it is clear that the business is currently priced less expensive compared to pre-pandemic levels.

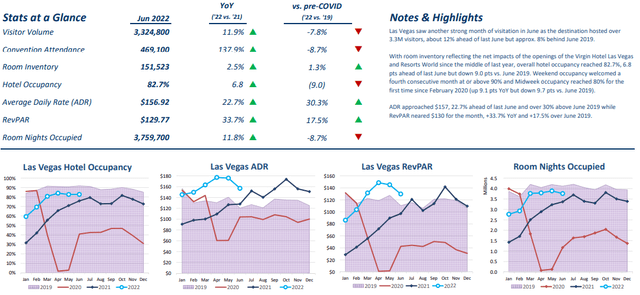

Las Vegas is back

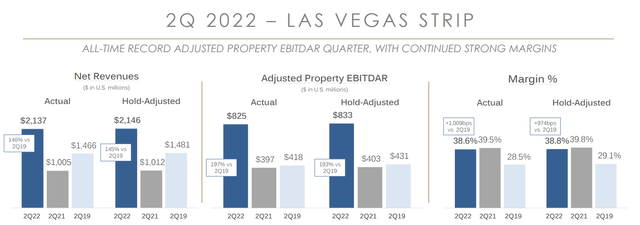

MGM Resorts is flourishing in Las Vegas, resulting into revenue of $2.1 billion and all-time high EBITDAR during Q2. These results include the revenue MGM received from the new acquisitions of “The Cosmopolitan” and “Aria“. Anyhow, same-store revenue also increased by almost 60% compared to the same quarter last year.

Las Vegas Convention and Visitors Authority’s research made a great overview of the current tourism in Las Vegas. On a year-over-year basis, you can clearly see that business is back. However, there is still room for improvement compared to pre-pandemic levels. Visitor volume, convention attendance and hotel occupancy are still lacking compared to 2019. As a result, there could be more upside on MGM’s revenue as visitor volume recovers alongside stable margins.

Las Vegas Convention and Visitors Authority

Two positive catalysts underway

China relief

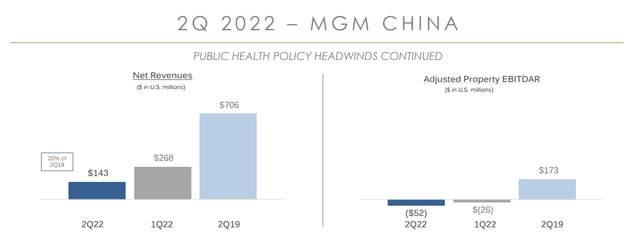

MGM’s China segment has been lagging the company’s overall performance. Even though the company reached all-time high EBITDAR in the Las Vegas strip, the EBITDAR of the China segment resulted into a loss of $52 million. A relief on the public health policy in China could revamp revenue and further improve the fundamentals of the company.

A JPMorgan analyst expects meaningful business to return in Macau during the Golden Week (national holiday) in October.

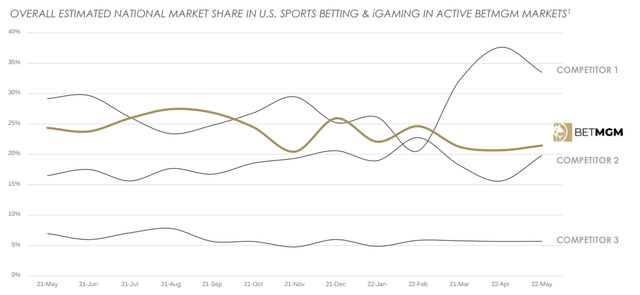

BetMGM

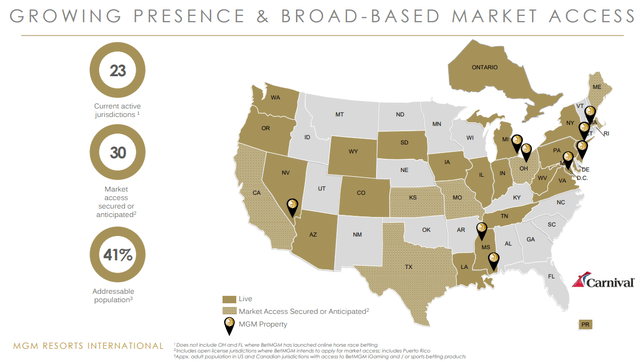

On the other hand, the firm has established a leading position on their digital platform BetMGM in U.S. sports betting and iGaming. So far, the platform is still losing money as the first priority is gaining a strong market share position and creating brand awareness in the online industry. Although this brings lot of expense to the table, BetMGM is expected to be EBITDA positive as soon as 2023.

During the Q2 earnings call, the CEO Bill Hornbuckle mentioned:

BetMGM operates now in 23 markets United States and Canada, across retail, online sports, and iGaming operations. In May, BetMGM committed 21% in share in the active markets in both U.S. sports betting and iGaming, which puts us in the number two position.

BetMGM is the clear leader iGaming and having reached 29% market share in May. And looking forward with the addition of Ohio was recently Massachusetts, as well as the potential for California, we continue to see great opportunity for expansion with BetMGM. We’re accessible to those three states has over 45 million addressable audience.

The addition of new states will stimulate short term growth. Keep an eye on the legalization of sport betting and iGaming in California and Texas. Once these states get a green light, BetMGM growth might be immense. For the end of 2023, the new platform is estimated to access 40-45 markets.

Investor Relations Q2 22 Investor Relations Q2 22

Market missing the bigger picture

In 2019, MGM China’s revenue ($2.9B) accounted for 22% of the total revenue of the business. In 2021, MGM China’s revenue ($1.2B) accounted for only 12.5% of the total revenue. In 2022, the Q1 and Q2 revenue in China has been down respectively 63% and 53% compared to 2021.

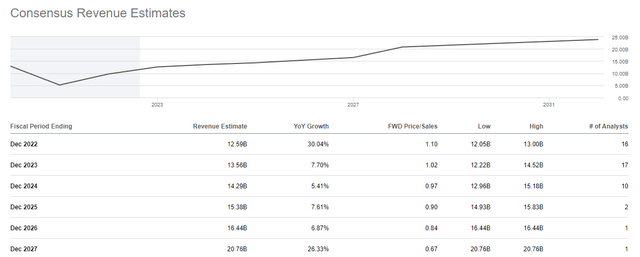

Revenue estimates for 2023 are only $1 billion higher than the 2022 estimates. The recovery of MGM China alone can fuel the $1 billion to the upside on revenue. All of this, does not include the possibility of more visitors in Las Vegas and the revenue growth of BetMGM with the addition of new markets. Therefore, it seems that the revenue estimates are a bit soft and revisions upward could happen throughout the year.

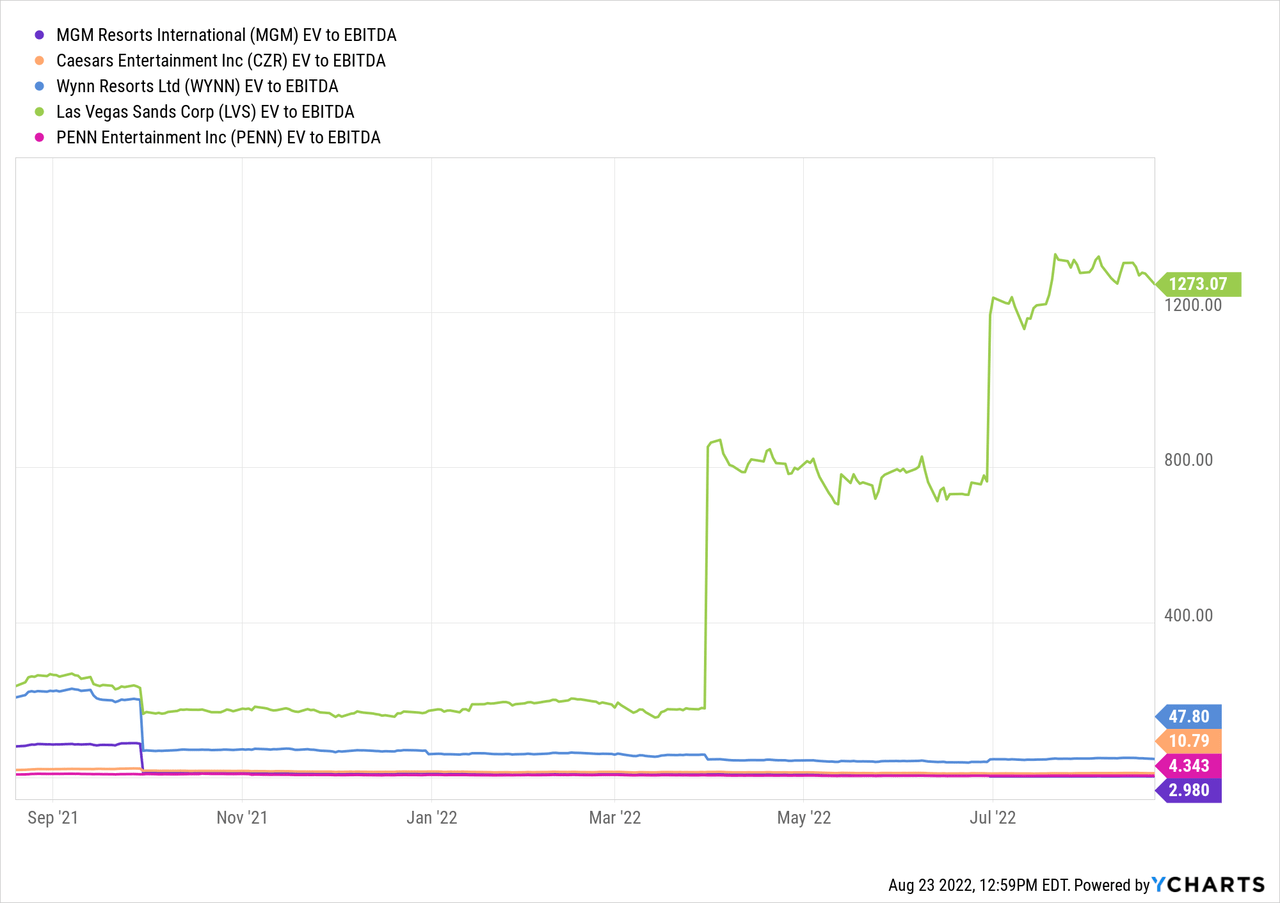

Valuation comparison

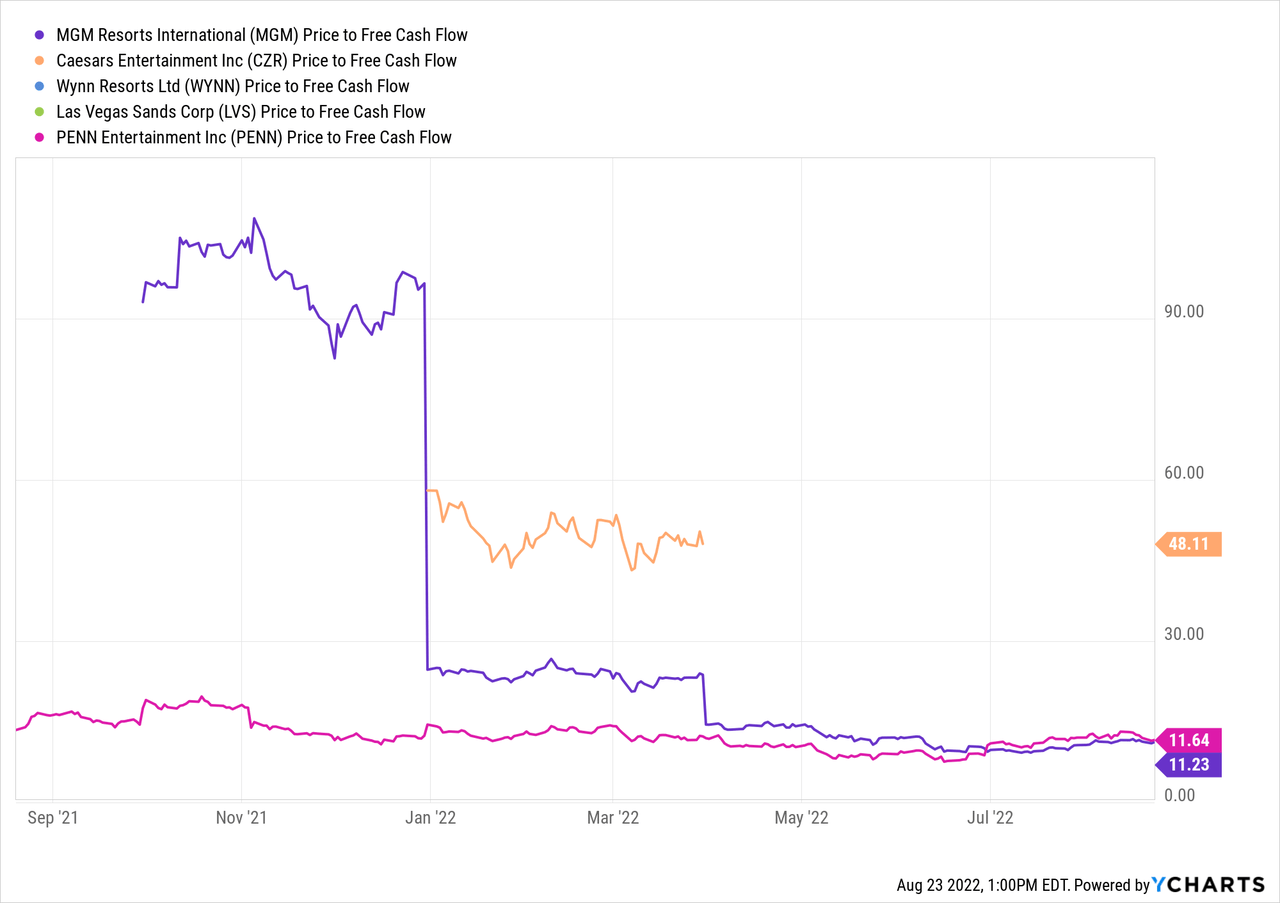

MGM Resorts is indisputably the better priced stock compared to the industry peers. At 2.98x EV-to-EBITDA, it seems like the catalysts mentioned above are not really priced in. Therefore, the current stock price might be a great entry point for long term investors.

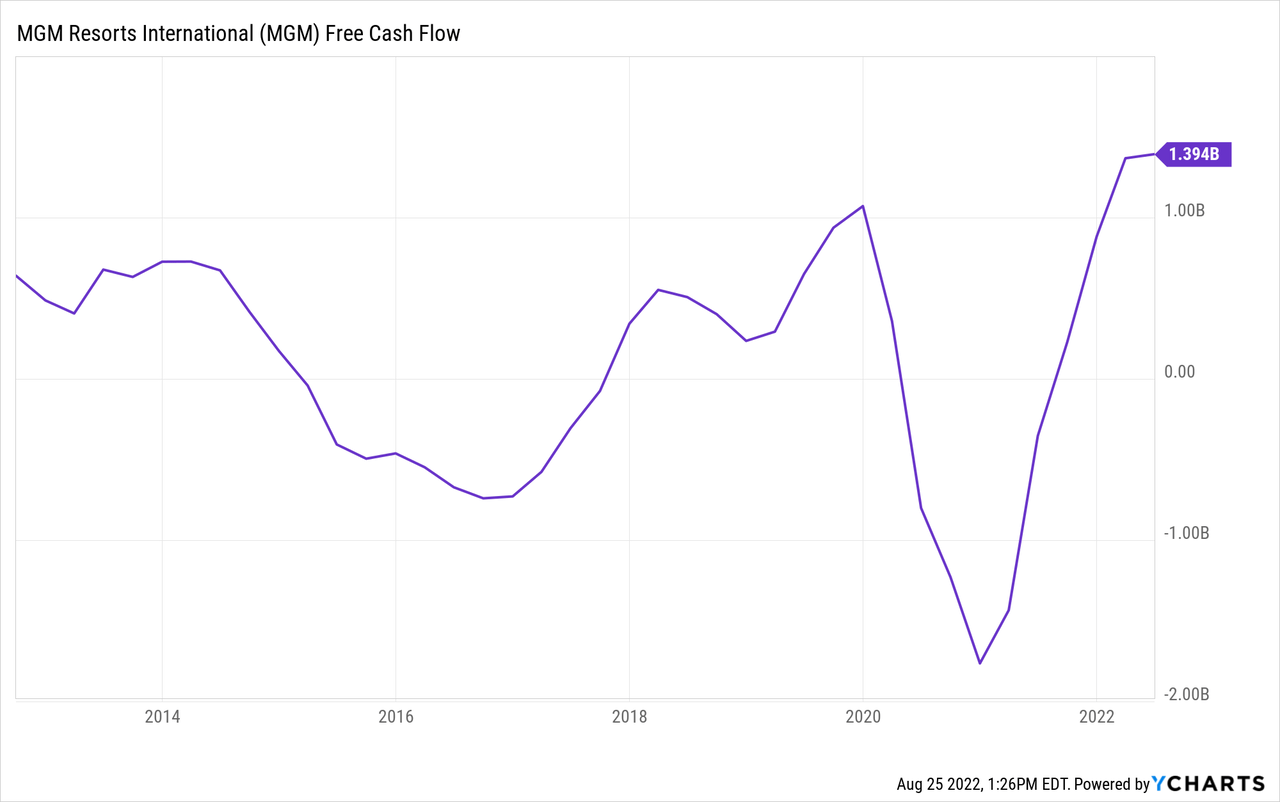

In addition, MGM’s free cash flow has been skyrocketing and flew past the 2019 high. Accordingly, the price-to-free cash flow looks very attractive. The only close competitor seems to be PENN Entertainment (PENN). Wynn Resorts (WYNN) and Las Vegas Sands Corp (LVS) are still struggling to get free cash flow positive.

Profitability permits buybacks instead of dilution

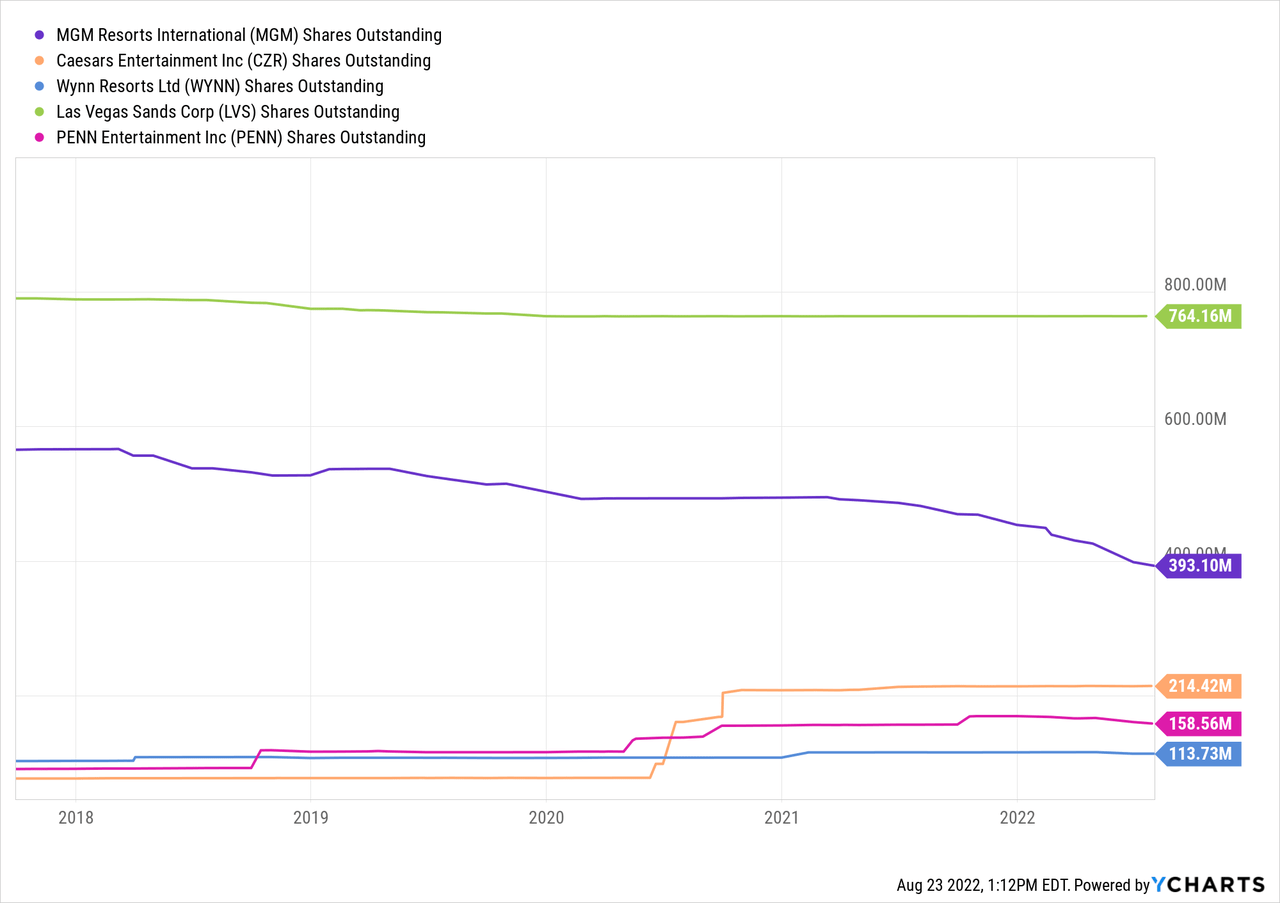

Since free cash flow is back on track, the company has room to give back to shareholders. During Q2, the company has repurchased $1.1 billion of shares or 8% of the outstanding shares at $34.42 per share. This is what makes MGM much more attractive compared to their peers. Almost all the other casino companies had to increase shares outstanding during the pandemic to continue their operations. As a result, the investors got diluted and lost value of their shares. The graph below highlights the great business performance and management execution of MGM Resorts.

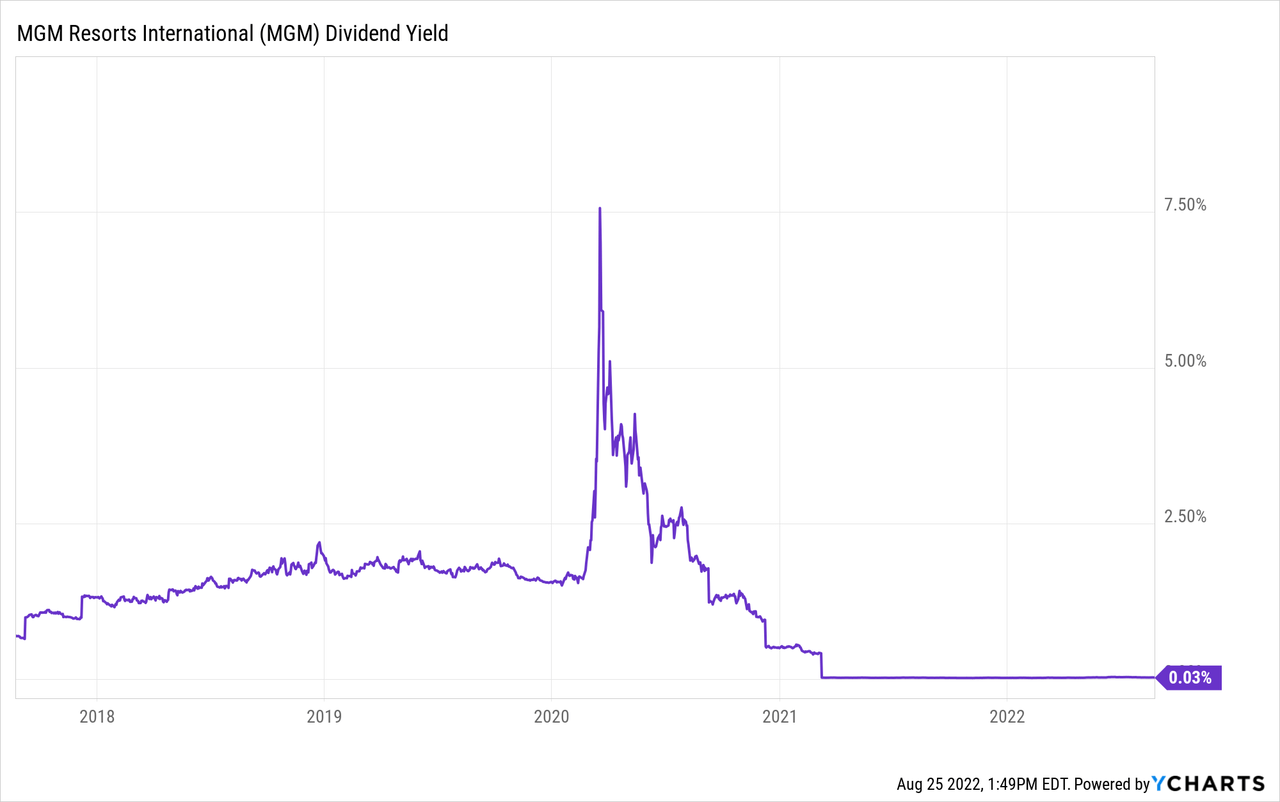

A reinstatement of the dividend could be the cherry on top of the cake. However, at the current prices the management should focus on the share buyback plan. In the future, there is a rather high chance for the normal dividend yield to come back, when buybacks are less attractive and the Macau business has recovered.

Risks

Of course, every investment has risks and we must consider them to a great extent to become a better investor.

Although the chances are pretty low, a new pandemic or outbreak can happen anytime. I say the chances are pretty low, because the world is ready more than ever before. The infrastructure, equipment and the amount of knowledge has only improved and therefore the risk of complete lockdowns has decreased. The future of the business in China is in the hands of the government and how long they will keep the strict Covid-19 measures. Nevertheless, investors should not worry too much in the long term as these measures are not permanent.

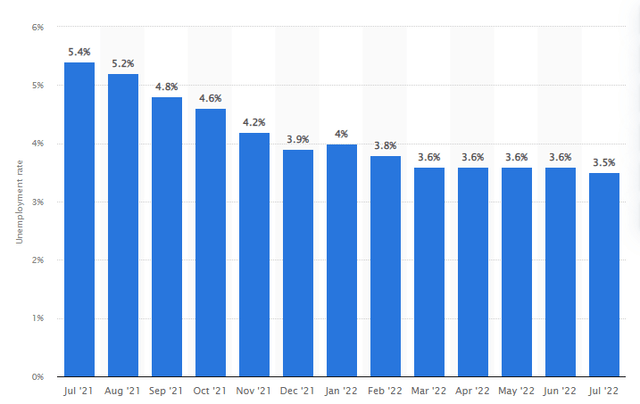

The beginning of a recession is another risk for the casino industry. Most casino visitors gamble with money they can lose, when there is no leftover money to spend casinos might get in trouble. A positive for the casino industry is the strong unemployment rate that has only been decreasing. As long as people got money, they can spend it.

Takeaway

I rate MGM Resorts a Strong Buy at $35 per share. The company’s business performance and management execution led to a great recovery after the pandemic. At the current price, long-term investors are likely to get rewarded. The stock is undervalued, while investors ignore the possible recovery of the business in Macau together with the growth and expected profitability of BetMGM. Finally, the buyback program shows investors that the business is healthy and will reward investors.

Be the first to comment