photoschmidt

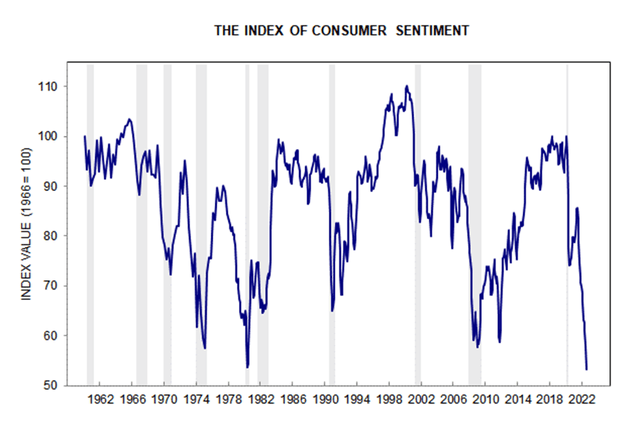

The weak performance of U.S. financial markets so far this year has been driven by high inflation, rising interest rates, and general uncertainty about the state of the world. The war in Ukraine has put pressure on commodity markets while also creating a shroud of uncertainty and possible fear of escalation with indeterminate consequences. These and other negative factors have caused consumer sentiment to plunge consistently since April 2021, reaching the lowest levels in at least 50 years according to the Consumer Sentiment Index from the University of Michigan. The next lowest level was recorded in May 1980.

Consumer Sentiment Index (Surveys of Consumers – University of Michigan)

Unfortunately, the negative factors listed above have not been offset by the low unemployment rate, wage growth, and relative strength of consumer finances as measured by households’ ability to pay their debts. Inflation, interest rates, geopolitical concerns, and possibly the political division in our country are the dominating forces.

Persistent Inflation

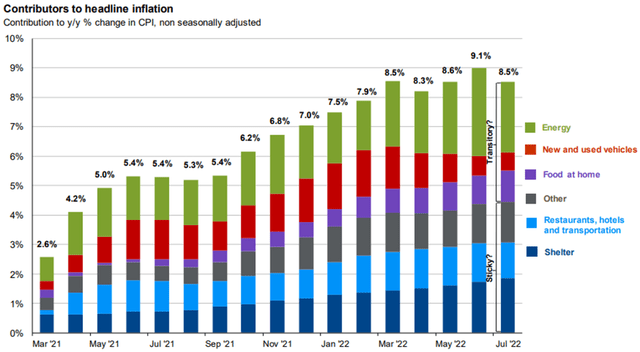

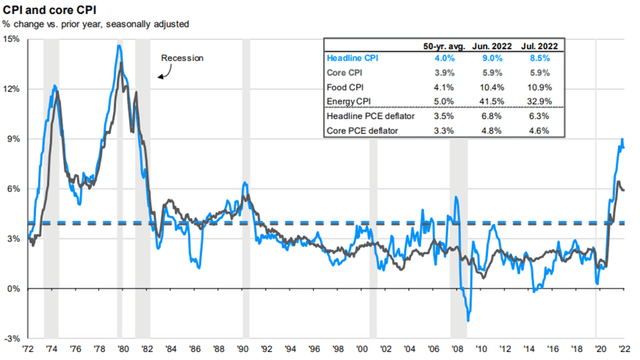

Inflation has been more persistent than those who expected it to be “transitory.” Of course, how transitory is defined in terms of months or years is subject to debate, but it is reasonable to say that most individuals would no longer consider it to be so. Costs have risen for housing, food, energy, travel, etc., and to the average consumer, there may seem to be little relief in sight. That said, there are indications that inflation will decline in coming months. With rising rates, housing prices are likely to slow their rise or even decline in some markets. Energy prices have already declined significantly from their recent highs, with prices at the pump falling every day for nearly three months. Lower fuel costs will filter through to the cost of other goods and services also, albeit slowly. Furthermore, future inflation figures could moderate from base rate effects as they are measured against the elevated levels from previous periods.

Sticky Inflation

Inflation is driven by its component parts, and we are seeing relief in some of those contributors, primarily energy and new and used vehicle sales. While that is a good start, stickier inflation components consisting of housing costs, dining and travel costs, and other spending (including clothing, education, medical care and other personal services, etc.) have prevented inflation from declining substantially. Although I believe that inflation will decline steadily given the focus of the Fed, it is reasonable to expect consumer sentiment to lag, taking at least several months of meaningful declines.

Inflation Components (JP Morgan)

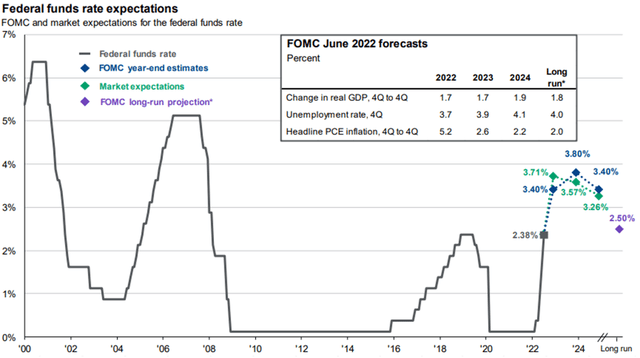

Rising Rates

Those needing to borrow to purchase a house or vehicle are facing the highest interest rates in years, although still low based on historical averages.

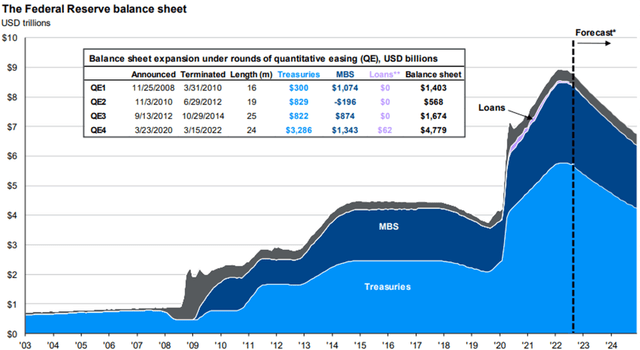

The Fed is on a mission to bring down inflation by withdrawing liquidity from the economy. Its current plan is to increase its target for the federal funds rate and to start shrinking its balance sheet by letting current positions roll off without reinvesting the proceeds in Treasuries or mortgage-backed securities or whatever else it has been buying. It his recent statement at Jackson Hole, Fed Chairman Jerome Powell stated that the priority was to bring down inflation, but during this short 8-minute talk, he used the word “pain” twice. From an economic perspective, “pain” likely means slower growth, possibly recession, and rising unemployment. The question is if the Fed is just “talking tough” or if it will stick its guns to try to reach its target inflation in the 2% neighborhood. While rising unemployment will certainly stifle consumer demand, which would be expected to reduce inflation, it also likely means inflicting a disproportionate hardship on the lower economic classes.

Federal Funds Rate Outlook (JP Morgan) Federal Reserve Balance Sheet Forecast (JP Morgan)

Political Division and Economic Outlook

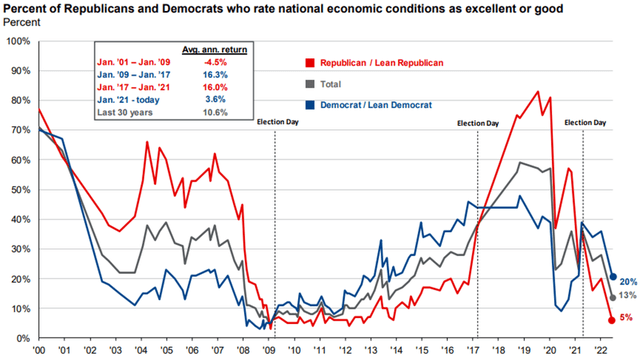

While the rating of the economy by the total population has been declining since the beginning of the pandemic (with a couple of rebounds), the rating of the economy by Republicans is far lower than that of Democrats. This has been driven by higher gas prices and inflation since Joe Biden took office. Unfortunately (or fortunately), he and his administration have little to do with these factors. Inflation and energy costs are a global problem, not a U.S. problem, so I’ll leave politics out of this discussion. These markets are highly nuanced, and politics is one of many factors that drive prices. I do find it interesting that there can be such a divergence of opinion when viewing the economy; it is the same economy for everyone but viewed through two political lenses.

Rating of the Economy by Political Party (JP Morgan)

Looking for the Silver Lining

Despite what will likely be slow improvement in the factors discussed above, there are some bright spots and reasons to be optimistic, at least for long-term investors.

As traders and investors anticipate falling inflation that leads to a less aggressive Fed policy, some of the current headwinds could turn into tailwinds for the markets. As inflation moderates, Fed policy should become more accommodating or at least move to a more neutral position. More stable interest rates, even if at a higher level than recent years, will help businesses and individuals make purchasing and investment decisions. Sure a 30-year mortgage at 5.5%-6% isn’t as good as 3%, but if rates are stable at that level, the home purchase decision becomes simpler for households. With less interest rate volatility, companies can plan for long-term capital expenditures. It is difficult to plan major growth projects with an uncertain and volatile cost of capital.

The timing of this stability and neutral stance is unpredictable, but that unpredictability can create opportunities for long-term investors. With lower inflation, stable dollar (or at least not a strengthening dollar), and only a moderate tick higher in unemployment, U.S. stocks will be attractive.

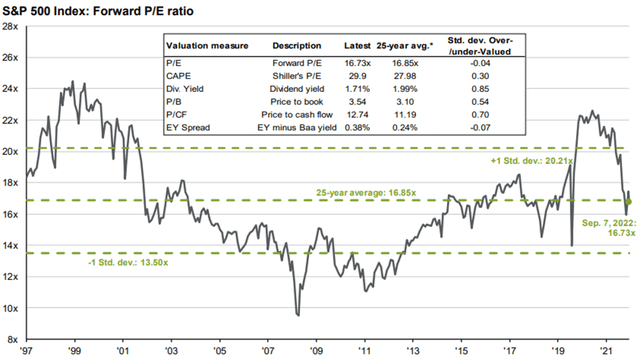

Valuation

The question at this point is whether the market is fully pricing in not only these current headwinds, but further rate hikes and the shrinking Fed balance sheet? If it isn’t then there is likely to be further declines in stocks, or at least choppy sideways trading. If it is pricing in the current reality and anticipated Fed actions, then pending confirmation of declining inflation, stocks will be attractive for long-term investors. From a valuation perspective, the S&P 500 is slightly below its 25-year average P/E, although remains slightly above the long-term averages for P/B and P/CF.

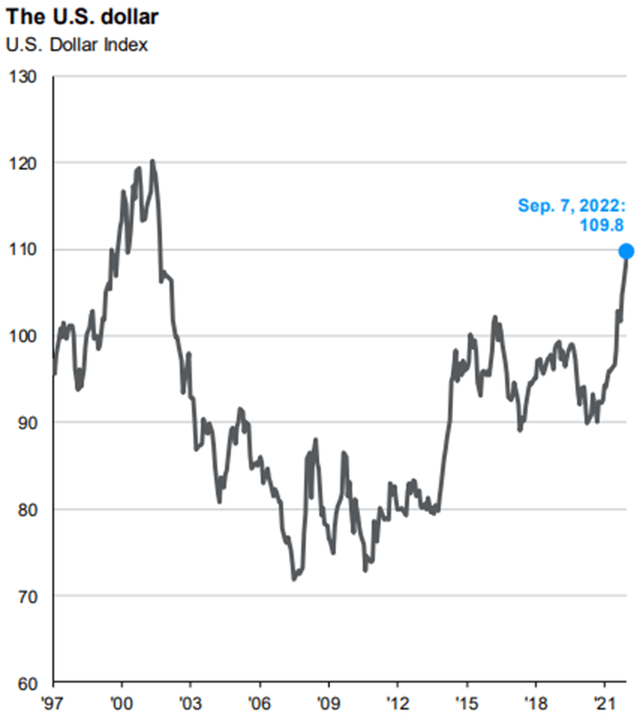

A Strong Dollar Becoming a Stable Dollar

The strengthening U.S. dollar relative to other world currencies has served as a headwind to company revenues, margins, and stock prices. While the relative strength has benefited Americans travelling abroad, large U.S. companies earn a significant amount of revenue and profit from foreign markets. This factor, along with supply and labor constraints has created a challenge for many companies that is beyond their direct control. A flattening or reversal of this trend would be expected to provide positive support for stocks. This could be driven by a less aggressive Fed if inflation eases for multiple months with a clear trajectory toward a normal range at least below 4% (50-year average headline CPI.)

Resolution in Europe

A de-escalation, and ultimately, a resolution and end of the war in Ukraine would be a positive catalyst for markets. While Ukrainian armed forces have made progress in regaining control of some territory from the Russians in recent days, the ultimate outcome of the war is far from clear. While the conflict still exists, so will volatility in certain commodity markets, including energy and grains. The impact of this on the European economy has been negative, but an end to the war would provide relief not only to those markets, but globally as rebuilding in Ukraine could start, and life in Europe could slowly return to “normal.”

Long-Term Opportunities

The economic headwinds and cross currents have created a challenging environment for traders and others with a short-term perspective but might create attractive entry points for long-term investors. To capture the long-term opportunity following a reversal in at least some of these headwinds, it is helpful to focus on specific areas of the market. Specific areas that would be expected to perform best in that environment would be U.S. large cap, technology, and possibly consumer discretionary names and industrials.

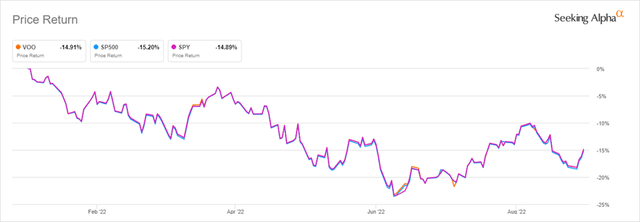

U.S. Large Cap

With easing inflation, normalized interest rates, and stable dollar, high quality large cap U.S. stocks would be major beneficiaries. Not only would consumer sentiment improve in that environment, a significant factor in an economy that is about 70% consumer spending, but it would also provide support for the nearly 40% of S&P 500 sales that are generated outside the U.S. The simplest way to capture a rebound in the U.S. economy and stocks is through the SPDR S&P 500 ETF Trust (SPY). The market-weighted fund currently has a growth tilt within large cap, about 15% exposure to midcap companies, and no exposure to small cap. For effectively the same exposure, the Vanguard S&P 500 ETF (VOO) has an expense ratio of 0.03% compared to 0.095% for SPY.

U.S. Large Cap YTD Performance (Seeking Alpha)

Large Cap Tech

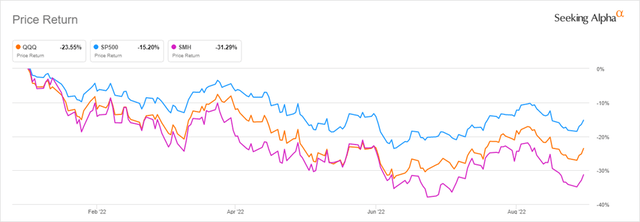

In a stable dollar environment, combined with lower inflation, it would be reasonable to expect tech spending to be strong, both from individuals and companies. Capital projects that might be on hold because of interest rate volatility will be revisited and, in many cases, pursued. I like the Invesco QQQ Trust (QQQ) in this case because it not only focuses on large cap growth, but spans technology, communication services, and consumer discretionary, all areas that are levered to a reversion to normalcy and increased spending.

Within tech, semiconductors have become increasingly attractive. The last couple of years have been tricky in the chip space, a problem that has spread to many other areas of the economy. As that market thaws, supply bottlenecks resolved, and new investments in U.S.-based manufacturing come online, this is an industry poised for long-term growth. I like Intel (INTC), not only because of its multibillion-dollar investment in Ohio with Federal funding from the CHIPS and Science Act, but because of other recent investments in new chip materials and processes to increase computing power. Intel has also become a value play (hopefully not value trap) with a forward P/E below 14x and current yield over 4.5%. To avoid the idiosyncratic risk of a concentrated position in Intel, I suggest a more diversified exposure to the industry using the VanEck Semiconductor ETF (SMH), which for an expense ratio of 0.35%, provides global exposure that includes about 25 names. The top three positions in the fund are Taiwan Semiconductor (TSM), NVIDIA (NVDA), and Texas Instruments (TXN).

Tech has lagged the broader market so far this year, dragged down in part by continued weakness in the semiconductor space. Given the potential for a stabilization or reversal of current headwinds, combined with capital expenditure projects backed by Federal subsidies, this year’s drawdown could be an attractive entry point for long-term investors.

Tech and Semiconductor Sectors YTD Performance (Seeking Alpha)

Consumer Discretionary

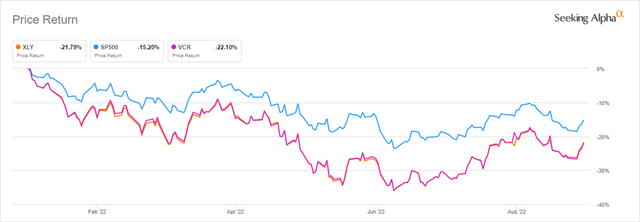

With stabilizing, and ultimately, improving consumer sentiment, I would expect cyclical and discretionary companies to benefit. To gain exposure to this space, I suggest using the Consumer Discretionary Select Sector SPDR ETF (XLY). The fund has an expense ratio of 0.10% and provides exposure to nearly 60 U.S.-based companies. The three largest holdings, Amazon (AMZN), Tesla (TSLA), and The Home Depot (HD), represent over 50% of the fund value.

A more diversified option is the Vanguard Consumer Discretionary ETF (VCR) that is also 10 basis points, but holds a portfolio of over 300 names, although it has the same top three holdings that account for over 45% of fund value. Consumer discretionary stocks have underperformed the broader market year-to-date, an expected result given the nosedive in consumer sentiment.

Consumer Discretionary Sector YTD Performance (Seeking Alpha)

Industrials

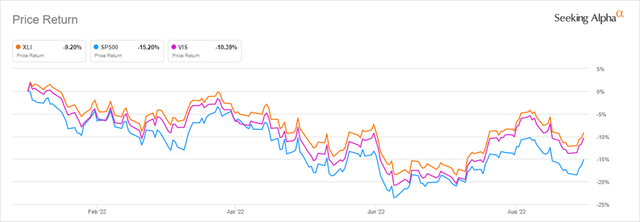

The industrial sector will be a direct beneficiary of a pick-up in economic activity, capital expenditures, and infrastructure spending. There are several catalysts that will boost industrial earnings in coming months and years. Federal spending in the U.S., including both the CHIPS and Inflation Reduction Act, will serve as a tailwind for many large businesses in the semiconductor, construction, clean energy, and pollution reduction areas. Most outcomes in Ukraine will also be helpful to the industrial space. In one scenario, there is an end to the war, followed by rebuilding throughout eastern Ukraine. In another case, the war escalates, prompting increased military spending by the U.S. and its European allies. Defense names, including Raytheon (RTX), Lockheed Martin (LMT), and Northrop Grumman (NOC) are well-represented in the industrial indexes. For example, the Industrial Select Sector SPDR ETF (XLI) holds over 70 equity positions, with the three mentioned above representing about 11% of fund value. Alternatively, the portfolio for the Vanguard Industrials ETF (VIS) holds over 360 underlying equity positions. The three defense positions listed above represent about 8.5% of this fund’s value. Both funds have an expense ratio of 0.10%. Despite rising interest rates and broad economic concerns, industrials have outperformed the S&P 500 year-to-date.

Industrial Sector YTD Performance (Seeking Alpha)

Final Thoughts

Given the current cross currents in the economy and financial markets, I can understand why investors would be hesitant. I am not. I still have decades of investing in my future, and regardless of the headline of the day, I am long-term bullish. Easy for me to say given my investment horizon. I understand that. If you are approaching or already in retirement, I can appreciate how this is a challenging and unsettling time to be an investor and maintain confidence in the long-term. To move beyond this, it is helpful for investors to not only understand what and why they own certain positions, but also to understand what their objectives are. Why are you investing at all? Is it for you? Your children? Your grandchildren? Thinking about your children and grandchildren can put things into perspective. For many investors, their investment horizon extends beyond their retirement needs and lifetime. In those cases, market drawdowns and volatility create opportunities. I look forward to your feedback in the comment section below.

Be the first to comment