RandyAndy101/iStock Editorial via Getty Images

Investment Thesis

A rebound in casino revenue as well as a strong record of dividend growth in the past six years could lead to further upside for this stock.

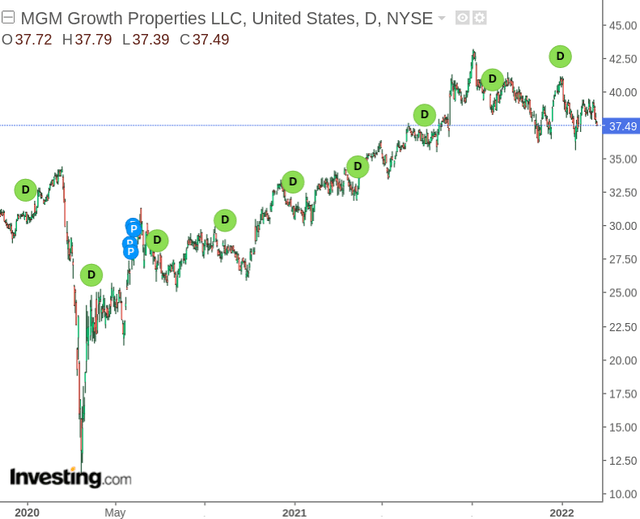

MGM Growth Properties (MGP) has seen a strong recovery from the lows seen in 2020. However, the stock has recently begun to consolidate:

While the hotel REIT sector had come under pressure as a result of a drop in travel demand, a rising inflationary environment may be an opportunity for the sector to thrive as rising property prices provide a hedge against inflation. The purpose of this article is to assess whether MGM Growth Properties could have significant upside in advance of being fully acquired by VICI Properties (VICI).

Performance and Inflation Outlook

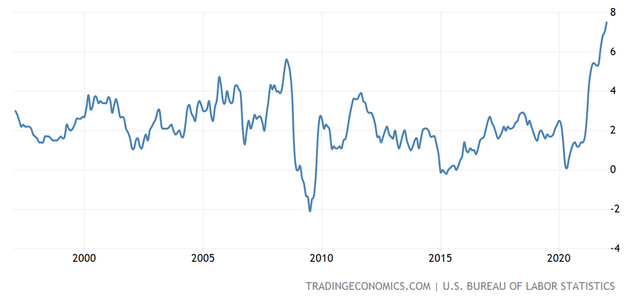

At 7.5%, inflation in the United States recently hit its highest level in 40 years.

Real estate should, at least in theory, provide a suitable hedge against such inflation as rising property prices will bolster a company’s asset value.

In the segments which MGM Growth Properties operates (primarily casino gaming, hotel, convention and entertainment), triple net leases typically govern leases to such tenants – whereby the tenant is responsible for covering all the expenses of the property.

This is an attractive proposition for MGM, as it mitigates having to pay rising maintenance costs on more expensive properties. As a result, MGM benefits from higher property values in the event of inflation – while the tenant covers all expenses.

With that being said, these industries have only recently recovered from the effects of the pandemic, and there is no guarantee that establishment owners will ultimately renew leases if profitability remains below pre-pandemic levels for a prolonged period – particularly if new COVID-19 variants lead to any future restrictions.

Additionally, inflation might reduce consumer demand for such amenities depending on the economic trajectory going forward. Therefore, while higher inflation could bolster asset prices in the short term, this could be a risk in the longer term if lease demand starts to drop as a result.

However, 2021 was quite an encouraging year for casino businesses, with vaccinations and removal of restrictions having brought a sharp rebound in revenue. For instance, Nevada reported $13.4 billion in gambling revenue in 2021, which is a record and beats 2019 revenue figures by 11.6%.

Cash Flow and Dividend Growth

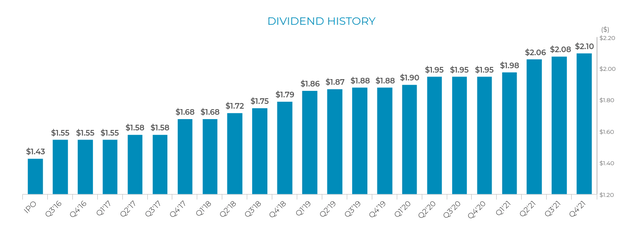

Moreover, the fact that MGM Growth Properties continued to grow its dividend during the pandemic is quite impressive; and should this trend continue, then I take the view that the stock will continue to rise further.

That being said, MGM Growth Properties is a capital-intensive business, whose long-term growth ultimately depends on generating income from real estate investments.

Taking figures from Q1 2020 onwards, here is the cash to net debt ratio as well as the real estate investment to net debt ratio.

| Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | |

| Cash and cash equivalents | 1762616 | 725889 | 655169 | 626385 | 143231 | 298175 | 319576 | 8056 |

| Net debt | 3973409 | 3614749 | 3516477 | 4168959 | 4161439 | 4162918 | 4164898 | 4216877 |

| Net real estate investments | 8486200 | 8427330 | 8369090 | 8310737 | 8251957 | 8194148 | 8147627 | 8780521 |

| Cash to net debt ratio | 44.36% | 20.08% | 18.63% | 15.02% | 3.44% | 7.16% | 7.67% | 0.19% |

| Real estate investment to net debt ratio | 2.14 | 2.33 | 2.38 | 1.99 | 1.98 | 1.97 | 1.96 | 2.08 |

Source: Figures sourced from Q1 2020 to Q3 2021 Quarterly Reports – ratios calculated by author

From the above table, we can see that the cash to net debt ratio has decreased by a big margin. However, we also see that the ratio of real estate investment to net debt has not decreased significantly since Q1 2020 – with a ratio of over 2 in the most recent quarter.

Additionally, net debt itself has not increased by a big margin and real estate investment continues to remain vibrant.

For as long as these trends continue, I take the view that long-term dividend growth will subsequently follow as continued real estate investment is what will ultimately generate cash for the company in the long term. Additionally, with inflation rising, the company’s continued investment in real estate looks to be a good move, as it makes little sense to conserve cash simply to invest when real estate becomes more expensive in the future.

Upcoming Acquisition by VICI Properties

VICI Properties Inc – also a REIT specialising in casino properties – is set to acquire MGM Growth Properties in a deal valued at $17.2 billion.

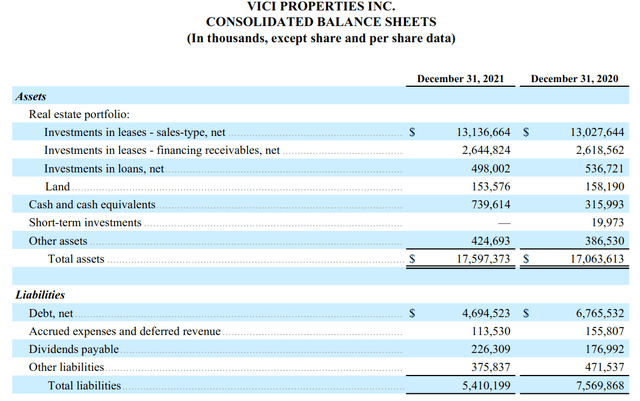

With MGM Growth Properties having reported net real estate investments of over $8.1 billion in the last quarter (compared to $13.1 billion for VICI Properties in the last quarter), this acquisition allows VICI Properties to greatly expand its investments in an industry for which revenue has rebounded strongly.

VICI Properties – Form 10K – Q4 2021

Additionally, while VICI Properties will also take on MGM’s net debt of over $4 billion (as reported in MGM’s most recent financial quarter), we also see that VICI Properties has reduced its own net debt by over 30% since the same period last year.

Conclusion

To conclude, MGM Growth Properties has shown significant resiliency during the pandemic, and real estate investment has remained vibrant.

As a newly formed part of VICI Properties, I take the view that the acquisition of this company is well placed to thrive in an inflationary environment and has the capacity to significantly bolster its real estate investments going forward. Should revenue growth remain robust, then this would make a further case for upside.

Be the first to comment