niphon/iStock via Getty Images

Investment Thesis

Meta Platforms, Inc. (NASDAQ:FB) went beyond the generic social media platforms when it introduced its ambitious Metaverse in October 2021, which created a global hype surrounding the concept then. However, the company’s stocks tanked in February 2022, when many investors realized a $10B impact on its future revenues from Apple’s (AAPL) new privacy changes. In addition, Meta’s image took a further beating when it announced its plans to charge a 47.5% commission rate in Horizon Worlds.

However, we think the reaction is overdone, given how Roblox Corporation (NYSE:RBLX) charges even higher rates at 72% for its world-building platform. Nonetheless, the company has yet to report profitability, despite its massive bookings of $2.7B in FY2021, Daily Active Users (DAUs) at 45.5M, and Hours Engaged at 41.4B. As a result, we believe that Meta may face similar profitability and monetization issues, given its $10B aggressive expenditures into the Metaverse in FY2021.

In the meantime, we encourage you to read our previous article on Meta and RBLX, which would help you better understand its position and market opportunities.

- Meta Platforms Vs. ByteDance: The Impact Of TikTok On Instagram

- Roblox: Aggressively Diversifying Its User Demographics

The ‘Controversial’ Platform Fees

On 13 April 2022, Meta invited criticism when the company announced its plans to charge creators a 47.5% commission on the sale of all digital assets and experiences developed in Horizon Worlds. It comprises 30% of platform fees through Meta Quest Store and another 17.5% of Horizon platform fees. Many saw the move as hypocritical, given how Meta had often criticized Apple’s (AAPL) 30% commission rate on its App Store.

For reference, AAPL’s App Store charged commissions in the range of 15% to 30%. The former rate applies to app developers earning less than $1M annually (accounting for 98% of its apps), while those earning over $1M will be subjected to the standard rate of 30% commission rate. On the other hand, Alphabet’s (GOOG) (GOOGL) Google Play Store charged a 15% fee, regardless of the app developers’ revenue. However, it is also important to note that AAPL historically charged a flat 30% rate since 2016 and GOOG since 2018, which was reduced only due to the court case between Epic Games and AAPL in 2020. Otherwise, we expect the duopoly would have continued to enjoy its massive revenue streams at the sky-high rate of 30%.

It is also important to note that the comparison is unfair, given how Meta’s Horizon World and Apple’s App Store are not apple to apple comparisons. Certain websites have also compared Meta’s commission rate to the fees charged by the NFT marketplaces in the range of 2% to 2.5%. Again, not the best comparison. In our opinion, it would be more apt to compare the Horizon World to Roblox (RBLX), given how both platforms encourage digital world games and experiential building.

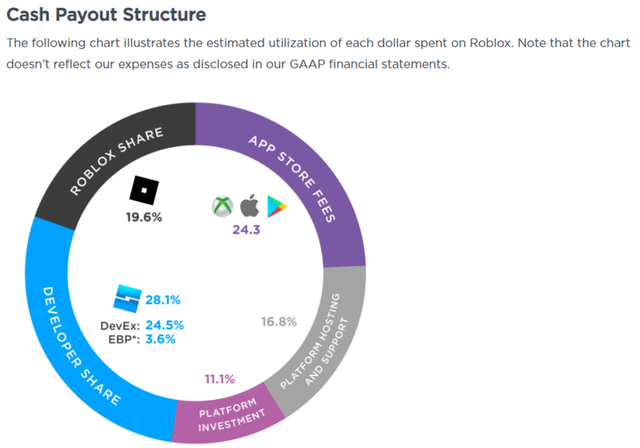

RBLX Cash Pay Out Structure

Based on its website, “Roblox pays creators and developers over 28 cents per dollar spent,” i.e., 72% commission for the company. Now, compared to Meta’s 47.5%, RBLX’s 72% rate is definitely high. It comprises 19.6% of RBLX’s share, 24.3% for App Store fees, 16.8% for platform hosting/ support, and 11.1% for platform investment. When we deduct away the App Store fees, we arrive at the same rate from Meta at 47.5%. Thus, Meta’s claim that its rate is “competitive” with its peers in world-building platforms is undeniably valid. On an unrelated note, Meta’s CTO Andrew Bosworth also noted that its 47.5% fee is similar to YouTube rates.

However, it is also alarming that RBLX has yet to report profitability despite charging such a high commission rate. In FY2021, the company reported revenues of $1.91B while generating a net income of -$491.65M. Nonetheless, Meta is also exploring a similar Horizon Worlds Creator Bonus program for US participants, similar to RBLX’s Engagement-based Payouts (EBP) of 3.6% as a part of the latter’s variable Premium Payouts to reward engaging digital experiences. As a result, the current proposed commission rates are not cut and dried.

Given that Meta is also looking to launch a mobile version, we are not sure how the company expects to extract profitability from the Horizon World. Unless the platform goes on the path of cloud gaming, which is currently favored by many game developers, such as Amazon (AMZN), Xbox, Sony (SNE), and Nvidia (NVDA), Meta would be forced to acquiesce to Apple App Store and Google Play Store’s commission rate of 30% and 15%, respectively. Nonetheless, given Zuckerberg’s vocal criticism of AAPL’s 30% rate, it is apt that Meta’s CTO Andrew Bosworth recently revealed in a tweet that the company is looking to release a web version of its Horizon Worlds platform. As a result, Meta’s proposed commission rate would fall to 25% for the web version, instead of 47.5% through its Oculus Quest VR. The reduced fee is undeniably more palatable for many digital creators.

Meta had reported early successes with 300K Monthly Users in February 2022, representing a 10-fold growth since its public launch in December 2021. In comparison, RBLX had Daily Active Users (DAUs) of 45.5M as of December 2021, while Rec Room, another world-building platform available in VR and non-VR versions, reported over 37M Monthly Users with over 1M VR Active Users in February 2022. It is evident that Meta is also trying to significantly increase its reach into the non-VR user market, given how RBLX and Rec Room have reported much success with their non-VR versions. In addition, YTD, Meta only sold approximately 10M sets for its Oculus Quest, which dramatically restricts user adoption and the consequential growth of its Horizon Quest.

In order to recoup its lost advertising dollars from the AAPL fiasco, Meta is also looking to monetize its Horizon Quest through “advertising opportunities for brands around digital goods and immersive shopping.” Its partnership with VNTANA, an e-commerce technology firm, will also allow 3D advertising in its Metaverse and its conventional social media platforms on Facebook and Instagram. Furthermore, with the potential launch of Meta’s first generational AR glasses by 2024, Zuckerberg aims to “redefine our relationship with technology,” akin to the introduction of smartphones by the iPhone back in 2007. Chris Barbour, director of augmented reality partnerships at Meta’s Reality Labs unit, said:

In a way, this offers a glimpse of what you might expect on future devices like AR glasses. (Reuters)

Since Horizon Worlds is currently restricted to the US and Canada, we expect Meta to slowly open up the platform globally moving forward, given its early successes. In addition, since Meta is looking to go beyond VR to allow access from Facebook and Instagram apps, we expect more of its 3.6B monthly active users to potentially access Horizon World as part of the expanded Facebook experience. As a result, we expect Meta’s Horizon World to perform well, with the global cloud gaming market expected to grow from $244M in 2020 to $21.95B in 2030, at a CAGR of 57.2%. Of course, assuming widespread adoption and success.

So, Is FB & RBLX Stock A Buy, Sell, or Hold?

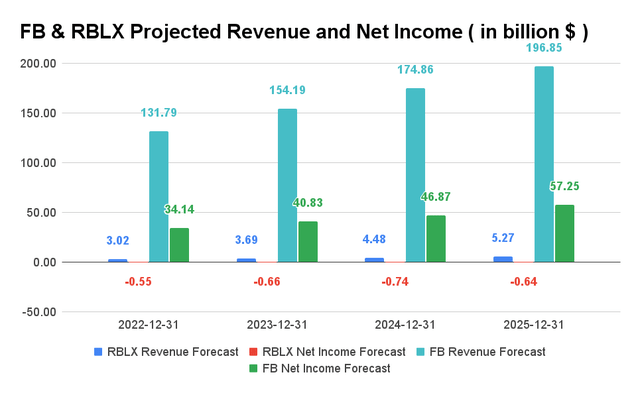

FB & RBLX Projected Revenue and Net Income

Meta is expected to grow its revenues and net income at a CAGR of 14.31% and 18.81% over the next three years, respectively. For FY2022, consensus estimates that Meta will report revenues of $131.79B and net incomes of $34.14B, representing YoY growth of 11.7% and a YoY decline of 13.2%, respectively. The decline in net income is partly attributed to AAPL’s changes in privacy settings, resulting in reduced effectiveness in Meta’s targeted ads. However, it is also important to note that the company is also spending massive Research and Development expenses of $10B on its Metaverse in FY2021, potentially contributing to its reduced net income. However, we are not concerned, given the company’s massive Free Cash Flows of $39.1B in FY2021.

As for RBLX, the company is expected to report revenue growth at a CAGR of 20.39% over the next three years. For FY2022, consensus estimates that RBLX will report revenues of $3.02B, representing YoY growth of 58.1%. However, it is also important to note that the company has yet and will not be reporting net income profitability at least in the next four years, despite its fat commission rate. The lack of profitability is mainly attributed to RBLX spending more on its research and development to age up its younger user base beyond the current 13-year-olds, while also improving its “infrastructure and trust and safety.” The latter is probably attributed to the raising concerns about the safety of its platform, given the recent news on sexual content and child pornography.

Meta is currently trading at an EV/NTM Revenue of 4.07x, lower than its 3Y mean of 6.79x. Given the market’s over-reaction post FQ4’21 earnings call, the company is also trading at $210.18 on 14 April 2022, down 45% from its 52 weeks high of $384.33. Nonetheless, given that the company is still the largest social media company globally while generating steady YoY revenues growth, we expect the company’s ambitious foray into the Metaverse to pay off once it has reached sufficient scale. However, no one would know precisely when. In the meantime, Meta’s valuation will likely remain flat, unless it witnesses a positive catalyst in the form of recovering advertising dollars in its upcoming earnings call.

On the other hand, RBLX is currently trading at an EV/NTM Revenue of 7.72x, lower than its historical mean of 15.45x. The stock is also trading at $42.36 on 14 April 2022, down 70% from its 52 weeks high of $141.60, given the projected deceleration of revenue and booking growth post-pandemic. Despite the normalization of revenue growth, RBLX remains a buy, given its successful execution and monetization of Metaverse. However, the company’s lack of profitability should be considered before adding more to your portfolios.

Therefore, we reiterate Meta stock as a Buy for long-term investors, while re-rating RBLX stock as a speculative Buy.

Be the first to comment