BeritK

REITs (VNQ) are currently priced at historically low valuations at the moment and we have spent a lot of time lately researching two industrial real estate investment trusts (“REITs”) in particular. Those two REITs are:

STAG Industrial is currently our largest industrial REIT investment. We believe that it is one of the best opportunities in the current market and we have been steadily accumulating more of it.

ILPT is another industrial REIT that we have been considering for our Core Portfolio. As we explained in a recent report, we believe that ILPT could earn you a 100%+ return within a year if they can resolve the financing of their recent MNR acquisition.

The earning results of both REITs came out in late July and here’s what we have decided to do:

Decision #1 – No Position in ILPT:

We won’t initiate a position in ILPT. Its valuation is very cheap and we continue to think that it may be a good opportunity for higher risk-tolerant investors.

However, the CEO’s remarks on the earnings call made us less confident that they will manage to secure permanent financing for the MNR acquisition without significantly diluting shareholders.

As a reminder, ILPT acquired MNR with a bridge loan and its plan was to later raise equity via JVs and also by selling some properties. But shortly after closing the transaction, interest rates rose significantly and transactions in the industrial sector dried up. This forced them to almost fully eliminate their dividend to preservice liquidity and to win some time as they negotiate with lenders.

We were hoping that the management would reassure us on the earnings call and tell us that they are making some progress with asset sales and JVs, albeit at a slower pace than initially expected. But that’s not what happened.

The CEO noted that they were forced to completely pull out of the market because JV partners and property buyers were asking for steep discounts that they weren’t willing to give.

“However, as interest rates have increased debt rates significantly higher than projected, it has led to a meaningful deterioration in real estate market conditions with buyer seeking steep discounts on marketed properties, or, in many cases, walking away from transactions.

As we are not a distressed seller, we have made the decision to move — to remove the 30 Monmouth properties totaling 4.9 million square feet from the market and plan to reengage in marketing efforts when debt and capital markets normalize. Additionally, we have paused discussions with potential partners for the Mountain Industrial joint venture.” [emphasis added]

I suspect that property buyers and JV partners know that ILPT’s clock is ticking due to the coming maturity of its bridge financing, and so understandably, they are trying to profit from the situation.

ILPT is telling us that it is not distressed, but the fact that it even needs to say that is quite concerning. Their 12.4x debt to EBITDA leaves no room for error and with no access to equity, they are now considering alternative sources of capital, which will all come at a cost.

It appears that ILPT really overextended itself by biting more than it could chew. It forced it to take a huge amount of leverage and now shareholders are entirely at the mercy of interest rates.

If rates begin to drop, the transaction market will likely pick up, allowing ILPT to close deals and secure permanent financing without much or any dilution.

But if rates keep on rising, then ILPT will suffer significant value destruction.

This means that ILPT has become very speculative as interest rates are highly unpredictable. We will continue to closely monitor the situation and may invest at a later date if and when we get some indication that interest rates are stabilizing and the transaction market is picking up, hopefully at cap rates close to those of today.

We prefer to wait a bit and potentially have to pay a bit more to have this clarity. For now, we remain on the sidelines and will continue to observe what’s next for them.

Decision #2 – Make STAG into a Large Position:

We have decided to buy a lot more shares of STAG to make it a large position in our Core Portfolio. We believe that a large position is warranted because:

- STAG is what we would consider to be a blue-chip in terms of quality.

- Its fundamentals are stronger than ever with record internal growth.

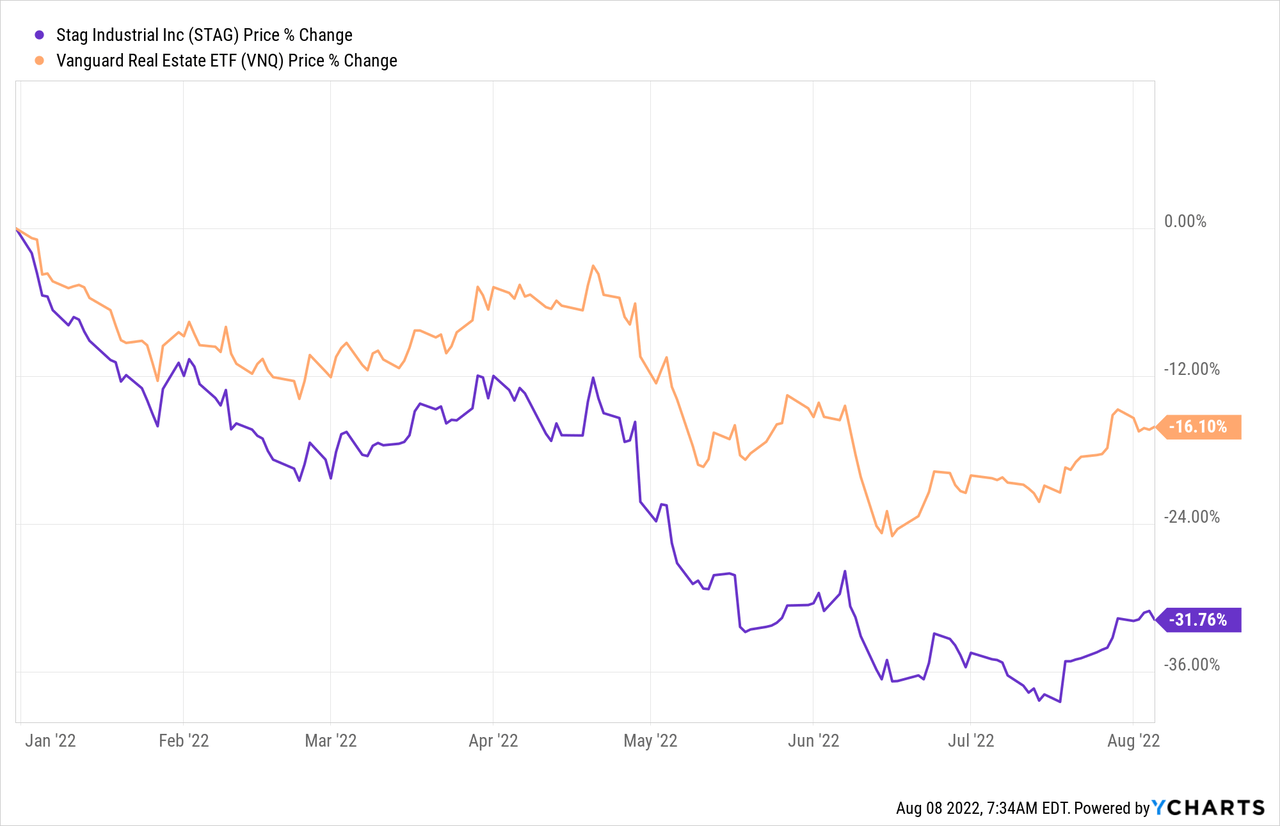

- Despite that, its share price is down a lot more than the REIT market:

The management is quite literally telling us that their business is doing better than ever. They expect 2022 to be a record year in terms of organic growth as they are able to release vacated space with a ~15% rent hike. Here’s what the CEO noted on the recent earnings call. Emphasis added:

“The positive industrial backdrop coupled with our team’s operational excellence resulted in another strong quarter. Our portfolio is in great position to take advantage of the macro tailwinds for our sector, leading to record internal growth guidance for 2022.” said President and CEO Bill Crooker.” [emphasis added]

The industrial sector is doing so well right now because of three main reasons:

- The growth of e-commerce greatly accelerated during the pandemic and it absorbed a huge amount of industrial space.

- Increasingly many companies are now bringing back larger portions of their supply chains into the US because the pandemic and the war in Ukraine have shown them that being too heavily reliant on foreign countries, especially dictatorships like China and Russia, has downsides.

- To this day, the demand for new space outpaces the new deliveries as we are simply not building enough, in part because of supply chain issues, high construction costs, and rising interest rates.

One quarter ago, STAG’s occupancy rate was 96.9%. Now, it is 98.1%, which is a new record for STAG. It clearly shows you that there are more companies wanting to lease space than there are companies downsizing, despite all the negative headlines that you may read.

With occupancy rates now at near 100%, and STAG’s rents still below market, it is in a particularly strong position to keep hiking rents on expiring leases, and this is why the CEO is so bullish.

How do you then justify the 1/3 drop in its share price?

Is STAG overleveraged? No, it has a strong investment grade rated balance sheet with low leverage and high liquidity.

Was it overvalued? No, even at its peak, it traded at a large discount to peers, and since then, its internal growth has accelerated.

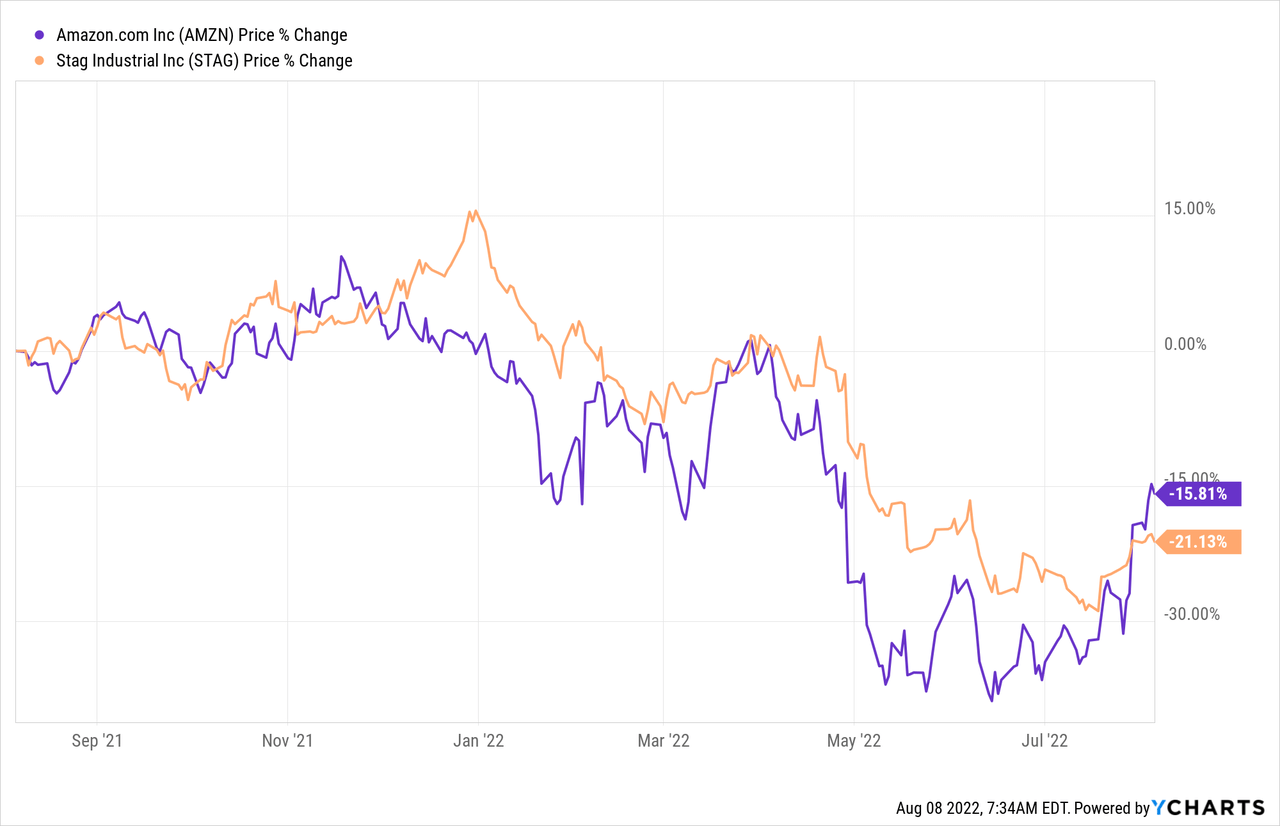

Could it just be a market overreaction? We believe so. STAG sold off particularly heavily due to reports that Amazon (AMZN) was scaling back its growth projects and expected to lease less space in the near future. Interestingly, STAG appears to have dropped almost in a straight line with Amazon as if their businesses were greatly correlated:

In reality, STAG’s business is well diversified and a few years of slower e-commerce growth is unlikely to have a material impact on its business.

As we have noted earlier, STAG’s rents are growing the fastest in the company’s history right now, which isn’t exactly what you would expect from a REIT that just lose 1/3 of its value.

As the market realizes that STAG’s business is doing so well, we expect a quick recovery to its previous highs, unlocking ~50% upside to shareholders and while you wait, you earn a near-5% dividend yield.

Bottom Line: ILPT vs. STAG

At the end of the day, it comes down to what you are looking for:

ILPT is offering a highly uncertain but very significant upside of 100%+.

STAG, on the other hand, is offering a likely upside of ~50%.

If we lived in a stable and predictable world, I would quite likely invest in ILPT, but given the high uncertainty surrounding important factors like interest rates and cap rates in the near term, I believe that STAG is the better opportunity.

Its upside is not quite as high, but it is significant nonetheless, and importantly, it is much more likely. This is why we recently doubled down on STAG and made it a large position in our Core Portfolio.

Be the first to comment