Mario Tama

Mullen Automotive (NASDAQ:MULN) is at a key inflection point. The company is involved with some groundbreaking initiatives that, if they come into fruition, will change the EV (electric vehicle) landscape (and of course produce outsized returns for shareholders). One thing is certain; there are many exciting things happening at Mullen, all within a very short period of time. And the positive catalysts keep on adding up; from the Mullen Five and cargo van orders to impressive battery test results and deals with OEMs (Original Equipment Manufacturers).

Please note: all dates in this article are for 2022 unless otherwise stated.

All eyes are on Mullen’s battery technology, which is arguably one of the biggest, if not the biggest, catalyst. On 31 May, Mullen announced very impressive solid-state polymer battery test results. The testing was conducted at BIC (Battery Innovation Center) in Indiana, a leading institution supported by renowned universities, government agencies, and commercial enterprises. In other words, we have a credible, world-class institution validating Mullen’s technology. Importantly, results were also in line with the previous test results conducted at EV Grid. In other words, we have a double confirmation of Mullen’s technology. The doubters argued that EV Grid was not the most credible institution to conduct the tests. So, David Michery, Mullen’s CEO, wanted to reassure the investment community by conducting the tests at BIC as well. Let’s call it a sanity check. Mission accomplished; Mullen passed by going through multiple intense testing sessions from accredited testing facilities. In fact, the test data collected from both EV Grid and BIC have exceeded the expected test tolerance and show an impressive future for solid-state batteries. The President and CEO of BIC Mr Ben Wrightsman stated:

We are pleased to see that the results from ongoing testing are in-line with those previously notated…the cell thus far has performed as stated, and we will continue to test additional parameters to characterize the overall capabilities and performance.

Why is this important?

When scaled to the vehicle pack level, a 150-kilowatt hour solid-state battery is expected to deliver more than 600 miles of range on a full charge. I think we can all agree that 600 miles of range is appealing, in line with conventional vehicles running on gas and diesel. This is game-changing news. The battery test results imply greater mileage and faster charging time, and Mullen is well-positioned to become a notable player in both the energy as well as EV space.

What about the traditional lithium-ion cell batteries used by companies like Tesla?

In general, solid-state batteries offer higher energy density, faster charging time, smaller size, and safety compared to traditional lithium-ion cell (we have seen the videos of lithium-ion cell batteries catching fire). In other words, Mullen will be ahead of Tesla (TSLA) on the battery front, believe it or not.

What about the competition?

We are still in the beginning of the global battle for solid-state battery leadership. Mullen has a nice head start compared to many and it’s important for the company to accelerate its efforts, especially given the impressive aforementioned battery test results. Now is the time to double down.

As mentioned above, range, charge and safety risks are the biggest challenges of lithium-ion batteries. Solid-state battery technology is here to resolve these issues. Many big firms have already made moves including Toyota which is the leading holder of solid-state battery patents. But Mullen has a good fighting chance. It is evident that the solid-state battery technology is the next big thing. Even high-profile investors, including Mark Cuban of Shark Tank, have recently invested in the space.

Unfortunately, competition will get more intense. Fortunately, Mullen has the balance sheet strength to progress its battery to the vehicle pack level, after securing an additional $275M in funding following its annual stockholder meeting on 26 July. In fact, Mr Michery dropped big news during his recent Benzinga interview on 4 August. The market has yet to digest the news. Mr Michery mentioned the following about a big deal he is very confident about:

We’re talking to a ton of attorneys, accountants, auditors. If we accomplish this, which I believe we will, and we will have an 8-K/Press Release that will come out in the very near future. And if this completes, this will be a first of its kind, we are going to tip the entire EV space on its head

He gave us a hint though. The Mullen Energy facility in Monrovia will be in a position to produce 30,000 packs per year. This is huge.

In the same interview, Mr Michery also gave as a brief update on the major Fortune 500 customer order regarding its electric cargo vans. He reiterated that they have been working for more than 1 year on this deal, and the customer (telecommunications provider in the Southeastern part of the U.S.) has reported they are pleased with the performance. The customer requested certain van modifications in support of their anticipated use. The van was picked up by Mullen and modified to fit the specs requested by the customer, including an upgrade to an 80-kWh battery pack. The van is now in the final testing phase and if everything goes well there will be a vehicle purchase order. In other words, everything is on track. It is healthy for a business relationship to have some back-and-forth, especially before a sizeable deal is concluded. The fact that the customer requested specific modifications shows there is serious intent. In addition, Mullen is planning to add some additional tech features to its vehicles and make some aesthetic improvements to have the most appealing vans out there, as Mr Michery stated. Also, in addition to the Fortune 500 order, Mullen signed a binding agreement with DelPack Logistics, an Amazon Delivery Services Partner, for up to 600 Class 2 EV cargo vans over the next 18 months (the first 300 vans can be delivered by 30 November at the request of the customer). Investors can expect more orders in the coming months. To this end, Mullen is on a hiring spree and ramping up production. We are still in the very early stages of possibly a great success story.

Talking about expansion, on 1 August, Mullen announced the opening of a new Automotive Development Center (16,000-square-foot facility) in Irvine, California, located in the heart of Irvine’s technology corridor and in close proximity to the Irvine Spectrum Center, in support of Mullen’s expanding automotive team. As Mullen continues to grow and expand its corporate footprint, various teams are being strategically split between the Mullen Monrovia and Irvine locations. Specifically, Battery, Powertrain, Thermal, and Infotainment teams will be located at the High-Voltage Facility in Monrovia, California and the Irvine Automotive Development Center will be home to the Engineering Design and Development, Styling, Program Management, Marketing, and Finance teams.

In addition, on 3 August, announced the opening of a new EV Technology team, focusing on developing EV technologies for Mullen’s portfolio of commercial vans. The team will be based in Detroit and will be home to a new division of engineers and technology developers focused on Mullen’s Class 1 – 5 commercial vehicle development. This “Detroit Tech Center” and its EV Technology team will play an important role in Mullen’s goal of developing highly efficient EV technology that utilizes less energy consumption while offering greater vehicle ranges/power. Mullen has already brought on close to 20 new hires and expects to have upwards of 50 employees by year end. The Detroit Tech Center will be the 5th location opened by Mullen. To summarize, at the time of writing, Mullen facilities include:

- Detroit Tech Center in Pontiac, Michigan

- Irvine Automotive Center, located in Irvine, California

- Advanced Manufacturing and Engineering Center based outside Tunica, Mississippi

- Mullen’s High Voltage facility located in Monrovia, California

- Mullen’s Corporate Headquarters based in Brea, California.

It is evident that Mullen is scaling up rapidly. Now is the make-or-break moment. Mr Michery commented:

Detroit is a natural spot for us for all the right and obvious reasons. A majority of our current partners are based in Detroit, so opening this center made perfect sense for our ongoing and future commercial van development… It is great timing for us as many of the other EV companies are reducing their teams, and we are growing at a rapid rate.

Going back to the battery technology, as mentioned above, when scaled to the vehicle pack level, a 150-kilowatt hour solid-state battery can deliver more than 600 miles of range, on a full charge, for the Mullen FIVE EV Crossover. Talking about the Mullen FIVE, it is important to note that Mullen has filed over 130 patents in 24 countries. This implies that Mullen has global ambitions for the Mullen Five EV Crossover.

Having a solid-state battery that can deliver more than 600 miles of range on a full charge is game-changing news. And this is exactly why Mullen has already commenced negotiations with several major OEMs. Mr. Michery is “talking to them at the CEO level” as they were impressed with the battery test results. Mr. Michery portrayed his excitement by saying “stay tuned, it’s going to be pretty good.” It is fair to say that positive developments on the OEM front will open up a brand new revenue stream, something that the market is disregarding right now. In fact, Mullen’s vision is to share this technology with everybody, for all types of equipment and devices, including cell phones and power tools, “to be like Bluetooth”.

Mullen’s battery technology is what this company is all about. It can empower deals with OEMs but also make Mullen’s vehicles standout. In addition to the cargo vans, the Mullen Five also has a bright future. The Mullen FIVE beat other finalists, Lincoln Aviator Grand Touring and Rivian R1S, to win the LA Auto Show 2021 Zero Emission Vehicle Award (ZEVAS™) in the ‘Top SUV ZEV’ category. This is a recent accomplishment, as the LA Auto Show took place less than a year ago, on 17 November 2021, where the FIVE was debuted to the world for the first time. The Mullen Five was able to go up against an impressive set of competitors, including both legacy brands and exciting new startups, and won by a huge margin. Moreover, many investors are still skeptical since they have not seen Mullen vehicles in action. This will change shortly. As of this fall, starting in California and working its way throughout the US, across 19 cities, interested parties can place a reservation and experience first hand driving the Mullen FIVE EV Crossover. This will be a great way to build momentum.

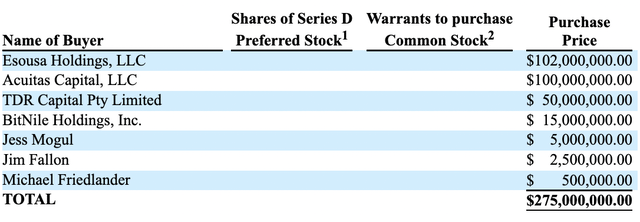

It goes without saying there are many company-specific risks, in addition to the competition, as outlined above, from established players like Toyota who are in a race for the solid-state battery. One of the key risks was for Mullen failing to raise the $275 million, which was subject to stockholder approval. Now this risk is out of the way following the stockholder meeting on 26 July. Below is the list of investors that will participate in funding Mullen’s growth aspirations.

It is important to note that many of the aforementioned investors have provided capital to Mullen in the past. Having a loyal shareholder base, with deep pockets, is important, especially in such turbulent times. For instance, competitors like Arrival (ARVL) are facing a cash squeeze and are cutting costs while others like Electric Last Mile Solutions (OTC:ELMSQ) have filed for bankruptcy. Mullen seems to be on a solid financial footing (more on the balance sheet below), going on offence at a time when others are going on defence and/or struggling to survive.

That said, to be in a position to raise the additional $275 million, Mullen had to increase the authorized number of shares of common stock to 1.75 billion and the authorized number of shares of preferred stock to 500 million. To this end, many investors are concerned about dilution. Indeed, if Mullen were to issue all these shares today, this would lead to substantial dilution at rock-bottom prices. However, it is important to understand the difference between authorized shares and issued shares. Authorised shares are not automatically issued. They could be issued, as the company sees fit, but are yet to be issued i.e. they are not part of the float. One of the issuances will relate to raising the $275 million. This was well known by the investor community i.e. fully expected. Even at today’s share price, this will take up only a small percentage of the new authorized shares. As such, it is up to David Michery and his team to issue the remaining shares at much higher share prices and therefore go into a mode of accretive share issuances rather than destructive dilution.

Taking this point a step further, for the above-mentioned $275 million deal to close, based on the current share price and assuming only common shares are issued (the securities purchase agreement also refers to preferred stock), I expect around 275 million new shares to be issued, and this will lead to a ~50% increase in the issued share count. In addition, it will also increase the company’s cash balance by $275 million, all else constant, and with the existing $60M in cash and cash equivalents on hand, the pro-forma cash balance will be around $350M. The pro-forma market cap (based on around 750M issued shares) will be around $750M, meaning that around 50% of the pro-forma market cap will consist of cash. This is attractive. Note, Mullen reduced its overall indebtedness from more than $30 million last year to an estimated $11 million currently. In other words, Mullen is virtually debt free.

Assuming the above scenario plays out, Mullen could refrain from issuing new shares, and only consider doing so at much higher prices, e.g., via opportunistic ATM (at-the-market) offerings, in an accretive manner. That said, let’s take the worst-case scenario. If Mullen goes ahead and issues all authorised shares today (i.e. bringing its share count to the maximum of 1.75 billion common shares), then it would more than triple the actual share count calculated in the float. On the flip side, Mullen would be sitting on more than $1 billion in cash and cash equivalents. One could argue that with more than $1 billion in cash, this might be the last time that Mullen every raises equity. And, if everything plays out with the solid-state battery, licensing to OEMs, Mullen Five, cargo van orders, etc, then Mullen will be playing in the big league and be a multi-billion market cap company, suggesting multi-bagger returns, even if the company fully ‘dilutes’ today. As such, even this pessimistic scenario is not that bad. What would be bad is for Mullen’s initiatives to fail dramatically, essentially throwing $1+ billion dollars down the drain.

Another risk is failing to secure the Department of Energy ATVM loan application, however the impact of this risk is lower since Mullen has already secured additional funding, as discussed above. The ATVM loan application is a process that can take anywhere from 12 to 18 months, and there are no guarantees that the application will be successful. That said, the Senate just passed the climate bill and the rush to renewable energy is on, unlocking some $370 billion in funding for clean energy. More funding offered by the Federal government implies greater chances for Mullen succeeding in one of the government’s programs. Let’s see what happens, but the timing is certainly good for Mullen.

Be the first to comment