Justin Sullivan

Meta Platforms, Inc. (NASDAQ:META) reported 2Q22 earnings results that missed both top and bottom line estimates. Revenue of $28.8 billion represented a YoY decline of 0.9% (+3% constant currency), missing consensus by $130 million. GAAP EPS of $2.46 was down 32% YoY, which also missed estimates by $0.09. Shares are down ~7% as of writing. Let’s go over the good, the bad, and the ugly.

The Good

The first evidence of the good is that shares of Meta didn’t exactly suffer a major decline, as investors were already expecting such underwhelming results considering 2Q22 revenue went up against an insurmountable 2Q21 that saw revenue growth of over 55% YoY. From 2020 to 2022, Q2 revenue grew at a 2-year CAGR of 27%. Following a very strong 2021, when digital advertising bounced back from a subdued 2020, 2022 is proving to be a difficult year. Pandemic benefits are essentially gone, while CEO Mark Zuckerberg cited a challenging macro environment. Compared to Snap Inc. (SNAP) after Q2 earnings (analysis here), Meta’s price action is a walk in the park.

On the technology side of things, Meta is investing aggressively in AI to compete against TikTok by shifting its recommendation engine to be more discovery-based rather than recommending content on accounts that users already follow. Management noted that ~15% of the content on a user’s Facebook and Instagram feed is now recommended by AI from people, groups, and accounts that the user doesn’t follow, and this will more than double next year. Reels (short videos) are gaining traction, with a 30% QoQ increase in time spent on Facebook and Instagram. They now have a $1 billion annual run rate, higher than that of Stories in the same period since launch.

The biggest fear amongst investors who bought Meta’s stock on valuation also didn’t quite materialize after sell-side analysts slashed their earnings estimates post earnings. 2022/23 EPS estimates have been revised down from $11.72/$13.88 to $9.8/$12.46, pushing forward 22/23 earnings multiples up from 13.8x/11.7x to 16.6x/13x, yet the stock seems to be holding up quite well above the key support level of ~$159 a share. In short, a lot of bad news from declining revenue growth to earnings compression has already been baked in.

Meta also finished Q2 with roughly $40 worth of cash (cash + marketable securities) on the balance sheet, or $14.9 cash per share. This comes down to an ex-cash 22/23 forward P/E of 15x/12x. The company bought back $5 billion worth of stock during the quarter and has $24 billion left in the buyback program.

The Bad

Now that Q2 is in the rearview mirror, Q3 doesn’t offer investors any reason to be positive. For the current quarter, Meta guided revenue of roughly $27 billion at midpoint, indicating a YoY decline of 6% (flat constant currency). This is 10% below Street estimates of $30 billion. Similar to Snap, Meta pointed to deteriorating macro conditions as advertisers typically become more sensitive on ad spend returns in a downturn. It’s unclear how long this down cycle will last, so the challenge in 1H22 will likely persist in 2H22.

Despite crossing the $1 billion run rate mark, Reels monetization remains below that of Feed and Stories. More specifically, management highlighted that the faster Reels grow, the more cannibalization of other better monetizing formats. Nevertheless, Reels are expected to ultimately monetize at a similar rate to Feed.

In terms of iOS challenges, Meta aims to keep users on its own properties as much as possible and will continue to invest in AI to allow advertisers to run ads with less data through modeling. This again shows the impact from IDFA is a longer-term issue, as Apple (AAPL) has essentially cut off all the signals sent to app developers when users choose to not be tracked. In other words, once an iOS user selects the “ask app not to track” option, Meta is prohibited from accessing the system advertising identifier (IDFA), and is also not allowed to track the user’s activity with other identifiers such as his/her device ID or email address. It’s unlikely that Apple will change its stance on privacy, and Android is also widely expected to adopt a similar policy.

The Ugly

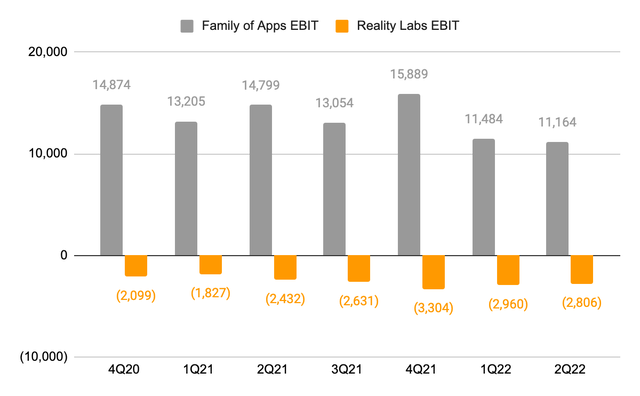

Meta’s earnings outlook is concerning as the core advertising business has dramatically slowed down while Zuckerberg’s metaverse is costing the company billions of losses every quarter. In Q2, Reality Labs generated revenue of $452 million, up 48% YoY, yet reported $2.8 billion in operating loss. In Q1, Reality Labs reported revenue of $695 million and almost $3 billion in operating loss. For the first half of 2022, the metaverse already cost Meta $5.8 billion in negative operating income, even though it made up an insignificant amount of total revenue.

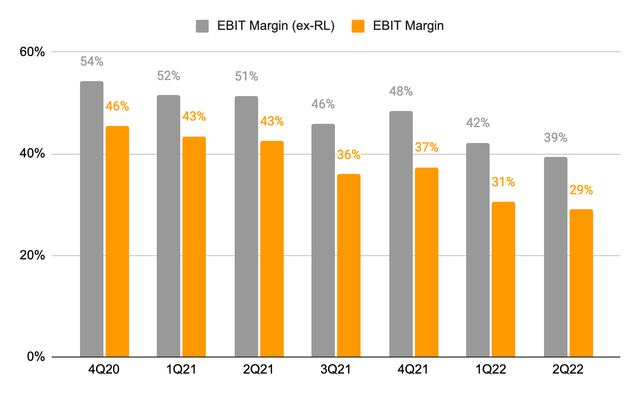

Since its inception, the metaverse has recorded a total operating loss of $18 billion. Over the past 4 quarters, the delta between total operating margin with and without Reality Labs has been at least 10%. While this may not be a problem if core advertising growth and margin remained healthy, investors are beginning to question Meta’s earnings power as the operating margin for Family of Apps has been trending down in recent quarters. In Q2, FoA operating margin of 39% was significantly below 51% in 1Q21.

Final Thoughts

As much as many may see Meta as a value stock, I continue to hold the view that it is not (previous analysis here). This is because the company is facing a challenging outlook with nonexistent top-line growth, contracting core advertising margins, and a worsening bottom line as billions of dollars continue to be burned in building the metaverse. While it may be tempting to again look at the forward P/E and conclude that Meta is a bargain of a lifetime, I believe investors should avoid buying the stock based on valuation.

Be the first to comment