Chip Somodevilla

Our community continues to grow and I’m pleased with the strong engagement we’re seeing driven by progress on our discovery engine and products like Reels. While we face near-term challenges on revenue, the fundamentals are there for a return to stronger revenue growth. We’re approaching 2023 with a focus on prioritization and efficiency that will help us navigate the current environment and emerge an even stronger company.

With these words Mark Zuckerberg opened Meta’s Q3 2022, but the market probably did not even read his commentary. Shortly after the report was published the stock immediately lost 13%, and the causes once again were reduced margins and excessive CapEx due to investments in the reality labs segment. By the time this article is published I would not be surprised to see an even more pronounced collapse, but in any case my view on Meta remains bullish. I did not invest in Meta (NASDAQ:META) with the expectation that the reality labs segment would become profitable in a few months, I knew from the beginning that these investments would take years to recover; therefore, I see this short-term volatility as an opportunity to increase my position. Certainly I am aware that Meta is a very risky investment and I could be wrong, but at the same time I know that Mr. Market often has a short memory and may have forgotten that this company in FY2021 recorded a free cash flow of $39.11 billion.

Highlights Q3 2022

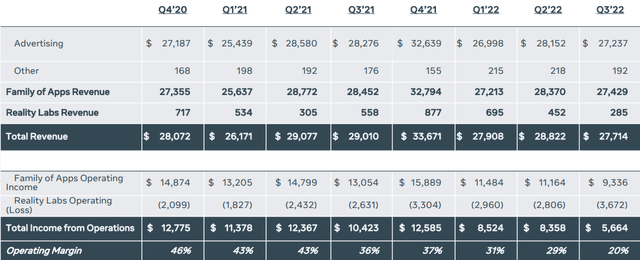

From an income perspective, Q3 2022 was rather subdued compared to Q3 2021, as there was not only a deterioration in margins but also in revenues. The advertising segment is struggling to even have positive revenue growth because of the current economic slowdown that is pushing companies to spend less on advertising. This problem is affecting virtually all companies whose business model is based on advertising and is likely to continue in the coming quarters as the macroeconomic environment seems to be getting worse every day. The reality labs segment generated the largest operating loss since its existence, $3.67 billion.

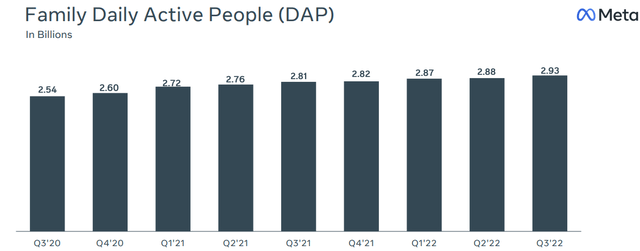

As for DAPs, surprisingly Meta’s growth continues, and about 1 in 2.7 people worldwide log on to one of the Meta Apps every day.

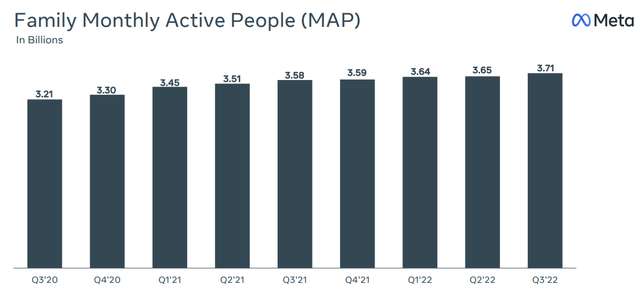

On a monthly basis, there has also been an increase here. About 1 in 2.1 people in the world connect to one of the Meta apps per month. Counting only people who have the possibility of connecting to the Internet, we are talking about 1 in 1.34 people. Not bad for a company that is apparently failing.

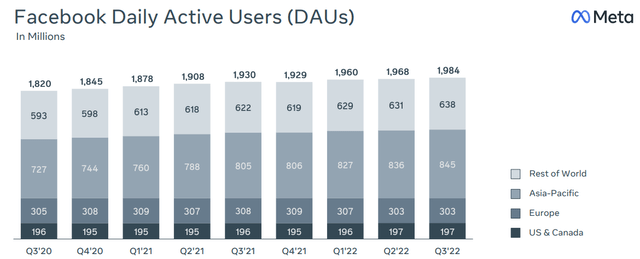

In this other image we can see the growth of Facebook’s DAUs. I have often heard that this social is dying, but the data say otherwise. It is true that user growth in Europe and North America has stalled for years now, but the same cannot be said for users belonging to the Asia-Pacific and Rest of the World, which by the way have a far greater weight in total users.

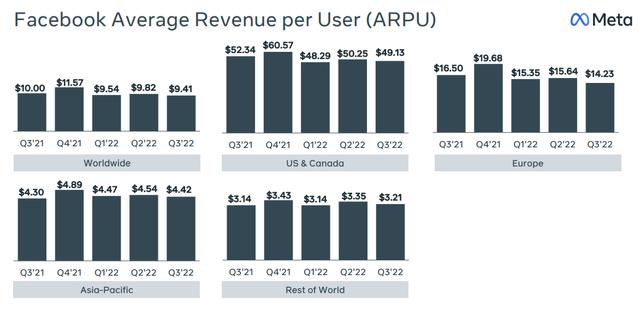

In terms of revenues, however, Europe and North America are by far the most profitable but are going through a downward phase. Asia Pacific and Rest of the World presented increasing ARPU compared to Q3 2021, but they fail to cover the total losses. Therefore, ARPU worldwide presented a decrease of $0.59.

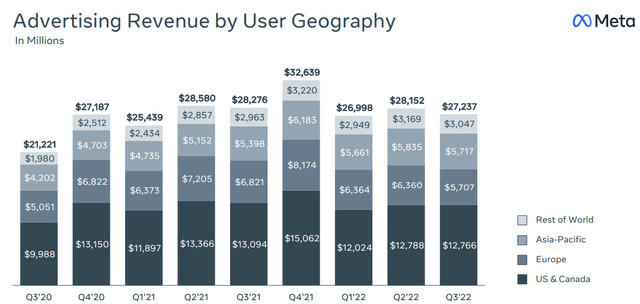

Overall, considering advertising revenues from all apps and not just Facebook, the result is similar. Growth in Asia-Pacific and Rest of the World and decrease in Europe and North America.

On the other hand, as far as the reality labs segment is concerned, doubts are growing. Revenues were only $285 million, the worst quarterly result ever, and estimates of how much Meta intends to invest in it in the short to medium term have been updated.

- CapEx between $32-33 billion is expected for FY2022.

- For FY2023 a CapEx between $34-39 billion is expected.

- Beyond 2023, Meta expects to pace Reality Labs investments so as to increase operating income over the long term.

According to these estimates, practically Meta will have no free cash flow until at least 2024. To conclude, the company has prepared $17.78 billion to continue its buyback plan.

How much is Meta worth after Q3?

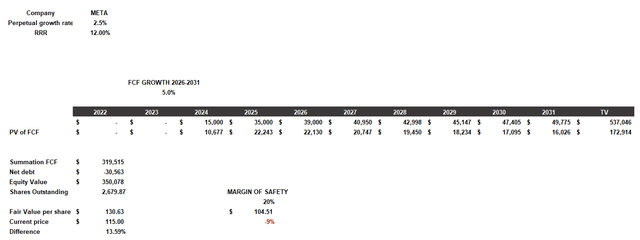

As with any company, Meta’s fair value is given by discounting future cash flows. I will use a discounted cash flow to understand whether or not it is worth investing in it, trying to be as conservative as possible. The model will be constructed as follows:

- The RRR will be 12%. Since Meta is a risky investment I will require an annual return above the S&P500 average.

- The free cash flow in 2022 and 2023 will be $0, thus reflecting the company’s choices to increase CapEx considerably. In 2024 I have considered a free cash flow of $15 billion since the company has stated that it wants to improve its operating income by reducing the amounts invested. In 2025 the free cash flow will be $35 billion and in 2026 $39 billion, the same figure as in 2021 practically.

- The growth rate entered from 2026 onward will be only 5%. In this way I am assuming that the hundreds of billions invested in the reality labs segment will lead to paltry growth. In addition, there will also be low revenue growth in the family of apps segment. More conservative than that I cannot be.

- Net debt and shares outstanding were personally calculated based on Q3 2022.

According to my assumptions, buying Meta at $130 per share can give an annual return of 12%. Buying it around $100 per share also gives a 20% margin of safety. Personally, I think Meta’s fair value is higher, but I purposely wanted to create a super conservative model to highlight how this company is undervalued even by including unfavorable assumptions.

For those who believe in the long-term plans of this company, being able to buy it at the current price is definitely an opportunity, so they should not get caught up in the negative sentiment of most people. The best opportunities arise when everyone is afraid, not the other way around. At the same time, however, one must recognize the riskiness of this investment and avoid overexposure.

Be the first to comment