Hiroshi Watanabe

On a near daily basis, Intel (NASDAQ:INTC) shareholders are hit with negative news. The latest disappointment is the Mobileye Global (MBLY) IPO likely to price at far lower levels raising less money for the chip giant. My investment thesis remains Bearish on Intel due to ongoing dividend cut risk, as the company doesn’t generate the cash to pay the large annual payout and invest aggressively in capex.

Mobileye IPO Slashed

Only months ago, Intel promoted selling 10% to 20% of Mobileye at a $50 billon valuation. The premise of taking the self-driving unit public was to help raise funds for the aggressive foundry building plan causing a massive increase in capex spending.

Intel was poised to raise anywhere from $5 to $10 billion based on investor appetite for the IPO. Now, the Mobileye valuation has been cut to a maximum of $16 billion with Intel only looking to sell 41 million shares at a range of $18 to $20 per share.

The chip giant only plans to dispose of 5% of Mobileye and maintain voting control of the business. Intel will only raise a near meaningless $820 million at the top of the range considering each fab costs up to $10 billion.

The company bought Mobileye for $15.3 billion back in 2017. At the low end of the range, Intel would actually price the auto tech unit at a valuation below what was paid for the company over 5 years ago.

Clearly, Intel is bringing out the Mobileye IPO nearly a year late here. Qualcomm just highlighted a $30 billion design-win pipeline in auto tech, yet the stock has fallen to multi-year lows.

The other part of the problem is that Mobileye only produces $1.7 billion in revenues now. Intel clearly overpaid for the company considering the stock will trade at 8x a $2.0 billion sales estimate. As highlighted many a time in previous research on Intel, the $50 billion valuation forecast was just out of touch with reality and the weak market has made this come to fruition.

Dividend Cut Risk

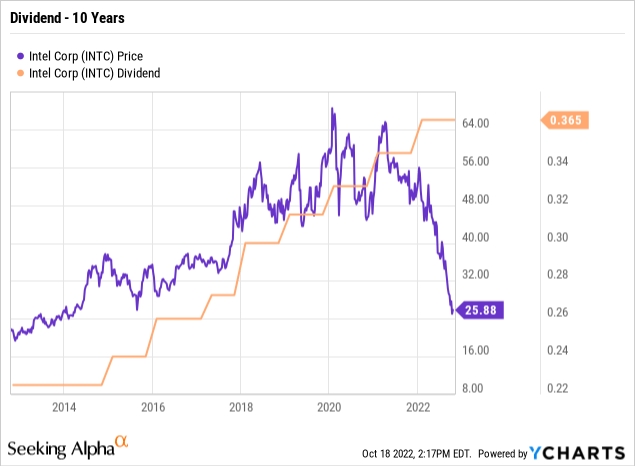

Investors really have to question how long Intel can keep paying the dividend. The current $0.365 quarterly rate amounts to a $1.5 billion payout rate. The chip company has to fork over $6 billion annually to shareholders while the money isn’t exactly in the bank or produced by ongoing cash flows.

The stock has been volatile over the last decade. Despite the company constantly hiking dividends annually, Intel has mostly traded with little regard to the dividend payout anyway.

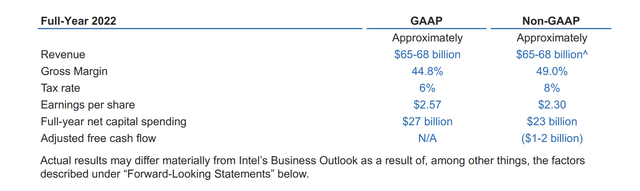

The prime reason is that Intel doesn’t have a CPU chip monopoly anymore and profits aren’t guaranteed. Intel last forecast free cash flows for 2022 at a slight burn rate of up to $2 billion.

Source: Intel Q2’22 earnings release

Intel is likely to update estimates as follows:

- Operating cash flow – $20.0 billion (down from ~$21.5 billion)

- Capital spending – $20.0 billion (down from $23.0 billion due to BAM deal)

- Free cash flow – $0.0 billion

- Dividend Payout – $6.0 billion

The biggest risk is that operating cash flows don’t meet these updated numbers. The company still has to come up with another $6 billion in cash to cover the dividend payout and the recent Advanced Micro Devices (AMD) preliminary guide for Q3 questions whether Intel hits those prior targets. AMD saw a shocking $1 billion hit to the client group, or 50% of related revenues. Intel is far bigger with the Client group producing $7.7 billion in quarterly revenues in the last quarter.

Intel already has $8.4 billion in net debt and the company doesn’t want to go farther into debt in order to payout large dividends. With the large capex requirements, the chip company will have to eventually chose whether to invest in additional capacity or pay shareholders.

The last available guidance had 2022 free cash flows at -$1.5 billion. Intel signed a deal with Brookfield Asset Management (BAM) to fund ~$15 billion of the Ohio fabs to help the tech giant save an equal amount of cash flows over the construction period followed by lowered earnings during the operation period of the plant.

The problem here is the AMD news could completely eliminate the savings pressing Intel back towards cash breakeven in 2022. Even in the peak 2021 year, Intel only generated $30 billion in operating cash flows, which would barely cover the higher capex and the $6 billion in dividend payouts.

The company needs to return to $10+ billion in annual free cash flow production in order to reduce the dividend payout ratio to 60% and below. Even with capex cut to $20 billion annually on the Brookfield deal, Intel would need to return to peak operating cash flows from 2021 of $30+ billion to afford this current dividend payout ratio. Our view is that Intel will struggle to generate and positive free cash flows going forward due to competitive threats from AMD.

Intel has a long way to go to return to a scenario where free cash flow covers the dividend. Once at that point, an investor should want the chip giant to improve the balance sheet with a return to a large cash position and lower overall risks.

What ultimately matters with Intel is whether the company can produce modern chips before competitors, not the level of the dividend payout. Investors focused on dividend payouts need to focus more on whether Intel produces profits, not the portion of those profits paid out to shareholders.

Takeaway

The key investor takeaway is that Intel continues to make moves like the Mobileye IPO and the Brookfield investment due to having the large dividend payout. The company appears far better poised to recapture chip prominence without the capital overhang of the large dividend payout.

In our view, the dividend should be at risk, but Intel won’t likely make a cut anytime soon. The company will continue making investment decisions around protecting capital, not maximizing profits.

Be the first to comment