Drew Angerer

This is one of the most straightforward investment thesis I’ve ever considered. I’m buying all I can of Meta Platforms (NASDAQ:META) stock today. This company invented one of the most dominant media, communications and technology platforms of all time (Facebook), and developed two others (Instagram and WhatsApp). The current headwinds are real, but they will pass and in a short period of time I feel confident that this company’s stock will reward patient shareholders.

Recent Earnings Were Bad, But…

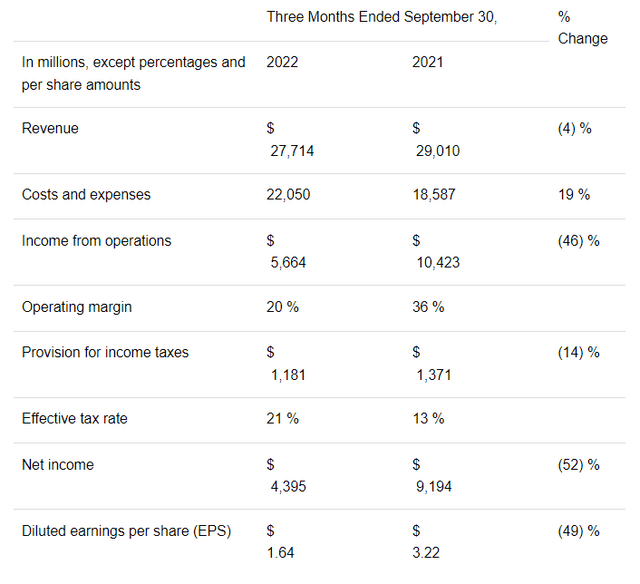

There are no two ways around it – yesterday’s earnings release was a doozy. Revenue was down slightly from the same quarter one year ago, but profits fell more than half. In addition, costs and spending on new investments in the poorly-received Metaverse project mean the company generated no free cash flow.

With all that being said, it’s easy to lose sight of the fact the company still earned over $4 billion, which was $1.64 per share:

You can either look at this kind of decline and make the assumption that this loss of earnings power is permanent and you need to value the stock lower, or you can think about what it means the company is likely to do in the future. The rapidly falling share price to under $105/share reflects the “permanent loss” view. I take a different tack.

WhatsApp Profits aren’t Reflected in earnings – But they will be!

If you live outside of the United States, Facebook’s communications product WhatsApp is a critical part of your daily life. So far, this property remains almost completely unmonetized despite the fact that it has over two billion daily users, according to the most recent conference call transcript. Recognizing the value of an asset such as this inside the consolidated financials of a public company can be frustrating because the costs are already included, but the opportunities for revenue are not reflected. Based on the east of use of the product and the ability to integrate it into people’s daily lives, I think it’s reasonable to assume the profits associated with this piece of infrastructure are worth well in excess of $10 for 1 billion users (first world, wealthy WhatsApp are more valuable than other customers because they spend more money on products sold through advertising). At a cautions multiple of 13 times earnings, this is easily a $130 billion property.

Meta’s Value is much higher than this

Now we return to the valuation of the rest of the company. The company reported Cash and Marketable Securities of $42 billion against Debt of $9 billion. Because they continue earning money, we can call that net cash “excess” and subtract it from the stock’s valuation. At $105/share, the market cap is $282 billion. I subtract the net cash to get a valuation of $250 billion.

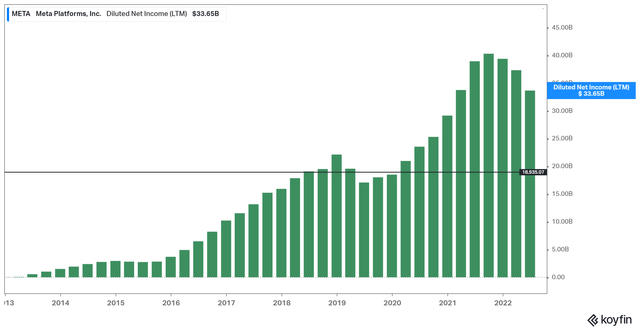

The first question to ask is, “Can Meta earn one-thirteenth of $250 billion?” This would give the company a valuation of 13 times earnings if they can produce net income of $19 billion. As you can see from this chart:

Meta Net Income History (Koyfin, Author)

Facebook has reached that $19 billion goal in the past. It’s reasonable to infer that recent earnings were driven by the response to the Covid-19 epidemic, including “stay at home” orders and stimulus. In that case, return to prior peak earnings was driven by something unlikely to occur. That being said, this number is not clearly out of the ordinary, either. As I said before, I also believe that once WhatsApp becomes more highly monetized, it could easily earn $10 billion per year for the company.

Last quarter’s earnings were still $4.4 billion. So annualizing that $4.4 billion to a “core” or “pre-WhatsApp” earnings of $15 billion, and then assuming WhatsApp earnings grow with monetization, it seems very likely to me that this company can earn my required “hurdle rate” of $19 billion in earnings within the next one, two or three years.

Considering the Risks to The Long Thesis

There are a number of reasons to be concerned about the company (if there weren’t, the stock wouldn’t be cheap!). First, earnings are clearly declining rather than growing. Second, there are meaningful changes in leadership with the departure of Sherly Sandburg and the dual-class stock structure that gives founder Mark Zuckerberg control of the company. Third, there are reasons to be concerned about societal and regulatory backlash against the company from those concerned about its influence as a platform. Fourth, video sharing apps such as TikTok pose a competitive threat in not only drawing away users and their time and attention, but also making Meta have to spend more to retain its existing customers. Fifth, as mentioned above, there are reasons to be concerned that Metaverse efforts are costly, distracting and reflect a management team that is either headed in the wrong strategic direction, or not capable of executing a major new initiative.

As described above, I’m willing to take the other side of each of these arguments for a few reasons. First of all, the economy is contracting and most businesses look like they have lower earnings potential than they used to. Someday the tides will shift and we’ll be talking about the large incumbents and their unshakeable moats. Second, many companies and leaders make mistakes – most of the good ones, learn from them and change. I’ve been impressed by the success of Mark Zuckerberg and the company he built for a long time, and I think this is just such a time that he’ll respond to by making the right corrections.

Conclusion

While the recent past looks relatively weak, that’s only true in comparison to the phenomenal success we’ve seen at this company before. We know that the headwinds are real, but I feel very comfortable taking a large position in this stock.

I’m buying Meta stock at prices below $105 share. For risk management reasons, I would consider selling some of my position at $150. Over a longer time frame, I don’t expect to sell until you start seeing sometime in the future when you see the business press laud the future comeback at this company (and its share price).

Thanks for reading. Best of luck to all!

Be the first to comment