Justin Sullivan

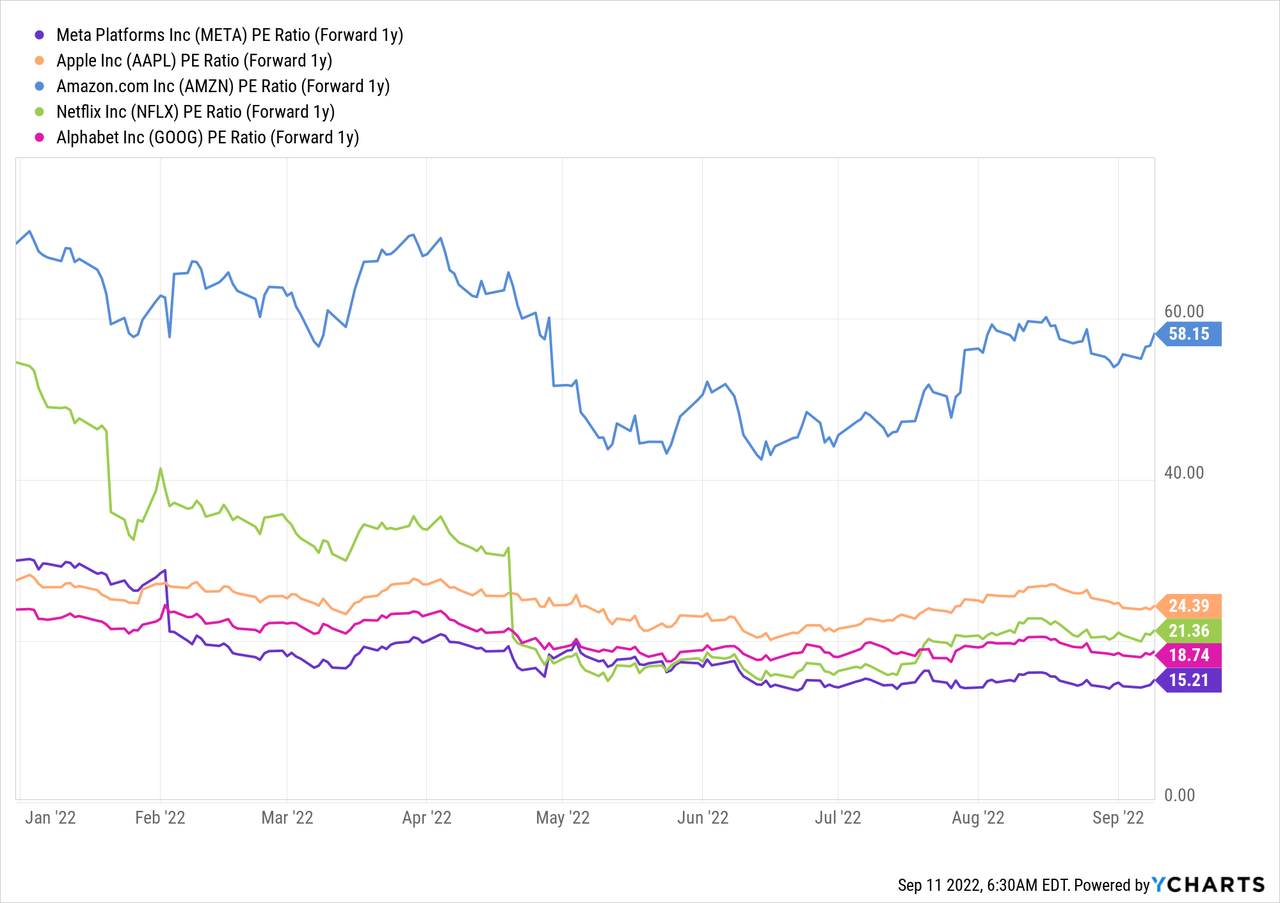

Meta Platforms (NASDAQ:NASDAQ:META) is the most undervalued technology stock of the original FAANG group of stocks with a P/E ratio of only 15X. Although Meta Platforms is facing a temporary down-turn in the advertising industry, Facebook’s large reach and clout in the ad business should lead to a rebound in growth next year. Meta Platforms’ revenue growth has been slowing down in FY 2022, but I believe the social media company is fundamentally undervalued and has a fair value around $300. Because Meta Platforms’ shares are so cheap, I believe the risk profile is heavily skewed to the upside for long-term investors!

Meta Platforms’ value: reach and free cash flow

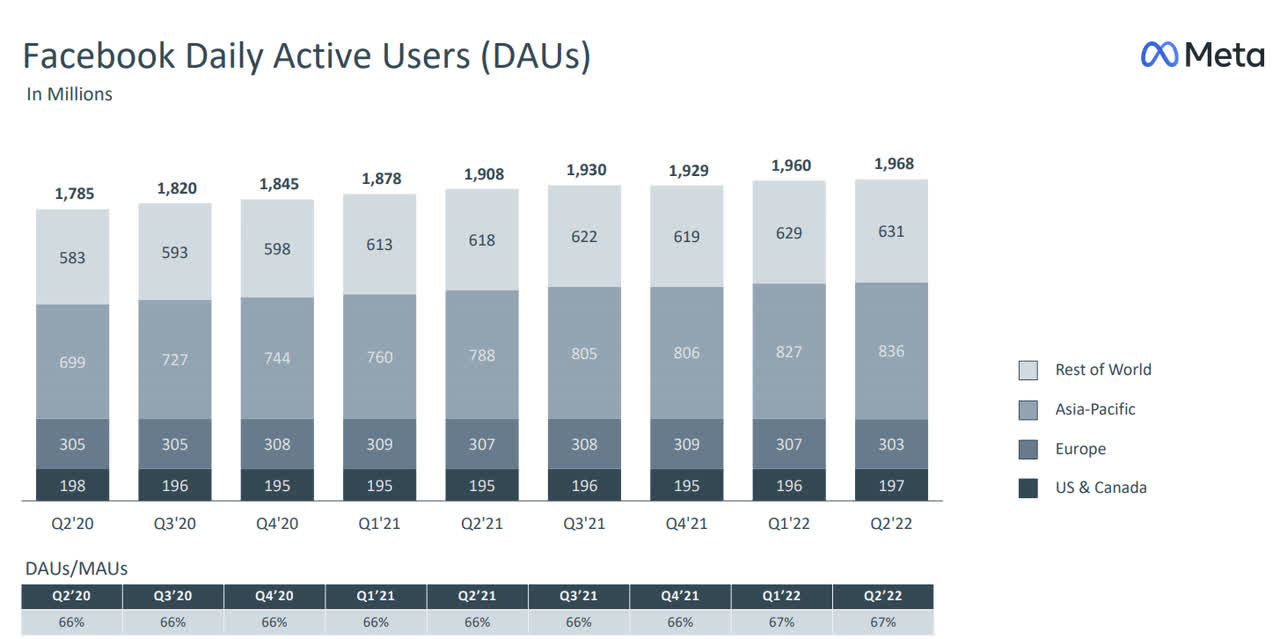

The real value of Meta Platforms lies in its unparalleled reach of its Facebook platform. In the second-quarter, Meta Platforms had 1,968 million users that logged in to the platform on a daily basis, showing 3% year over year growth. The long term trend is pointing upwards and although the platform lost some users in Q4’21, Meta Platforms is growing again…

Meta Platforms: DAU Trend

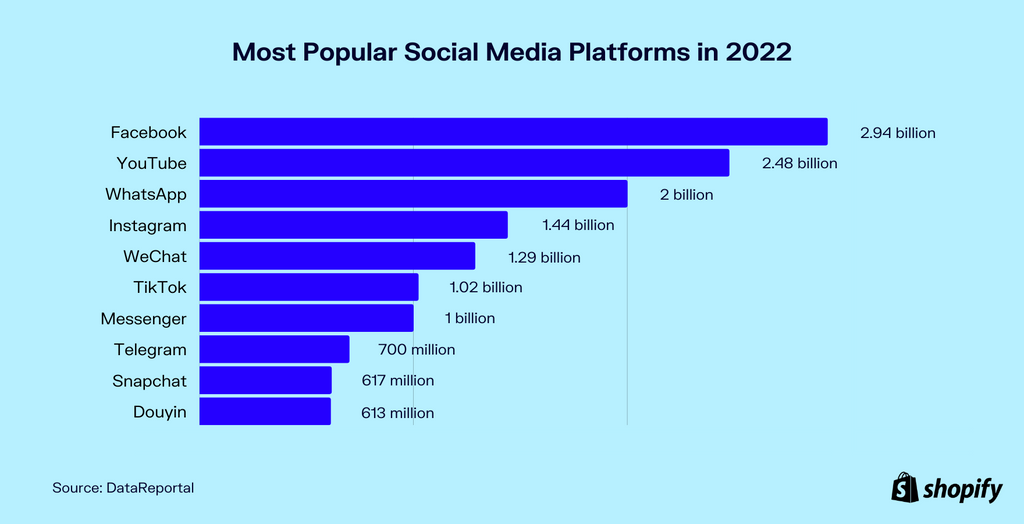

Facebook has consistently been ranked — for better or worse — as the (non-Chinese) social media platform with the largest reach, beating out rivals like YouTube and Snapchat by a long shot.

Shopify: Social Media Platforms Ranked Based On Monthly Users

For advertisers, the platforms with the largest reach are going to remain the most attractive places to spend ad budgets, for obvious reasons: platforms with the largest reach and engagement are promising the best return on ad-spend for advertisers. Although Meta Platforms is dealing with a down-turn in the advertising industry that is clouding the company’s short term revenue prospects, Meta Platforms will continue to achieve the overwhelming amount of revenues from its ad business going forward. In Q2’22, Meta Platforms generated 98% of its revenues from advertising and only 2% from other services, such as the metaverse. I wrote about Facebook’s metaverse opportunity here.

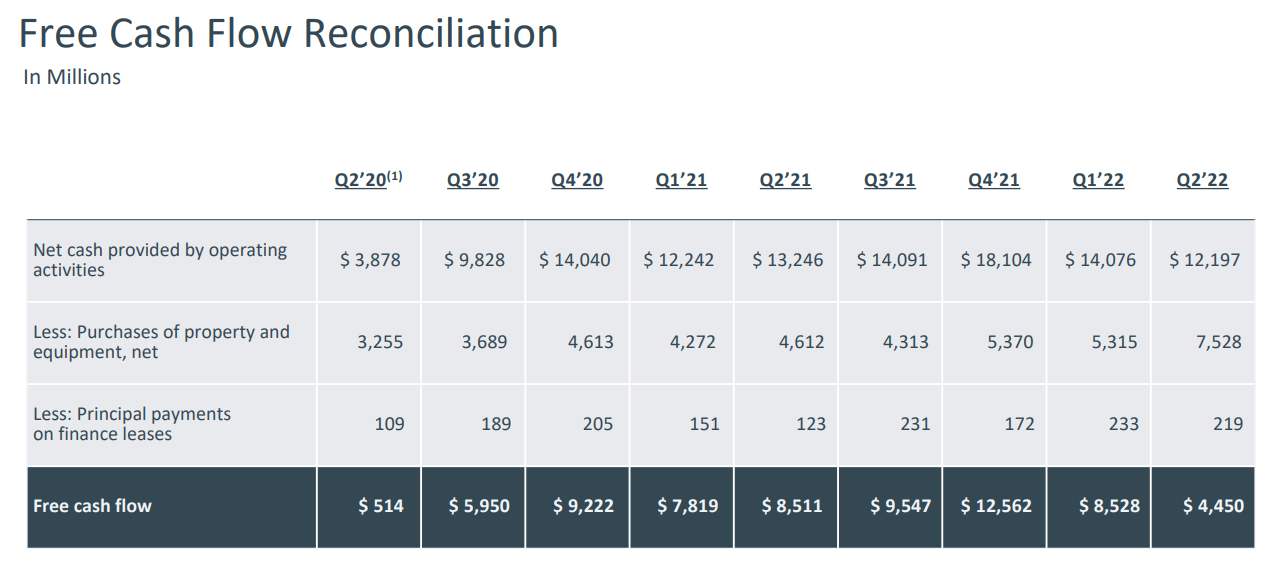

Facebook generated $114.9B in advertising revenue just in FY 2021 which represented a revenue share of 97.5% and the platform, in total, generated a massive $38.4B in free cash flow (“FCF”)… which calculated to a FCF margin of 32.6%. Due to the down-turn in the advertising market and increased investments in the metaverse opportunity, Meta Platforms’ free cash flow dropped in the second quarter to just $4.5B. Year to date, Meta Platforms generated $13.0B in free cash flow which calculates to a still very decent FCF margin of 22.9%.

Meta Platforms: Free Cash Flow Trend

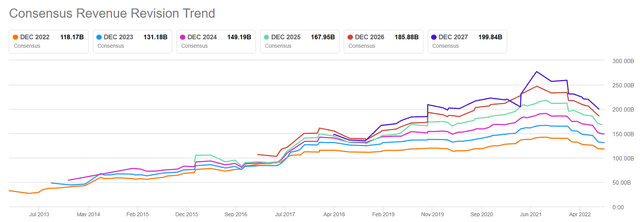

Estimates indicate a return of top line growth in FY 2023

Because of the headwinds in the advertising business and a strong USD, estimates for Meta Platforms’ FY 2022 and FY 2023 have trended down. Meta Platforms guided for third-quarter revenues of $26.0-28.5B, indicating potential for an up to 10% quarter over quarter top line drop. In part because of this guidance, there were 47 down-ward revisions for Meta Platforms’ annual revenue estimates in the last 90 days and 0 up-ward revisions. The revenue estimate for FY 2022 ($118.2B) implies 0% year over year revenue growth, but top line growth is expected to return next year. Estimates call for 11% year over year growth in FY 2023 and total revenues of $131.2B.

Seeking Alpha: Meta Platforms’ Revenue Estimates

Meta Platforms is significantly undervalued

Meta Platforms currently trades at a forward P/E ratio of 15X which is very low given the firm’s enormous free cash flow potential and large clout in the digital advertising market. Meta Platforms is also the cheapest FAANG stock with a P/E ratio of 15X.

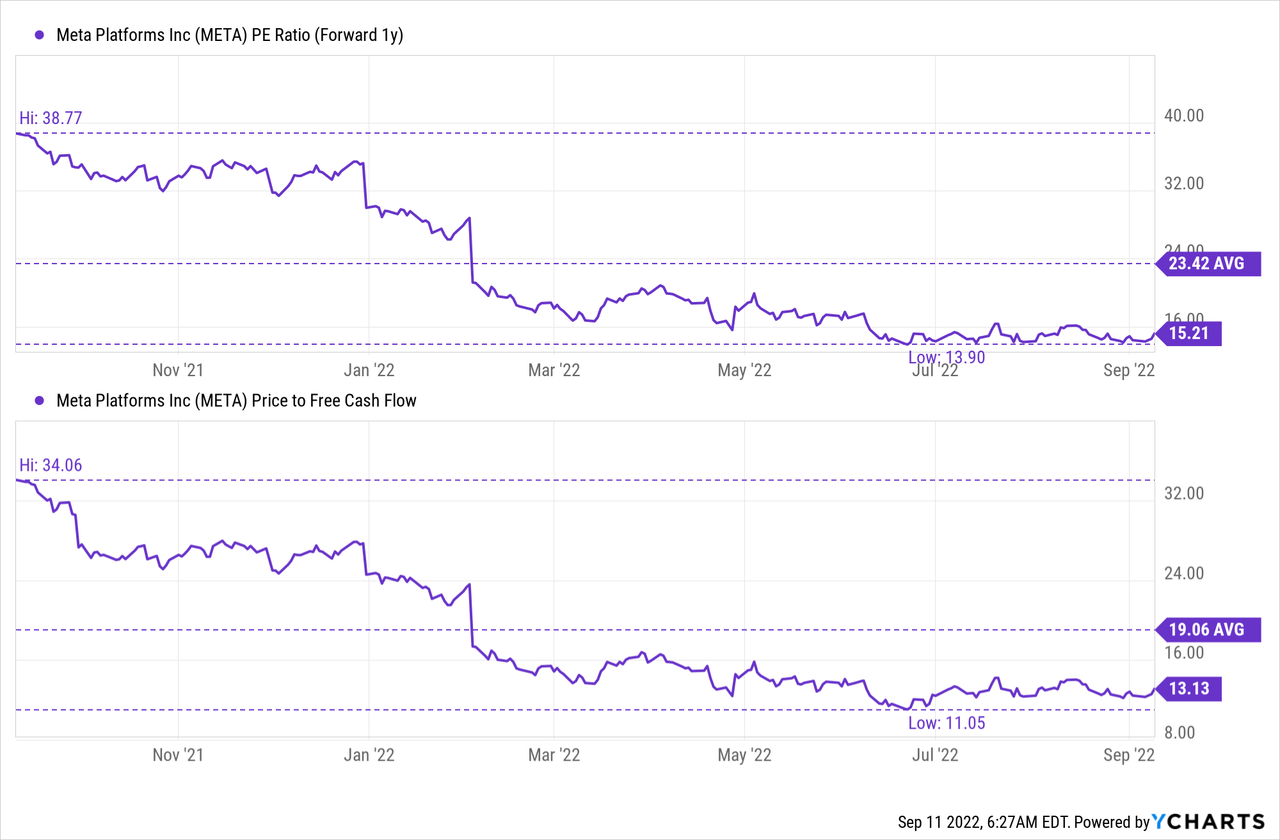

Expectations are for Meta Platforms to have EPS of $9.80 in FY 2022 and $11.12 in FY 2023 and because of META’s steep drop in pricing over the last year, shares are trading significantly below the 1-year average P/E (23.4X) and P/FCF (19.1X) ratios. If Meta’s shares were to manage to just trade at the average P/E ratio of the last year, then shares could rise up to $260, indicating 54% upside. If Meta’s shares were to manage to just trade at the average P/FCF ratio of the last year, then shares could rise up to $245, indicating 45% upside.

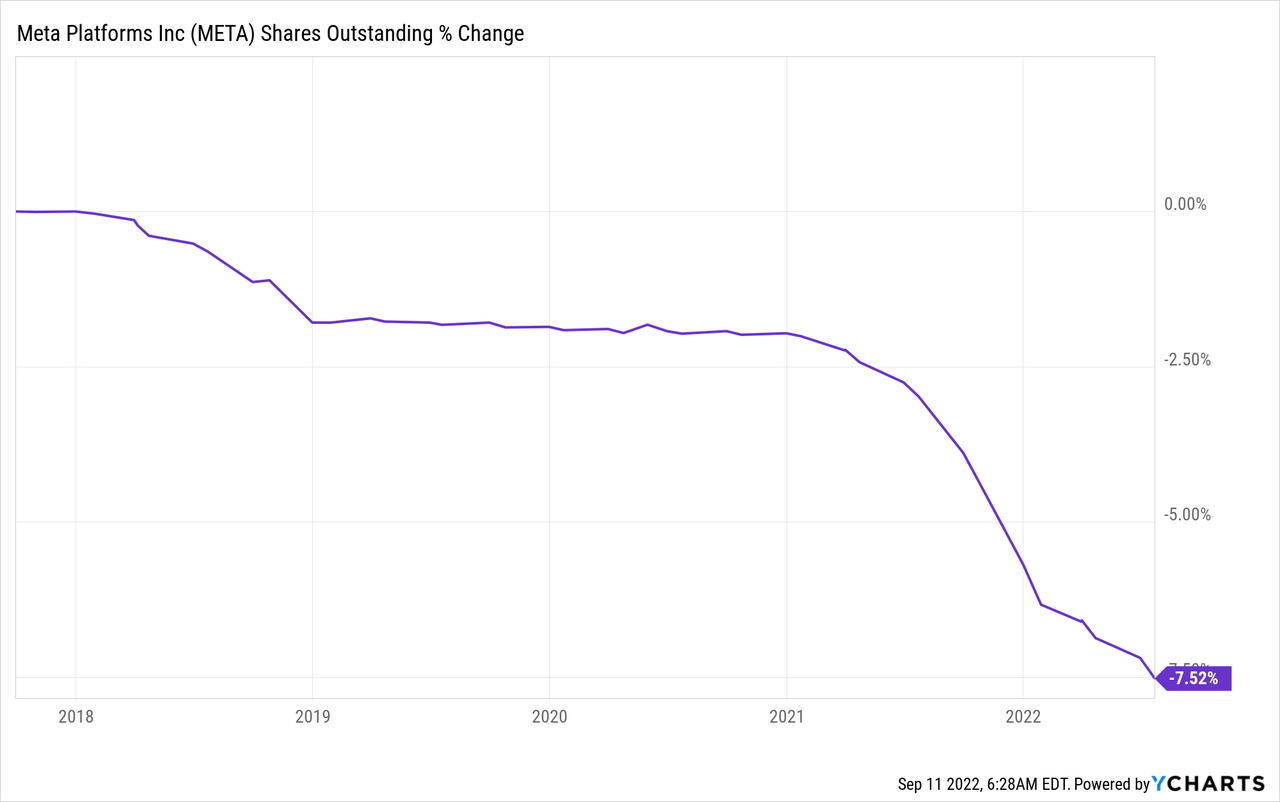

Stock buyback

Meta Platforms’ FCF prowess, softening core business and low stock price could lead to a large-scale stock buyback which I believe would be a good use of funds. Platforms repurchased $5.1B of its common stock in the second-quarter and $9.4B in the first-quarter. At the end of Q2’22, Meta Platforms had about $24.3B left on its stock buyback authorization. Over time, Meta Platforms has aggressively repurchased stock… and since Meta Platforms business prospects are trading at a discounted valuation right now, stock buybacks have never made more sense than now.

Risks with Meta Platforms

Meta Platforms’ key challenge is slowing ad-spend on the part of large advertisers. However, I believe the slowdown is only temporary because consumers will continue to use social media platforms and the value proposition of Meta Platforms lies in its unparalleled reach with close to 2 billion daily active users. Estimates also indicate that the growth slowdown is only transitory.

However, if the social media company were to lose more users to rival platforms such as TikTok or entire new social media start-ups, then Meta Platforms may see a more serious slowdown in revenues and free cash flow. What would change my mind about META is if the company fundamentally lowered its outlook for Q4 revenues in late October and free cash flow margins dropped materially.

Final thoughts

The market is wrong in pricing shares of Meta Platforms at only a 15X P/E ratio. I believe that shares of Meta Platforms are way too cheap here, given the amount of free cash flow the platform generates and given the value the social media company still represents to advertisers. Revenue estimates for next year also indicate that Meta Platforms is going to see a nice rebound in top line growth.

Meta Platforms’ value lies in its reach and free cash flow, as well as its potential for stock buybacks which could get ramped up since shares are so cheap. Out of all the FAANG stocks, Meta Platforms offers the deepest value, I believe, and also the biggest rebound potential!

Be the first to comment