Justin Sullivan

The investment thesis

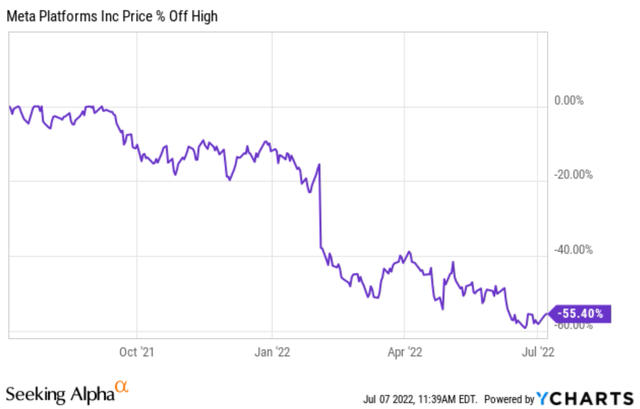

The stock price of Meta Platforms, Inc. (NASDAQ:META) has declined by more than 1/2 since its peaked last year. As you can see from the following chart, its share price fell by almost 60% off its 52-week high and currently is 55% below. The major drivers for such decline were a combination of three factors in my view.

- The stock was in a bubble regime at a P/E of ~38x during 2021 and 2022 when its price peaked. So, a sizable correction was inevitable. it is just a matter of if it comes as a soft-landing or a hard-landing;

- A broader market correction; and

- Finally, its business fundamentals indeed face some headwinds such as slowed user growth, lower monetizing rates, and privacy changes to Apple’s iOS system.

The bubble has completely burst by now. As a matter of fact, it is overdone in my view. The market is notorious for its overreactions, especially at the fear or greed extremes of sentiment. Looking forward, now I see a business with healthy growth prospects priced as a permanently stagnating one according to Buffett’s 10x EBT rule, as detailed immediately below.

META and Buffett’s 10x pretax rule

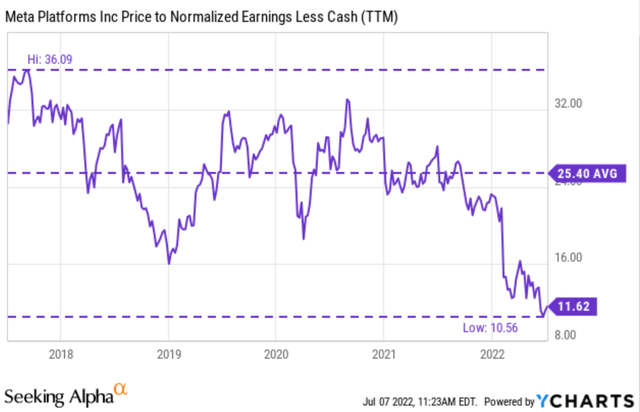

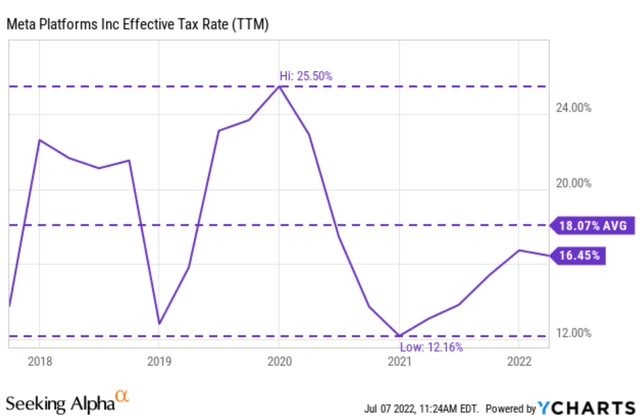

The first chart below shows META’s PE valuation adjust for its cash position. And the second chart shows its effective tax rates. From the first chart, you can see that its valuation peaked above 32x P/E adjusted for cash in during 2021 before the plunge to the current level of 11.6x. And from the second chart, you can see that its current effective rate is about 16.4% and the long-term average is about 18.1%.

Its tax rates in the quarter of 2022 are about 16%, and its CFO expects the full-year 2022 tax rate to be above the Q1 rates and in the high teens (barring any changes to U.S. tax law). Thus, applying the long-term effective rates of 18% to the 11.6x P/E, it is currently for sale at only about 8.4x pretax earnings (also referred to as EBT in this article), which brings us to Buffett’s rule of 10x EBT.

According to this rule, even if META stagnates forever, by paying 8.4x EBT, the investment would already provide about 11.9% pretax earnings yield, comparable to an 11.9% yield bond. And to be seen next, META has a healthy prospect to grow.

In case you are new to Buffett’s 10x EBT rule, I have a free blog article to provide all the details plus all the Q&A I’ve received. A quick summary to facilitate the ease of reference:

- Buffett paid ~10x pretax earnings for many of his largest and best deals (ranging from Coca-Cola, American Express, Walmart, Burlington Northern, and also the more recent AAPL purchase). It is hardly a coincidence because buying a business that stagnates forever at 10x EBT would already provide a 10% pretax earnings yield, directly comparable to a 10% yield bond. Any growth is a bonus.

- The 10x EBT rule does NOT mean you should go out and buy every/any stock that is priced below 10x EBT. Investors face two primary risks: A) quality risk or value trap, and B) valuation risk, i.e., paying too much. The 10x pretax rule is mainly to avoid the type B risk AFTER the type A risk has been eliminated already.

- Then how do we eliminate type A risks? I look for three things primarily. First and second, the business should have no existential issue in short term and the long term. And third, the business should have a decent chance to grow (at the so-call perpetual growth rate). This will be a plus.

So with this framework, let’s examine META more closely.

META: does it have any short-term existential issues?

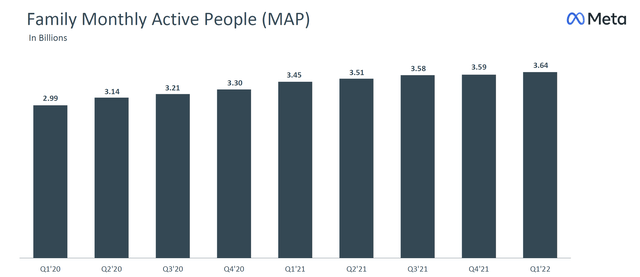

With META’s market-leading position and the robust demand in digital ad, I do not see any short-term survivability issues at all. As a matter of fact, it just delivered a healthy 2022 Q1. There are signs of pressure ahead an operating margin contracted from 43% a year ago to 31% (to be elaborated on later). But overall, the business raked in $27.9B of total revenue, a healthy 7% growth YoY. And key operating metrics are stable. Key metrics such as family daily active people, family monthly active people, and Facebook daily active users all improved in the mid-single-digit range of 3 to 6% YoY.

Looking ahead, there are challenges ahead (such as cost control and heavy CAPEX requirement) but again I see no concern of existential issues at all. The CFO’s outlook commentary provides a good summary of these challenges to the outlook in the near term (abridged by me):

We expect second quarter 2022 total revenue to be in the range of $28-30 billion. This outlook reflects a continuation of the trends impacting revenue growth in the first quarter, including softness in the back half of the first quarter that coincided with the war in Ukraine… We expect 2022 total expenses to be in the range of $87-92 billion, lowered from our prior outlook of $90-95 billion… We expect 2022 capital expenditures, including principal payments on finance leases, to be in the range of $29-34 billion, unchanged from our prior estimate.

META: does it have any long-term existential issues?

In the long term, the existential issue ultimately is largely a subjective judgment. My view is that META does not have any existential issues in the long term. On the opposite, I see healthy growth prospects for META. The advertising world is shifting toward digital ads unstoppably. 2022 is poised to mark a major milestone in this shift. It is very likely the first time that digital ad spending exceeds traditional ad spending, according to an eMarketer’s forecast. And by 2023, the forecast projects digital ads to surpass two-thirds of total media spending. And META is a leader in this space despite its slower growth (followed by Google). Its market share of 34.9% leads Google’s (GOOG, GOOGL) 27.7% by more than 7%.

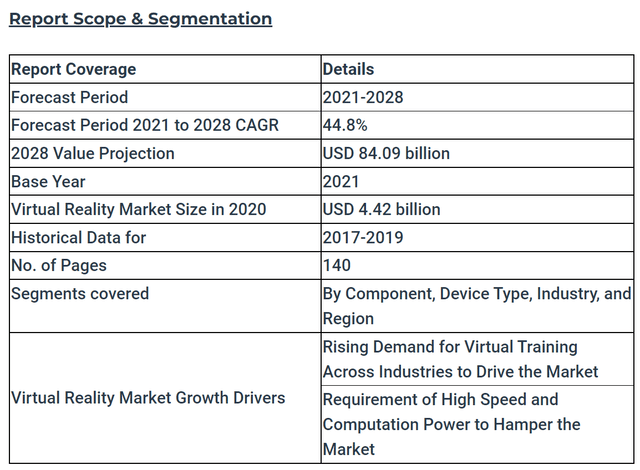

Virtual reality presents another high-growth area for META. According to the following Globe Newswire report, the market size is projected to grow at an explosive rate of 44.8% CAGR. The current total market is admittedly small and META Reality Labs are still in their early phase. However, the growth prospects are explosive. At 44.8% CAGR, the virtual reality market would reach $84 Billion in 2028. And META is investing aggressively in this space and is well-positioned to capitalize on this growth as discussed next.

META: what are its perpetual growth prospects?

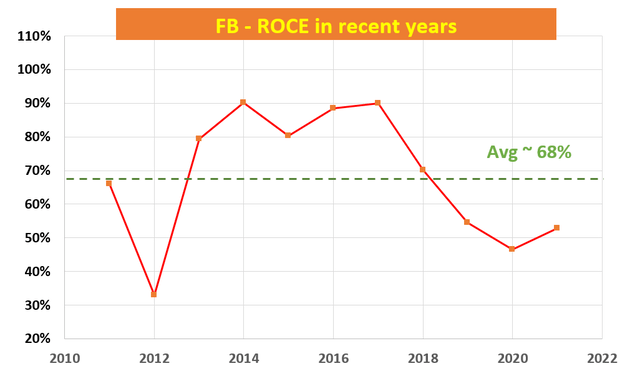

As detailed in my free blog article, in the long term (like 10 years or more), the growth rate is simply given by: Longer-Term Growth Rate = ROCE * Reinvestment Rate, where ROCE stands for the return on capital employed.

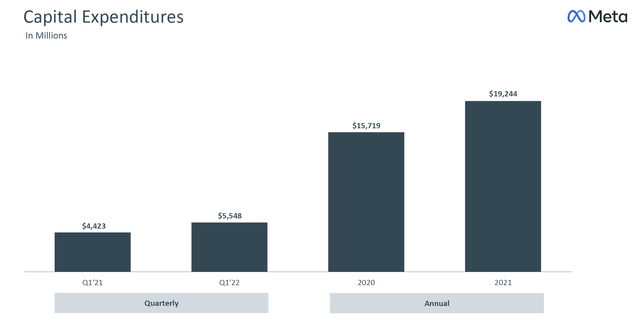

So in the long-term, the key drivers are reinvestment rate (i.e., CAPEX expenses) and ROCE. In terms of CAPEX investments, META has been spending aggressively to pursue futuristic technologies such as virtual reality. As seen in the chart below, it has been spending an enormous amount of CAPEX in recent years: $15.7B in 2020 and more than $19.2B in 2021. Looking forward, its 2022 total CAPEX expenses are expected to be even higher, in the range of $29-34 billion.

In terms of ROCE, as seen from the second chart below, META was able to maintain a spectacular ROCE between 80% to 90% during its golden years between 2014 and 2017. And you can see the headwinds it has been facing since then. The ROCE decrease sharply to less than 50% in 2020 and currently is about 55%. It is not only substantially below its peak level but also below its long-term average of 68%.

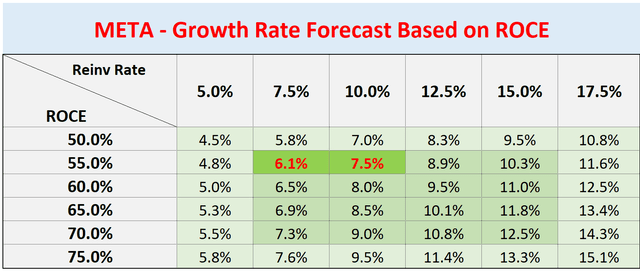

However, two key observations here. First, note that a 55% ROCE is already very competitive even among the FAAMG group (whose average ROCE is about 50% to 60%). And second, note that a 55% ROCE, combined with a reasonable reinvestment rate, can already deliver healthy and sustainable growth in the long term already as you can see from the table below.

Source: author and Seeking Alpha.

With its projected CAPEX spending in the $29B to $34B range, its reinvestment rate is estimated to be about 7.5% to 10%. And assuming its ROCE is permanently stuck at its current low level of 55%, its earnings will already grow in an upper-single-digit range already. For example, a 10% reinvestment rate combined with 55% ROCE can drive 5.5% real growth rate (10% reinvestment rate * 55% ROCE = 5.5%). Note the estimates in the table are nominal growth and include an inflation escalator of 2%.

Now to put the pieces together and conclude:

- META is currently for sale at about 8.4x FW EBT adjusted for cash, equivalent to an 11.9% yielding equity bond;

- At the same time, there is a good prospect of 6%~7.5% long-term growth. This is the growth rate that can be funded organically and sustainably given its healthy ROCE of 55% and reinvestment rates of 7.5% to 10%; and

- So an investment here is similar to owning a bond with a ~11.9% yield and at the same time with the coupon payment increase of 6% to 7.5% per year, leading to a very favorable odds of upper double-digit return.

Final thoughts and risks

The current mispricing in META is too large to ignore. It is currently priced at 9.65x FW pretax earnings and only around 8.35x when its cash position is adjusted. Under such a valuation, it can already provide an 11.9% pretax yield even if it stagnates permanently. Yet, I see healthy growth prospects given its competitive ROCE of around 55% and sustainable reinvestment rate. There are even explosive growth opportunities in the virtual reality space, which is not really necessary for the thesis but provides substantially upside optionality.

Finally, risks. META is currently facing a range of risks, some macroscopic and some unique to its own operations. As aforementioned, major macroscopic risks include the uncertainties created by the war in Ukraine. Its margin is under pressure due to lower monetizing rates and higher expenses due to labor shortage and inflation. The Reality Labs are in their early stage and will require continued substantial investment. For example, its 2022 total expenses are projected to be in the range of $87-92 billion, slightly lower than the prior outlook of $90-95 billion but significantly above the level from a year ago. And the expenses are largely due to the Family of Apps segment and the Reality Labs.

Be the first to comment