Kelly Sullivan

Meta Platforms (NASDAQ:META) has lost more than 60% of its value this year, making it one of the hardest hit stocks as it grapples with both souring market sentiment and internal operating challenges. Despite its robust chequebook, rising concerns over the company’s decelerating growth, user decline, and capital intensive metaverse vision have been viewed as major drawbacks.

However, the long-term gains that we had alluded to in a previous article may be finally starting to show. Meta’s yearslong investment in AI/ML developments are starting to payoff, as advertisers start to show interest in its new products.

Advantage+ (previously known as Dynamic Ads), a recently introduced portfolio of AI/ML-enabled ad distribution tools for advertisers and small- and medium-sized business (“SMB”) owners, now enables lower cost per purchase conversion while also driving improved ad delivery to relevant users, driving effective engagement and conversion rates. Not only does it address the roadblock faced by its targeted ads business after Apple (AAPL) severed a critical user data pipeline through App Tracking Transparency, the additional cost-savings enabled by Advantage+ are also drawing appeal from advertisers looking to maximize their returns on ad spending (“ROAS”) as they turn cautious amid a looming economic downturn. Advantage+ also allows recession-prone SMBs, which represent a substantial portion of Meta’s advertising customer base, to take advantage of the simplified ad creation and delivery process, leverage Meta’s massive first-party data base, and draw additional business via an effective yet low-cost channel.

Continued development in the arena of effective AI/ML-driven automated advertising is expected to help Meta wean off its reliance on targeted ads – which was once a core business to Meta that has since lost its luster as a result of Apple’s signal-loss headwinds – and restore hope for renewed growth in the near- to medium-term by maintaining its credibility as a leading digital advertising platform. And over the longer-term, we expect Meta’s digital advertising business to benefit from its ongoing development of AI/ML-enabled “Privacy-Enhancing Technologies” (“PETs”), which will ultimately drive more relevant ad delivery to users and better performance measurement to advertisers, while using less data.

Now trading at under 3x forward sales, Meta remains one of the cheapest stocks on the market that boasts profitable growth still. The increasing effectiveness of and take-rate for its new advertising formats also implies positive progress in Meta’s navigation through near-term operating challenges, bolstering its core free cash flow engine. This accordingly creates a compelling case for the stock as a long-term investment with favourable risk/reward trade-offs at current levels.

What is Advantage+?

Formerly known as Dynamic Ads, Advantage+ is a portfolio of different AI/ML-enabled tools that support end-to-end advertising solutions – from simplified ad creation to automated ad delivery. Some of the key advertising tools included in Advantage+ include:

- Advantage+ Creative: The feature allows advertisers and/or SMB merchants to create different variations of a particular ad that is then deployed on a personalized basis by Meta based on viewers’ preferences and response. The function automatically generates different variations of an ad created by the advertiser to optimize ad performance (e.g. clicks, conversions, purchases) and improve costs.

- Advantage+ App Campaigns: The feature is essentially the automated equivalent of manual app ads enabled by AI/ML capabilities. Advertisers are subject to a simpler ad campaign creation process under Advantage+ App Campaigns, which require “fewer inputs and only one ad set with ability to bulk create ads”. Then, AI/ML is used in the ad placement and delivery process – it is first broadcasted across Meta’s various distribution channels (i.e. Facebook, Messenger, Instagram, and Meta Audience Network) based on initial audience targeting inputs submitted by the advertiser, then further optimized by expanding to “better performance opportunities outside the defined audience”.

- Advantage+ Shopping Campaigns: Advantage+ Shopping Campaigns was officially rolled out and made available to all advertisers/merchants in August 2022 following a successful beta test run. The advertising tool is a one-stop-shop that “automates up to 150 creative combinations at once” – meaning instead of manually creating 150 ads, a single ad set can now be automatically turned into 150 different ad variations. The tool targets e-commerce and retail advertisers by using AI capabilities to simplify and lower the costs of ad campaign creation via automation. Ad delivery and placement is “powered by new ML models” similar to the one implemented by Advantage+ App Campaigns – ads are first distributed based on advertisers’ initial audience targeted inputs, then optimized by expanding to other relevant audiences.

- Advantage+ Placements: Implemented in Advantage+ App Campaigns and Advantage+ Shopping Campaigns, Advantage+ Placements uses AI/ML to deploy ads based on advertisers’ targeting inputs “in as many places as possible across Facebook, Messenger, Instagram, and Meta Audience Network” to optimize reach and engagement.

- Advantage Lookalike: Using AI/ML capabilities, Advantage Lookalike draws on advertisers’ audience targeting inputs (i.e. Custom Audience), and finds a “lookalike audience” that is determined to improve ad performance.

- Advantage Detailed Targeting: Similar to Advantage Lookalike, Advantage Detailed Targeting also aims at expanding ad reach to improve performance and ROAS. Advantage Detailed Targeting, which delivers ad to a relevant audience beyond advertisers’ Custom Audience, is automatically activated when it “determines that doing so could improve performance”. For instance, if the advertiser selects an age group between 18 and 25 years old as the target audience input, and Meta’s system finds that the ad is better received by the age group 25+, then Advantage Detailed Targeting will expand ad deployment to the latter age group which is outside of the initially defined audience to improve overall ad performance.

What Problems do Meta’s Advantage+ Address?

The new and improved Advantage+ ads primarily address two immediate headwinds that Meta currently faces – namely, Apple’s signal loss and the near-term slowdown in ad spending amid looming recession risks.

1. Countering Apple’s ATT Update

The effectiveness of Meta’s digital advertising business remains a key focus area for investors after Apple rolled out ATT with its iOS 14.5 software update in April 2021, and severed access to critical user data. Earlier this year, Meta disclosed that it expects to lose $10 billion in ad sales this year as a direct result of Apple’s signal loss, which is consistent with the market estimated range based on current ATT opt-in rates:

An independent research carried out by Branch – a company specialized in analyzing mobile app performance – has indicated that the iOS 14 changes could reduce Facebook’s ad revenues by 7% if 20% of the operating system’s users agree to be tracked; and if only 10% of users grant tracking permission to Facebook, the company’s ad revenues could reduce by as much as 14% in the near-term.

Source: “Never Mind The Regulatory Headwinds, Facebook Is Slated For Unstoppable Growth“

Looking ahead, Meta’s upcoming 3Q22 earnings release will be a tell-tale to whether it has what it takes to weather the storm ensuing from Apple’s signal loss. Specifically, the company’s 3Q22 results will mark its first full quarter coming off of tough pre-signal-loss comps – any y/y improvement to ad sales will suggest effectiveness of its new campaign deployment and performance measurement tools implemented to date. And Advantage+ just might be the near- to mid-term lifeline for Meta’s digital advertising business.

The common thread among the different Advantage+ ad tools is that they benefit from reduced reliance on user data transmitted by Apple and bypasses signal loss, which Meta’s targeted ads business had almost solely relied on previously. As mentioned in a previous analysis on the stock, Meta has implemented “Aggregated Event Measurement” to allow the measurement of web activities from iOS 14+ users (i.e. post Apple signal loss), and better pinpoint the delivery of targeted ad placement. For the implementation of Advantage+ ad deployment for a business’ app, where access to in-app user data is blocked by Apple’s App Tracking Transparency (“ATT”) feature without user consent, engagement from users of iOS 14.5 or later Apple devices will be redirected to the business’ website to better capture conversion events and improve measurement via Aggregated Event Measurement.

The effectiveness of Advantage+ in partially compensating for challenges stemming from Apple’s signal loss is further corroborated by positive user feedback. Close to half of Advantage+ users recently surveyed by RBC Capital Markets is “seeing [key performance indicator] improvement around campaign performance…, while half of those that reported ROAS improvement attributed it to Advantage+”. Though the new advertising formats are still in early stages of reaching advertisers (since some had only recently completed beta testing and entered market availability in August), the positive feedback received to date implies Meta may be back on track to restoring its credibility as a leader in effective targeted advertising after a tumultuous year, and outperform other app-based digital advertising peers (e.g. SNAP / PINS) that have been affected by ATT.

2. Countering the Market Slowdown

As a social media platform where much of its free cash flow is generated from the cyclical advertising business, Meta is also reeling from growing macroeconomic headwinds. Waning consumer sentiment amid surging inflation and tightening macroeconomic conditions have caused advertisers to become more cautious about their ad spending, with many looking for maximized ROAS:

Leading media intelligence MAGNA Global has trimmed its prediction on global ad spending growth this year from 12% to 9% amid growing risks of a structural economic downturn later this year. This compares to global ad spending growth of +23% year-on-year in 2021 (U.S. +26% y/y), buoyed by a brief stint of post-pandemic economic recovery.

Source: “Microsoft Stock: Is Now A Good Time To Buy, Sell, Or Hold?“

But Advantage+ might be the solution to partially shielding Meta from said challenges. Advantage+ Shopping Campaigns, which was launched in August 2022, has already received favourable feedback from customers, with many citing the ad format’s capability in enabling improved economics. According to Meta, the newly introduced ad format has already proven to drive “12% lower cost per purchase conversion compared to advertisers’ Business as Usual ads”, which refer to the generic day-to-day marketing that can be easily updated.

This is further corroborated by street consensus – half of the advertising agencies recently surveyed by RBC Capital markets have observed “noticeable cost per action improvement on the order of 10% to 15% per campaign”. The improved economies are also “estimated to bride over half the impact generated by the Apple signal loss”, which was music to advertisers’ ears given sweeping inflationary pressures that have arrived at the doors of almost every industry. Advertisers that have benefited from improved economics with Advantage+ have credited effectiveness in new AI-enabled features, such as automated ad creation and expanded audience placement as discussed in the earlier section, for the cost savings. This gives Advantage+ the upper hand in competing for ad dollars under today’s dour market climate, as advertisers look to budget-friendly, yet effective, alternatives.

And as mentioned in a previous coverage, SMBs make up a meaningful portion of Meta’s ad sales customer base. SMBs are more recession-prone, and are first to cut back on spending amid macro headwinds. But Advantage+ has proven its case for cost-savings while enabling effective engagement and ad delivery, making it an attractive option for SMBs looking to broaden their business’ reach. Paired with Meta’s decision to reduce its ads pricing by as much as 14% this year to attract better take-rates, the company is expected to salvage demand from its core SMB client base.

Revisiting the Fundamentals

Coming off of a tough 1H22 with rapid deceleration and declines in revenue growth due to both idiosyncratic and macro headwinds, Meta is expected to benefit from several tailwinds in 2H22 – ramping up Advantage+ take-rates, holiday-driven ad demand, and rolling off of tough pre-signal-loss comparables.

Instead of earlier consensus estimates for full year revenue declines for the first time in Meta’s history since becoming a public company, the company just might be able to end the year flat. This is further corroborated by improved ad spending sentiment in 3Q22 that has “largely persisted into Q4”. Specifically, industry already observes an uptick in pre-holiday ad demand in October as businesses prepare to capitalize on an earlier-than-usual holiday shopping season this year with consumers looking to prevent a last-minute scramble due to supply chain snarls and take advantage of sales amid surging inflation. We expect Advantage+ sales to have a more evident impact on Meta’s fundamental performance through 2023 as take-rates continue to ramp-up, with improved market share gains driven by its pricing advantage.

As such, we are maintaining our previous forecast for y/y revenue growth of approximately 1% at Meta this year, which would be consistent with expectations for inline to slightly better-than-expected ad sales in 3Q22, alongside modest sequential growth into 4Q22 based on “conservative optimism” recently observed across advertisers. 4Q22 consolidated revenue growth assumptions also takes into account modest growth expectations in Reality Labs revenues due to anticipated emulation of last year’s seasonal demand for Quest headsets. Meanwhile, net income is expected to decline in the current year to $28.3 billion, which is consistent with expectations for higher opex to support ongoing metaverse investments, partially offset by cost-cutting measures, such as hiring freezes, headcount reductions and budget decreases, recently implemented across administrative disciplines.

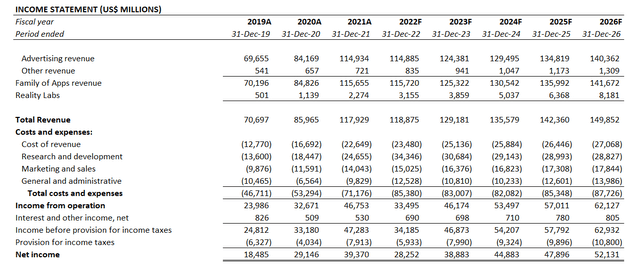

Meta Platforms Financial Forecast (Author)

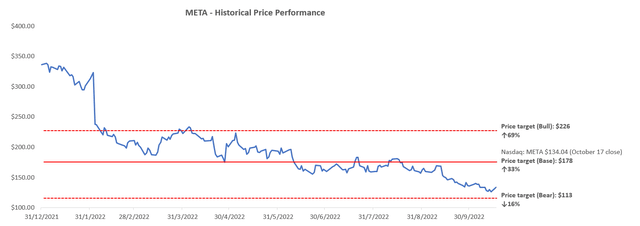

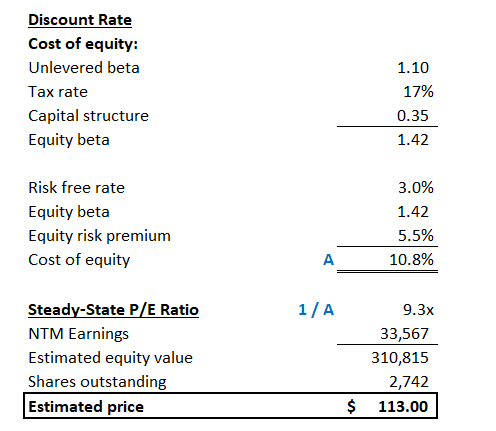

On the valuation front, we have revised our previous 12-month PT of $226 as the bull case. Our base case PT is now $178, with bear case PT being $113.

Meta Platforms Valuation Forecast (Author)

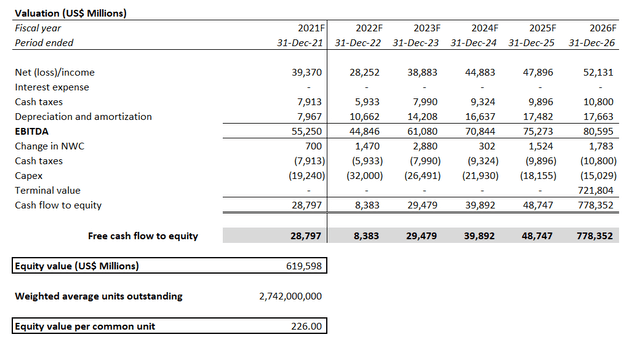

- Bull case $226: The bull case PT is consistent with assumptions applied in our previous forecast performed using a discounted cash flow (“DCF”) analysis in conjunction with the fundamental projections discussed in the earlier section. A modest 2.8% perpetual growth rate is applied to reflect Meta’s anticipated long-term growth as one of the dominant market share holders in digital ads.

Meta Platforms Bull Case Valuation Forecast (Author)

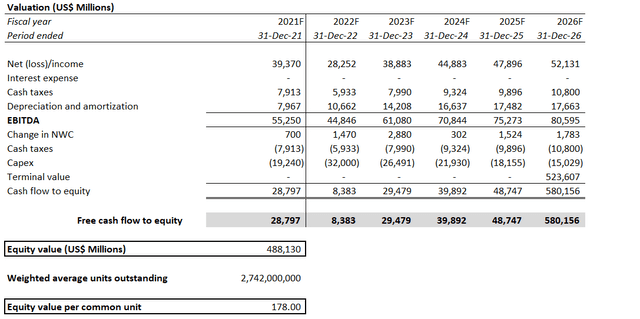

- Base case $178: The base case PT is derived by applying a conservative 0% perpetual growth rate in the DCF analysis. We have applied this growth rate in the base case forecast to reflect investors’ skeptical sentiment still over Meta’s near-term growth prospects. Meta’s success in digital ads is not only a result of its innovative technology developments, but also its sprawling reach. Yet, the latter has seen both deceleration and declines earlier this year due to rising competition from rival social media platforms such as TikTok. Under the assumption that Meta fails to stem its loss of share in users’ screen time in the near-term, its core business driver – namely, ad sales – will remain muted, hence the 0% perpetual growth assumption applied in our revised base case valuation analysis. The base case PT of $178 still represents upside potential of more than 30% based on the shares’ last traded price of $134.04 apiece on October 17, implying that Meta is oversold at current levels.

Meta Platforms Base Case Valuation Forecast (Author)

- Bear case $113: The bear case PT is computed by applying a forward P/E ratio of 9.3x. The P/E assumption is derived based on the formula “1 divided by cost of equity” to gauge Meta’s steady-state valuation, which represents the company’s estimated intrinsic value when it reaches a point of indefinitely sustained profits , where any “incremental investments will not add, nor subtract, value”. The bear case PT is expected to represent Meta’s value at status quo, assuming it will retreat from being a market leader in digital ads and its metaverse vision does not materialize as expected. This is in line with recent observations of “slower-than-projected growth” in sign-ups for Horizon Worlds, Meta’s virtual world, which underperforms rival Roblox’s (RBLX) better-than-expected sign-up volumes observed in the third quarter. We expect Meta’s stock to find support at $113 at the bear case, even considering near-term macroeconomic deterioration which has been factored in the computation of its cost of equity used in deriving the steady-state P/E ratio applied.

Meta Platforms Bear Case Valuation Forecast (Author)

Meta_Platforms_-_Forecast_Financial_Information.pdf

Final Thoughts

Skepticism remains high heading into Meta’s upcoming 3Q22 earnings release, with investors hungry for an update on whether it can stave off losses in its share of users’ screen time to competition, weather the near-term macro storm hovering over its core advertising business, and sustain its costly metaverse ambitions over the longer-term. However, positive industry sentiment and feedback on Advantage+ offers some reprieve to Meta’s tumultuous year in dealing with Apple’s signal loss, making it a potential spotlight in its upcoming earnings that might be able to hold the stock from further declines.

Based on the foregoing valuation analysis, we believe the Meta stock remains in oversold territory. Considering the recent rally in financial stocks despite mediocre overall performance and a cautious tone on forward prospects, we believe markets are starting to bridge the distance between the overvalued and oversold – namely, stocks that have been oversold in 1H22 will experience some relief if the company can deliver any sort of fundamental improvement, while those that are still maintaining lofty valuations amid this year’s selloff will be held against higher expectations. With Meta being in the oversold cohort, we expect any good news to be a sufficient reason to draw up a potential rally in the near-term.

Be the first to comment