Justin Sullivan

Today I will be revisiting (NASDAQ:META), wherein I will work through a few points of discussion and analyze the company’s most recent Q3 earnings report. All dollar values depicted in figures are in millions of USD.

Over the course of the last few weeks, I feel like the most frequently talked about equity on Fintwit has been Meta. Whether that be with the exposé of sorts on the company’s Horizon Worlds efforts, the host of individuals, both high-profile and otherwise, offering their suggestions for the financial path the company should be taking, or the company’s poor earnings report, saying that Meta has maintained a certain degree of notoriety would be an understatement.

With all of that being said… what exactly is worth diving into?

The first thing I believe warrants discussion is the thought-piece Packy McCormick put forward a few weeks on Meta’s Innovator Dilemma. Taking inspiration from the revered work of Clayton Christensen, Packy outlines the inherent characteristic of disruptive technologies, particularly how they start off looking like unproductive toys, but occasionally grow to heights that blow incumbent tech companies out of the water.

Packy goes on to provide the example of Kodak (KODK), a company that reached dazzling heights at a $30B market cap, a value that has now sunk to approximately $300M, tarnished by technological disruption and the recent memeifcation seen during the pandemic trading era. The digital camera started off to many as an unproductive toy, and despite Kodak patenting the original design for the device, the company ended up shuttering it to focus on the maintenance of short-term-oriented financial targets and margins. Would the company have been better off sacrificing short-term financial well-being to focus on the development of a technology that changed the world? With the benefit of a rearview mirror, yes. At the time, however, therein lies The Innovator’s Dilemma.

Another example I couldn’t help but think of was Intel (INTC). This tech company has not completely bitten the dust yet, however, once upon a time they were arguably one of the most important components of the semiconductor industry, flourishing as they combined their expertise in both the design and fabrication of chips to design and distribute innovative technology to the world. Over the last few years, the company has arguably fallen victim to their management team living in a spreadsheet, and we have seen the organization start to flounder against competitors that were once miles behind. Again, therein lies the dilemma – do you sacrifice short-term financial prosperity to continue to innovate the leading edge or do you rest on your laurels and eventually fall behind? Technological progress waits for no one.

The prioritization of margins, though often resulting in the successful appeasement of shareholders in the interim, may often result in the detriment of a company overall, since they are not able to keep up with the ever-expanding world of technology. Meta today faces that same issue. It is clear the company is spending hand over fist in order to make this metaverse dream a reality, and it will likely take a decade for investors to even get an inkling of whether or not these efforts have been effective. As Packy states in conclusion, we are watching the Innovator’s Dilemma play out in real time and it will continue to be fascinating to monitor going forward.

What was failed to be mentioned within this short essay was how the book’s author, Clayton Christensen, actually proposes going about said dilemma. More specifically, Christensen suggests that the company should assemble the smallest team possible to continue to work on a piece of technology that is being deemed silly to many, keep said team siloed within the rest of the organization, and have them build their own culture therein. This stands in stark contrast to the organizational transformation that Meta has gone through over the last year. The company that possesses some of the most valuable pieces of social technology in the world completely rebranded themselves to encompass an unproven idealism, i.e. the “metaverse”.

Although Christensen’s aforementioned strategy was arguably adopted through Meta’s acquisitions made in the past, such as with Oculus, and to a larger extent with Instagram, where management was deemed crazy for the price tag they paid for a largely unproven photo-sharing application, Meta didn’t change their identity completely to move towards an unproven idea; stark contrast to what has happened today.

Take how the company’s metaverse teams are reportedly embracing this transition and associated product development as an example…

In a recent WSJ exposé, the authors delved into internal Meta documents, of which provided a not-so-pretty insight into developments associated with the organization’s metaverse-related technology. Notable takeaways can be summarized as follows:

-

Meta’s initial goal of reaching 500,000 monthly active users within Horizon Worlds fell short. After revising the goal down to 280,000, the most recent tally still fell flat, coming in at 200,000.

-

Most visitors to Horizon don’t return to the app after the first month and the user base has declined since the spring.

-

Only 9% of the world’s built by creators were ever visited by at least 50 people; most were never visited.

-

More than half of Quest headsets were not used in six months after purchase.

-

Meta employees aren’t using the product enough themselves.

Although the sample size was small (~n=514), the results affirm a picture that has been painted by anecdotes over the years. Given the relatively steep price tag of the hardware, such as $400+ for the base model or the $1500 entry price for the company’s new pro version, as well as the general nature of the user experience associated with the device once it has been acquired, it is not completely surprising to see these results. Although AR/VR does seem like a natural extension to how our world looks from a computing perspective today, the trajectory right now isn’t looking so hot. Future reports or experiences such as these will likely throw salt in the wound of the next few years of relentless capital expenditures, which are being conducted in a low-feedback system. On the opposite end of the spectrum, adoption of most widespread consumer technology wasn’t stunning at first and will take time to develop even in the most positive of cases.

The next point worth harping on is Altimeter’s letter to Meta…

Therein, the fund called for the company to make the following changes, which may help the organization arrive at $40B in annual FCF:

-

Reduce headcount expense by at least 20%

-

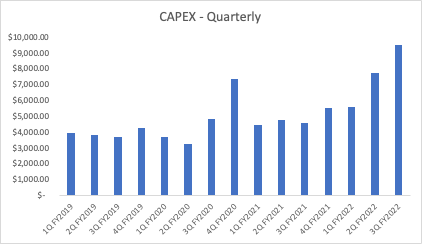

Reduce annual capex by at least $5B from $30B to $25B

-

Limit investment in metaverse/reality labs to no more than $5B per year.

These points, though largely ironic given the nature of Altimeter’s other portfolio holdings, are not without merit. Although innovation cannot oftentimes be quantified by an Excel sheet – this doesn’t mean that the company should embrace lackadaisical financial management processes either. Additionally, when one starts to dig a little bit deeper into how the company performed as of their most recent quarter, these requests start to ring even more true.

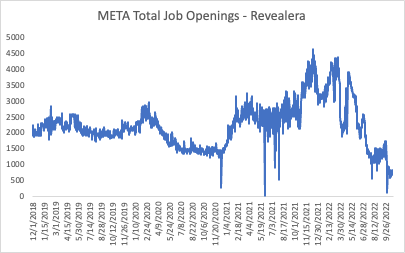

Let’s start off with personnel. We have seen management harping on the fact that they intend to rein in the rate of hiring, and these trends have largely been observable in the overall decline in job postings:

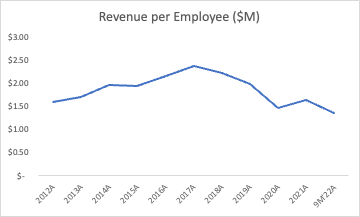

However, the company’s total headcount continues to expand and their overall revenue per employee (9M’22A calculated using TTM revenue values) is not on a positive trend. I think it goes without saying that the company cannot continue to expand in the manner it has, especially as we enter an environment where the cost of money continues to be sustainedly high:

Although there have been rumours circulating that the company intends to lower headcount by approximately 20%, for the time being, it appears that the company may be a tad bloated.

Outside of headcount, how is the business performing?

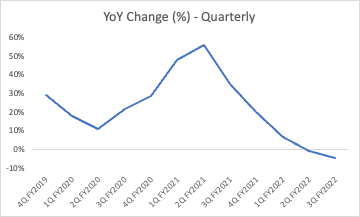

On the headline, as I’m sure all of you are aware, Meta revenue came in as a slight beat ($27.71B vs $27.53B estimate) and EPS came in as a miss at $1.64 vs. $1.91 est. Delving deeper, the company’s top line continues to stick to its trend of deceleration:

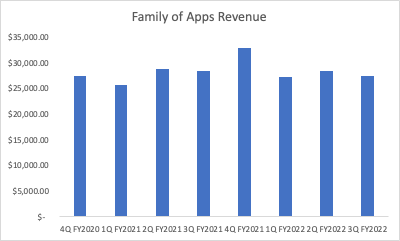

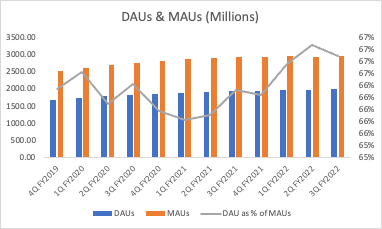

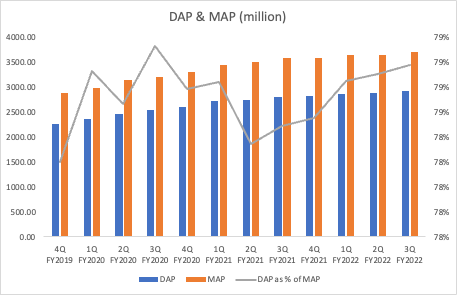

On a segment level, Family of Apps retained displayed strong levels of engagement. However, it is clear the company is continued to be impacted by ATT, albeit potentially feeling the effects of macroeconomic turmoil and geopolitical strife as well.

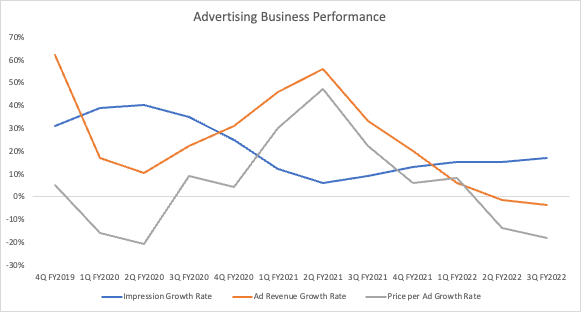

Viewing this from the perspective of the performance of the company’s advertising business as a whole, we are seeing clear trends. The prioritization of reels has evidently assisted with the company’s ability to deliver more advertising impressions per unit of screen time to individuals, however, as reflected in the rate of change of advertising revenue and the price per ad growth rate, the company is continuing to feel the effects of ATT.

As corroborated by many analysts this week, there is certainty in the statement that the company’s advertising business continues to feel pressure. Looking at how other advertising businesses have performed this quarter is largely affirmative of that assertion. The likes of WPP (WPP, OTCPK:WPPGF), Publicis (OTCQX:PUBGY, OTCQX:PGPEF, OTCPK:PBCBF), Omnicom (OMC), etc., the majority of which raised Q4 guidance, highlight the fact that these advertising holding groups have largely seen their advertising revenues survive unscathed, while those impacted by ATT have not. Time will tell if Meta’s investments are able to successfully weather this storm.

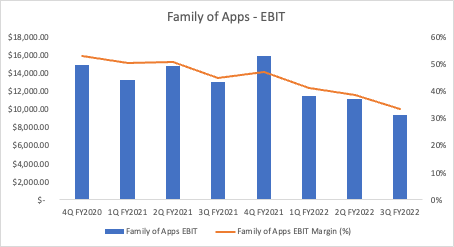

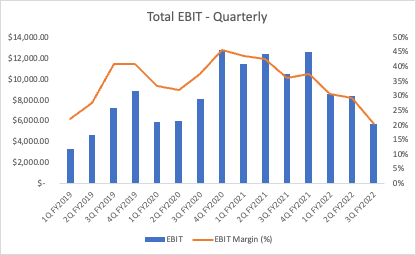

Moving on, on an EBIT level, FOA continues to lose its lustre, a problematic phenomenon given the fact that Meta intended to fuel its RL investments with profits generated from its main businesses, which continue to dwindle:

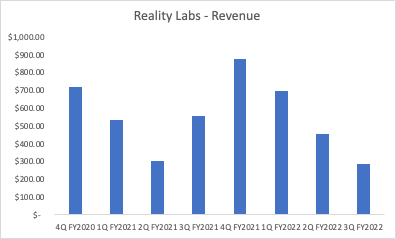

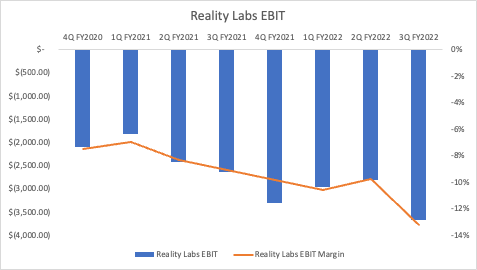

Moving on to Reality Labs, the segment continues to perform poorly, revenues are not painting a positive trend picture, and the company’s operating losses in the segment continue to expand:

As Mark mentioned on the earnings call, the pace of these investments is likely not slowing anytime soon. The company still plans on building out four major platforms: the social metaverse platform, VR, AR, and neural interfaces, each of which will require large amounts of capital to do so.

With this all in mind, how does the company start to look when these segments are put together?

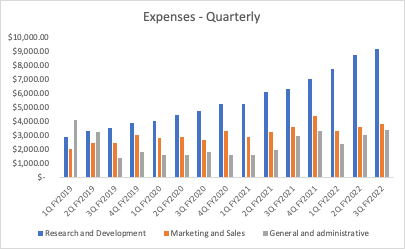

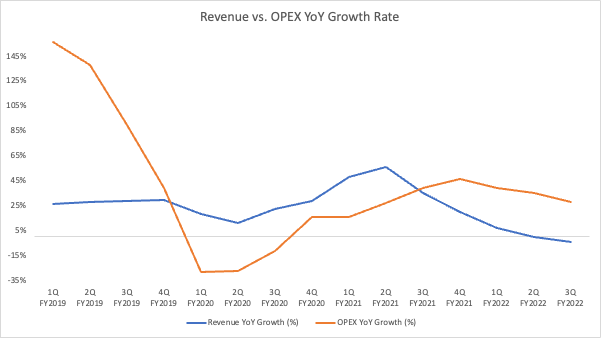

Looking at the company’s expenses is pretty telling. Sales and Marketing and General and Administrative Expenses remained relatively stagnant on a YoY basis; however, R&D continues to increase substantially and when Total OPEX growth rates are analyzed in comparison to the company’s top line, we are still seeing outpaced expansion in OPEX on a relative basis:

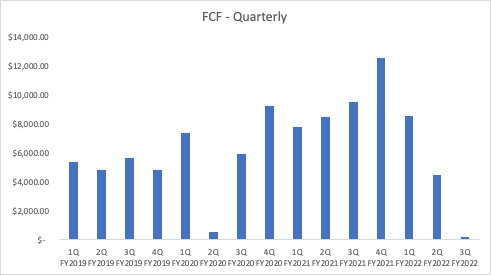

Lastly, with the dwindling pile of earnings, combined with the company’s continued steadfast expansion in capital expenditures, the FCF print in the most recent quarter is dismal, to say the least – coming in lower than the first quarter of the pandemic era:

In short, this quarter paints a poor picture for the company – one that was not entirely unexpected, but nonetheless, one that will still require monitoring going forward to ensure things don’t continue to deteriorate. Investment is important and it will be crucial for Meta to gain a strong footing in AI, continue to navigate the ATT headwind and develop effective advertising tracking technology, diminish the competitive forces of TikTok and strengthen their positioning in the short-form video space, and make the Metaverse ambition more than just a pipe dream.

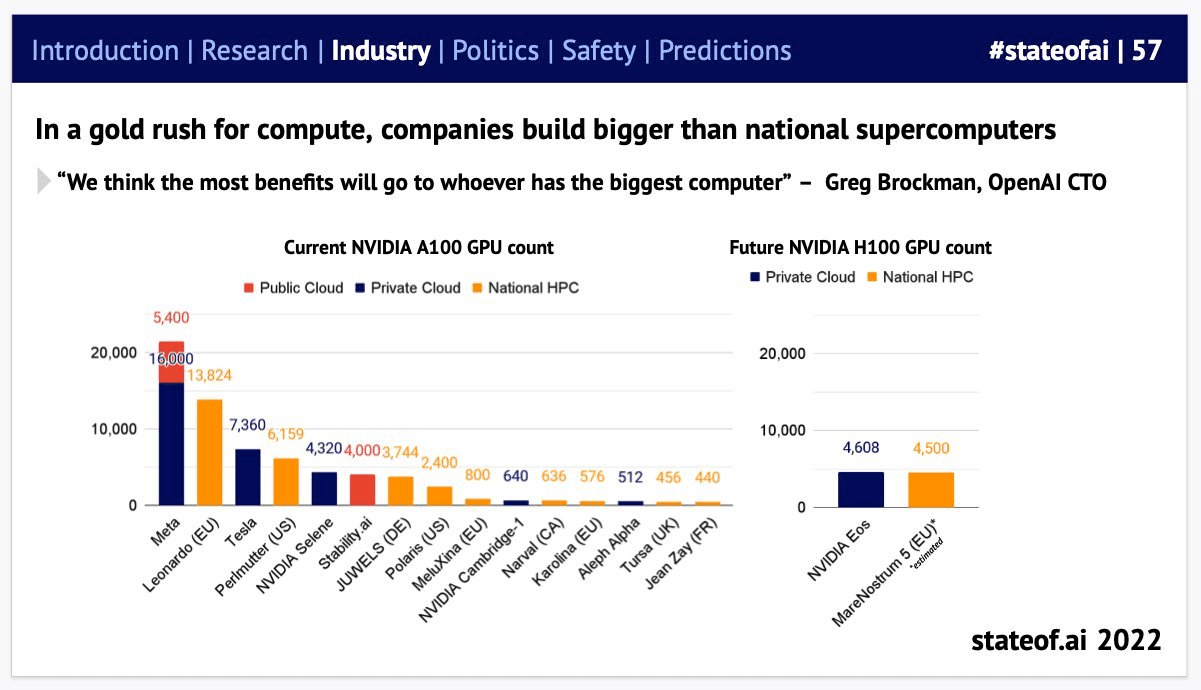

Honing in on AI-associated spend as an example, these expenses have been largely forecasted, with the company’s Chief Product Officer Christopher Cox stating that the company would need to increase their number of graphical processing units in their data centers by a factor of 5x into the end of the year in order to push their discoverability efforts forward. Looking at the most recent state of AI report, combined with the company’s recent expense numbers, it is clear they are continuing to bolster their compute powers at the expense of profitability:

This is a double-edged sword. It is hard to say that these investments should be done at the expense of shareholders, however, they will likely put them in a strong position from a compute perspective, and could very well start to weather some of the aforementioned headwinds as a result; only time will tell what the ROI will end up being. In short, the company’s expenses are anticipated to come in between $96B-$101B next year, and as such, it is clear that relief is not coming anytime soon.

The company still possesses an insanely valuable FOA business, one that is facing headwinds, yes, but is still a crucial component of modern culture. However, Meta is arguably facing the brunt of decisions made by their prodigal, and now infamous founder. The voting class structure of the company’s shares has placed the trajectory of the organization solely in his hands and there is no doubt that the path he has taken the ship on thus far has gone through choppier waters than need be. If these lofty ambitions continue to shrink the pile of earnings and free cash flow made available to shareholders, P/E and P/FCF can continue to approach infinity, even despite the numerator continuing to decline in a substantial manner.

As I asserted in my deep-dive a month ago, “Meta is fighting for its life”, and after this quarter, I believe that still remains the case.

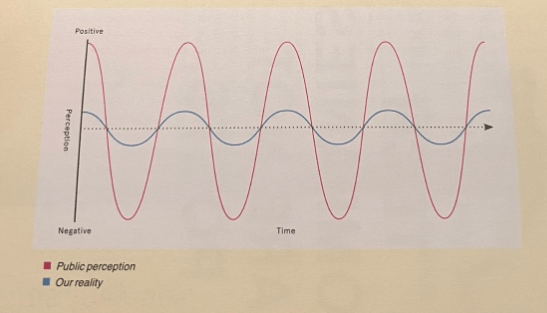

In Meta’s 2012 culture book, the company stated that they are never as good or as bad as people say. Only time will tell if this remains the case, or if sentiment really does reflect accurate depictions of a misguided and poorly thought-out capital allocation strategy.

Disclaimer: The information and research contained herein is all my own opinion and should not be used as a substitute for proper due diligence. Please consult your financial advisor and evaluate your financial circumstances before making any investment decision.

Disclosure (as of October 29, 2022): MT Capital Research holds no position in the securities discussed herein and does not anticipate to initiate a position in the forthcoming five days.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment