tupungato/iStock Editorial via Getty Images

LVMH (OTCPK:LVMHF) delivered an earth-shaking third-quarter earnings report, with key segments growing at double figures once again. The report comes as no surprise to us because we identify LVMH’s operational characteristics as non-cyclical. In addition, regression analysis conveys that LVMH stock is an excellent conviction play.

Is LVMH stock a buy after an approximate 28% year-to-date drawdown? We definitely think so, and here’s why.

Veblen Goods Status

Discretionary consumer goods are often categorized as one and the same. However, there’s a key distinction to be made. Discretionaries should theoretically be subdivided into Giffen goods and Veblen goods. The latter refers to high-value goods that are typically acquired by high-net-worth consumers, while the prior refers to cheaper goods exposed to price-elasticity risk.

Veblen goods, such as the items sold by LVMH, are rarely cyclical. But why’s that?

Well, the theory behind it is that the more expensive the products get, the more demand rises. Veblen goods cater to a consumer that seeks exclusivity, and guess what? Most exclusive goods cost a fair deal of money.

In our opinion, LVMH is categorized as a Veblen goods retailer as it sells high-value products such as Louis Vuitton fashion items, pricey alcoholic beverages, exclusive holiday retreats (via Belmond), and more. Therefore, we expect sustained demand throughout a possible recession as the firm’s target market is niche yet has “deep pockets”.

Earnings Review

LVMH released its third-quarter earnings report earlier this week, revealing a continued growth trajectory, with organic sales proliferating by 20% year-over-year, beating analysts’ estimates.

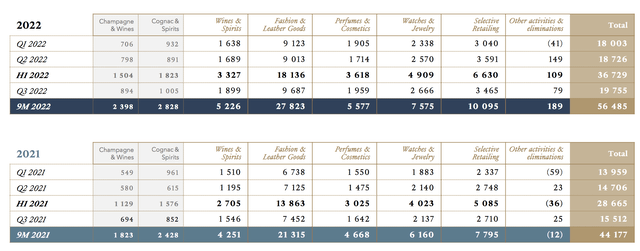

Much of the company’s quarterly success stemmed from its fashion and leather goods segment, which shot up by 31% year-over-year. This isn’t a surprise to me as Louis Vuitton (an LVMH brand) holds a global footprint with frequent product line shake-ups to match the zeitgeist among consumers.

Furthermore, wine & spirit sales skyrocketed by 23% compared to the same time last year. I guess we could correlate this to COVID-19 reopenings. I mean, I’m sure some of the avid clubbers saved up to pop a few bottles of Moët. In addition, all other segments surged, with cosmetics up by 20% and Jewelry up by 23%.

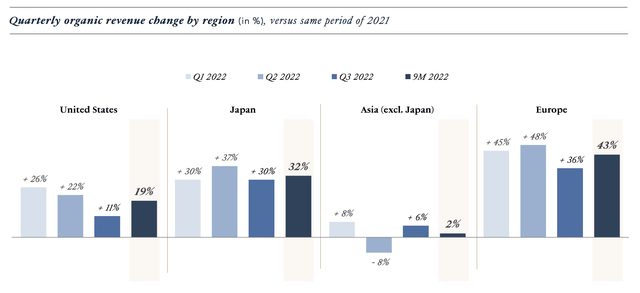

LVMH’s regional revenue mix is consistent across the board. This indicates two things, 1) seasonality probably isn’t a problem for the company, and 2) LVMH’s international marketing strategy is well-aligned.

The company’s revenue mix is well-diversified. However, the bulk of LVMH’s revenue stems from Fashion & Leather goods. I don’t see this as a risk because some of its brands, namely Louis Vuitton, Christian Dior, Fendi, and Givenchy, possess strong brand identities and customer loyalty. For instance, Louis Vuitton holds down 21% market share in the luxury leather goods market by itself. Therefore, the firm’s luxury leather sales will likely remain consistent.

Cumulatively, LVMH exhibits exponential growth rates, with its long and short-term compound annual growth rates forming a secular pattern.

| 3-year CAGR | 12.95% |

| 5-year CAGR | 12.49% |

| 10-year CAGR | 10.62% |

Source: Seeking Alpha

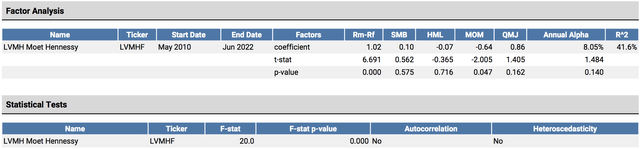

Factor Analysis – How To Trade LVMH

The following pertains to a factor regression. The regression tests LVMH’s previous returns and discovers how LVMH can be traded. The regression relies on market segmentation discovery. For instance, is the stock an outperformer whenever investors predominantly invest in growth stocks, value stocks, momentum stocks, etcetera?

Here is what the regression tells us.

- LVMH outperforms the broader market whenever investors are small-cap stock (SMB) seeking. This usually occurs during economic expansion as investors are risk-seekers.

- LVMH outperforms the market whenever investors seek quality stocks (QMJ). Quality is a stock segment embodied by stocks with strong financial statements and strong industry market positions. This type of market sentiment usually occurs whenever there are recessionary concerns.

- LVMH underperforms whenever the market’s value is orientated (HML). A value-orientated market usually occurs in an early market recovery with a growing economic trajectory and early-stage inflation.

- LVMH doesn’t form part of the momentum anomaly group. The momentum anomaly occurs in late-stage bull markets when investors stay invested due to market liquidity rather than economic growth.

- LVMH outperforms the general market portfolio whenever the market’s growing linearly with the economy. This usually occurs in an efficient market that isn’t exposed to a cyclical state – Denotation Rm-Rf.

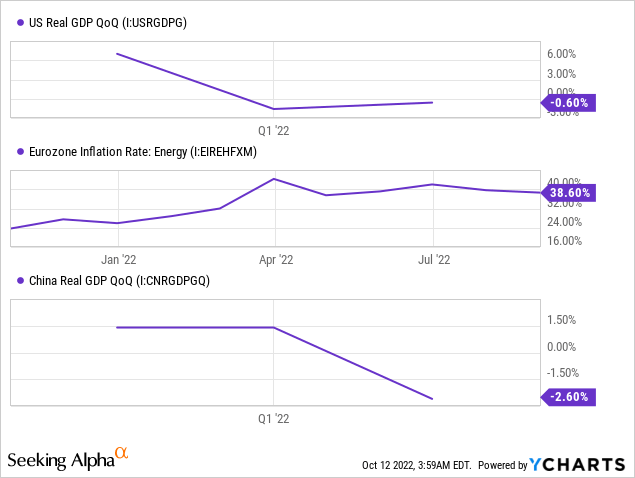

Based on the regression’s output, LVMH could outperform the current market as it loads on the quality factor. As previously mentioned, quality tends to outperform whenever there’s fear of a recession. To interlink the argument, the parsimonious macroeconomic data in the diagram below conveys that we’re either already in a recession or heading into one.

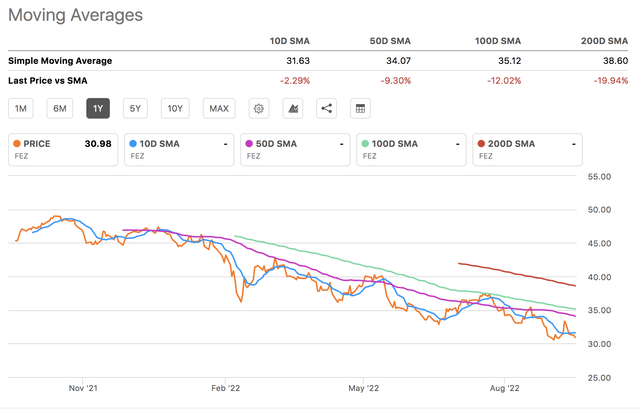

To juxtapose the argument, a concern is that the stock loads positively on the small-cap (SMB) factor. We don’t believe the current market would welcome small-cap stocks, as we’re far from an early-stage bull market. Nonetheless, I would say LVMH’s quality loading would phase this negative out. In addition, the stock’s negative loading on momentum is a plus because we’re clearly not in a momentum-orientated market (for context, see the Euro Stoxx (NYSEARCA:FEZ) moving average chart below).

Risks

I previously outlined a few macroeconomic variables. We believe the economy’s extremely fragile due to an energy crisis in the Eurozone, persistent COVID-19 lockdowns in China, and a monetary policy spiral in North America. Although LVMH is a Veblen good, there comes a time when macroeconomic headwinds trump all industries. I fear that sustained economic reversion could send the broad market into a prolonged downturn.

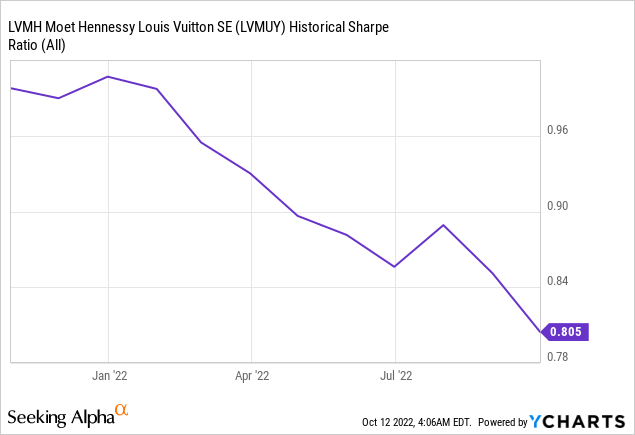

Secondly, LVMH’s Sharpe Ratio has drifted below 1.00. In isolation, this implies that the stock’s return distribution is currently unfavorable relative to its traded volatility. I mention 1.00, as it’s seen as the generally accepted threshold.

My Concluding Thoughts On LVMH Stock

LVMH’s Veblen good status means it’s less susceptible to income and price elasticity. Therefore, it’s no surprise that the company delivered a stunning third-quarter earnings report. Furthermore, LVMH’s revenue mix remains sound, with brand identity key to its recent success.

A factor regression shows the stock loads heavily on the quality factor, meaning investors tend to invest in the stock whenever the risk of a recession is high. Thus, we’re bullish on LVMH and assign a strong buy rating.

Be the first to comment