PM Images

Author’s note: This article was released to CEF/ETF Income Laboratory members as part of last week’s CEF Weekly Roundup. Please check the latest data before investing.

NCV resumes distributions

The second news to discuss is the announcement that Virtus Convertible & Income Fund II (NYSE:NCZ) has resumed its distributions. From the press release:

NCZ declares October distribution; starts process to pay previously declared common share distribution

HARTFORD, Conn., Nov. 3, 2022 /PRNewswire/ — Virtus Convertible & Income Fund (NYSE: NCV) and Virtus Convertible & Income Fund II (NYSE: NCZ) (each, a “Fund” and, together, the “Funds”), today announced final results for each Fund’s voluntary tender offer (each, a “Tender Offer” and, together, the “Tender Offers”) for up to 100% of its outstanding auction rate preferred shares (“ARPS”). The Tender Offers expired at 5:00 p.m., New York City time, on November 1, 2022.

Based upon current information, 8,902 shares (approximately 99.7% of outstanding ARPS) were tendered for NCV and 6,452 shares (approximately 99.2% of outstanding ARPS) were tendered for NCZ. Payment for such shares will be made on or about November 2, 2022. All of the ARPS of each of NCV and NCZ that were not tendered remain outstanding. The purchase price of properly tendered shares is equal to 97.95% of the ARPS per share liquidation preference of $25,000 per share (or $24,487.50 per share), plus any unpaid ARPS dividends accrued through the expiration date of each Tender Offer.

As a result of the tender offer, NCZ has reached the minimum asset coverage ratio for total leverage required under its organizational documents for the declaration and payment of dividends. The Fund therefore will begin to process its monthly distribution of $0.0375 per common share that was previously scheduled to be paid on October 3, 2022 to shareholders of record as of September 12, 2022, with a new pay date of November 4, 2022. In addition, the monthly distribution of $0.0375 per common share, which was originally scheduled to be declared on October 3, will be paid on December 1, 2022 to shareholders of record as of November 15, 2022 (ex-dividend date of November 14, 2022).

Both NCZ, and its sister fund Virtus Convertible & Income Fund (NYSE:NCV), conducted voluntary tender offers for their outstanding auction-rate preferred shares (ARPS). ARPS are legacy securities issued before the Global Financial Crisis of 2007-2008, and were used by NCV and NCZ as sources of leverage. However, as discussed in a previous CEF Weekly Roundup, plummeting net asset values caused NCZ to breach its 1940 Act leverage caps, forcing them to suspend distributions.

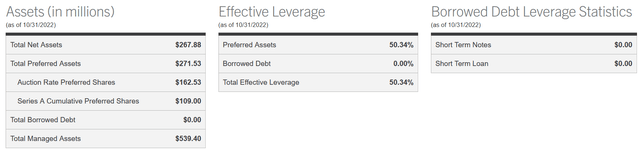

We can see this from the NCZ’s website showing 50.34% total leverage for the fund, exceeding the maximum 50% threshold allowed for declaring and paying distributions.

Hence, NCZ, as well as NCV in a preemptive move, redeemed their ARPS in order to lower their leverage ratios. This unfortunately, does mean that the funds have deleveraged at lows, weakening its asset base and making a distribution cut now more likely than ever, as the +12% NAV distribution yields of these two funds will be harder to maintain.

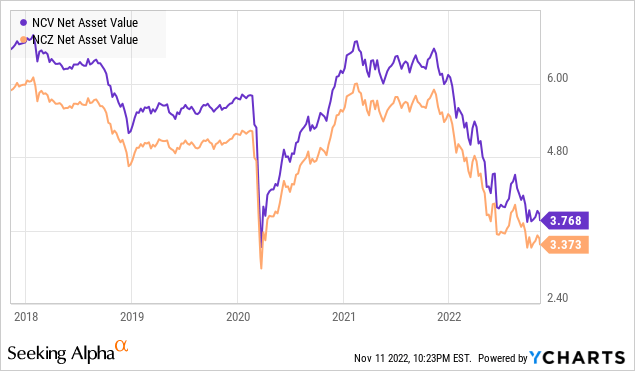

YCharts

Swap opportunity with NCV

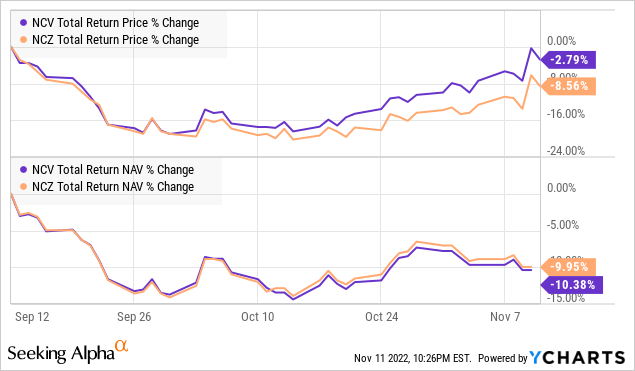

The fact that only NCZ, and not NCV, suspended and resumed its distribution, has opened up a powerful swap opportunity for investors who own NCV. NCV trades at a discount of -6.05%, which is around 7 points narrower than NCZ’s discount of -13.17%. This difference is presumably due to investors fleeing NCZ when they announced their distribution suspension, resulting in significant price divergence between the two funds. Now that NCZ has resumed their distribution, this difference in valuation seems unwarranted given their near-identical NAV profiles.

YCharts

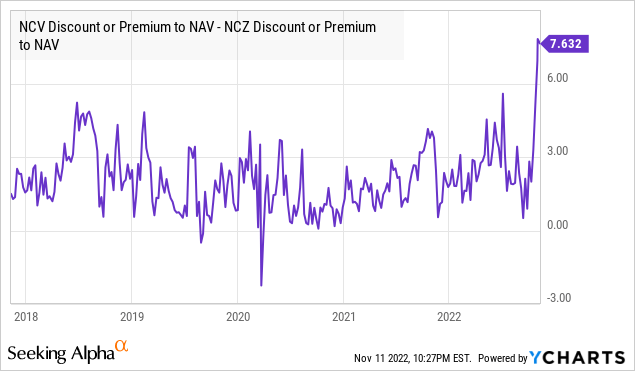

In fact, the spread between NCV and NCZ’s discounts has reached historically high levels.

YCharts

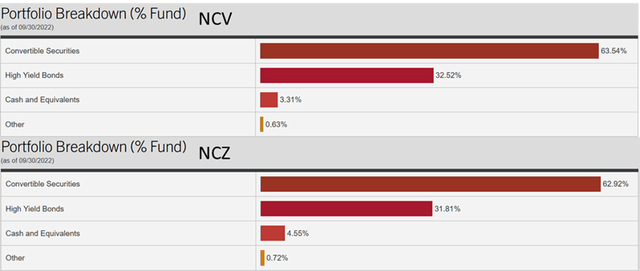

Portfolio allocations, which are mainly allocated convertibles and high yield bonds, are very similar as well between the two funds.

As a result, investors in NCV are strongly suggested to switch to NCZ.

Strategy statement

Our goal at the CEF/ETF Income Laboratory is to provide consistent income with enhanced total returns. We achieve this by:

- (1) Identifying the most profitable CEF and ETF opportunities.

- (2) Avoiding mismanaged or overpriced funds that can sink your portfolio.

- (3) Employing our unique CEF rotation strategy to “double compound“ your income.

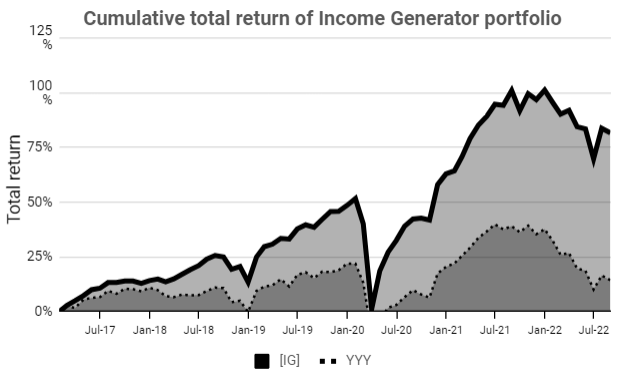

It’s the combination of these factors that has allowed our Income Generator portfolio to massively outperform our fund-of-CEFs benchmark ETF (YYY) whilst providing growing income, too (approx. 10% CAGR).

Income Lab

Remember, it’s really easy to put together a high-yielding CEF portfolio, but to do so profitably is another matter!

Be the first to comment