luchschen

Becton, Dickinson and Co. (NYSE:BDX) has had its stock battered down 17% in the past month. While there are some worries that investors should take note of, there are way more opportunities and upside than the market is giving it credit for. I am recommending a buy based on the following research.

Overview of BD

Becton, Dickinson and Co. is a medical technology company that develops, manufactures, and sells medical devices. It also provides products for the safe collection and transportation of diagnostics and instruments to detect many diseases and cancer. Based in Franklin Lakes, NJ, BD has seen great success from their three product segments.

How is BD Undervalued?

In my opinion, I believe that this stock is mispriced for a few reasons. First, their recent spinoff of their diabetic line is beneficial to the company because it allows them to focus on their more profitable segments and free up capital. Many investors see this divestiture as a positive because of this exact reason, but the market might still be uncertain since the divestiture was in the past year.

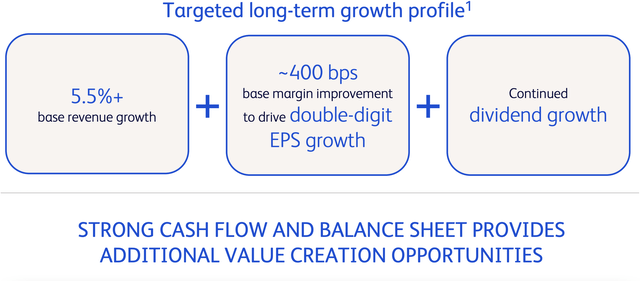

Second, shareholders will benefit significantly from BD’s margin expansion over the next few years. It is a top priority for CEO Thomas Polen and his team to work on expanding gross and operating margin to the tune of 400 basis points by 2025. This margin expansion will come from cost saving initiatives and mitigating the impact of inflation.

Third, BD has received regulatory approval for a large number of products recently which will only accelerate growth. One of the main avenues for BD expanding and continuing to grow is to increase the number of products that it can sell. Having a constant flow of new products that BD is infusing into the market will allow for this growth to be constant and steady.

With these mispricings, it is my belief that the market is overlooking these changes and discounting the value of this company. In this article, I will go over my valuation approach using a free cash flow to the firm model as well as relative valuation model. First, I will discuss my free cash flow to the firm model.

Calculating the Weighted Average Cost of Capital

In order to calculate my free cash flow to the firm model, I must first look at the capital structure of BD and assess a WACC based on its comparable companies. For the purpose of calculating this, I chose 5 comparable companies that are very similar to BD and have similar capital structures as BD. Those 5 companies are:

- Medtronic plc (MDT)

- Stryker Corporation (SYK)

- Baxter International (BAX)

- Boston Scientific Corporation (BSX)

- Siemens (OTCPK:SIEGY)

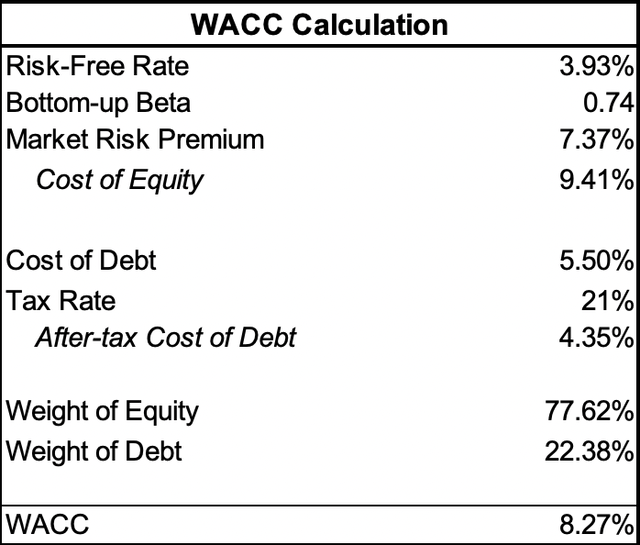

I used a bottom-up beta instead of the published beta for BD because I want to incorporate the risk of not just BD, but also the industry as a whole and this allows me to do that. I used a risk free rate of 3.93 which is the updated 30-year treasury as of the valuation date and a market risk premium of 7.37. I also used a cost of debt of 5.5% and a tax rate of 21%. With those assumptions, I arrive at a WACC of 8.27%.

This is my WACC calculation (My Model)

Examining the Free Cash Flow to the Firm Model

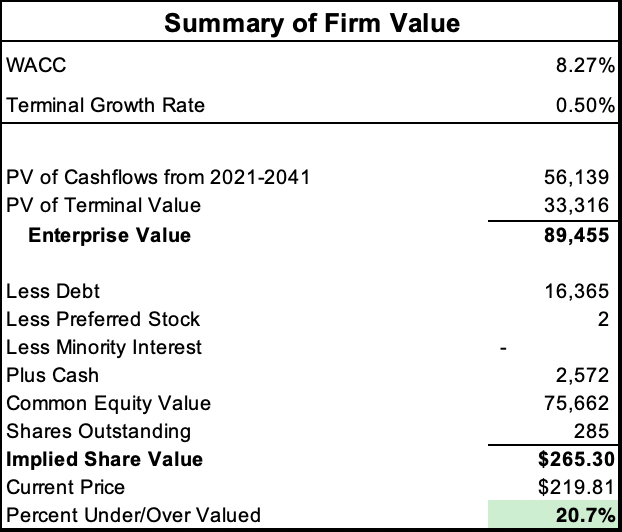

For my free cash flow to the firm model, the goal of this is to find the estimated free cash flow and discounting it back using my WACC. I have a terminal growth rate of 0.50% with a forecasted period of 20 years since that is how long I think it will take BD to arrive at its terminal growth.

I broke down the revenue into the three reporting segments: Medical, Life Sciences, Interventional. Medical will see a decline in 2022 due to their recent divestiture of their diabetes unit which contributed about $1.1 billion in revenue in 2021. After 2022, I expect the company to grow at their long-term growth rate of around 5.5% until 2027 where I see revenue starting to decline slowly. This is their largest revenue segment and growth will be steady and constant given that the company is always getting approvals for more products.

As for the life sciences segment, I am also forecasting a revenue decline in 2022, but immediately going back to growth in 2023 forward. While this segment is not as large as medical, there are still significant growth opportunities with new product lines and acquisitions that they are seeking. Lastly, for interventional, the last few years of revenue has not been very consistent. In 2018 they acquired C.R. Bard which jump boosted this revenue segment however 2020 was a rough year with revenue declining 4%. For this model, I do not see this segment growing as much as the other two with a growth rate starting at 4% slowly trending downward.

For cost of goods sold, as I stated earlier, the company is focussed on expanding margin which will contribute to EPS growth. I priced in a gross margin expansion of around 300 basis points over the next few years before stabilizing at a gross margin of 50%, up from 2021 which was 47%. SG&A and R&D have been relatively constant over the past few years, so I took the 5 year historical average for those since I do not foresee any material variances coming from them.

With those assumptions and considerations in mind, I arrived at a present value of cash flows and present value of my terminal value which gets me an enterprise value. From there, I subtracted debt, preferred stock, and minority interest. Lastly, I added cash to arrive at an equity value of which I divided by the shares outstanding. Using this free cash flow to the firm model, I believe that BD is undervalued by over 20%!

Summary of firm value using free cash flow to the firm (My Model)

Looking at my Relative Valuation Model

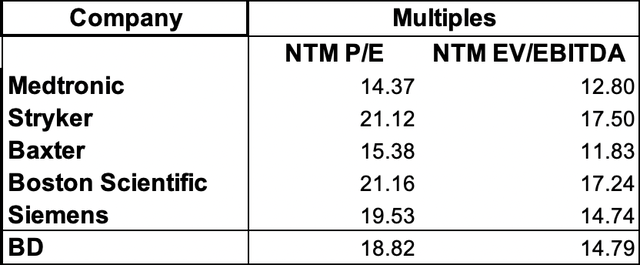

The other valuation technique that I used was relative valuation; using comparable company and identifying where BD ranks amongst the list. I used the same companies as I did in the WACC calculation because it represents a good opportunity to compare apples to apples as much as possible. I chose next twelve months EV/EBITDA and next twelve months P/E. These two metrics will give a good overview for where BD stands amongst its peers.

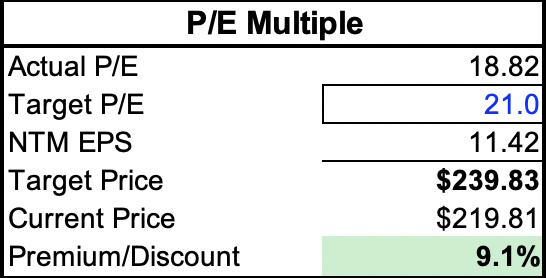

First, I will discuss my NTM P/E calculation. Looking at the comparable companies, I believe that BD ranks high on the list. BD excels in growth with their only negative being efficiency which management will be keen to improve over the next few years as they focus on margin expansion. They currently have a NTM P/E of 18.82, but I decided to rise the multiple to 21. Below I show the comparable companies and their respective multiples. As you can see, I believe that BD belongs in the same group as Stryker and Boston Scientific, thus my reasoning for the multiple increase.

List of comparable companies and their multiples (My Model) My calculation for NTM P/E (My Model)

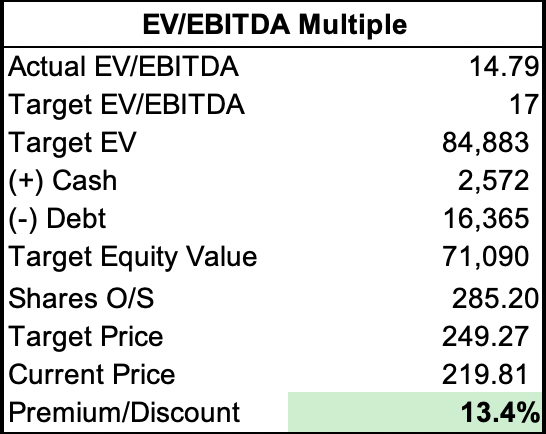

Next, I will discuss the NTM Enterprise Value-to-EBITDA multiple. Similar to the P/E multiple, I think that BD deserves a multiple increase due to their market presence and growth opportunities. BD currently has a NTM EV/EBITDA multiple of 14.79 which I decided to raise to 17. I believe that a multiple of 17 is better representative of where BD belongs amongst its peers.

My calculation for NTM EV/EBITDA (My Model)

Risks

While I have discussed why I think BD is undervalued, I think it is important to recognize the risks associated with investing in a company like this. Some of the major risks I see with this company include:

- Competition: The medical devices industry is highly competitive. Consolidation has increased market pressure in the industry. Failure to adapt to the dynamic industry and change as the market changes could be detrimental to the company

- Leverage: BD has a debt load of over $18 billion. Changes in the market environment could make getting more debt very hard.

- Inflation: Even though it’s one of management’s top priorities to expand margin, inflation is still a real issue that every company has to deal with. Failure to find cost savings or additional revenue could delay margin expansion by a few years

Bottom-Line

After spending days looking at this company and assessing its valuation, all three of my valuation techniques shows that Becton, Dickinson & company is undervalued. Their recent spinoff of their diabetic line will allow the company to better use resources to grow other segments. Management is dedicated to expanding margin by 300-400 basis points by 2025 which inflation mitigation measures and cost saving initiatives. Lastly, regulatory approvals of their new products continue to pile up which will allow the company to maintain solid growth for years to come. Becton, Dickinson & Company is undervalued and rate it as a buy.

Be the first to comment