OntheRunPhoto/iStock Editorial via Getty Images

In June, after covering regional airline SkyWest Airlines (SKYW), I also started covering Mesa Air Group (NASDAQ:MESA) and I pointed out that this was not the regional airline you would like to own, and since then things have not gotten much better. And as I discuss in this report, I don’t see a lot of reason to remain invested in Mesa Airlines Group or even less than before.

Mesa Air Group: A Major Underperformer

The thing that everyone has to like without exception is the fact that in a high fuel price environment, regional airlines such as Mesa Air Group can pass these costs on to their contractor under the capacity agreement they have with major airlines. That renders their business largely immune to fluctuations in fuel prices. The big problem for Mesa Air Group right now is the shortage of pilots which does not allow them to increase block hours and results in higher training costs and staffing costs to fight attrition. It’s a stark contrast from the outperformance that was expected from regional airlines as those would carry the post-pandemic recovery.

Results Reflect Operational Pressures

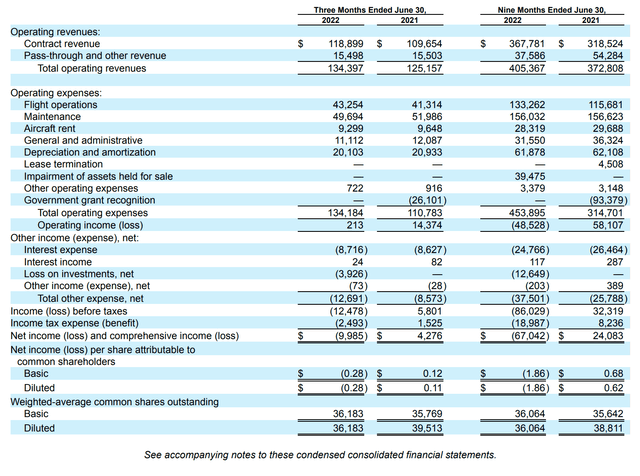

Results Q3 2022 Mesa Air Group (Mesa Air Group)

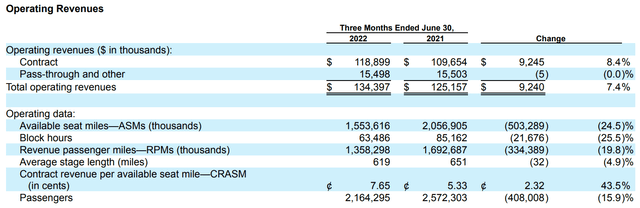

Operating revenues showed a 7% increase year-over-year, so the topline growth we’re seeing at regional airlines is not comparable to what we see at mainline carriers. That’s caused by the fact that these flights are flown under capacity agreements which is not tied to ticket sales, but based on a compensation that mixes block hours, flight hours, the number of departures and a fixed fee per month. Operating income dropped from $14.4 million in Q3 2021 to $0.2 million in Q3 2022. Adjusting for the government grant recognition operating income improved from a $40.4 million loss to a $0.2 million profit with adjusted pre-tax loss of $8.7 million compared to a $20.3 million pre-tax loss (also adjusted for government grant recognition) in Q3 2021.

Mesa Air Group

On an adjusted basis results are improving, so what’s the problem? For the answer, we have to look a bit deeper into the results. What we see from the operating data is that year-over-year capacity decreased by 25%, the reason why revenues still went up is an improvement in the contract revenue per available seat mile. So, the reduction in block hours is what’s putting a big damper on revenue growth. The problem that Mesa Air Group is facing, just like other regionals, is the pilot shortage. At the bottom of the chain where Mesa Air Group is positioned, mainline airlines are fishing for pilots and that leads to significant attrition. This leads to a reduction in pilots available leading to capacity being flown.

If pilots can choose to fly with better pay at a mainline carrier or for a lower pay with a regional carrier, the choice to make is obvious and that hurts Mesa Air Group. So, the airline is engaged in retaining its pilot by improving pay but a recent pilot agreement did not pass because other large regional airlines agreed on bigger pay increases making the one that Mesa Air Group prepared for its pilots unattractive and rejectable.

The result of the extreme competitive field for pilots and coupled higher pay at other airlines means that instead of seeing attrition fall, attrition stabilized but still at high levels, rendering Mesa Air Group unable to fly the capacity it wants to fly. Mesa Air Group will have to follow suit and double the pay for its pilots, which will increase costs. Additionally, the company is working on improving its training pipeline by introducing more simulators and offering a $50,000 bonus for newly-hired pilots. That does add to the flight expenses, but also should allow the company to improve topline performance. The problem, however, is that it takes 74 days for pilots to be ready and the combination of hiring the new people and retaining existing crews should be such that block hours can increase again. In other words, there should be a net inflow of pilots and it’s unclear when that will be the case.

To retain pilots and also to improve the inflow of new pilots, Mesa Air Group has opened the United Airlines career development program to all pilots. By doing so Mesa Air Group hopes it can attract new pilots that offers them a path toward flying at a mainline carrier eventually and it also embeds Mesa Air Group in a better predictable path to United Airlines which allows for better insights into pilot outflow. Additionally, the airline has recently purchased 29 trainer aircraft with options for 75 more to accelerate the path for pilots to obtain 1,500 hours allowing them to fly for Mesa Air Group.

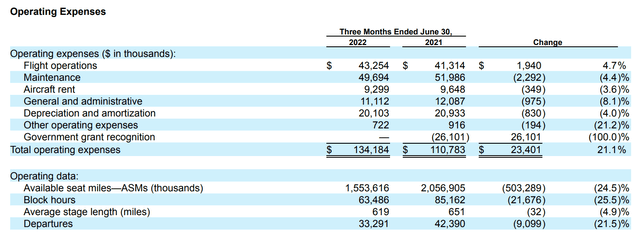

Mesa Air Group

The inability to fly the desired capacity also shows in the unit costs. Per block hour, adjusted for government grant recognition, the cost per block hour went from $994 to $2,114 of which $485 and $681 are flight operational costs. So, we do see higher costs per block hour as productivity is under pressure while training costs are pushing flight operational costs higher and with a new pilot agreement in place that also will increase costs. So, we see how the challenges are significantly eroding efficiency within the business.

Conclusion: Mesa Air Group Is A Near-Term Sell, Longer Term It Could Be A Hold

I’m not particularly charmed by the prospects of Mesa Air Group. They’re taking measures to expand capacity again, but it feels like the steps initially taken to battle attrition were too small and it was too focused on easing of the 1,500 hours rule to repair its business. The company now has initiatives in place that will cost the airline, but will improve predictability of pilot outflow. The results, however, remain to be seen. In the fourth quarter another quarter-over-quarter reduction in block hours of 12% is expected. So, it will get worse before it gets better. That itself also provides an opportunity, but one with high associated risks as we do not know when attrition will start to normalize. Eventually, what would help Mesa Air Group is a reduction in air travel demand which will taper the capacity expansion plan with mainlines and gives the regional airline more breathing space.

If you’re expecting to make big money with Mesa Air Group, I think you’re better off selling and investing elsewhere. If you have some appetite for risk, you could consider holding or averaging down at this point and wait for the recovery in staffing levels as analysts have a $2.83 price target for Mesa providing 122.83% upside. For me, however, Mesa Air Group is not worth the risk that comes with the upside. On the upside, if we see some sort of improvement in block hour production into next year, things might start looking more attractive for Mesa Air Group as it is shielded from fuel price and unit revenue fluctuations. As a result, I’m keeping my hold rating with a sell rating for short-term oriented investors.

Be the first to comment