Leila Melhado

Investment Thesis

MercadoLibre (NASDAQ:MELI) is one of the most well-known brands in Latin America, and found initial success through its eCommerce marketplace, being dubbed ‘the Amazon (AMZN) of Latin America’.

Yet the story is changing for this company, as I outlined in a previous article Forget E-Commerce: MercadoLibre’s Payment Solution Is Flying. MercadoLibre still has a load of potential in eCommerce, and can expand to Amazon-esque levels, but incredibly that is not the most exciting part about this business.

MercadoLibre’s fintech solution, MercadoPago, was initially used as a digital payment solution for the MercadoLibre eCommerce platform, just like how PayPal (PYPL) was initially used to facilitate payments on eBay (EBAY). Like PayPal, it turns out that MercadoPago could also find success as a digital wallet & payment facilitator for all sorts of online payments – not just within the MercadoLibre eCommerce marketplace.

My personal investment thesis for MercadoLibre is this: the market opportunity is huge, and no company has the experience within the Latin American market that MercadoLibre has. It has already scaled its eCommerce solutions, and built a powerful, trusted brand. There are many growth avenues for this business, and right now it is gaining traction with MercadoPago outside of its MercadoLibre ecosystem, which could turn this company into a powerful combination of Amazon & PayPal. I want to see this Off-Platform Fintech growth continue, but I think MercadoLibre can grow across multiple industries for years to come.

So, how do the Q2’22 results stack up against my thesis? Let’s take a look.

Earnings Overview

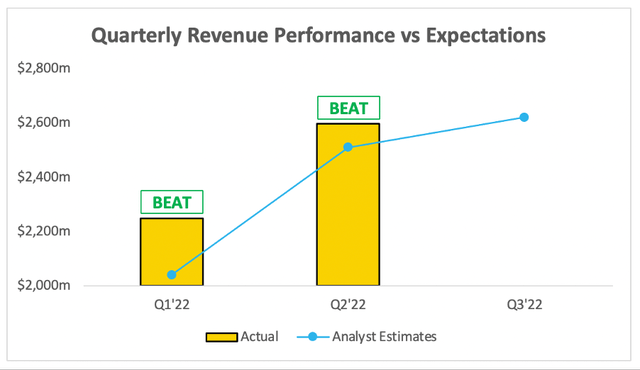

First, I should point out that MercadoLibre doesn’t give guidance – so I’ll just be comparing actuals with analysts’ estimates.

Starting with revenue, and MercadoLibre delivered another beat against estimates, coming in at $2,597m with analysts expecting $2.51B. This represented YoY FXN (FX neutral, i.e. excluding currency fluctuations) growth of +57%, which, against a backdrop of a tough macroeconomic environment & difficult YoY comparisons for eCommerce, was pretty impressive!

Investing.com / MercadoLibre / Excel

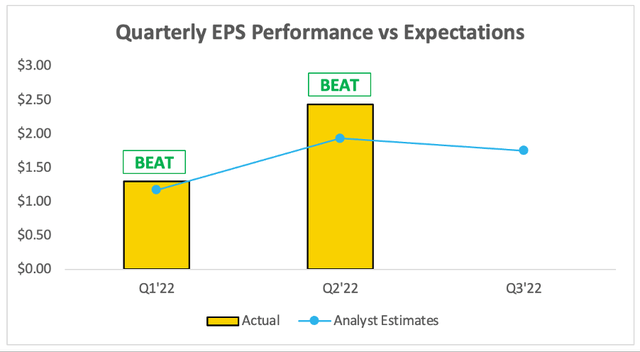

Equally impressive was MercadoLibre’s profitability for the quarter, with EPS of $2.43 coming in way ahead of analysts’ estimates of $1.93.

Investing.com / MercadoLibre / Excel

There are several drivers for MercadoLibre’s margin expansion, and management’s explanation on the earnings call was as follows:

In commerce, revenue growth comes mainly from our strength in third-party marketplace categories and the expansion of our advertising business. Our gross profit margin expanded year-over-year and quarter-on-quarter as we scaled our businesses and delivered operating leverage across most cost of goods sold.

As a result of this, our operating profit reached a record in the quarter with operating margins that were directionally in line with last years as we continue to balance investments mainly in product and technology and the credit business with cost leveraging across other operational expenses. The second quarter closed with net profit in our three main segments, including Mexico and with improvements in net income margin year-over-year.

Yet another strong quarter for MercadoLibre, which long-time shareholders should not be surprised about. But my thesis is very Fintech focused, so how did that segment do? Well…

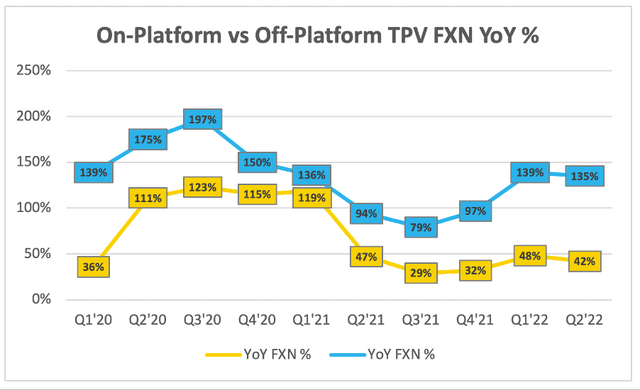

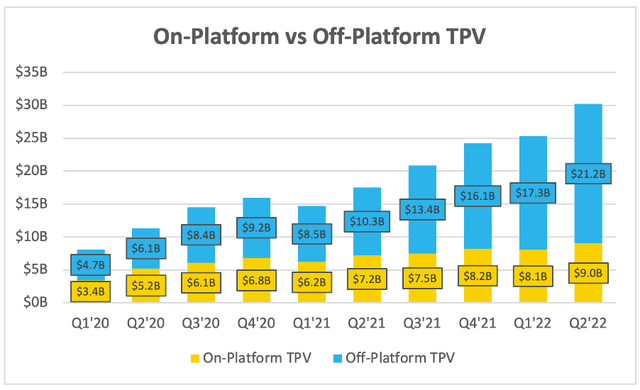

Off-Platform Fintech Goes Through The Roof

The growth in MercadoLibre’s Off-Platform TPV (Total Payment Volume) was staggering once again, growing a whopping 135% YoY FXN. Even more incredibly, this is coming off the back of 94% YoY growth in Q2’21, and 175% YoY growth in Q2’20. Whereas the On-Platform TPV has slowed down substantially following the eCommerce boom in 2020 and 2021, this Off-Platform side continues to impress.

My first thought when I see growth rates in the triple digits is that it must be coming off a small base, right? Wrong.

This 135% YoY FXN growth was coming off a base of $10.3B in Q2’21, meaning that Off-Platform TPV reached $21.2B this quarter! For some perspective, in Q2’20 Off-Platform made up ~54% of MercadoPago’s total payment volume, but just 2 years later it is making up ~70%.

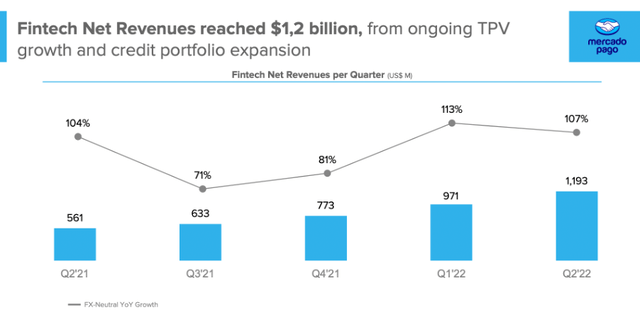

The result? Fintech revenues exceeded $1 billion for the first time in a quarter, growing at a staggering 107% YoY FXN and accounting for ~46% of total MercadoLibre revenue. I mentioned at the start that eCommerce is going to struggle this year, and MercadoLibre is no different – with ‘only’ 23% YoY growth in its commerce segment in Q2 – but the Fintech revenues more than made up for this.

MercadoLibre Q2’22 Investor Presentation

Quite frankly, I am blown away. The ability to grow Fintech revenue in triple digits, exceeding $1 billion in the quarter, despite a ton of macroeconomic headwinds & very difficult YoY comparisons, is staggering.

Sometimes, you just have to stand back and admire greatness from a company – that is what I’m doing with MercadoPago.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether MercadoLibre is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

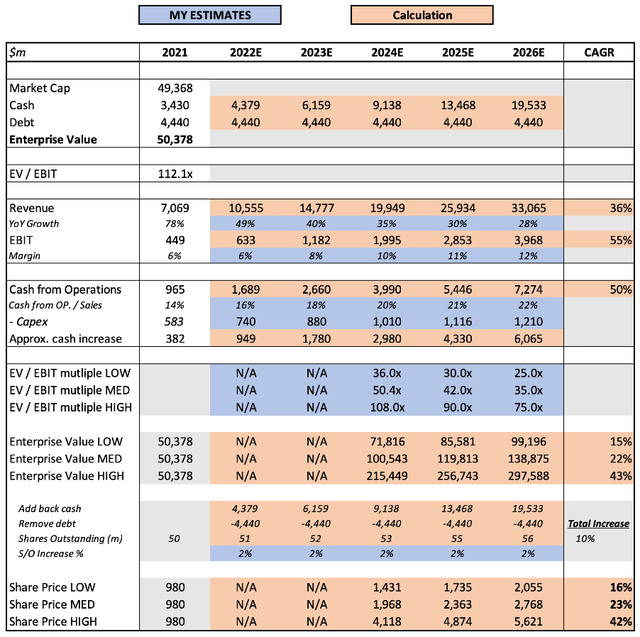

I have assumed 49% YoY revenue growth for 2022, given MercadoLibre’s performance so far this year combined with analysts’ estimates. I have this gradually declining over the years to come, although still growing at a pretty rapid clip, resulting in a CAGR of 36% through to 2026. I have also assumed EBIT margin expansion as the company continues to scale with its eCommerce offerings, and further improves margins on the Fintech side.

I have used what I believe to be an appropriate EV / EBIT multiple for 2026, given MercadoLibre’s growth prospects & ability to expand margins from that point onwards. I have also assumed slight shareholder dilution to be prudent; MercadoLibre has diluted shareholders in the past, but it does not dilute them regularly.

Put all that together, and I can see MercadoLibre shares achieving a 23% CAGR through to 2026 in my mid-range scenario.

Investment Thesis: Strengthening

I had hoped that my thesis focusing on Off-Platform Fintech would pay off, but I had no idea the extent that it would do so. This quarter completely reaffirmed my belief that MercadoPago is the superstar of this all-round amazing business, and the Off-Platform growth is likely to continue as MercadoPago becomes the go-to digital payments platform for Latin America.

This was a stellar quarter, and growth was beyond my expectations as this company continues to execute. As such, I am upgrading my previous rating of ‘Buy’ to a ‘Strong Buy’, since I believe MercadoLibre can keep growing & succeeding for years to come.

Be the first to comment