AsiaVision/E+ via Getty Images

The Goal of This Article

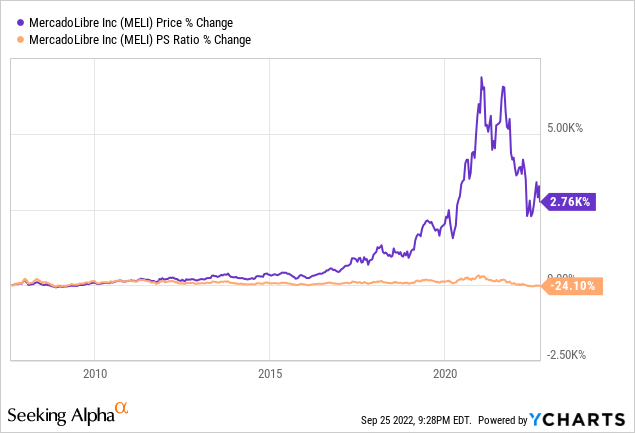

It doesn’t happen often that a growth stock with massive shareholder returns since IPO, has only a little over 10% retail ownership. The institutional shareholder count is nearly 81%, so they obviously see potential in this stock even after the 2,760% returns it has generated since becoming public just 15 years ago. Right now may be a great time to start investing in MercadoLibre (NASDAQ:MELI) as it has a P/S ratio of 4.6 which is 24% cheaper than its IPO.

The goal of this article is to educate more retail investors on what MercadoLibre does as a business, why the stock is undervalued based off of future free cash flows, and how their business model can deliver compounding returns. These are just some of the reasons why the stock has 80%+ of all shares held by institutions.

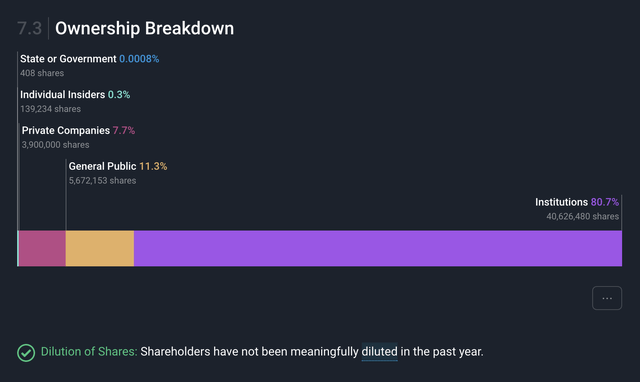

Percentage of Shareholders (Simply Wall St. App)

What Does MercadoLibre Do as a Business? And What Tailwinds Can Propel This Stock to New Heights?

MercadoLibre is the leading e-commerce and fintech platform of Latin America. This area of business is a rapidly growing sector in Latin America, but also under-penetrated compared to the USA and other countries. With more of Mexico, Brazil, and Argentina growing its internet user base and e-commerce buyers, this provides a large TAM for the company to attack.

The opportunity for MercadoLibre to continue to grow its fintech user base is massive as 70% of Latin America is unbanked or underbanked. In addition to this, 58% of the point of sale purchases are made in cash, which are perfect targets for MercadoPago the Fintech payment solution offered by the company. MercadoLibre’s mission statement is “To democratize commerce and financial access to all in Latin America” and they are certainly doing that with their ecosystem. MercadoLibre doesn’t just operate an e-commerce marketplace for buyers and sellers but has a supporting flywheel of products that enable acceleration for buyers and sellers.

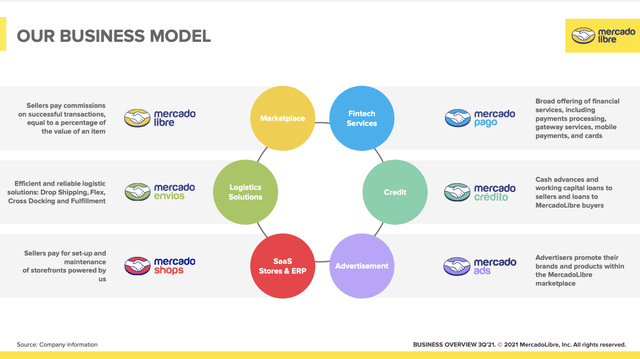

The MercadoLibre ecosystem platform adds the following value to merchants and customers.

- MercadoLibre is the marketplace where sellers pay commissions on successful transactions and buyers purchase products online.

- MercadoPago is a robust offering of financial services, including payment processing, gateway services, mobile payments, and credit cards.

- MercadoCrédito is the credit arm of the company that provides cash advances, working capital loans to sellers, and loans to MercadoLibre buyers.

- MercadoAds is the advertising product that helps sellers and businesses use to promote their brands and products within the MercadoLibre marketplace.

- MercadoShops is a service which sellers can pay for to have set up and maintenance of their online storefront.

- The last product offering MercadoLibre has is its logistics platform MercadoEnvios. This offering is one that the company continues to invest heavily in, as they spent $1.8 billion in 2021 to be able to provide next day and 2-day shipping to multiple regions. This offering also offers drop-shipping, Flex shipping options, along with distribution and fulfillment centers in multiple countries. Over 95% of all of MercadoLibre items are shipped via their own logistics solutions optimizing costs.

MercadoLibre Ecosystem (MercadoLibre Investor Presentation)

MercadoLibre has a commerce ecosystem that enables more people in Latin America to start their own business and grow it through their platform. The company is present in over 18 different countries in Latin America, including the three largest markets which are Brazil, Argentina, and Mexico. There are nearly 385 million people in those three countries alone, and they have an average e-commerce CAGR of 26% until 2025.

What Risk Factors Should Investors be Aware of?

MercadoLibre has been a very volatile stock over the years and currently trades at a Beta 1.63. Shareholders benefit like with most stocks, when the dollar cost average into this stock, as share prices can fluctuate often. I have been a shareholder since early 2019 and purchased the stock in the low $400s all the way up to the $1100s and back down. Currently, MercadoLibre is 54% off its share price a year ago. For short-term investors, the risk would be that we are living in unpredictable times in the stock market, and this stock can even go lower from where it’s at today at $815 a share.

Another risk factor a shareholder must be aware of is unlike many American stocks, this international stock headquartered out of Buenos Aires, Argentina doesn’t post many news updates often. MercadoLibre is not in the media often, so it is difficult to stay up to date on this stock on a daily or weekly basis. This makes the quarterly earnings and annual reports much more important for investors to follow to say up-to-date on business operations.

MercadoLibre has also faced several currency challenges over its 23 years of history due to recessions and government debt issues in Argentina and other countries in Latin America. It may also be hard for some investors to invest in a company that does not have a presence in North America, but I view this as a future opportunity.

What Can We Learn From MercadoLibre’s Q2 Performance?

As I stated earlier, MercadoLibre is no stranger to navigating through challenging times, especially in the macroeconomic whirlwinds that have happened over the years. The company has executed through numerous financial crises and delivered growth regardless. This past Q2 was no different as MercadoLibre delivered growth in numerous parts of its business, even with facing economic headwinds like inflation and supply chain issues. This is a direct reflection of MercadoLibre’s experienced leadership team and the resilience of the flywheel ecosystem they have built.

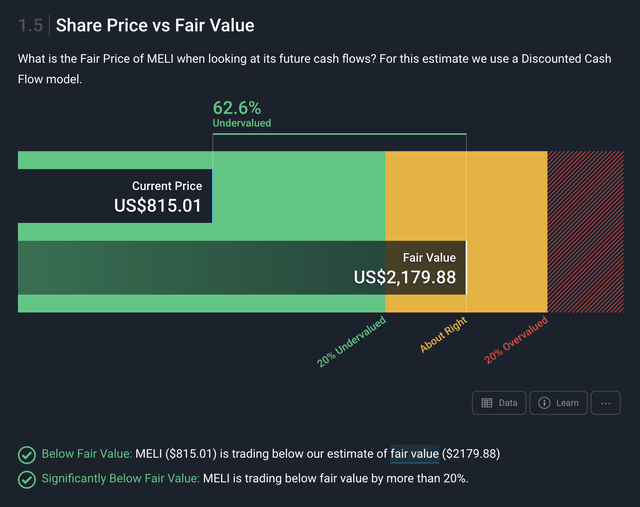

After the company’s last quarter performance, the stock currently is 62% undervalued according to DCF valuations by analysts at Simply Wall St. The 23 institutional analysts that cover the stock have an average 1yr price target that is 60% higher at over $1,300 a share. I believe these high upside expectations for the stock are reflective of the expanding value and growth created by MercadoLibre’s platform ecosystem.

DCF Valuation of MELI (Simply Wall St. App)

In Q2, the company grew net revenues 57% FXN YoY at $2.6 billion. There are not many companies in these macroeconomic times growing nearly 60% year-over-year revenues, hence why the stock jumped previously after earnings. What is just as important is how the total purchase value off the marketplace for MercadoPago grew 135% FXN YoY. This shows high adoption of the fintech payment platform across areas outside just MercadoLibre, which will drive additional profits. The newer offering MercadoCrédito has also taken off with 232% growth year-over-year with $2.7 billion provided, which is driving expanded net interest margins for the company.

The Conclusion for Retail Investors

MercadoLibre continues to grow earnings and record profits. The operating margins continue to increase as they expanded to 9.6% in Q2 and a record $250 million dollars in income from operations. MercadoLibre is now profitable, growing free cash flows, and most importantly continuing to grow adoption of the full ecosystem, even during these challenging macroeconomic times. So when you invest in MercadoLibre there will be volatility, less research information available, but you can rest assured they have an exceptional CEO founder and leadership team that has proven performance results.

I believe the tailwinds in e-commerce, internet adoption, and fintech payments are long-term catalysts for MercadoLibre. I also believe their results demonstrate excellent execution and expansion of their platform extensively. It is for these reasons that I think over 80% of ownership is from institutions holding shares in the stock. The question is, after learning about MercadoLibre, do you want to own shares as well?

Be the first to comment