NicoElNino

When I look at software companies today with valuations coming down significantly from the days of market hysteria, I will advise investors of all kinds to focus on the quality software companies of today that are poised for huge success of tomorrow. Datadog (NASDAQ:DDOG) is clearly one such category that fits this particular category of software companies that are high quality, continuing to see strong and resilient growth while operating at a high level of efficiency.

Investment thesis

The investment case of Datadog is rather compelling in my view:

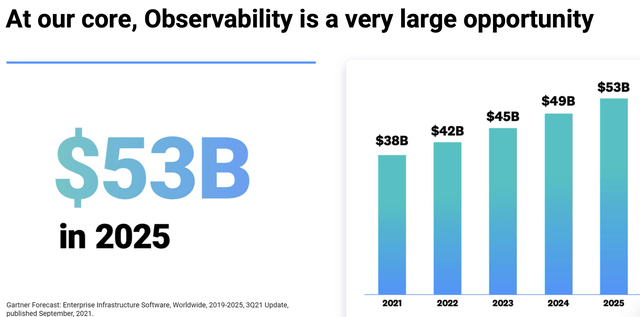

- With a huge addressable market of $53 billion by 2025 as well as the fact that the current guided annual revenue for 2022 is only $1.6 billion, these facts point to the huge market opportunity Datadog has before it.

- Strong execution and track record in land and expand strategy as Datadog has shown its ability to upsell and cross-sell.

- Datadog is operating at the Rule of 89, better than the average in the software industry and producing better retention ratios as well.

Overview

Datadog offers customers a Software as a Service (“SaaS”) monitoring and security platform for cloud applications. They offer unified observability in real time for its customer’s entire technology stock. As such, Datadog enables its customers to drive digital transformation and cloud migration as well as collaboration among the various teams in the organisation, and an end-to-end solution for monitoring and analytics. The company operates a land and expand strategy as they expect customers to increase usage of its products over time from the initial purchase and eventually buy other products on its platform.

Huge market opportunity

As highlighted below, Datadog sees a huge total addressable market of $53 billion by 2025. In my view, the growth comes from the growth in cloud as workloads are increasingly deployed on the cloud. As an end-to-end observability platform, Datadog is able to capture this, along with the increase in application development in modern DevOps environments. As such, I think that Datadog is well positioned in the huge market, where it’s seemingly still rather under-penetrated. With an expected revenue of $1.6 billion in 2022, this represents just 3% of the total opportunity set to come in 2025. Thus, I think that the longer-term runway is set with the huge market opportunity that’s presented to the company.

Huge market opportunity in observability (Datadog Investor Slides)

Land and expand strategy execution is solid

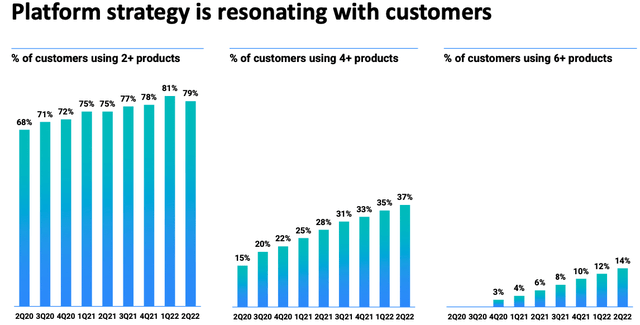

It’s crucial for a company like Datadog to show it’s able to leverage on its large customer base to sell its product expansion. As can be seen below, Datadog has a very large number of customers that are using at least two products, with almost 80% of customers doing so. Since 2Q20, the company has had great progress in pushing customers to use at least four products, with the percentage of customers more than doubling from 15% in 2Q20 to 37% in 2Q22. While I thought that on its own was impressive, the growth in number of customers using at least six products was even more impressive, in my view. Customers that are using at least six products expanded by almost four times from 3% in 4Q20 to 14% in 2Q22. While this is encouraging, I expect that this will continue to grow in the quarters to come as its customers see the benefit of the end-to-end observability solutions that Datadog provides.

Land and expand strategy performance (Datadog Investor Slides)

With the data explained above, I think that it’s rather self-explanatory that Datadog has a strong track record of being able to execute the land and expand strategy, and be rather successful at it, in my view. This is because the company can even gain traction in the number of customers that use at least six products, and this number continues to have traction and growth over the quarters since 4Q20, with each quarter adding about 2 percentage points to the percentage of customers using at least six products.

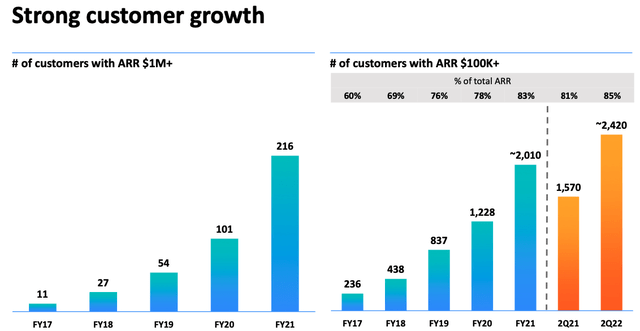

At the same time, there’s evidence that the upselling and cross-selling are just getting started. In 2Q22, Datadog’s customer base grew 29% to around 21,000 customers. The pace of growth was even faster for the customers with at least $100,000 in ARR as the number of customers in the category grew by 54%. All this growth comes at a time when investors were concerned about the durability of Datadog’s growth in an uncertain environment. If I were to go one step further, the 2,420 customers that have more than $100,000 in ARR are only about 10% of the total customer base of 21,000. While I do not think that every one of these 21,000 customers will become a big spender in Datadog, there’s certainly sufficient opportunity for the average ARR to grow further as the company continues to show strength in its land and expand strategy.

Strong large customer growth (Datadog Investor Slides)

To conclude, I think that Datadog’s ability to cross-sell and upsell to its existing customer base is well demonstrated. As such, I expect the company to continue to be able to do so as it rolls out more products and offerings in its current or adjacent markets. Furthermore, its current customer base has scope to spend more and bring up the average ARR in the company as only 10% of its customers spend at least $100,000 in ARR.

Solid retention rate and Rule of 89

I think that the case for Datadog’s solid execution, huge market opportunity and strong innovation puts it among the top-tier software companies with business models that work well. The company is operating at the Rule of 89 in the second quarter of 2022 as its revenue growth of 74% was combined with 15% free cash flow margins.

This, of course, is higher than the average of the Rule of 40 in the industry and demonstrates Datadog’s superior business model and its long-term business viability in the software space. There are continued tailwinds for Datadog to maintain this leadership in its business model as well as a higher than average Rule of 40 we see in the industry. This will come with continued product expansions that meet its customers’ needs as they continue their cloud migration journey, continued improving free cash flow margins as profitability improves, and lastly with strong top-line growth, which I think will enable Datadog to continue to operate very efficiently and strongly relative to peers. Therefore, I would argue that Datadog is not only currently in the top tier of software companies, but it will remain on top for some time in the future.

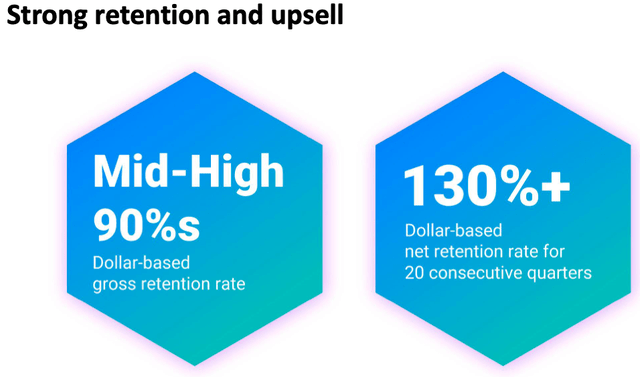

Furthermore, the company also has maintained dollar-based net retention rate of at least 130% for the past 20 consecutive quarters, as well as mid-high 90% dollar-based gross retention rates. This high retention rate demonstrates the resiliency of the business over time as Datadog is able to not just attract but keep customers over a rather long period of time. This higher retention ratio is valuable today in an uncertain environment with rising rates and high inflation causing recession fears that may dampen demand for some parts of software.

Strong retention ratios across time (Datadog Investor Slides)

Valuation

I use an EV/Sales to derive a price target for Datadog. Adjusting for Datadog’s higher growth rate of more than 30% as well as the company operating at a higher than average rule of 89, I think that a higher EV/Sales is justified for the company.

I assume an EV/Sales terminal multiple of 15x as a result of FY2025 sales and discount that back by a discount rate of 10% to arrive at my target price. As such, my one-year target price for Datadog is $121. This implies an upside of 39% from current levels.

Risks

Competitive pressures

While I think that Datadog has demonstrated a track record of solid innovation and ability to cross-sell and upsell, the company does face competition in the observability market from existing market players like Splunk (SPLK) and Dynatrace (DT). While I would argue that Datadog has its own competitive moat that can enable it to outperform these competitors, there’s still the risk that competition might intensify in the industry.

Pent-up demand from pandemic waning

There are some concerns that the pandemic accelerated the adoption of cloud and cloud migration but if demand was brought forward, this may signal that the high base effects of the pandemic may bring about the risk of waning demand in the near term as customers rationalize and digest their accelerated demand from the pandemic.

Macroeconomic environment

While the risk of macroeconomic slowdown affects all other companies and probably less so for Datadog given the high retention ratios, the risk remains that the company has not had to operate in a deep recession scenario, which could challenge the durability thesis of the company’s long track record of retention ratios.

Conclusion

When looking to invest in the current volatile environment, I think that it’s important to be picking the best quality names that will grow into the leaders of tomorrow. I think that Datadog is well positioned to be a market leader of its segment. The company has a strong track record of upselling and cross-selling, validating its land and expand strategy as it continues to grow the number of products each customer uses. Also, the company boosts industry-leading retention ratios that have been sustained for 20 consecutive quarters, and also it’s operating at the Rule of 89, considered among the best-in-class among software peers. The market opportunity for Datadog is huge as it is only currently only 3% penetrated in a $53 billion market. As such, my one-year target price for Datadog is $121, implying an upside of 39% from current levels.

Be the first to comment