Kevin Hagen

Introduction

We review our Buy rating on News Corp (NASDAQ:NWSA) after shares are again near their 52-week low.

We initiated our Buy rating on News Corp in early July. Since then Class A shares (which we preferred) are down 2%, taking them back to near their 52-week low and down 37% in the past year:

|

News Corp Class A Share Price (Last 1 Year)  Source: Google Finance (25-Sep-22). |

(News Corp has two classes of shares, Class A and Class B (NASDAQ:NWS), with both having the same economic rights but only Class B having voting rights in most situations. We prefer Class A for being slightly cheaper.)

We continue to believe News Corp shares to be an attractive investment, both in their own right and as a pair-trade opportunity against its listed subsidiary, REA Group Ltd. (OTCPK:RPGRY). Operational performance has continued to be solid, with Q4 providing a mostly strong finish to FY22. Shares are trading at a 12.5x P/E and a 1.3% Dividend Yield. The REA stake is still worth 70% of group market capitalization, leaving a 20%+ Free Cash Flow Yield for the rest. We expect a 20-30% upside from either holding NWSA shares or from a long News Corp/short REA trade.

News Corp Buy Case Recap

News Corp. is a NASDAQ-listed media conglomerate with interests in property listings, print and television. The company operates primarily in the U.S., Australia and the U.K., and reports in five main segments.

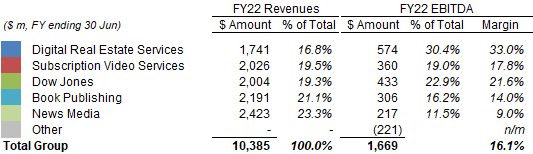

|

News Corp Revenues & EBITDA by Segment (FY22)  Source: News Corp company filings. |

At our initiation, we saw two ways in which we believe investors could generate a profit:

- Long News Corp, short REA – News Corp owns a 61.4% stake in listed Australian property listings company REA Group, and the value of this stake equalled to around 70% of News Corp’s market capitalization, which means the rest of News Corp appeared significantly undervalued with an implied Free Cash Flow Yield of nearly 20%

- Own News Corp shares outright – News Corp has a mixed portfolio of assets, but many are high-quality and we believe overall EPS can grow at mid-to-high single-digits over time. We also believe the P/E can potentially re-rate upwards by 20-30%, especially if management decides to tackle News Corp’s conglomerate discount

Q4 FY22 results released on August 8 represented a strong finish to the year, supporting our investment case.

News Corp Q4 FY22 Results

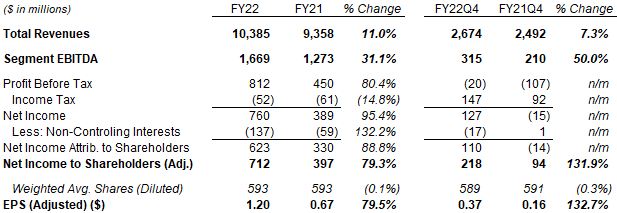

News Corp finished FY22 with Total Revenues up 11.0%, Segment EBITDA up 31.1%, and Adjusted Net Income as well as Adjusted EPS up nearly 80% year-on-year, helped by a continuing rebound from COVID-19 as well and acquisitions, but offset by currency; Q4 FY22 saw Total Revenues grew 7.3% and Segment EBITDA up 50.0%:

|

News Corp P&L Headlines (Q4 & Full-Year FY22 vs. Prior Periods)  Source: News Corp results release (Q4 FY22). |

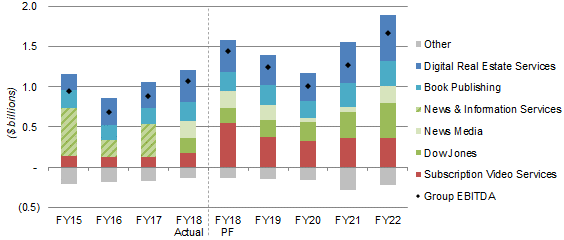

News Corp EBITDA has continued to rebound from the pandemic-related trough in FY20. Within the $396m increase in EBITDA in FY22, the largest contributor was the cyclical, ad-driven News Media segment ($165m), followed by Dow Jones ($101m) and Digital Real Estate Services ($60m); the other two segments had roughly flat EBITDA.

|

News Corp EBITDA by Segment (FY15-22)  Source: News Corp company filings. NB. FY ends 30 Jun. Figures include impact of currency and acquisitions/disposals. |

Just as importantly, News Corp’s solid growth has continued into Q4, despite investor concerns on global macro.

News Corp Performance by Segment

News Corp’s different segments represent a mixed portfolio of assets, with quality ranging from great to okay. At our initiation we predicted that overall EBIT can grow at mid-to-high single-digits annually on average, based on:

- Digital Real Estate Services – EBIT growth at 10%+

- Dow Jones – EBIT growth at 10%+

- News Media – EBIT growth at 4-6%

- Book Publishing – EBIT growth at 3-4%

- Subscription Video Services – EBIT decline of 2-3%

Recent performance has been slightly stronger than we expected, helped by a continuing recovery from COVID-19.

We review each segment’s recent performance in turn below. All segmental results are distorted by acquisitions (positive) and the strengthening dollar (negative), while some were also helped by an extra week in Q4 FY22. We have focused on EBITDA, not EBIT, because the former forms most of management reporting. “Adjusted growth” figures quoted below exclude the impact of currency and acquisition and are the most meaningful.

Digital Real Estate Services

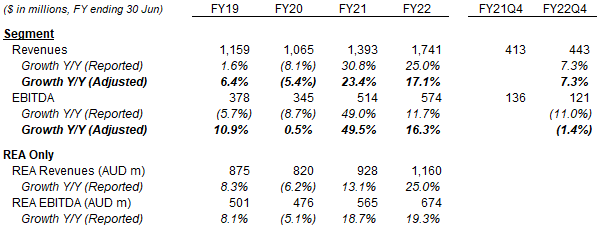

Digital Real Estate Services finished FY22 with Adjusted growth of 17.1% in revenues and 16.3% in EBITDA, including local-currency growth of 25.0% in revenues and 19.3% in EBITDA for REA:

|

Segment Revenues & EBIT – Digital Real Estate Services  Source: News Corp & REA company filings. |

Q4 growth was weaker, with an adjusted growth of just 7.3% in revenues, and an adjusted decline of 1.4% in EBITDA, both affected by a $20m adjustment in the value of future trailing commissions at REA financial services.

The segment has seen some signs of a cyclical slowdown in residential property markets, for example with the U.S. subsidiary Move seeing a 39% year-on-year decline in lead volumes and REA seeing Australian residential new buy listings rising just 2% year-on-year (compared to 54% in the prior year).

The risk of a downturn in Australian and U.S. property markets have clearly risen for the near term. Over a longer timeframe, however, we still expect strong revenue and EBITDA growth to continue in this segment.

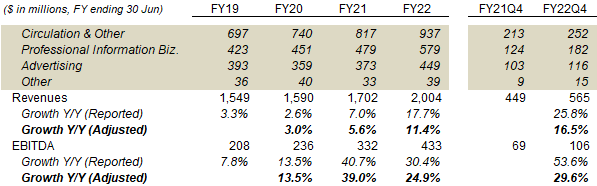

Dow Jones

Dow Jones finished FY22 with adjusted growth of 11.4% in revenues and 24.9% in EBITDA, helped by both structural growth in circulation and professional information revenues, as well as a cyclical rebound in advertising; reported growth was stronger than adjusted growth, helped by acquisitions of OPIS and Base Chemicals:

|

Segment Revenues & EBIT – Dow Jones  Source: News Corp company filings. |

Q4 adjusted growth was stronger than the full year by approximately 5 ppt, but largely due to an extra week this year that was worth $40m (9 ppt); Q4 reported growth was stronger than the full year due to acquisitions, with OPIS contributing a full quarter and Base Chemicals contributing a month.

We expect strong circulation and professional information revenues to continue to drive Dow Jones EBITDA growth.

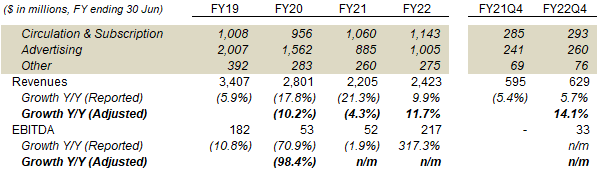

News Media

News Media finished FY22 with adjusted revenue growth of 11.7%. Reported revenue growth of 9.9% ($218m) was helped by both a rebound in Advertising (up $120m) and structural growth in Circulation & Subscription (up $83m); operational leverage in the segment meant that EBITDA rose 317% ($165m):

|

Segment Revenues & EBIT – News Media  Source: News Corp company filings. |

Q4 was driven by similar dynamics, with adjusted revenue growth of 14.1%, but helped $36m or approximately 6 ppt by an extra week this year. Reported revenue growth was 5.7% ($34m) after currency headwinds. EBITDA growth ($33m) was similar to reported revenue growth ($34m), despite $20m of incremental investment on Talk TV in the U.K.

Q4 also saw Advertising revenues grow 8% year-on-year (after currency), “with strength in digital across all our key mastheads” and “driven by the strength of digital advertising”, which management “expect will soon be the largest source of the segment’s advertising revenues”.

Growing circulation and subscription are likely to continue, driving steady EBITDA growth for the segment.

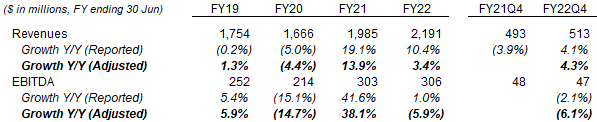

Book Publishing

Book Publishing finished FY22 with 3.4% of adjusted revenue growth but 5.9% of adjusted EBITDA decline, the discrepancy being the result of supply chain and inflationary pressures, which “continue to persist”. Reported growth was much higher than adjusted growth, largely due to the acquisition of Houghton Mifflin Harcourt Books & Media in May 2021.

|

Segment Revenues & EBIT – Book Publishing  Source: News Corp company filings. |

Q4 growth rates were similar to those of the full year, though management stated they “have seen increased orders ahead of the Rings of Power series on Amazon Prime” in September and expected the related publicity to “have a profound impact on HarperCollins’ performance”.

We continue to expect Book Publishing to be a mostly stable business, thanks to its scale advantage, with earnings growing slightly faster than inflation but with occasional volatility linked to macro and blockbusters.

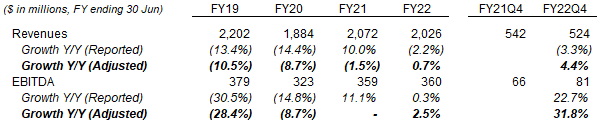

Subscription Video Services

Subscription Video Services finished FY22 with its first annual growth in five years, with adjusted growth of 0.7% in revenues and 2.5% in EBITDA, thanks to lower churn on its traditional offering and growth in newer streaming services:

|

Segment Revenues & EBIT – Subscription Video Services  Source: News Corp company filings. |

Year-on-year, Q4 revenues were down 3.3% on a reported basis, due to currency headwinds, but up 4.4% on an adjusted basis; they were also up sequentially from Q3 on a reported basis. Streaming revenues had reached 23% of circulation and subscription revenues (which were in turn 87% of segment revenues in FY22), and their growth more than offset the decline in broadcasting revenues in Q4. Management believes this to be “a key inflection point”.

We still assume small revenue and EBITDA declines in Subscription Video Services for now, but it is possible that the management has managed to stabilize the segment better than we expected.

News Corp Group Valuation

News Corp Class A shares are trading at a 12.5x P/E and a 1.3% Dividend Yield.

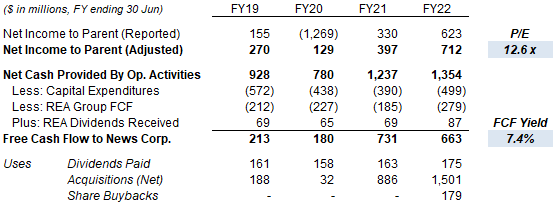

Including both Class A and B shares, News Corp is at a blended 12.6x P/E and a 7.4% Free Cash Flow (“FCF) Yield:

|

News Corp Earnings, Cashflows & Valuation (Since FY19-22)  Source: News Corp company filings. |

Class A shares are slightly cheaper than Class B ones, and their P/E is 12.5x.

The Dividend Yield is 1.3%, from a semi-annual dividend of $0.10 per share ($0.20 annualized).

Management is currently executing a $1bn share repurchase program that was announced in September 2021, its first since a $0.5bn program in May 2013. Buybacks totalled $189m in FY22, leaving $817m in the program, equivalent to 9% of the current market capitalization. We expect buybacks to reduce the share count by a low single digit each year.

Free Cash Flow was lower year-on-year in FY21, despite a much higher Net Income, due to more of the cashflow having been generated by the separate (but majority-owned) REA and higher CapEx.

Long News Corp, Short REA

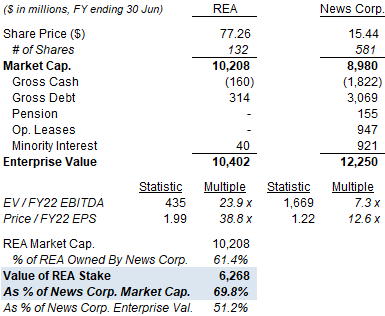

The pair trade opportunity of going long News Corp and short REA remains largely unchanged.

News Corp’s stake in REA continues to represent approximately 70% of its market capitalization:

|

Valuation – News Corp vs. REA  Source: Company filings. |

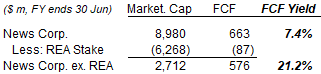

This leaves a 20%+ FCF Yield for what’s left of News Corp excluding the REA stake:

|

FCF & FCF Yield – News Corp vs. REA  Source: Company filings. |

This “News Corp ex. REA” FCF Yield is far too high and should eventually shrink. If the FCF Yield were to shrink by roughly half to 10%, then the value of “News Corp ex. REA” would rise by approximately $3bn, giving a 34% uplift to News Corp’s overall market capitalization. A 20-30% upward re-rating in News Corp shares is plausible.

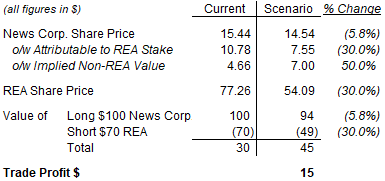

Investors can benefit from this by going long News Corp and short REA. The actual ratio to be used depends on subjective judgement, but each News Corp share owns 0.140 REA shares indirectly, which implies a dollar ratio of 100:70. We look at an example where we buy $100 of News Corp and sell short $70 of REA below:

|

Example Long News Corp / Short REA Trade  Source: Librarian Capital estimates. |

In this example, suppose REA’s share price were to fall by 30% while the theoretical value of the non-REA part of News Corp were to increase by 50%. These should theoretically translate into a 5.8% decline in the value of each News Corp share, which means we would lose $6 on the long side but gain $21 on the short side, resulting in a net profit of $15 from the trade. This would represent an upside of 50% from the original $30 net exposure.

Is News Corp A Buy? Conclusion

We continue to believe investors can expect a 20-30% upside in News Corp shares by one of the following:

- Long News Corp, short REA to gain exposure to the undervalued non-REA part of the business

- Own News Corp shares outright, and benefit from a potential 20-30% upward re-rating in its P/E

Should valuation changes fail to materialize, we believe News Corp shares would generate a low-teens annualized return over time, leading to the same 20-30% upside after a few years. The low-teens annualized return would represent the sum of a high-single-digit EPS growth (from EBIT growing at mid-to-high single-digits and buybacks reducing the share count by a low-single-digit each year) and the current 1.3% Dividend Yield.

We initiate a Buy rating on New Corp stock.

Be the first to comment