FangXiaNuo/E+ via Getty Images

Investment Thesis

MELI 5Y Stock Price

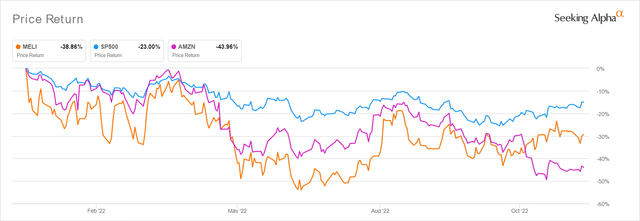

MercadoLibre, Inc (NASDAQ:MELI) has unnaturally rallied by 56.65%, trading at an eye-watering premium of $941.01, despite nearing its rock-bottom P/E valuations of 57.31x. There is no doubt that we have missed the previous June bottoms of $600s, making us wonder when the next opportunity will arise. This sentiment is especially true since the inflation rate in Latin America has been successfully moderated from 6.6% in 2021 to 6% thus far, with 2023 potentially further decelerating to 5.1%. Thereby, also fueling Mr. Market’s growing optimism about the e-commerce recovery in the region, pointing to our folly in attempting to time the market then.

On the other hand, Amazon (AMZN) has been drastically corrected to $95.50, nearing its 52 weeks low of $85.87, despite the upbeat P/E valuations of 67.53x against its previous blood-bath levels of 54.87x. The market is illogical indeed, since things remain volatile in the short term. Oh, well.

MELI Will Continue Deliver Margin Expansion, No Matter The Soft Landing Or Recession

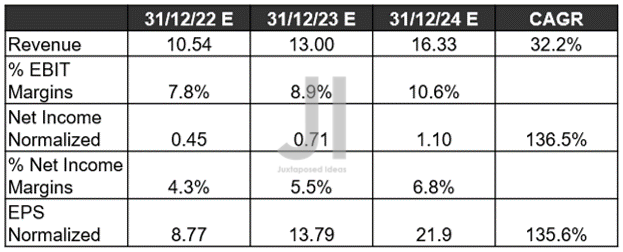

MELI Revenue, Net Income (in billion $)%, EBIT %, and EPS

In its recent FQ3’22 earnings call, MELI reported exemplary top and bottom line expansion indeed, despite a slight revenue miss of $10M. Therefore, it is not surprising that the company is expected to report a further expansion of revenue growth for FQ4’22, due to the accretive effect of Black Friday, the FIFA World Cup, and Christmas. Market analysts have projected that MELI will deliver impressive YoY revenue growth of 39.9%, net income of 47.36%, and EPS of 387.2%, despite the tougher YoY comparison and supposed recession.

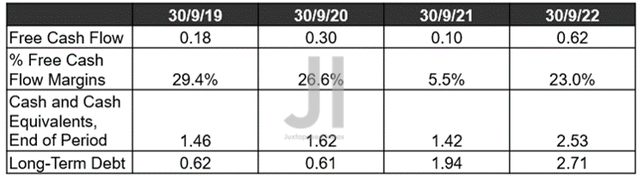

MELI Cash/ Equivalents, FCF (in billion $)%, and Debt

Furthermore, MELI has been executing brilliantly by expanding its Free Cash Flow (FCF) generation to $0.62B and FCF margins to 23% in FQ3’22, indicating impressive QoQ and YoY growth. Its balance sheet is well-insulated as well, at $2.53B of cash and equivalents and $4.38B of total receivables by the latest quarter, representing further YoY growths of 47.95% and 92.95%, respectively.

While MELI has also increased its reliance on long-term debts to $2.71B, illustrating an increase of 9.16% QoQ and 39.89% YoY, we are not overly concerned for now, since only ~$343M will be due 2022, with the rest well-laddered through 2031. Furthermore, part of these debts is attributed to its fintech business, which has proved to be a robust revenue driver with an excellent YoY growth of 247.70% by FQ3’22.

Moving forward, we expect Pago to be highly income accretive as well, with the latest quarter already delivering 40M unique users and $32.2B of TPV. These numbers indicate an excellent 26.58% and 54.06% YoY growth, indicating that there is no destruction of fintech demand despite the elevated inflation rate.

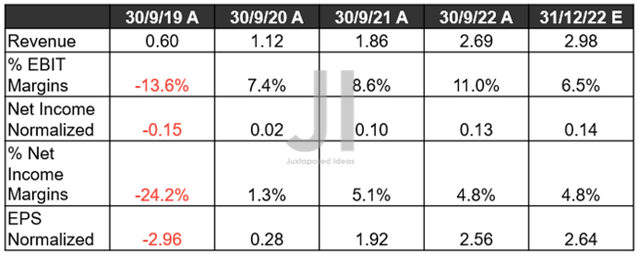

MELI Projected Revenue, Net Income (in billion $) %, EBIT %, and EPS, and FCF %

S&P Capital IQ

Most importantly, MELI’s forward execution remains intact, despite the recessionary fears and rising inflation. Its top and bottom line growth have already been upgraded multiple times since our previous analyses, pointing to Mr. Market’s growing optimism. Thereby, triggering the aggressive expansion in its FY2022 revenue and net income estimates by 2.82% and 28.57% since August 2022 as well.

Furthermore, MELI’s margins are expected to expand further from EBIT/ net income of -6.7%/-7.5% in FY2019 and 6.2%/1.2% in FY2021 to 10.6%/6.8% by FY2024. Thereby, naturally expanding its EPS growth to an ambitious $21.9 by 2024, at a stellar CAGR of 135.6%. It is no wonder that market analysts remain remarkably bullish about the stock, with a price target of $1.45K and a 54.8% upside from current levels.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- MercadoLibre: $600s Could Be Coming Again, Thanks To Global Headwinds

- MercadoLibre: The Crystal Ball Looks Rich Ahead – Wait For The Rally To Be Digested

So, Is MELI Stock A Buy, Sell, or Hold?

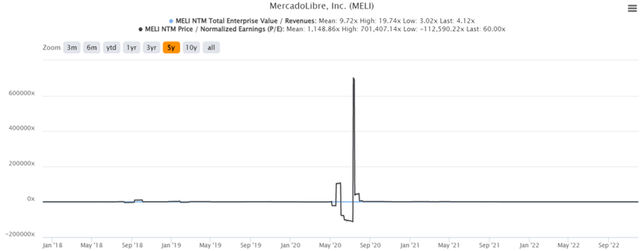

MELI 5Y EV/Revenue and P/E Valuations

MELI is currently trading very attractively at an EV/NTM Revenue of 4.12x and NTM P/E of 60.0x, massively discounted from its 5Y mean of 9.72x and 1,148.86x, respectively. Combined with the factors discussed above, those with higher risk tolerance and next-decade investing trajectory may still nibble the stock at current levels, due to the exemplary 5Y total price returns of 245% and 10Y of 1,238.5%. Impressive, despite the -51.76% discount from its peak stock price of $1.95K in early 2021.

MELI’s numbers are definitely more impressive than AMZN’s projected 48.37% upside to the consensus price target of $141.69. The latter’s 5Y total price returns of 64.3% and 10Y returns of 657.8% are naturally underperforming in comparison as well, pointing to its tragic situation thus far.

Otherwise, as with ourselves, we prefer to maintain a wait-and-see attitude for now, since the Feds may not pivot as early as expected by 14 December. Naturally, it all hinges on the November CPI reports against the Thanksgiving and Black Friday festivities in the US. Assuming another elevated inflation rate, we may see the Feds deliver another fifth consecutive 75-basis point hike, against the market projection of a 50 basis points hike and the Bank of Canada’s recent moderation in October. Combined with the possibility of raised terminal rates to over 6%, we may see more market correction through 2023, giving interested investors another speculative chance to load up.

Naturally, we would also like to offer a word of caution. Bottom-fishing investors may run the risk of losing out on MELI’s sailing boat, since the whole market will rally if the Fed genuinely pivots over the next two weeks. The stock market could start its next-decade bull run, as seen during the previous recession in 2008. Only time will tell.

Be the first to comment