Thomas Barwick/DigitalVision via Getty Images

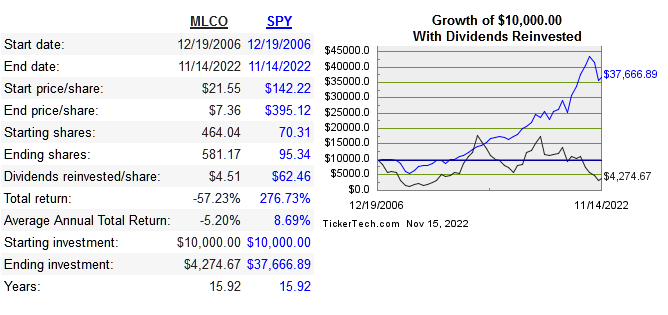

Melco Resorts (NASDAQ:MLCO) is a resorts and gambling company that operates resorts in Macau, Philippines, and Cyprus. They are a subsidiary of Melco International (MDVEF) and have been public since 2007. Below is the share price performance since IPO.

dividend channel

Obviously the company was hit hard from Covid as revenue dropped dramatically from $5.73 billion in 2019 to 1.72 billion in 2020. Below are the return on capital metrics.

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

-6.2% |

10.2% |

4.4% |

n/a |

n/a |

|

|

11.4% |

10.5% |

8.5% |

26% |

9.5% |

|

|

2.56% |

4% |

0.8% |

24.7% |

6.4% |

|

|

6.6% |

14.9% |

14.1% |

8.4% |

14.6 |

Net income and FCF have been negative since covid. Debt has also increased as we will see below.

Risk

The two big risks with this company are the debt load, and a struggle to return to profitability. Even before covid, the company was inconsistent with regards to positive free cash flow and net income. Shares were already declining before covid and leverage was increasing as well.

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Gross Margin |

27.9% |

30% |

30.3% |

29.5% |

31.1% |

32.7% |

35.7% |

36.5% |

10.9% |

25.8% |

|

Operating Margin |

12.4% |

16.5% |

14.2% |

2.4% |

8% |

11.5% |

12.1% |

13% |

-54.4% |

-38.7% |

|

Net Margin |

10.2% |

12.5% |

12.6% |

2.6% |

3.8% |

6.5% |

6.8% |

6.5% |

-73.1% |

-40.3% |

|

Long Term Debt(bil) |

2.3 |

2.2 |

3.6 |

3.8 |

3.6 |

3.5 |

3.6 |

4.3 |

5.6 |

6.9 |

|

Equity(bil) |

3.3 |

4.2 |

4.2 |

4.3 |

3.3 |

2.8 |

2.1 |

2.4 |

1.1 |

0.24 |

Long term debt is over 3x last year’s revenue. This is a terrible sign considering that net income peaked in 2013 at $637 million. Even at their highest earnings, they’ve put themselves into an almost inescapable debt spiral.

Valuation

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

MLCO |

6.4 |

-91.6 |

-17.5 |

-32.3 |

|

MCRI |

3.2 |

9.9 |

17.2 |

3 |

|

RRR |

3.2 |

7.3 |

34.7 |

309.6 |

|

HGV |

2.2 |

8.1 |

9.8 |

2.2 |

I’m not including a DCF model because I don’t see a scenario where they return to profitability anytime soon. At best the price might be low enough to get a quick pop one day in a deep value sense. This isn’t the case though. Think about what you get for the multiple you are paying. Over 6 times sales for a company that has almost inescapable debt and no hope for profitability.

Conclusion

MLCO was devastated by the pandemic and this was obviously not the company’s fault. Since then they have piled up more debt while revenue still struggles to return to normal levels, and still don’t even generate an operating profit. Anything in leisure, hospitality and gambling can be cyclical, but there’s no doubt that intrinsic value is only decreasing over time. Multiples don’t tell the full story, but in this case we can see that there are much better stocks in the industry if you are set on that. Profits were already inconsistent before the pandemic, and now the future is more uncertain than ever plus the debt levels have gotten out of control. I don’t see this ending well and I will firmly avoid this stock.

Be the first to comment