Editor’s note: Seeking Alpha is proud to welcome Leon Laake as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Flashpop/DigitalVision via Getty Images

Investment thesis

Medifast (NYSE:MED) has a long history of weight loss management but only a restructure of its business in 2016 brought new life into this stock. In 2016, Medifast started to focus on its product Optavia which helped to grow its revenue and income tremendously while perfecting its profitability. The share price appreciated accordingly, at least until June 2021. Since then the share price got nearly slashed in half.

My thesis is that Medifast’s stock will rise again and outperform the market due to a great market outlook, superior growth and profitability metrics, and a better balance sheet compared to its peers, in addition to its current undervaluation.

Business model

Medifast has 40 years of history in producing and selling healthy meal replacements for people with a wish, but no time, for a better diet. The company has built a community with coaches that help the persons mentioned above due to combining meal replacements and a training plan with the support of a community.

Optavia

What was founded as ‘Take Shape For Life’ in 2002 got rebranded to Optavia in 2017. In recent years, Optavia has become the primary growth driver of Medifast, and has consistently grown faster than peers and competitors.

Optavia is a community for people for whom diets alone have failed. The goal is to help these clients to create a healthy lifestyle instead of just treating the problem by losing weight. To reach this goal, Optavia combines scientifically proven plans with their meal replacements, diet products, and the support of independent coaches.

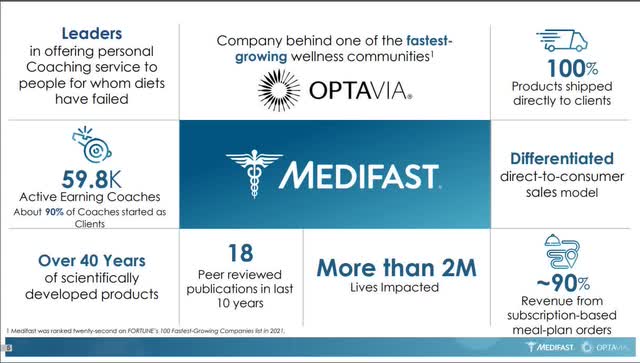

Optavia, Investor slide

While meal and training plans, as much as diet products, are prevalent and not directly different from competitors’ offerings, Optavia has the advantage of combining these with the support of coaches. This makes Medifast a first mover and leader in the weight-managing industry.

The coaches work independently and provide their customers with the education, encouragement, and inspiration they need to follow through with their transformation into a healthier lifestyle. As of March 2022, Medifast had nearly 60k active earning coaches, of which 90% were clients first.

The advantage of this system

Well, I think the most common reason people fail to pull through their diet is that this can be very hard in certain circumstances, and people are missing the motivation. With their personal coach, they have someone to talk to and someone who pushes them to their goals.

Furthermore, humans are meant to be social. Not everyone, but the broader mass works better with people around them. The feeling of being part of a community of people with the same goal is indeed helping them.

The help Optavia clients get not only refers to weight loss alone. The coaches help them transform their whole lifestyle, which is meant to keep the weight-loss sustainable. This is one big difference between Medifast’s Optavia and its competitors. This advantage, combined with the company’s diet products and plans, has already helped more than 2 million clients.

Optavia vs competitor’s business model

Another reason why I think that system works great is because 9 out of 10 coaches were former clients. They won’t become coaches if it hasn’t worked for them, right?

Medifast’s clients get their products via a direct selling channel which advantages conventional selling structures, which mainly need go-betweens to connect customers with the products. These middlemen take their part of the cake and therefore shrink margins. As a cherry on top, nearly all products are subscription-based, so about 90% of the revenue is recurring.

In my eyes, due to a higher chance of success for the client, an already existing community, a direct selling system, and recurring revenues, Medifast has the most superior weight-loss system out there and outclasses its peers and competitors – which is one of the reasons for a market and peer outperformance I mentioned in my investment thesis.

Business fundamentals

Medifast is one of very few stocks that combine good growth, value, and dividend metrics.

Growth

Medifast has a phenomenal track record when it comes to growth.

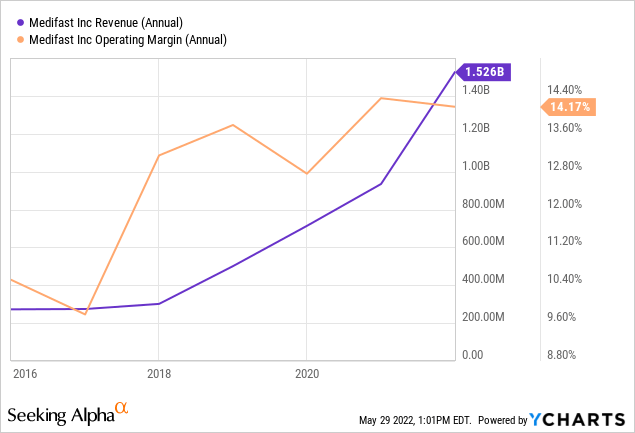

Between 2017 and 2021, revenue grew by 455% or 91% annually. The company generated $1.5 billion in 2021 and $417.6 million in Q1 2022 alone, at a YoY growth of 22.6%. Simultaneously, operating income grew by 700% or 140% annually to $216 million by 2021. In Q1 2022, Medifast reported an operating income of $55.1 million, a growth of 4.4% YoY. The operating margin stands at 14.17%. The management’s long-term goals are 15% revenue growth and 15% operating margin. Active earning coaches, the backbone of the company’s operations, grew by 300% or 75% annually, while the revenue per coach grew 10% annually.

Key metrics

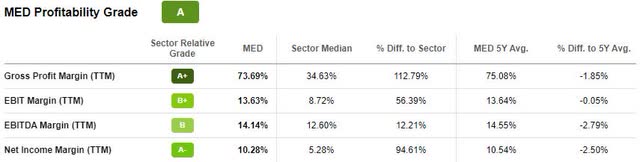

The metric that counts the most for a value stock is the valuation, which I will cover later. Another metric that speaks for value is good profitability. With:

- gross profit margin of nearly 74%

- EBITDA margin of 14.14%

- net income margin of 10.28%

Medifast is showing that it is excellent at turning sales into profits.

When it comes to return ratios, Medifast doesn’t fail to satisfy either. With:

- return on equity of 84.29%

- return of capital of 63.2%

- and return of assets of 39.1%

Medifast is also proving that it can generate phenomenal returns.

While the margin and return ratios seem very good stand-alone, they look even better when compared with the sector median (shown below). As you can see below, all these metrics are considered between grades A+ and B by the SA Quant rating system.

Seeking Alpha Quant rating

Seeking Alpha Quant rating

Dividend

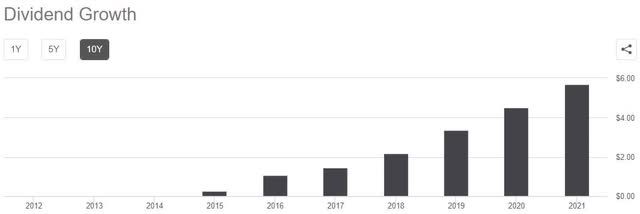

As said above, Medifast combines all this with a very pleasant dividend yield and even more pleasant dividend growth. At the time of writing, Medifast yields 3.5% while paying out 42% of its net income.

Medifast has grown its dividend by 2524% in total and 360% annually since it began paying one in 2015. In the last five years, the dividend grew by 39% annually.

Seeking Alpha dividend growth

Let’s pretend Medifast grows its dividend as much in the next five years as it has in the last five years, so by 13.2% annually (which is conservative in my eyes), we would then get a dividend of $12.2 which would account for a yield on cost of more than 7%. The DCR (dividend coverage ratio) is at 2.44. The DCR measures the number of times a company can pay its dividend with its net income. To bring this in perspective: a DCR above 2 is considered healthy.

In summary, Medifast offers a high yield with very high growth and good coverage, which is everything you could wish for.

Valuation

Despite bringing so much to the table in terms of growth, profitability, and dividends, the valuation is very cheap compared to historic multiples as much as the sector median and other companies with similar characteristics.

Let me state a few numbers:

- P/E GAAP (fwd): 13.49

- EV/EBITDA (fwd):8.15

- P/S (fwd): 1.37

- PEG GAAP: 0.42

Price to earnings of 13.5, or P/S of 1.4 for a company that grew at an average of 90% in the last five years while being profitable? That’s incredibly cheap if you ask me.

It gets even better when compared to the historical multiples of Medifast. Five-year averages:

- P/E GAAP: 26.6 – Discount: 49.3%

- EV/EBITDA: 17.4 – Discount: 53.2%

- P/S: 2.75 – Discount: 50.18%

- PEG: 1.05 – Discount: 60%

The median discount on these metrics is about 30% compared with the sector. You can look these metrics up on the valuation tab on Seeking Alpha.

In my opinion, with all the perks Medifast brings in as explained above, way higher multiples would be justified. Appropriate multiples which I find fully justified would be:

- P/E GAAP: 25

- EV/EBITDA: 15

- P/S: 2.5

- PEG: 1

These multiples are a bit beneath the historic multiples due to the nature of slowing growth with time but still pretty much above the current multiples due to the reasons I explained earlier: superior business model and fundamentals compared to peers and still a good growth and profitability outlook.

Following you can see the German version of FastGraphs which gives you a dynamic view of Medifast’s valuation:

Medifast valuation – Aktienfinder.net

As you can see, never in its history has this stock traded so far beneath historical earnings and dividend multiples. Assuming Medifast will trade at its historic average adj. earnings multiple at the end of 2023, this would account for a total return of 91% or 51% annually. As seen in the picture, Medifast tends to trade (heavily) above its multiples sometimes, so a return just to the historical multiples is relatively conservative, in my opinion.

Discounted Cash Flow Model – 5-year calculation

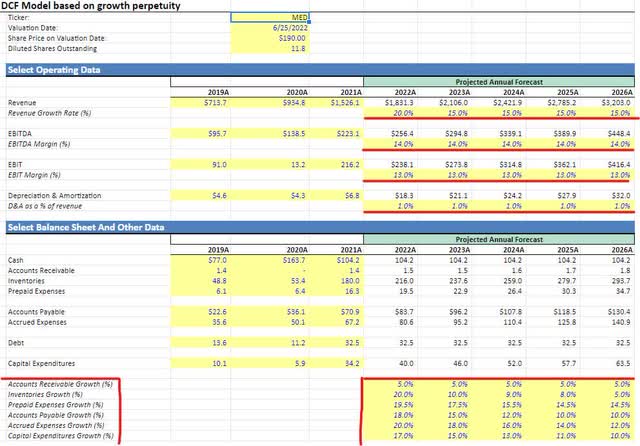

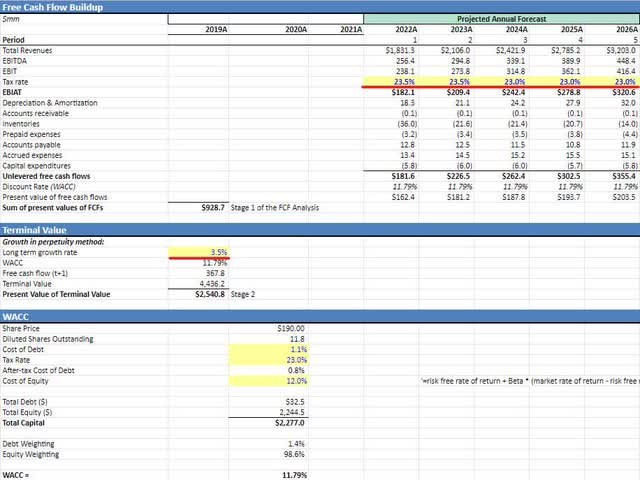

To evaluate Medifast based on my own and its growth predictions, I put the data in my DCF model. I am always a bit conservative when it comes to projections to create some kind of margin of safety. All the predictions in the balance sheet segment were made with averages of the last years and my predictions for the further years.

In short, I estimated 25% revenue growth for this year and 15% until the year 2026. EBITDA margin came in at 14% and EBIT margin at 13% until 2026. WACC was calculated at 11.79%. With these predictions, the DCF model generated a share price of $299.78, which represents an upside of nearly 58%.

For everyone interested in looking up all the details of this DCF model, I put screenshots of the full model right beneath. If you aren’t interested, scroll down to the result of my valuation chapter.

DCF operating data and balance sheet, author

DCF model cash flow and terminal value, author

DCF result, author

Result of valuation analysis

When taking all the different valuation methods (historic multiples, sector comparison, and DCF model) into consideration, I get an upside of around about 50% which is likable for a company with these characteristics. As mentioned in my investment thesis, this is one reason why I see Medifast as a great investment right now.

Balance sheet

In times of rising rates, a company’s performance is somehow dependent on its debt. In the case of Medifast, you don’t have to worry about debt since the balance sheet is entirely debt free. When it comes to debt-heavy growth stocks, Medifast stands out.

The company’s operations generated enough cash to fund this massive growth without borrowing money, which is an enormous advantage. This shows its incredible profitability and gives safety in times of rising rates, during which other companies lose much money as they have to pay more for servicing their debt. Furthermore, Medifast sits on a net cash balance of $122 million of cash & ST investments which should be enough to finance future growth.

Another thing that stood out for me is that the company doubled the property, plant, and equipment balance in 2021 from $38 million to $80 million. This is due to a new distribution facility in Texas which should help growth and cost efficiency, and therefore strengthen my confidence in the long-term growth and margin goals.

What else is there to like?

Investor-friendly management

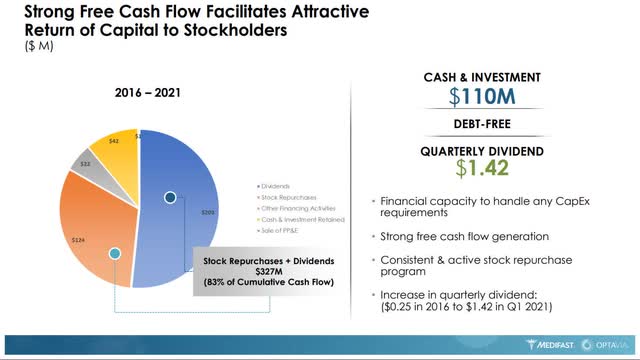

Previous use of capital shows that Medifast’s management is very investor-friendly.

Use of capital

Between 2016 and 2021, 83% ($327 million) of cash flow functioned as shareholder return. The majority of it, $203 million, was paid as dividends, and the other $124 million were used to buy back shares.

Since the first buyback in 2010, Medifast has bought back 3.1 million shares which equate to 21% of the total outstanding shares. I like companies that buy back shares because it shrinks the amount needed to pay the dividend and therefore saves money to allocate otherwise or helps boost the dividend to the remaining shares. Either way, those who profit are the shareholders.

Scalable business model

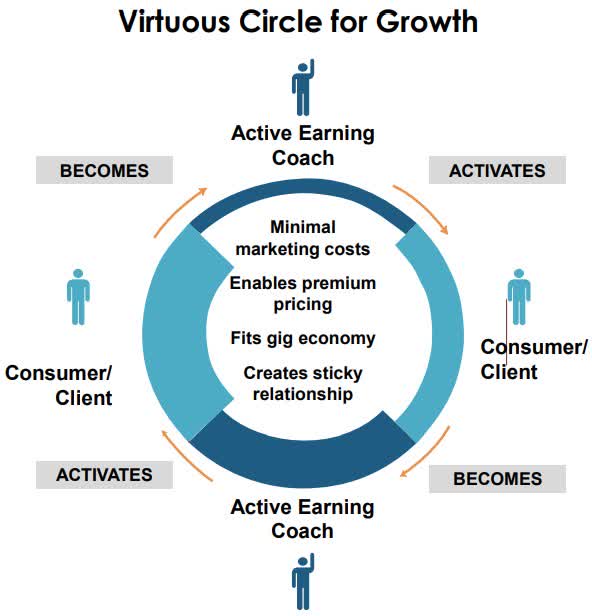

Clients/customers become coaches, creating a virtuous cycle in which clients automatically make customer acquisitions. The most significant positive effect of this is tremendous savings in money. This characteristic gives them the possibility for exponential growth, as more clients mean more coaches and vice versa. I found a good visualization of this in the company’s latest investor’s presentation:

Optavia’s virtuous cycle

Network effect

According to Morningstar, the network effect is one of the five primary sources of a moat. A moat usually generates a competitive advantage and, therefore, secures long-term profitability. A network effect is created when the value of a product or service increases with the number of its users. As more coaches and clients become part of the community, the more important and meaningful it gets. This way, Medifast generates a great network effect with its Optavia coaches-client community.

Asset-light business model

Medifast’s business doesn’t come with many assets which can be seen when looking at Depreciation & Amortization (D&A), Capital Expenditures, and Net Property, Plant & Equipment.

- D&A was only 0.45% of sales in 2021. The sector median is about 2.8%.

- CAPEX was 2.24% in 2021. The sector median is roughly 2.9%.

- Net Property, Plant & Equipment were only 5.28% of sales in 2021 which is incredibly low.

This means that Medifast can operate without a huge amount of machines, vehicles, inventory, real estate, and so on. This makes it more agile than other companies, which can come in handy in various situations.

According to EY, asset-light companies outperform their asset-heavy peers:

On average, the asset-light companies outperformed their asset-heavy peers by four percentage points in the last five years of total shareholder returns

Competition

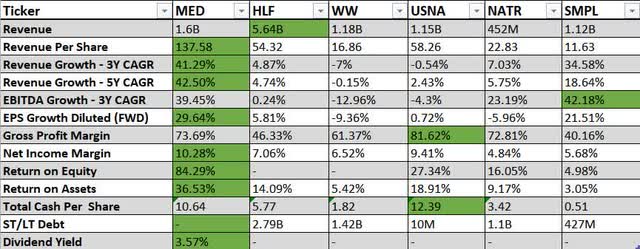

Let’s talk about Medifast’s competition to evaluate if there is luring danger there. In the latest annual report, Medifast mentioned which companies it sees as competitors. I will pick the first five off that list and compare the most significant differences with them.

Medifast competition comparison

You can see here that Medifast is the fastest growing and most profitable company with the best cash and debt profile while being the only one that pays a dividend. The Simply Good Foods Company (SMPL) is the one that comes near Medifast in terms of growth while USANA Health Sciences (USNA) is the closest regarding profitability. But Medifast safely secures the top position as the company that combines the best of all worlds.

In other words, Medifast is not only superior when it comes to the business model but also when it comes to fundamentals.

Market outlook

At around 42.4% (as of 2020), the United States has one of the highest obesity rates globally, and this figure is estimated to grow to 49% in 2030. For comparison, the average obesity rate was just 16% in 2008.

Here are some facts about the consequences of being obese:

- higher risk of developing type 2 diabetes, high blood pressure, strokes, and some types of cancer

- An additional $149 million annually in healthcare spending

- the most common reason for being rejected by the military

- At least 2.8 million people die each year due to obesity

Obesity is a severe condition that is widely overlooked, even though it kills millions of people every year. In the last few years, we have seen a trend towards greater more work-life balance, healthier food, and sports. The pandemic has strengthened this trend.

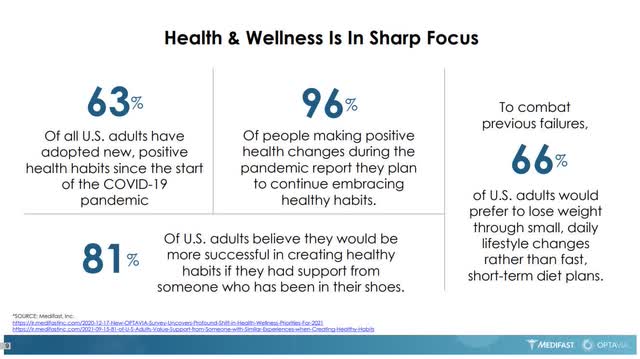

Additionally, governments, especially in Europe, put pressure on food producers to fight the rising rates of obesity. I can imagine that the healthcare system will pay for programs as a precautionary measure to stop the obesity rate from rising further. Medifast has found similar in surveys regarding weight loss and healthy habits concerning the pandemic:

Medifast investor relations slide

As described above, Medifast has a superior financial situation, growth, and profitability. In particular, the unique way in which its system is built will give it an advantage against competitors. Therefore I think that the market outlook is further proving my investment thesis and should help the share price to appreciate accordingly.

Risks to my thesis

Reviews

As with everything nowadays, you can read reviews and test results about Optavia on various sites like the US News Health. On this one, for example, Optavia gets 2.6 out of 5 stars which is everything but good in my opinion.

The criticisms in this one are mainly due to the difficulty of following this diet, which sounds somewhat strange to me because this is one of the core advantages of Optavia, as stated by Medifast.

Furthermore, they maintain that Optavia’s diet isn’t particularly healthy while saying they are missing long-time results.

The missing of long-term results is the key critique of most Optavias reviews which is understandable since Optavia is a fairly new diet. Of course, there is the risk that Optavia’s diet could be worse than competitors, but I for my part see this risk as pretty unlikely.

Management

Another potential risk, which is present for nearly every company, is mismanagement. Considering that the management already successfully restructured the company in 2016 and multiplied its revenue and income since then, I don’t see mismanagement as something you have to seriously factor into your investment case. The management proved itself to be very competent which will probably not change as far as the key personnel remain the same without major changes.

Business model

Medifast’s business model is also known as MLM or multi-level marketing. Multi-level marketing describes the practice that people recruiting people. In the case of Medifast, the coaches recruit the clients and therefore recruit other coaches, which is in fact an MLM model.

MLM, also known as network marketing or pyramid selling, is widely recognized with negative vibes due to some negative examples in the past and the present with MLM companies turning out to be illegal pyramid schemes.

To confront this topic, Medifast addressed this issue in the latest annual report:

OPTAVIA Coaches do not handle or deliver merchandise to clients. This arrangement frees our OPTAVIA Coaches from having to manage inventory and allows them to maintain an arms-length transactional relationship while focusing their attention on support and encouragement.

Revenue is derived primarily from point-of-sale transactions executed over an e-commerce platform

With this statement, Medifast wants to separate itself from the original MLM company which generates its revenue mostly from the people working for them in the network.

In my opinion, the resemblance of Medifast’s business model to MLM models does not represent a risk because it is too far away from being a pyramid scheme.

Conclusion

With Medifast you can get a company that is growing in double digits while being profitable, debt-free, paying a generous dividend, and buying back shares. The business model comes with a network effect, a promising future due to market conditions, and good management.

I would rate Medifast a ‘Buy’ if it would be at fair value and even with a slight premium to fair value. However, as the company is undervalued compared to the sector median and its own historic multiples, I rate it a ‘Strong Buy’ considering its higher total return potential.

Be the first to comment