CaseyHillPhoto/E+ via Getty Images

Boot Barn Holdings, Inc. (NYSE:NYSE:BOOT) is the nation’s leading western wear retailer. I last covered Boot Barn here on Seeking Alpha in January. I noted the company’s strong revenue and EPS growth rates, and I noted their market advantage of having no major direct competition of their size. Since I first wrote about Boot Barn in October, the share price increased from about $100.00 a share up to $134.50. The company continues to perform well, but the share price has since dropped to around $92.00 as of this writing. I believe the drop is more due to general economic conditions rather than company performance, but economic conditions have changed enormously since January and the effects cannot be ignored. I still see Boot Barn as undervalued, but I believe a fair market price for today is $108.30, and that is still significantly above today’s current market price.

Source for image, data, and information: Boot Barn

FY22 Q3 Results and Company Growth

Despite the industry supply challenges, Boot Barn continued to show its strength through Q3 FY22. Third quarter sales increased by 71% on a two-year basis, and that increase was approximately the same for retail store sales and e-commerce, with about 60% being same-store sales increases. Gross profit increased to 39.4% of sales, up from 34.2% in the prior two-year period. The company credits the success to less need for promotions and improved margins with the Sheplers brand, among other things, such as their ability to grow exclusive brands. While freight costs represent a significant headwind, the company has absorbed those costs well and they note the potential benefit to margins once freight costs return to more normal levels. With all considerations, Boot Barn believes that overall margins can continue to improve modestly.

Boot Barn acknowledges that some of its impressive sales gains can be attributed to favorable industry-wide trends, but note that their 70% plus gains are far above some unnamed competitors that reported 7%, 17%, and 10% gains. They believe that the company is being compared perhaps too closely to those peers, implying that a downward adjustment to their P/E in the market is not reflecting the astonishing growth rates.

In fact, the prior 9-10 months of gains were said to be at least half due to growth in new customers. As you may recall from previous articles, Boot Barn is growing in new store locations, e-commerce, and in targeting new customers, and product offerings. All these efforts are fueling robust growth.

For example, Boot Barn realized another market opportunity that targets certain customers that may not necessarily be a rodeo fan but may like to wear boots or other apparel and enjoys country music. They call this category “Just Country” and they created two new brands to attract those customers. These brands are “Cleo & Wolf” for ladies, and “Brothers and Sons”, for men. In addition, the company saw further target opportunities and created the “Rand 45” brand catering to a younger aggressive rodeo customer and the “Blue Ranchwear” brand for a more traditional ranch clientele.

In the two-year comparison, the company saw growth in men’s western boots, accessories, kids’ boots, men’s apparel, and work wear. But ladies’ apparel and ladies’ western wear and accessories have remained as the strongest performing lines.

The mentioned, “Just Country” category has been a large driver for bringing in new customers and is proving to be a great companion to the company’s traditional western wear offerings. As “Just Country” continues to grow, Boot Barn will be expanding the line by adding for new exclusive brands to the category in the coming months. The company sees “Just Country” as an opportunity that will generate growth for many years to come.

Also mentioned was the reported strength in the company’s e-commerce option. Boot Barn is growing the business by recently making the merchandise available in stores to be also available on the online site. Orders are made online and filled by the stores. Likewise, the company flipped the idea by making their online options now also available in stores. They see these actions as bringing the potential for more sales opportunities while reducing the need for markdowns.

Although inflation must be considered, Boot Barn notes some other trends that may work in their favor. For example, rodeos and concerts were often cancelled or generally occurred less during the pandemic, but Boot Barn states that they are starting to see those events come back. Also, even before the war in Europe occurred, Boot Barn was seeing a pick-up in sales of flame-resistant apparel for the oil industry. I think it is reasonable to expect that work in this industry is only picking up further when considering the world events, and Boot Barn should be well-positioned to provide for those needs. In fact, the full line of Boot Barn’s work wear products should provide some insulation from inflation, as work wear is an essential need.

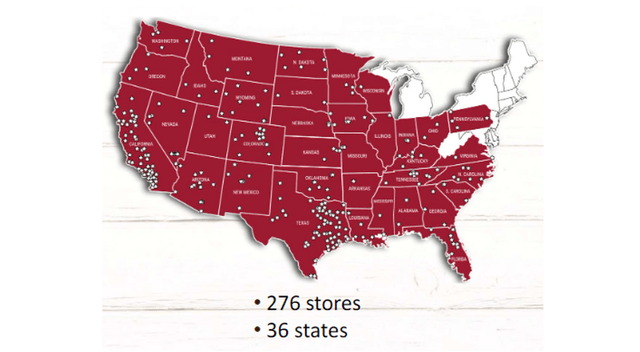

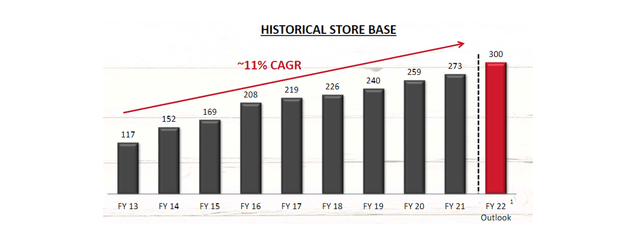

FY22 has been another strong year for store growth with 11 stores opened in the third quarter. The company expected to open another 11 stores during Q4 which would bring the total store count to 300 by the end of FY22. Perhaps even more interesting is that, as the company continues to expand into the northeast, they are finding that stores in some states are performing towards $4 million in annual sales, which they say is double what was expected. That’s fascinating considering that they are just making the initial inroads into that region, and it may imply a potential for lucrative unit sales growth opportunities. The company map below illustrates the point, although note that it does not show all the newest locations yet.

Store Locations Map (Boot Barn)

Boot Barn expects to continue its CAGR store growth rate of approximately 11%, and they believe that growth combined with product and e-commerce gains will position them as a multi-billion-dollar company in the next several years. They further stated that they believe they can produce a decade worth of 22% sales growth going forward.

Store Location Growth (Boot Barn)

Valuation

At my last writing, the company was projecting a TTM EPS of $5.70. Once the Q3 data was released, the numbers confirmed that exact projection. I used a 5-year average P/E from YCharts of 22.61 to set my fair market value at $128.88.

As I have presented in this update, Boot Barn continues a strong growth path, and sales have remained solid up through the Q3 data. For the upcoming Q4, the guidance given at the time is that January was showing further growth across all products and across all regions.

In a normal situation, I would project a conservative guess for Boot Barn’s Q4 and feel comfortable with using the current 5-Year average P/E of 22.3 as shown below. Also, I think the current market P/E of about 16 is too low when you consider all that Boot Barn has shown in accomplishment and in potential.

But I do have to acknowledge the current economic environment. If we were only talking about inflation, I wouldn’t be overly concerned. In fact, I think Boot Barn is looking attractive despite all the current uncertainty. Yet, to be conservative, I see a more realistic P/E of about 19. This is just a guess, but I am splitting the difference of the current P/E with the 5-year average. That should provide some cushion for the uncertainty, but I also believe it doesn’t provide the full value for the company’s current performance. However, it does allow for the possibility of excessive pressure from inflation or additional freight costs. If economic conditions improve, then I could certainly see room for an upgrade back to levels in line with my previous range, or higher.

Using the P/E of 19 for now, and simply assuming Q4 as flat from last year, that provides a current fair value of $5.70 x 19 = $108.30. Thus, I believe the current fair market value for Boot Barn is $108.30. That is less than my previous target but still substantially higher than the market is currently allowing. Obviously, there is good potential for Q4 to add to the TTM instead of being flat. Also, if the company continues to perform as well as the past levels show, then the 5-year average P/E should be at least more appropriate than current levels, if not too low.

Risks

The company provides a full list of risks in its annual filing. I recommend reading that in its entirety. Also, I listed several risks in my previous article that I believe are still relevant and should be considered. I have included those below. Note that any risks, including market fluctuations or world events, can lead to share values that do not reflect the thesis of the article.

Boot Barn will have some seasonality to its sales, and future quarters may reflect that more so than we have seen thus far in FY22. But it’s worth noting that Boot Barn is not as subject to seasonality as some other retailers are since a lot of their merchandise is for work wear that needs regular replenishment.

Boot Barn competes for the labor force and the company saw some increases in payroll expenses. Also, marketing costs were higher year-over-year. I believe a lot of this may be mostly a consequence of the returning of consumer demand that followed from the worst days of the pandemic.

Supply and inventory are a major concern for retailers currently. As mentioned, the company believes that it is well-positioned to meet demand.

Final Thoughts

Even in extraordinary times, Boot Barn has proven to be a stable growing company that appears to be managed very well. Through all the headwinds thus far, they have been able to increase inventories and they finished the quarter with no debt. They also ended Q3 with $115 million in cash. The company sees lots of opportunities to grow, and in the short term, they don’t plan to buy back stock or pay dividends. They see plenty of opportunities to use that cash to continue to grow the business, and that is the plan.

Companies like this can get caught up in a general downturn in the sentiment of the market, and I think that may be the case for Boot Barn right now. You can’t say any company will come out unaffected by unfortunate or even devastating events, but Boot Barn appears to be on a reasonably solid footing to withstand headwinds, perhaps better than many others.

Riding out in the sunset may not be so good for some, but if I had to guess, this group may be on their way to a Boot Barn to restock after another hard day at work.

Be the first to comment