JazzIRT/E+ via Getty Images

The market hasn’t been kind to many stocks, and surprisingly Medical Properties Trust (NYSE:MPW) has become collateral damage. MPW’s share price has drastically declined by 33.76%, pushing its yield to 7.25%. When shares reached $17.10, I added shares and left additional dry powder to be allocated if shares reached $15. The price decline is perplexing because MPW has strengthened its financials in Q1 while becoming one of the most attractive REITs in its respective peer group. I wrote an article on March 23rd about MPW, and at the time, its dividend yield was 5.7%, its price to Funds From Operations (FFO) was 12.34x, and its EBITDA to Total Debt ratio was 8.12x. Today, MPW’s dividend is larger, and its valuation is more attractive than before.

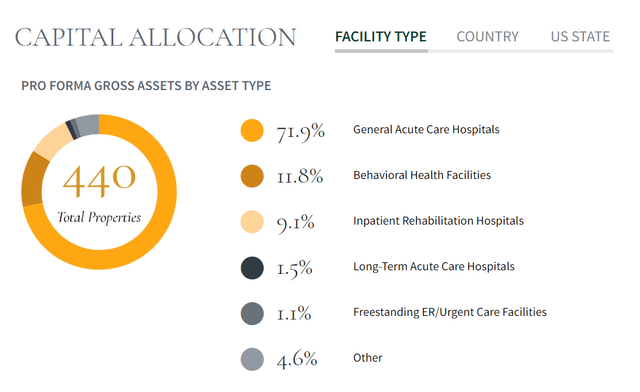

MPW operates one of the largest health care REITs and continues to grow its portfolio. MPW owns hospitals in 32 states 7 European countries, Australia and South America. The only physical real estate that I own is my primary residence. While I have always toyed with the idea of buying rental properties, I am not handy and don’t want to deal with tenants or the responsibilities that come with property management. Investing in equity REITs provides exposure to real estate investments without having to do the work and allows me to collect larger than average dividends. Within the vast range of real estate properties, MPW provides access to some of the most critical properties as healthcare facilities will always be needed. Today MPW operates a $22.2 billion portfolio consisting of 440 facilities in 10 countries with 46,000 licensed beds. As I watched the price slide into the high teens, I knew I needed to add more shares to my portfolio. MPW continues to strengthen its financials and is trading at a more attractive level compared to its peers than it was 3 months ago.

MPW share price has been on the decline but its financials have only gotten stronger

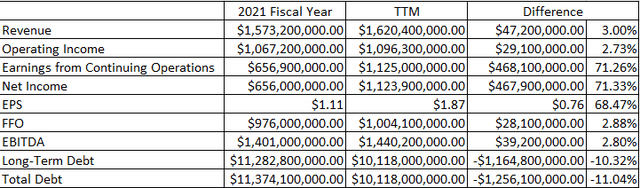

I search for this type of opportunity as MPW’s share price has declined while its financials have strengthened. On February 3rd, 2022, shares of MPW traded for $22.17 as it reported Q4 2021 and Fiscal Year 2021 results. MPW closed 2021 generating $1.57 billion in revenue, $1.07 billion of operating income, $656.9 million of earnings from operations, $656 million in net income, EPS of $1.11, FFO of $976 million, $1.4 billion of EBITDA, $11.28 billion in long-term debt, and $11.37 billion of total debt.

MPW reported its Q1 2022 earnings on 4/28/22 and delivered progress across the board when comparing the QoQ results from the 2021 fiscal year to the current trailing twelve months (TTM). MPW’s net income and EPS will look like large jumps, which is why reading through the cash flow statement is very important. In Q1 2022, MPW sold real estate assets and generated $1.53 billion in net sales.

Steven Fiorillo, Seeking Alpha

MPW’s revenue grew by $47.2 million (3%) while generating an additional $29.1 million in operating income (2.73%) in the TTM compared to the 2021 fiscal year. Earnings from continuing operations, net income, and EPS all jumped over 65% due to the net proceeds from MPW’s real estate sale. I am not as focused on this because it’s not a windfall of capital that is generated consistently, but I am interested in the FFO and EBITDA. MPW’s FFO increased by $28.1 million (2.88%), while EBITDA increased by $39.2 million (2.8%). This is important because FFO represents the actual cash generated from the REIT’s operation. It is a widely used ratio for valuation purposes as it has become the primary earning metric in REITs. FFO = Net Income + Depreciation and Amortization+ Loss on Sales of Asset – Gain on Sales of Asset+ Interest Income. This is the capital that MPW’s dividend is paid from, so it’s important that FFO is always growing.

MPW utilized the net capital generated from its asset sale to strengthen its balance sheet and repay a portion of its debt. MPW’s long-term debt declined by -$1.16 billion (-10.32%) as it fell from $11.28 billion to $10.12 billion. MPW’s total debt declined by -$1.26 billion (-11.04%) from $11.37 billion to -$10.12 billion. I believe this was a great utilization of capital because it put MPW in a much better position from an EBITDA to total debt perspective due to deleveraging the balance sheet.

MPW is now trading much more attractive than its peers compared to in the mid-range the last time I looked at the metrics

Dividends, price to FFO, and debt to EBITDA are three aspects I look at when evaluating REITs in addition to the overall financials. Prior to comparing MPW to its peer group of Healthcare Trust of America (HTA), Omega Healthcare Investors (OHI), Healthpeak Properties Inc (PEAK), Healthcare Realty Trust (HR), and Physicians Realty Trust (DOC), I want to show a QoQ comparison of what has changed with MPW.

|

3/23/2022 |

6/11/2022 |

Difference |

||

|

Share Price |

$20.30 |

$15.99 |

-$4.31 |

-21.23% |

|

Dividend Yield |

5.70% |

7.25% |

1.55% |

|

|

Price To FFO |

12.34 |

8.74 |

-3.60 |

-29.17% |

|

EBITDA to Debt Ratio |

8.12 |

7.03 |

-1.09 |

-13.42% |

MPW’s share price has declined by -21.23% since the last time I looked at these metrics, which has pushed its dividend yield up 1.55% to 7.25%. The reduction of share price and increase in FFO have made MPW’s FFO decline by -3.6 (-29.17%), and MPW is now trading at an 8.74x price to FFO. MPW has also lowered its EBITDA to total debt ratio by increasing its EBITDA and eliminating -11.04% of its total debt. MPW now trades at 7.03x EBITDA to total debt. These metrics indicate that MPW is undervalued but to validate this premise, I want to compare MPW to its peers.

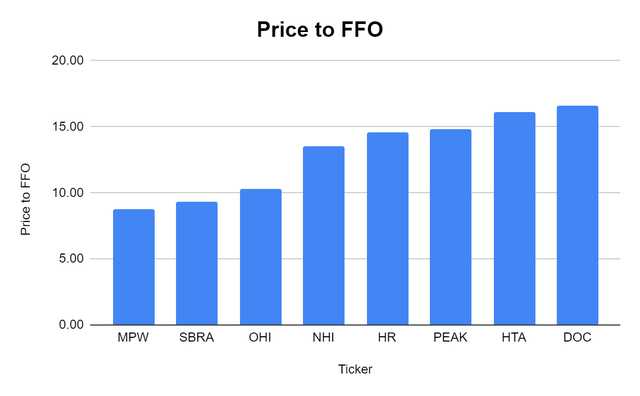

In my previous article about MPW, it traded at the 2nd lowest price to FFO (12.34x) valuation compared to its peers. MPW is trading at the lowest price to FFO valuation at 8.74x. Its peers trade at a range of 9.32x (SBRA) to 16.61x (DOC). Today’s share price allows you to add shares of MPW at the lowest price to FFO from its peers.

Steven Fiorillo, Seeking Alpha

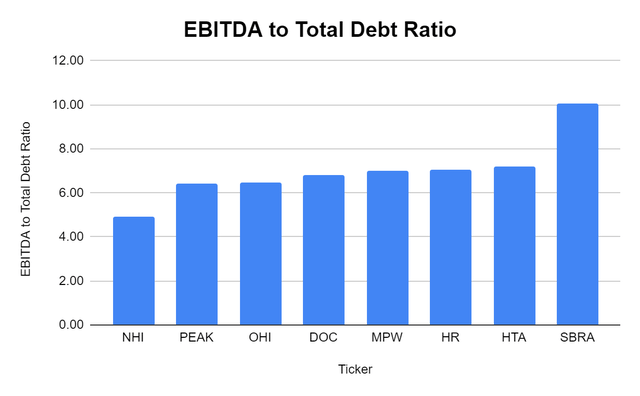

MPW previously traded at the largest EBITDA to Total Debt ratio at 8.12x. Its closest peer traded around 7x EBITDA to Total Debt. By deleveraging its balance sheet, MPW is now trading right around the midrange of the peer group EBITDA to Total Debt. The average EBITDA to Total Debt is 6.99x as the range spans from 4.92x to 10.06x. MPW is right on the midpoint as it trades at 7.03x, which is a much better valuation than the previous 8.12x.

Steven Fiorillo, Seeking Alpha

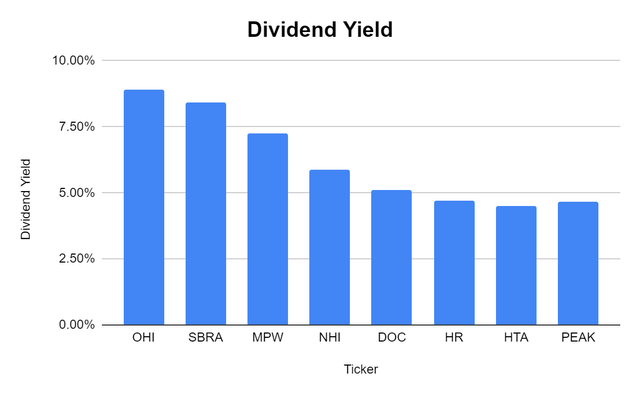

The declining share price has elevated MPW’s dividend yield to 7.25%. This is well above the group’s average dividend yield of 6.19%. Interestingly, OHI’s share price has appreciated while MPWs have declined, making their yields go in different directions. MPW has the 3rd largest yield of the 8 company peer group, and 1.36% separates MPW and NHI, which has the 4th largest yield of 5.9%.

Steven Fiorillo, Seeking Alpha

MPW is trading at a great valuation while producing growing revenue, EBITDA, and FFO. When I look at these companies, MPW looks very enticing with a 7.25% yield while trading in the middle of the EBITDA to Total Debt range and the lowest price to FFO valuation. If shares continue to slide, I will purchase more shares as this is now looking more like an arbitrage play as the market’s valuation looks incorrect.

MPW’s dividend is exactly what you should be looking for when it comes to REITs.

Investors look toward REITs to provide large amounts of income. I love Apple (AAPL), and I am a shareholder of AAPL, but I am not investing in AAPL for its income generation. This holds true for REITs. I am not looking at REITs for capital appreciation; I am looking at them as a vehicle to generate passive income.

Many investors don’t place as much emphasis on net income and EPS as Free Cash Flow (FCF), FFO, or Distributable Cash Flow (DCF) when determining the cash-generating ability of a company or its profitability level. The reason is that GAAP accounting rules can sometimes be engineered or manipulated and aren’t a true measure of the cash generated. In this case, FFO is the metric that is used for REITs, and it cannot be engineered or manipulated. The amount of FFO generated is the amount of cash the REITs operations generate.

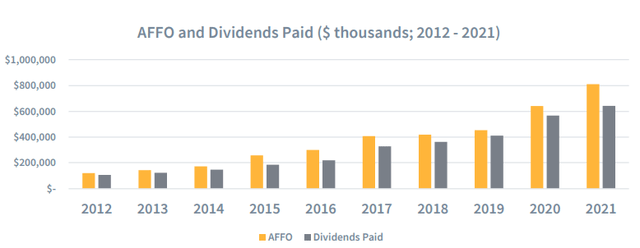

MPW has established a track record of 9 dividend increases with a growing AFFO since its IPO. MPW had paid a dividend going back to 2004 when they were a private company. MPW has proven that it can generate YoY growth in both its FFO and dividend even during unprecedented times such as the pandemic. Not every REIT was as fortunate as some were forced to cut or reduce their dividend. While MPW’s share price has declined, the amount of AFFO generated and dividends paid have increased. MPW is going ex-dividend on 6/14/22, and the Q2 dividend is payable on 7/14/22. If you’re looking for an income investment, MPW checks off all of the boxes, and the annual dividend increases should continue well into the future.

Conclusion

MPW looks undervalued as it trades at a discount to its peers. I don’t know where the bottom is, but I purchased more shares around the $17.15 mark last week, and if the bottom hasn’t been established, I will buy more shares around $15. MPW delivered its balance sheet in Q1 by eliminating over $1.25 billion of total debt while continuing to grow its revenue and FFO. I think shares should trade above $20, and there is a capital appreciation to be realized at the current level. As shares of MPW are yielding in excess of 7%, this is an opportunity that’s hard to pass up.

Be the first to comment