Khosrork/iStock via Getty Images

For those who don’t know, Medical Properties Trust, Inc. (NYSE:MPW) is a real estate investment trust (“REIT”). It invests in healthcare facilities subject to triple-net leases, which means it doesn’t pay:

- Property taxes

- Insurance

- Similar expenses.

The renter is responsible for all that, thereby reducing MPW’s risk.

Unlike many REITs we follow, MPW (which went public in 2005) is international. It has over 400 properties – rented out by 53 operators – mainly across the U.S., Australia, Colombia, Portugal, Italy, Spain, Switzerland, and Finland.

(MPW presentation – MPW IR)

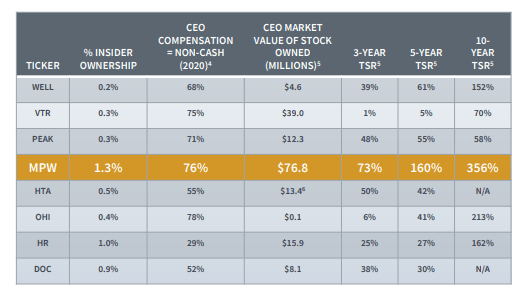

In the past, MPW has outperformed at a high level, delivering a 356% total return since 2012. That outperforms the Health Care Index, the MSCI U.S. REIT Index, and the S&P 400.

It’s boasted a growing dividend for a decade now, and its payout ratio last year was below 90% at the high end. Plus, MPW comes with a solid history of adjusted funds from operations (AFFO) growth.

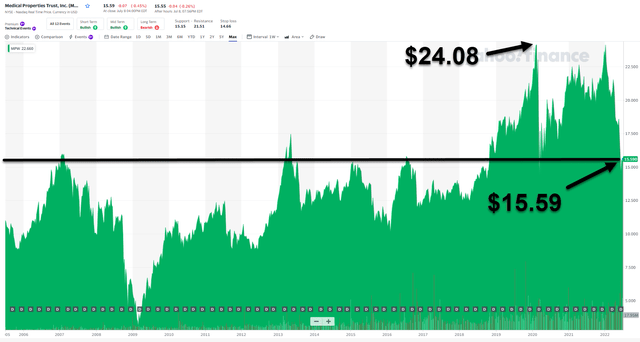

(Yahoo Finance)

Admittedly, there’s been some controversy surrounding it lately, so we thought now a good time to clarify some things. That involves an update that will hopefully illustrate why we consider MPW to be as strong as we do.

So without further ado, let’s discuss the one and only Medical Properties Trust!

Some Top Facts to Know About Medical Properties Trust

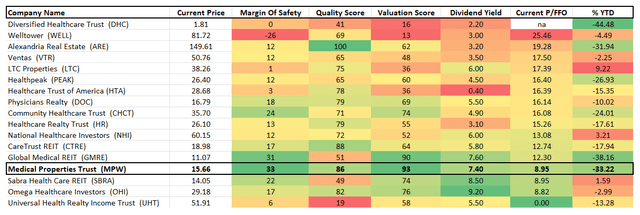

Because of the aforementioned controversy – which we’ll detail further on – Medical Properties Trust is trading at dirt-cheap multiples these days. Its AFFO and FFO multiples are well below most of its market peers… while maintaining the highest sector yield beside Omega Healthcare (OHI).

(Yahoo Finance)

Yet MPW markets itself as being able to deliver profitability even during the worst of times. Here’s why:

- Its properties are typically identified as necessary infrastructure that therefore doesn’t shut down.

- Its master-lease structures guarantee it can take back all properties if an operator defaults. After that, it only needs to ensure its properties are fundamentally appealing – which we believe they are for the most part.

- There’s little shortage of new tenants for most of its properties if a default or vacancy does occur. Typical tenants include but aren’t limited to both for-profit and non-profit operators such as UC Health, Methodist, and HCA.

Many consider MPW to be “lucky” in its results over the past 10 years. They ascribe its success to being at the right place at the right time.

But we argue that its profitability – despite operator bankruptcy – is a part of MPW’s strategy. This is evidenced by its fair market value for its properties; they’re re-leasing well above original levels and, in most cases, at double-digit lease yields.

MPW accounts its properties as having values well above their original investments. And it currently has three vacant properties prices at a total fair market value of $9 million.

A Master at Managing Medical Properties

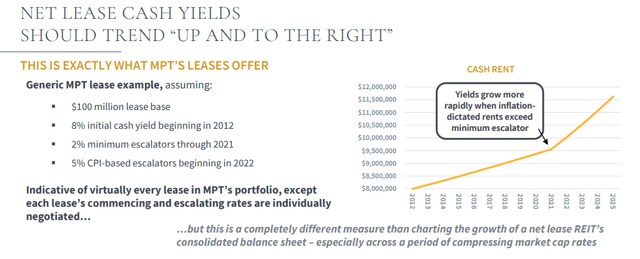

The way MPW structures its leases virtually guarantees growing income going forward.

(MPW IR)

Its real core competency lies there: in its qualitative and knowledgeable hospital underwriting. The cash flow generation from leases from properties alone is added to by the growing year-over-year rents.

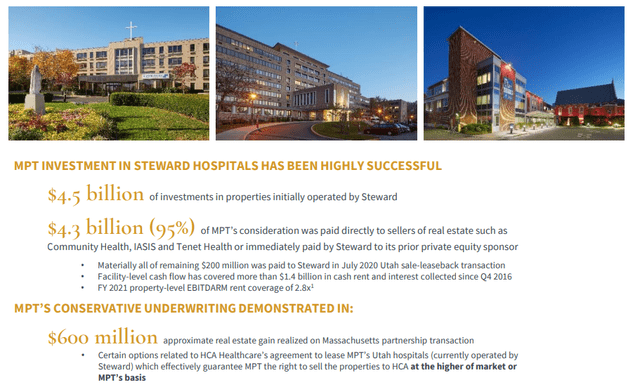

That’s thanks to escalators, re-leases, and cash gains in real estate re-evaluations. Take MPW’s investment in Steward Hospitals, as shown below.

(MPW IR)

That’s only one case of many of how MPW makes money.

The REIT can point to unlevered internal rates of return of 14% for transactions only five years old. And, again, there are repeated examples of this operator being agreed to by leases for purchasing assets at well above, or above market value. This illustrates the value of the MPW underwriting and safety process.

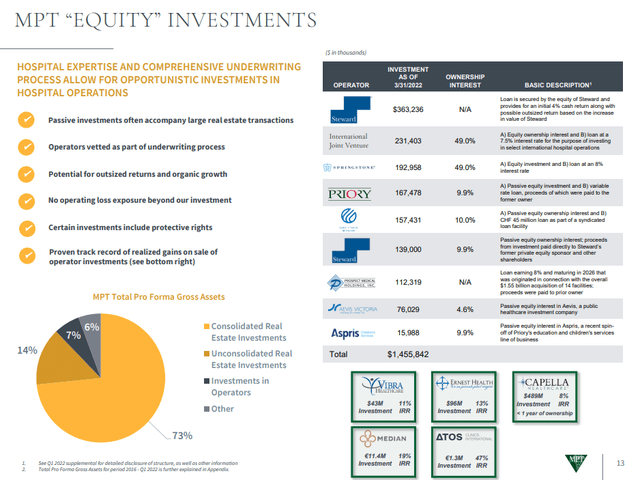

MPW also manages several equity investments, which is where much of its international profile comes into play:

- It’s a part-owner/joint-venture holder of hospitals operated in Switzerland;

- It has a 50% interest in eight Italian hospitals; and

- It has a 45% interest in two Spanish hospitals.

The company’s equity investment portfolio comes at various ownership interest rates and investment sizes – everything from the low, double-digit millions to the Steward investment. That one totals around $1.45 billion as of Q1-22.

(MPW IR)

This gives MPW an interesting mix of income and exposure, all of which we view as attractive.

It’s also an efficient operator. The REIT reduced its general and administrative costs of pro-forma gross assets from 1.1% back in 2013, to below 0.8% in 2021.

When comparing MPW to its peers, we also want to consider insider ownership. That amounts to over 1.2% instead of 0.2%-1%.

The reason should be obvious: MPW outperforms, and people – including company execs – like making money.

(MPW Insider Ownership Comparison – MPW IR)

More Reasons to Like MPW

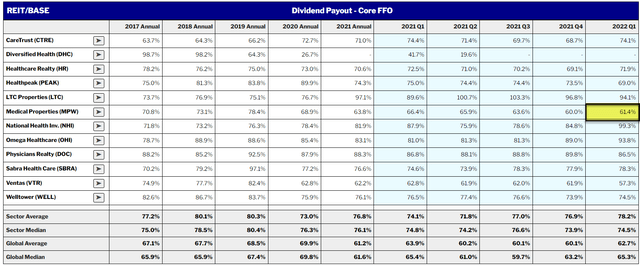

As a cherry on top, MPW’s yield is currently well-covered with a 63.7% 2022 FFO payout ratio.

(REIT Base)

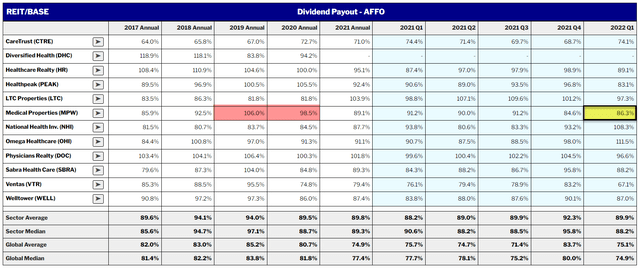

Of course, at iREIT on Alpha, we like to consider the AFFO metric too. As viewed below, that payout ratio is 86%, having improved from over 100% in 2019 and 98.5% in 2020:

(REIT Base)

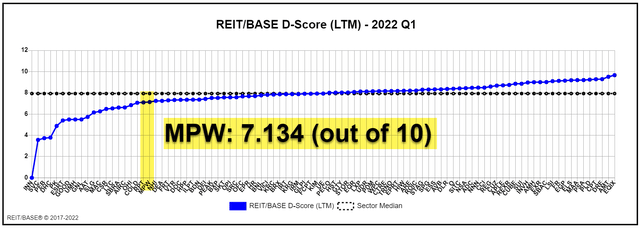

To be clear, this company ranks in the lower third of the iREIT 100 – the highest-quality equity REITs – with a D score of 7.134 (out of 10).

(REIT Base)

Nonetheless, MPW’s current dividend yield is 7.4%. And well-covered for the foreseeable future.

Not as much so as some other REITs we write about, but still. It remains attractively meaty in this market, where we expect a 7%-8% rate of consumer price index (“CPI”) inflation or above.

MPW’s Credit Rating

That’s also part of the reason for the company’s BB+ credit rating – which is close to but not quite investment-grade rated.

If you’re wondering if that’s something you should be worried about, I’d say you should be aware of it. We at iREIT aren’t worried though despite that controversy I mentioned way back in the beginning.

You see, MPW has been accused of issuing several loans to Steward healthcare and overpaying for lease-backed properties in order to help pay off its Cerberus Capital Management loans. It counters that those premiums paid reflect the underlying values made by its underwriting/financing team.

As for us, we believe there’s no proof of anything criminal here. We see nothing in the current documentation to suggest otherwise or, at worst, that overpaying was a widespread practice.

There are, after all, many misconceptions made by so-called investigative journalists regarding REITs.

Consider the accusation – also against MPW – of making risky mergers and acquisitions with unstable tenants because executive compensation was linked to M&A volume.

The journalist in question didn’t do his research though. A quick glance through the company’s policies shows us that, as per The Wall Street Journal:

- Compensation planning doesn’t directly link executive pay to M&A volume; and

- Executive pay is decreased when an M&A does not increase the BV (book value)/share.

So, again, no: MPW isn’t investment-grade rated. But it’s getting there. BB+ is good and could climb further.

We view MPW as moderately safe and feel comfortable moving forward. Which is precisely what we’re doing here.

The Art of MPW Valuation

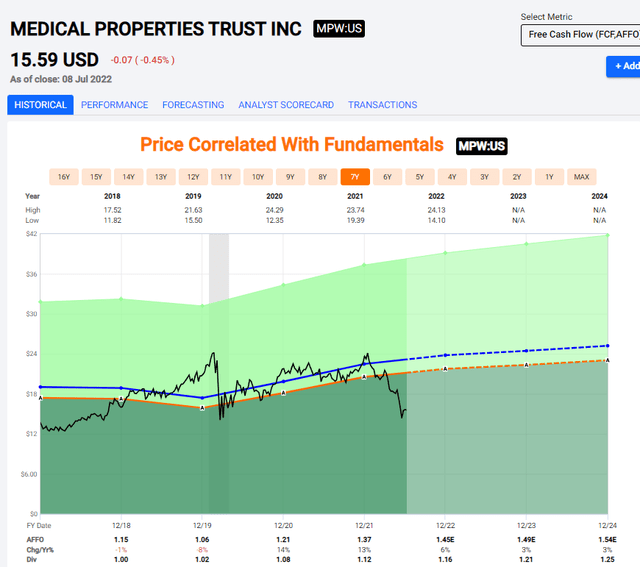

These days, Medical Properties Trust is trading at below Covid-19 levels. Its current P/AFFO is close to 11x and 8.9x using FFO.

Only Omega Healthcare shows to be a relevant peer with a lower valuation. The others are well above.

iREIT on Alpha

There simply aren’t any income/cash-related justifications for this drawdown. MPW is expected to grow is cash flow and earnings rate for the year and beyond.

2019 provided only a small drawdown of 8% lower AFFO per share. 2020 and 2021 both recovered at double digits. And 2022 should bring 6% growth, followed by 3% in 2023 and 2024.

(Medical Properties Trust valuation – FAST graphs)

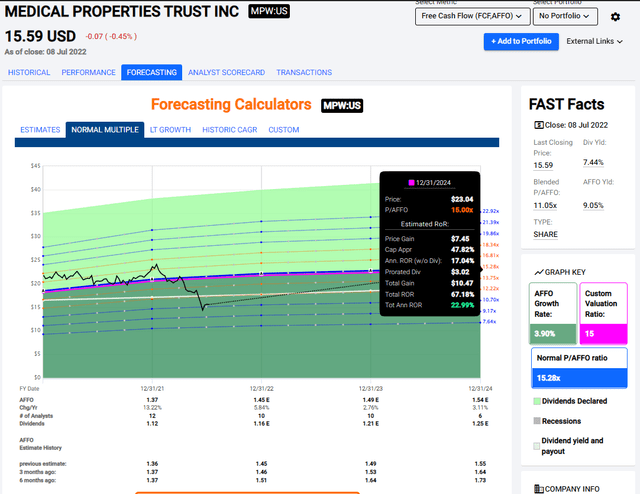

We can compare this to a five-year average P/AFFO multiple of 15.5x, which provides a massive discount.

Even if we assume goes no higher than 12x-13x P/AFFO – remaining virtually flat – we still get an annual 14%-15% cash-compounding-supported outperformance, backed by that solid 7.44% yield.

If we allow for a full reversal, that balloons to 23% per year, or a 67% total rate of return.

(MPW upside – FAST graphs)

So where’s the risk?

MPW owns class-leading properties in very appealing parts of the world. It’s well-diversified and therefore doesn’t have to worry about things not “working out” considering its tenant spread and safety.

And even in the case of bankruptcy, MPW recoups the property and can re-lease it.

At this yield, even a dividend cut wouldn’t necessarily make it unappealing. Yet it’s bumped that payout as late as February 2022.

What we have here then is a company that’s being punished because of market volatility. Which works for us!

This means we can buy cheap, which we love doing.

Things will eventually revert, leaving people wishing they’d had the foresight to pull the trigger before. But we aim to be counting our coins by then.

In Conclusion…

Things can always get cheaper. Buying now doesn’t mean it can’t fall further.

But that doesn’t change the fact that based on prospective earnings and forecasts, MPW is cheap today.

S&P Global, for one, considers it worth at least $21.5 per share with a low end of $15 and a high of $27. That indicates a 36.4% upside.

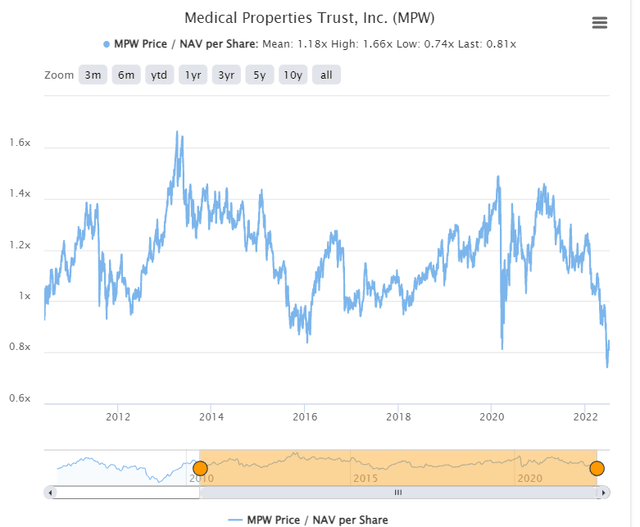

The company’s currently trading at a price/net asset value (NAV) of 0.8x – significantly below anything we’ve seen since the financial recession.

(MPW price/NAV – TIKR.com/S&P Global)

This is why we at iREIT consider MPW a Strong Buy.

We give it a price target of $23.4 and see no reason to shift this because of recent price action. Earnings and cash flows are intact.

All that’s happened is that MPW has become more undervalued – and that’s a good thing for us.

Be the first to comment