Stockfoo

Price Action Thesis

Twitter, Inc. (NYSE:TWTR) stock has declined more than 30% (as of July 11’s close) since we cautioned investors not to buy the hype in early April. We highlighted that TWTR didn’t deserve its premium at those levels, even before Tesla (TSLA) CEO Elon Musk submitted his bid to acquire Twitter.

Musk’s latest attempt to walk away and Twitter’s determination to enforce the terms of Musk’s $54.20 per share bid isn’t surprising to us. Given the current market conditions, we believe the deal price is too attractive for Twitter to reject and too high for Musk to accept.

Therefore, even as a potential courtroom drama could play out soon, feeding more headlines for the media, we urge investors to remain calm (note that no suit has been filed yet by either party at writing).

Instead, investors should focus on price action, which suggested the market wasn’t convinced that the deal would conclude in its current form since April. Investors who used the buying frenzy to cut exposure were well rewarded, exiting at solid levels in April/May.

Our analysis suggests that TWTR’s valuation is more well-balanced now. However, according to our internal models, it’s at most within the fair value range and not undervalued. Investors/traders who executed directionally-bearish bets could also attempt to cover their positions at its near-term support ($30), helping to sustain a potential bottom.

However, we have yet to observe a bear trap (significant rejection of selling momentum). Therefore, we urge investors to bide their time and not hurry to add exposure. Instead, let the price action play out and see how it attempts to form a base close to its near-term support.

As such, we reiterate our Hold rating on TWTR.

Twitter – Don’t Bet Against The Market’s Intelligence

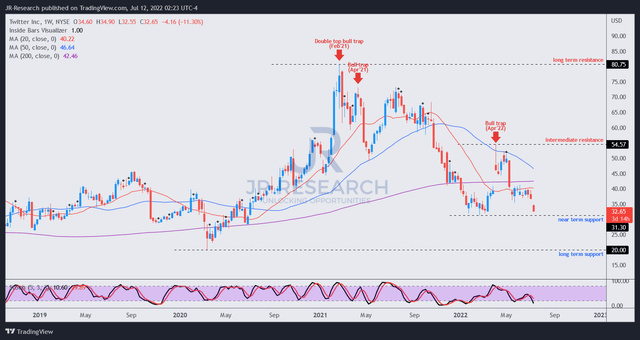

TWTR price chart (TradingView)

As seen in TWTR’s chart above, the market had already sent it into a bearish bias since November 2021. Furthermore, the market took its time to distribute TWTR over the next four to five months, with no signs of a bear trap.

Then, Elon Musk indicated in early April that he purchased a 9.2% stake, which sent TWTR surging into a bull trap (significant rejection of buying momentum) in April. Consequently, it also formed TWTR’s intermediate resistance of $54.57.

Notably, the market had formed its bull trap even before Elon launched his bid to acquire Twitter in mid-April. Even though the market allowed market momentum to build up after Musk publicly announced his bid, it further digested the buying momentum decisively by late April. Consequently, we believe it demonstrated clearly that the market was not convinced that the deal would conclude in its current form.

Notwithstanding, TWTR has fallen dramatically after an attempt to consolidate between May and July. But, there were no signs of a bear trap structure, and thus any effort to bottom was tenuous.

However, given the extent of the recent decline toward its near-term support zone ($30), we are learning slightly bullish. We believe the market is using the opportunity to force out weak hands who were chasing the deal’s closure.

Notwithstanding, we encourage investors to wait for more constructive price action to form close to its near-term support before considering adding exposure. Moreover, TWTR’s momentum remains bearish, and it’s not undervalued (according to our internal models).

Is TWTR Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on TWTR.

Although we are leaning slightly bullish, given the extent and forcefulness of the recent collapse, we still need to observe more constructive price action first. Coupled with its bearish bias, we believe caution is warranted. There’s no need to hurry.

We believe at $30, TWTR is at most fairly valued. However, if a decline forces TWTR below $30 and forms more constructive price structures, we may consider reassessing our rating.

Be the first to comment