Marco Bello/Getty Images News

The MicroStrategy stock (NASDAQ:MSTR) has lost close to 90% of its value since peaking in February 2021. Once valued at more than $1,300 apiece ($12+ billion market cap), the stock is now trading at a mere $150 with some change, as it faces a double whammy from an uncertain macroeconomic backdrop, as well as weakening investors’ confidence in the integrity and viability of crypto assets and related technologies.

MicroStrategy core operations in software sales, paired with its aggressive Bitcoin (BTC-USD) strategy compounds its exposure to the ongoing selloff in duration and speculative assets. Specifically, rising inflation and the ensuing Fed hawkishness on its policy stance is risking erosion on the valuation of tech companies like MicroStrategy, whose growth and cash flows are the furthest out from realization. Simultaneously, Bitcoin’s record-high correlation to the tech-heavy Nasdaq 100 index, alongside adverse headlines in recent weeks pertaining to the Terra/Luna collapse (UST-USD / LUNC-USD / LUNA-USD) and Celsius Network (CEL-USD) withdrawal halt have battered the performance of the world’s largest cryptocurrency. This has also further spoiled the market’s appetite for MicroStrategy, which is currently the “largest publicly traded corporate holder of Bitcoin in the world”.

In addition to investors’ aversion to duration and speculative assets, a potential margin call on MicroStrategy’s Bitcoin-backed Secured Term Loan is further fueling the selloff, making it one of the worst performing crypto-related stocks at the moment. However, a deeper examination of MicroStrategy’s Bitcoin-backed Secured Term Loan structure would reveal that the increasing risk of a margin call is a moot point that should not really be adding additional pressure on the stock’s performance. In contrast to fearmongering reports that MicroStrategy would need to “post more funds in addition to the $820 million it originally pledged” – which draws concerns that the company may be at risk of either 1) getting the $205 million Secured Term Loan called, which its $93 million cash on hand balance cannot fund, and/or 2) losing all Bitcoin collateralized at closing of the agreement – the company actually remains well within its ability in meeting the financial covenant on its Bitcoin-backed Secured Term Loan.

What is the 2025 Secured Term Loan?

On March 23, 2022, MicroStrategy, through its wholly-owned subsidiary MacroStrategy LLC (“MacroStrategy”), entered into a Credit and Security Agreement with Silvergate to obtain a $205 million, Bitcoin-backed Secured Term Loan due 2025 (“2025 Secured Term Loan”). The agreement essentially made MicroStrategy the pioneer of Bitcoin-backed term loans in public markets. Proceeds are used by MicroStrategy towards the purchase of additional Bitcoins, pay expenses pertaining to the 2025 Secured Term Loan, and/or for general corporate purposes.

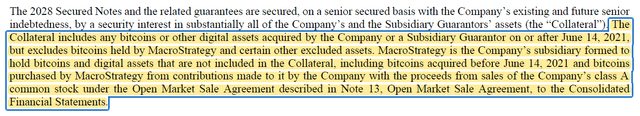

For context, MacroStrategy is essentially a Bitcoin holding subsidiary for MicroStrategy. MicroStrategy currently holds 129,218 Bitcoins as of March 31, 2022. Approximately 14,100 of MicroStrategy’s total Bitcoin holdings have been collateralized on its existing 2028 Senior Secured Notes. The remainder 115,118 Bitcoins are held through a wholly-owned subsidiary MacroStrategy, which are fully excluded from collateral on the existing 2028 Senior Secured Notes:

MicroStrategy 2025 Secured Term Loan Covenant (MicroStrategy 1Q22 10Q)

Now, back to the 2025 Secured Term Loan – the loan bears interest at a “floating rate equal to the SOFR 30 Day Average as published by the Federal Reserve Bank of New York’s website plus 3.70%, with a floor of 3.75%, and is payable monthly in arrears beginning May 2022”. As of May 31, 2022, the monthly interest payable on the 2025 Secured Term Loan would be calculated based on a rate of 4.4192% per annum (SOFR 30 Day Average rate of 0.71920, plus 3.70%), or approximately $755,000 (~$9.1 million annualized). Based on MicroStrategy’s cash on hand of $93 million and operating cash flow margin of 37% on TTM revenue of $507.1 million as of March 31, 2022, the company should not have any liquidity issues pertaining to interest repayments on the 2025 Secured Term Loan.

19,500 Bitcoins held by MacroStrategy were posted as collateral to Silvergate upon closing of the Credit and Security Agreement dated March 23, 2022. At the time, the collateral posted was valued at $820 million, representing 4x the loan principal.

What is the Debt Covenant?

Based on the Credit and Security Agreement on the 2025 Secured Term Loan, MicroStrategy must, at all times, maintain a Loan to collateral value ratio (“LTV Ratio”) of 50% or less. This would be equivalent to a collateral valued at a minimum of $410 million worth of Bitcoins at all times. As of closing of the 2025 Secured Term Loan agreement on March 23, 2022, the ~19,500 Bitcoins collateralized were valued at $820 million and represented a LTV ratio of 25%.

Pertaining to the debt covenant, if the price of Bitcoin drops to a level that causes the value of the initial collateral of 19,500 Bitcoins to exceed a LTV Ratio of 50%, it would trigger a reduction to the LTV Ratio requirement on the loan. This Bitcoin price threshold is quantified at approximately $21,000, which would value the 19,500 Bitcoins initially posted as collateral by MicroStrategy at $410 million, and represent a LTV Ratio of 50% on the $205 million loan principal.

In other words, the LTV Ratio requirement drops to 25% or less if Bitcoin price falls below $21,000. Alternatively, the LTV Ratio requirement ceiling can be upped to 35%, in exchange for an increase to loan interests by 25 bps until the “LTV Ratio is reduced to 25% or less”. MicroStrategy would be required to “either deposit additional Bitcoin in the Bitcoin Collateral Account or repay a portion of the 2025 Secured Term Loan” such that the LTV Ratio meets the new collateral requirement.

If the price of Bitcoin rises such that the collateral posted results in a LTV Ratio that is less than 25%, MicroStrategy will be “entitled to a return of such excess collateral”. Based on the 19,500 Bitcoins posted as collateral as of March 31, 2022, MicroStrategy would be entitled to a return of the excess amount if Bitcoin prices exceed $42,100 apiece.

What is the Ongoing Bitcoin Plunge Imply?

Bitcoin prices breached the $21,000 threshold on June 13th as it wrestled with volatility stemming from a risk-off environment in both crypto assets and equities after a hotter-than-expected May inflation print and Celsius Network’s decision to halt account withdrawals exacerbated its selloff. Based on the intraday low of $20,980 on June 13th, MicroStrategy would have had to increase its collateral from 19,500 to 39,085 Bitcoins in order to satisfy the new LTV Ratio requirement of 25% or less (i.e. collateral value of at least $820 million) on its 2025 Secured Term Loan.

As mentioned in earlier sections, MicroStrategy had ownership of 129,218 Bitcoins as of March 31, 2022. Less the 14,100 posted as collateral on the 2028 Senior Secured Notes, and the 19,500 posted as collateral on the 2025 Secured Term Loan, MicroStrategy has more than 95,600 Bitcoins that remain unpledged. This means even at a Bitcoin price of $20,980, MicroStrategy still has more than $2 billion worth of unpledged Bitcoins that can be used towards maintaining its collateral requirements on the 2025 Secured Term Loan. Alternatively, Bitcoin prices would have to drop below $7,123 – a level last seen in March 2020 – before MicroStrategy is at real risk of failing to meet the 2025 Secured Term Loan Covenant (unless, of course, MicroStrategy just plainly refuses to deposit additional Bitcoins into the loan collateral account, or if between March 31st to now it has used up the 95,600+ unpledged Bitcoins elsewhere, which no regulatory filings have been released on).

What is the Media Reporting?

There have been a spread of confusion and fear through media reports pertaining to MicroStrategy’s current situation on its 2025 Secured Term Loan covenant. Even reputable news outlets like Bloomberg and CNBC have been spreading confusion that is adding to the turmoil in MicroStrategy’s market valuation:

Among the issues weighing on the company is the threat that an even deeper drop in Bitcoin prices will require it to post additional collateral for the $205 million loan it took out in March. MicroStrategy said on conference call in May that if Bitcoin drops to about $21,000 they would need to post more funds in addition to the $820 million it originally pledged.

Source: Bloomberg News

To add to MicroStrategy’s woes, the company now faces what’s known as a “margin call,” a situation where an investor has to commit more funds to avoid losses on a trade augmented with borrowed cash… It’s not yet clear if MicroStrategy has pledged more funds to secure the loan.

Source: CNBC News

Based on the foregoing analysis, it is not about needing to “post more funds in addition to the $820 million”, but rather maintaining a Bitcoin collateral account to Silvergate valued at a minimum of $820 million at all times if the token’s prices fall below $21,000. The misunderstanding between MicroStrategy’s actual requirement to stake / top-up more Bitcoin as collateral when prices fall below $21,000, and the alleged requirement to increase collateral beyond $820 million as preached by multiple media sources has spread unnecessary fear and confusion on the company’s liquidity. This, amid other headwinds beyond MicroStrategy’s control, such as Fed policy tightening and the recent Celsius Network withdrawal, have only added incremental stress on the stock’s performance this week.

The Bottom Line

Yes, MicroStrategy is at risk of being margin called because the price of Bitcoin has dipped below the threshold that would mark its 19,500 tokens originally pledged to Silvergate as insufficient to meeting the LTV Ratio requirement on the 2025 Secured Term Loan. No, MicroStrategy is far from being at risk of getting the loan called or default just because Bitcoin prices dropped below $21,000.

Based on MicroStrategy’s 1Q22 earnings call, its annualized interest payment obligations based on $2.4 billion debt outstanding as of March 31st is about $44 million. Considering a cash on hand balance of $93 billion, operating cash flow margin of 37% on TTM revenues of more than $507 million with continued growth thanks to a robust demand environment for cloud and data solutions, and no immediate debt principal repayment obligations coming due until 2025, MicroStrategy remains far from default / liquidity risks.

Although MicroStrategy is slated for further impairment write-offs to the carrying value of its tokens held given the current volatility in crypto assets, the company is not entirely wrong on its aggressive Bitcoin strategy. I believe Bitcoin’s pullback this year is likely temporary, though volatility will remain the theme for a while longer. Whether DeFi and blockchain technology is here to stay is no longer a question up for debate, in my opinion, and Bitcoin remains the bedrock of the expansive innovation, which underscores its ultimate breakout from the current rut.

This is further corroborated by the increasing institutional interest, regulatory developments, and “mainstream media” awareness over Bitcoin as highlighted by MicroStrategy management during its latest earnings call. While there are no immediate catalysts in sight to trigger a turnaround in Bitcoin’s latest declines, which offers little respite to MicroStrategy’s near-term performance, the token’s positive long-term prospects could potentially position the company for attractive payoffs.

Be the first to comment