tofumax/iStock Editorial via Getty Images

McDonald’s (NYSE:MCD) is one of the most successful brands in American history, but right now multiples are quite high while underlying business growth is limited due to the law of large numbers.

The way to look at MCD as a business is as an unofficial REIT, with one of the most powerful franchise brands ever attached to it. This is because of their vast real estate holdings, estimated at about 47,000 acres valued around $28.4 billion. These holdings are key to making the whole system work.

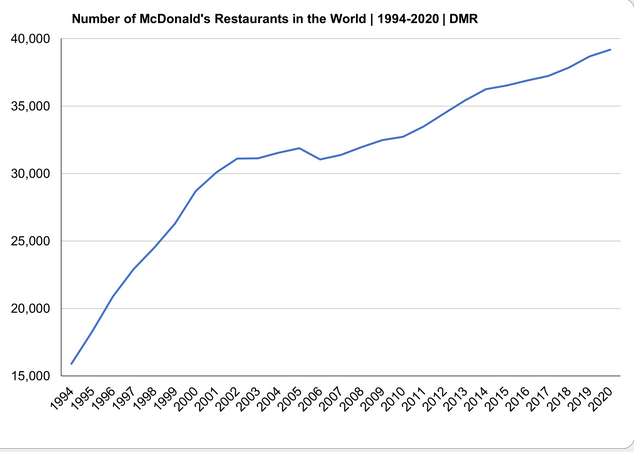

MCD’s revenue peaked in 2013 and basically declined until finally growing again last year. Under the hood though, store counts have increased year over year.

This however doesn’t change the fact that their earnings and FCF have been fairly stable and predictable.

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

FCF(bil) |

3.91 |

4.29 |

4.14 |

4.72 |

4.23 |

3.69 |

4.22 |

5.72 |

4.62 |

7.1 |

|

Net Income(bil) |

5.46 |

5.58 |

4.75 |

4.52 |

4.68 |

5.19 |

5.92 |

6.02 |

4.73 |

7.54 |

Its best growth is far behind it, especially in the US. So how FCF is allocated at this point is critical.

Shareholder Yield

MCD absolutely qualifies as a legacy moat because they can generate sustainably high returns on capital in spite of other well-known competitors. It is arguably one of the most powerful brands of all time, and the imprint left in the mind of the consumer collectively shouldn’t be understated. The only problem is that they can’t earn equally high returns if they reinvest all profits back into the business, so capital must be returned to shareholders which they of course do.

Treat a blue-chip stock like this for what it is. A mature company with a solid legacy moat, that returns most of its FCF back to shareholders via dividends and repurchases. I view shareholder yield as being one of the primary drivers of returns for most blue chips. This is especially the case with MCD, given the franchise model allows them to grow store count without reinvesting themselves. All the more reason for strong shareholder yield.

Below we compared return on capital metrics, shareholder yield and share count.

|

Company |

10-Year Median ROE |

10-Year Median ROIC |

10 Year EPS CAGR |

10-Year FCF CAGR |

Augmented Payout Ratio TTM |

10-Year Share Count Change |

|

MCD |

-13% |

18.1% |

6.7% |

5% |

89.2% |

-25.7 |

|

13.8% |

36% |

6.6% |

1.6% |

160.2% |

-36.2% |

|

|

11.8% |

3.4% |

13.8% |

23,.5% |

94.7% |

53.4% |

|

|

16.6% |

3.7% |

46.3 |

10.7% |

156.6% |

-43.8% |

Valuation

Comparing multiples is always a pricing game. Right now, there is a premium on MCD, but it’s too high considering the growth limits and current dividend yield. The dividend yield itself is not everything, but with fundamental growth so limited at this point in a company’s life cycle, achieving an above average yield (of S&P 500 stocks) should be a must for making a purchase. A low multiple isn’t always necessary as long as the dividend yield is decent. For such an established business, shareholder yield should essentially act as a royalty on unit volume, while fundamental growth should match GDP growth.

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

MCD |

8.6 |

17 |

28.6 |

-28.9 |

2.3% |

|

YUM |

6.3 |

18.8 |

30 |

-3.7 |

2% |

|

QSR |

5.7 |

25.8 |

21.2 |

5.5 |

5.5% |

|

WEN |

3.1 |

12.9 |

29.4 |

8.4 |

2.8% |

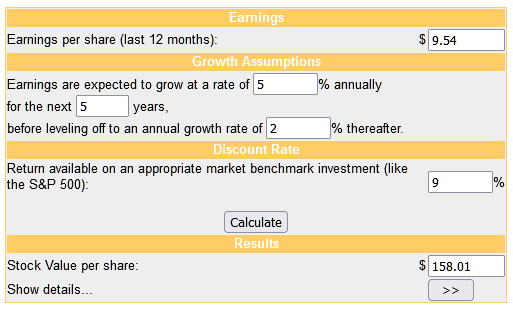

Using an overly conservative DCF, MCD is definitely overvalued right now.

Moneychimp

I do think they deserve some sort of a quality premium based on sustainable returns on capital, but right now it’s too much of a premium.

Risk

The biggest long-term risk to MCD is secular decline caused by consumers turning away from their product. There can be a shift towards healthier food by more affluent while at the same time demand for cheaper alternatives increases. Not only does a secular shift take a long time, but MCD has enough financial strength to withstand and cater to these changes eventually.

The fast-food industry is estimated to grow at around 6% over the next decade. MCD being the biggest in its category obviously means it takes part of that, so it can be baked into the growth estimates. But remember, the value is in the real estate, which means should a highly improbable scenario of the brand losing power to attract customers and franchisees, there could always be a pivot. I wouldn’t count on this at all, and the real estate assets will probably never be sold.

Conclusion

At the most basic level, returns of any stock are driven by three things: EPS growth, multiple expansion, and dividends. To buy MCD at the current price, you only get nominal business growth and buybacks to boost EPS. Multiples won’t likely increase much from here. Finally, the dividend yield is only slightly above what you get from buying the index. The only way to tilt the odds in your favor is to buy at lower prices.

I’m bullish on the fundamentals of MCD, but the share price is simply too high right now. FCF and earnings are relatively stable and returns on capital are consistently high. This does warrant a premium, but at these levels you will get a relatively low dividend yield along with essentially no room for multiple expansion. I would focus on locking in a higher yield whenever the share price drops enough.

Be the first to comment