Steve Pope

Thesis

On Friday 19th August, Warren Buffet’s Berkshire Hathaway (BRK.B, BRK.A) won approval to buy an equity stake of up to 50% in Occidental Petroleum (NYSE:OXY). OXY shares jumped almost 10% following the announcement and I argue the market’s first reaction was perfectly reasonable.

Occidental Petroleum is a quality company trading at a reasonable valuation. The company’s stock is the best performer in the S&P 500 (SPY) YTD, being up almost 130% versus a loss of about 12% for the S&P 500. and I expect after Buffett’s strengthened engagement (which of course also adds buying pressure), OXY stock is poised to continue to outperform.

Seeking Alpha

Buffett And OXY

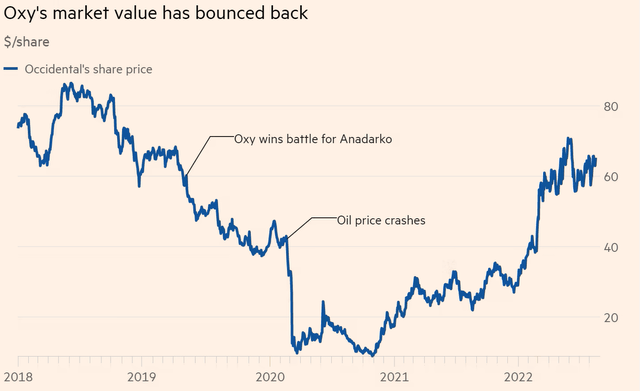

Buffett first engaged with Occidental CEO Vicki Hollub in 2019, when Berkshire had committed to invest $10 billion to help Occidental finance the takeover of Anadarko–winning a bidding contest against Chevron (CVX). Berkshire structured the investment by purchasing 100.000 shares of preferred stock, which promised to pay an 8% annual preferred dividend. The deal was highly controversial. Carl Icahn commented:

(Occidental) grossly overpaid for Anadarko and have risked the company and stockholders’ money. In the army, they would be court-martialed.

But Buffett liked the deal. He said:

oil prices will determine whether almost any oil stock is a good investment over time … If [oil] goes way up, you make a lot of money

Accordingly, OXY shares lost more than 80% of market capitalization when the oil price crashed due to the Covid-19-induced panic. But with the following energy boom OXY shares recovered and are now targeting the 2011 ATH.

Financial Times

Buffett Is Buying

Taking advantage of depressed prices, Buffett liked the risk/reward of making an additional investment (in addition to the preferred stock Berkshire owned as a consequence of the Anadarko deal). Reportedly, Buffett had told Becky Quick that he started making investments after reading the transcript of Occidental’s Q4 2021 earnings conference call with analysts.

I read every word, and said this is exactly what I would be doing …

… She (Hollub) is running the company the right way

He added that

and we bought all we could.

Buffett’s Sec 13F filing for the June quarter revealed that between April to end of June, Buffett has increased his stake in OXY by 16.26%, now being valued at approximately $9.3 billion.

Previously, Buffett’s Berkshire Hathaway was authorized to acquire up to 25% of Occidental Petroleum, but after approval from the Federal Energy Regulatory Commission, the conglomerate can now buy up to 50%. In response to Berkshire’s request, which was filed already on July 11, the FERC concluded that

the proposed transaction is consistent with the public interest and is authorized

Strong Fundamentals

Occidental’s fundamentals have benefitted enormously from the recent rally in energy prices. For the trailing twelve months, Occidental generated $33.7 billion of revenues, versus $20.9 billion in 2020. Operating income jumped from a loss of $8.3 billion in 2020 to a gain of $11.5 billion for the past twelve months.

Given the energy price tailwind, Occidental also managed to quickly de-lever its balance sheet. The company’s net debt is now $22.07 billion, less than x2 the company’s TTM cash from operations of $14.8 billion.

Arguably, although Occidental has strongly outperformed the S&P 500 TYD, the stock is still lagging fundamentals. Analysts estimate that one-year forward GAAP P/E of x4.85, which implies a discount to the energy sector of about 44%.

Investor Implication

While the FERC filing does not indicate an obligation, but the right, to acquire up to 50% of Occidental uncertainty remains. We do not know what Buffett’s precise plans are. Notably, Buffett holds warrants that allow Berkshire to acquire about 83.9 million OXY shares for approximately $5 billion, or $59.62 each. If exercised, Berkshire’s stake would jump to about 27%.

Personally, however, I like to speculate that Buffett is planning to buy 50% of OXY stock. In fact, I believe that Buffett is likely planning to buy Occidental entirely. The odds are favorable: Occidental fits Buffett’s investment criteria, Berkshire has more than $105 billion of free cash on hand and Buffett obviously likes to work with OXY CEO Vicky Hollub.

Personally, I see Buffett’s engagement with Occidental stock as a nice extra to strong fundamentals. At a P/E of x4.85 I feel comfortable buying OXY stock also without the prospect of a takeover, which I view as a ‘free’ implied call option.

Be the first to comment