Justin Edmonds

Shares of Domino’s Pizza, Inc. (NYSE:DPZ) are enjoying a relief rally after a mixed earnings report, which showed that while the business continues to struggle with elevated inflation, it may be nearing a turn. Still, even with today’s rally, the stock is down over 30% over the past year as its multiple has compressed in the face of higher interest rates and lower profit margins. Its highly cash-flow generative business is attractive, and DPZ will likely be a beneficiary of tighter Federal Reserve monetary policy. I see shares being able to return to the $350-375 area

In the company’s third quarter, Domino’s earned $2.79, which was $0.19 short of estimates, in part due to higher taxes. EPS was down 13% from last year even as revenue was in line at $1.07 billion and up 7% from last year. Higher food and wage prices continue to be a significant headwind. Gross margins were down 290bp to 35.7% as supply chain costs rose 11.8%. In the face of higher input prices, DPZ is tightening the belt elsewhere. As a share of sales, it brought down G&A by 110bp and advertising down 20bp. As a consequence, operating margins were down but only by half as much as gross margins, or 160bp, to 16.5%.

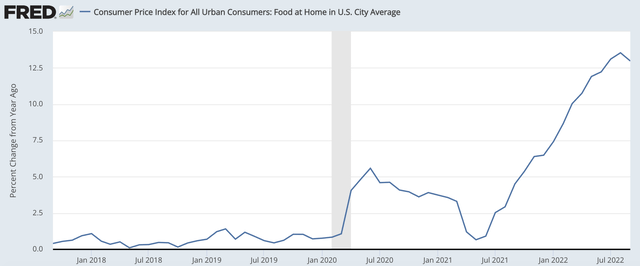

In the quarter, Domino’s raised the prices of the food it sells to its franchises retail stores by 13.4%. Still, that was not enough to maintain margins. For the full year, the company expects its food basket pricing to be up 13-15%. On the bright side, even in today’s hot inflation report, we did see food inflation tick down slightly. Dairy prices rose a modest 0.3% (less than 4% annualized) while meats remain problematic at 0.7% (8.8% annualized). Even this elevated meat inflation is better than that 13% food inflation over the past year. While I am not saying food inflation is going away, the force of the headwind DPZ has been battling looks to be fading.

Importantly, U.S. same-store sales growth came in at 2%, a nice turnaround from last quarter’s 3.6%. With gas prices having come down from their highs, consumers may be spending a bit more on going out. Plus, given how much grocery prices have risen, DPZ’s value proposition actually is more attractive. It was encouraging to see this sales improvement even as it reduced advertising spending. Overseas is more problematic as international stores saw a 1.8% decline ex-currency. This was partly driven by a difficult tax change comparison in the UK, which is Domino’s second largest market, based on its starting year store count.

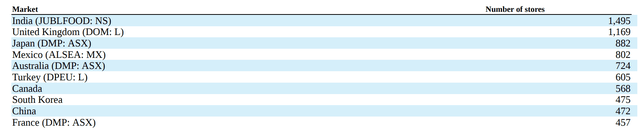

While I expect Domino’s international operations to remain a headwind, it has a relatively attractive international store mix. In particular, I am most concerned about continental Europe’s economy, as their extremely high natural gas prices are likely to squeeze consumers’ income and force a recession. France is the only EU member in DPZ’s top ten, and they receive most of their power from nuclear not natural gas, a positive.

Currency will be an ongoing challenge. In fact, global retail sales growth was 4.7% but currency was a 6.3% headwind, erasing all of that gain and then some. This revenue growth was aided by the fact Domino’s continues to grow its store count, adding 225 stores, 90% of them overseas. Given its limited exposure to Europe, I am relatively comfortable with its overseas geographic mix.

To confront higher prices, the company is rationing spending, taking its cap-ex budget from $120 million to $100 million and its G&A spend down about $7 million to a $415-$420 million range. Even with these pricing pressures, it remains very cash flow generative thanks to the asset-light and recurring revenue nature of the franchise business model. Through nine months, it has generated $279 million in free cash flow despite a $50 million working capital headwind. Given this cash flow, in Q3, it repurchased nearly $200 million in stock with $410 million remaining under its authorization. That brought the share count down 2.8% from a year ago. Given its $5.1 billion debt load, I would expect share buybacks to largely track free cash flow over the next 18 months but to not significantly exceed it.

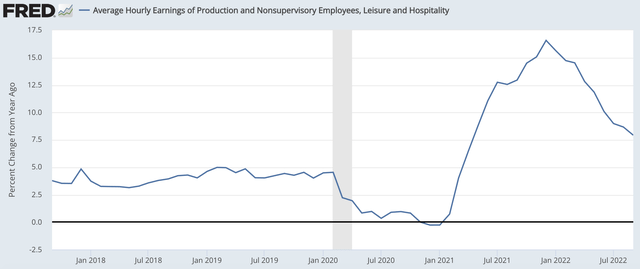

In addition to having food price inflation that may be about as bad as it gets, the labor picture is getting better. Leisure and hospitality (the category restaurants fall under) wages soared last year and through Q1 of 2022 amid widespread reports of working shortages. At the start of the year, Domino’s reported they have “recently experienced increased labor shortages.”

Now, the Fed is actively working to reduce wage growth and soften the labor market with rate hikes that should slow economic activity. As you can see below, wage growth is now starting to moderate significantly. Up over 7.5%, it remains too high and inconsistent with 2% inflation, so there is more work to do, and DPZ’s margin pressures are not going to improve dramatically overnight, but the trend is favorable.

Labor and food costs account for 50-60% of the cost in a company-owned store, so with the Fed pushing to reduce inflation in these categories, and achieving some success on the labor front, it is helping companies like Domino’s improve their cost structure. At the same time, demand is resilient with U.S. same-store sales growth accelerating, and its value proposition should hold through a moderation in economic activity. As a consequence, I think 2023 can be a year of margin expansion, and this quarter has the signs of the turnaround starting to occur, which is why shares have risen about 7% this morning despite the tax-driven EPS miss.

If the company can capture back 2/3 of its lost gross margins this quarter during the next 12 months, it has about $15 in earnings power and $500 million in free cash flow capacity, giving shares a 21.5x P/E multiple and a 4.4% free cash flow yield. With ongoing store growth and potential margin upside beyond 2023, the company can generate 5+% free cash flow growth over the medium term, which can support a 3.5-4% free cash flow yield or about $350-375 a share.

The primary downside risk would be that the Fed is not able to bring down inflation, and that these margin pressures persist for longer. Conversely, if we see the dollar decline with other currencies, earnings power could move past $16, creating additional upside.

While I do not expect shares to return to their highs over $500, as higher interest rates limit the potential multiple expansion, Domino’s has improved operating performance, and it should benefit from the Fed’s inflation fight. I see about 10% upside in Domino’s Pizza shares and would be a buyer.

Be the first to comment