shaunl

Home’s where you go when you run out of homes.”― John le Carré

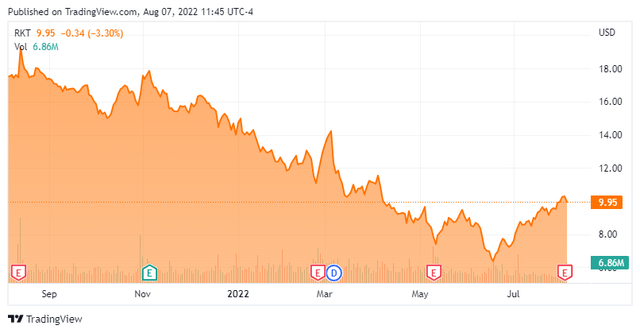

Today, we take our first look at Rocket Companies, Inc. (NYSE:RKT). Best known for its Rocket Mortgage business, the shares have managed a decent rally recently after a large pullback. This is a name I have been accumulating within covered call positions over the last six weeks starting when the equity was trading in the mid $7s. The company just posted second quarter results and the stock has seen considerable insider buying in recent months. An analysis follows below.

Company Overview

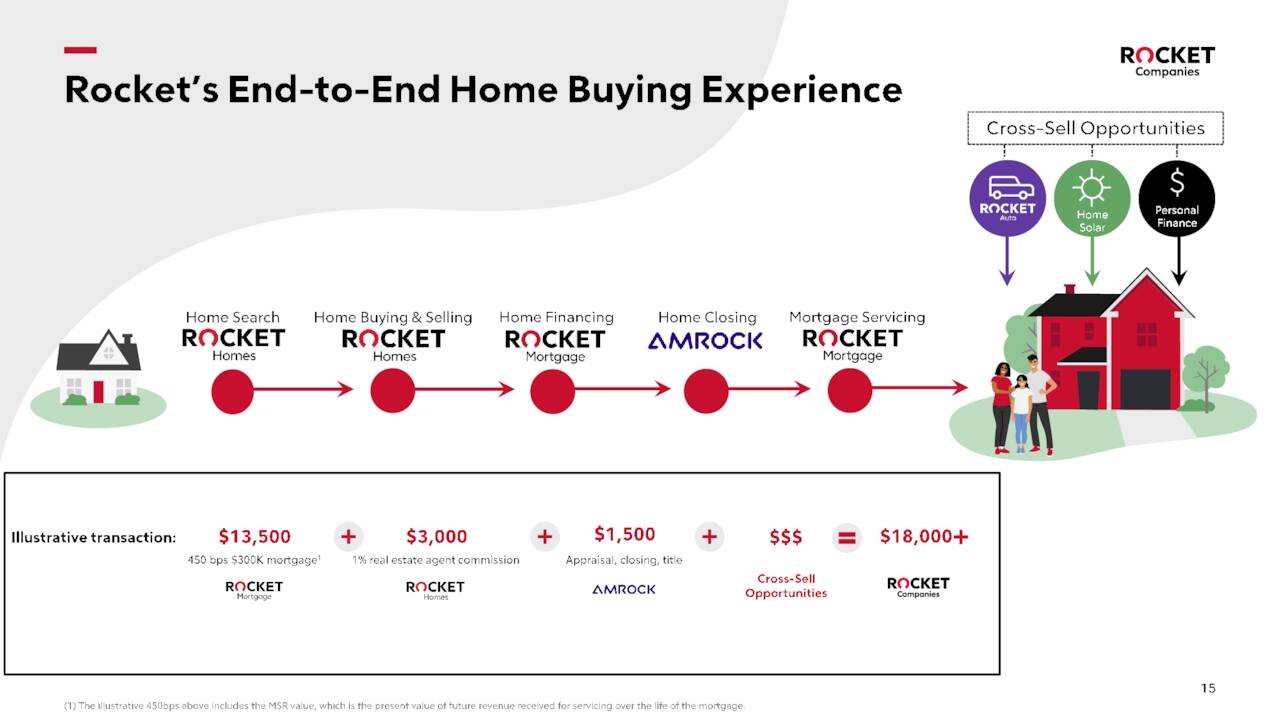

Rocket Companies, Inc. is based in Detroit. It has several business holdings, starting with Rocket Mortgage which is the bulk of its business. It also operates Rocket Loans, an online-based personal loans business as well as Amrock which provides title insurance, property valuation, and settlement service. It also offers Rocket Auto, an automotive retail marketplace that provides centralized and virtual car sales support to online car purchasing platforms. Finally, Rocket Homes provides a home search platform and real estate agent referral network, which offers technology-enabled services to support the home buying and selling experience.

August Company Presentation

The company is very focused on retaining their customers for life and efficiently targeting cross-selling other services within Rocket’s ecosystem. The company recently enabled ‘single sign-on’ across all of its businesses, so a customer can seamlessly move from capability to capability. The stock currently trades just south ten bucks a share and sports an approximate market capitalization of $19.5 billion.

August Company Presentation

Second Quarter Results

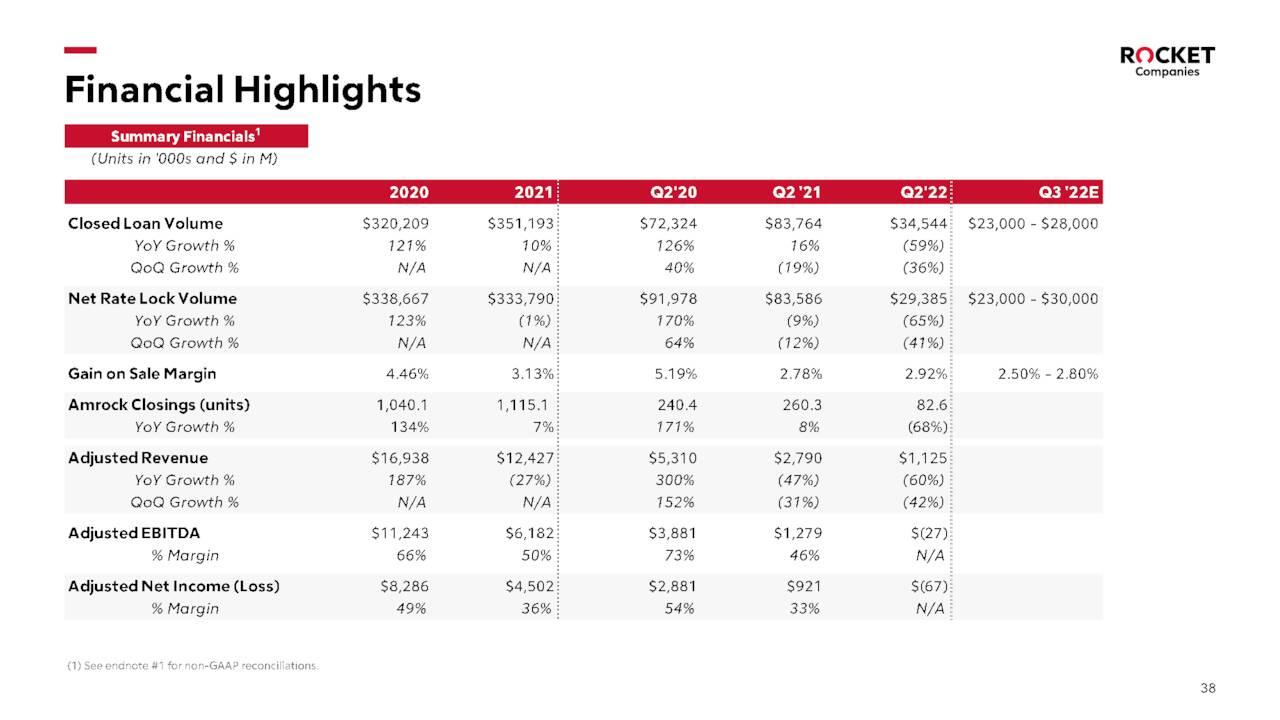

On August 4th, the company posted second quarter numbers. They were quite dismal. Rocket Companies posted a non-GAAP loss of three cents a share, a nickel worse than expected. Adjusted revenue dropped by nearly 60% on a year-over-year basis to $1.13 billion, missing expectations by some $400 million.

August Company Presentation

As you can see from the graphic above, the huge drop-off in sales was triggered by a massive slowdown in home closings. The 30-year fixed rate mortgage jumped from 3.2% at the beginning of the year to nearly 6% at the end of June, the steepest and fastest rise in over 50 years. The average rate has recently dropped to around the five percent level even as the Federal Reserve continues to hike interest rates.

Closed origination volume dropped to $34.5 billion, down drastically from $83.8 billion a year ago. The company posted a negative $27 million adjusted EBIDTA during the quarter, compared with a gain of $1.3 billion in 2Q2021. The company did take $300 million out of its expenses during the quarter, compared to the first quarter of this year. Leadership expects to take another $50 million to $150 million out of expenses in the quarter ahead. In addition, Rocket’s home search platform and real estate agent referral network grew overall real estate transactions by 25% from the same period, very impressive given the huge drop in transaction activity.

Analyst Commentary & Balance Sheet

The stock has a large short interest of just over 30%. The stock is almost universally hated by the analyst community at the moment. Approximately a dozen analyst firms including Bank of America and UBS have Hold or Sell ratings on the shares. Price targets proffered range from $7 to $10 a share. The lone holdouts seem to be JPMorgan ($11.50 a share) and Wells Fargo ($10 price target) who continue to maintain Buy ratings.

Several insiders, including the CEO, have been frequent and consistent buyers of the stock throughout 2022 at under $10.00 a share. They have added millions of dollars to their holdings in aggregate. There has been no insider selling in the stock since March of 2021 when the founder and others dumped a huge amount of equity when the shares were trading just under $25.00 a share.

The company exited the second quarter with $915 million of cash on the balance sheet as an additional $3.1 billion of corporate cash used to self-fund loan originations. Total liquidity stood at $7.3 billion at the end of the quarter and the company has added a $1 billion MSR facility since boosting total liquidity to $8.3 billion.

Verdict

Before quarterly results posted, the analyst consensus had Rocket seeing overall revenues fall some 45% in FY2022 to just over $7 billion. Sales are projected to be flat in FY2023.

August Company Presentation

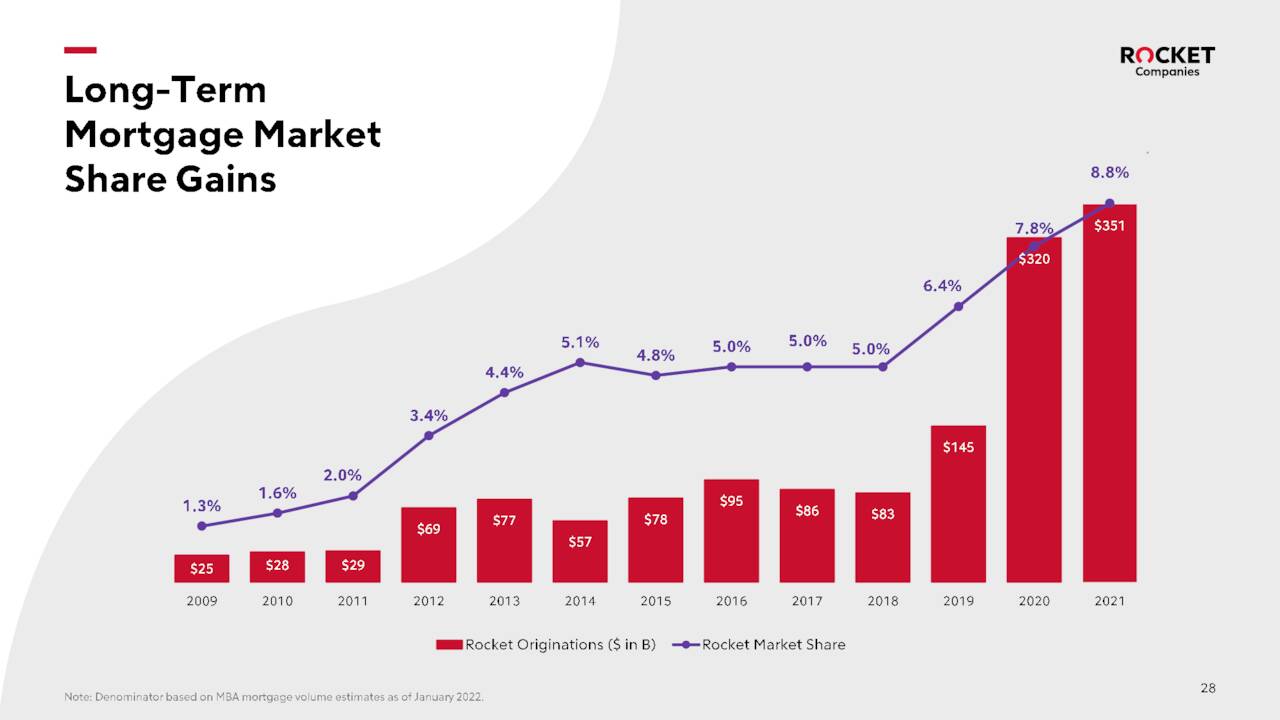

The company does seem well-positioned because of its technology platform to continue to gain market share in the coming recession. Things are likely to get worse in the housing market before they get better, but Rocket seems better able to navigate this storm than their competitors.

My plan is to continue to slowly accumulate shares in RKT anytime they get to $8.50 a share (The midpoint of price targets among the bears in the analyst community on the stock) via covered call orders as options are liquid and lucrative against this equity. I look for Rocket to emerge stronger when the turbulence in the housing market ends.

Perhaps home is not a place but simply an irrevocable condition.”― James Baldwin

Be the first to comment